Bill Of Sale Kansas Form

Description

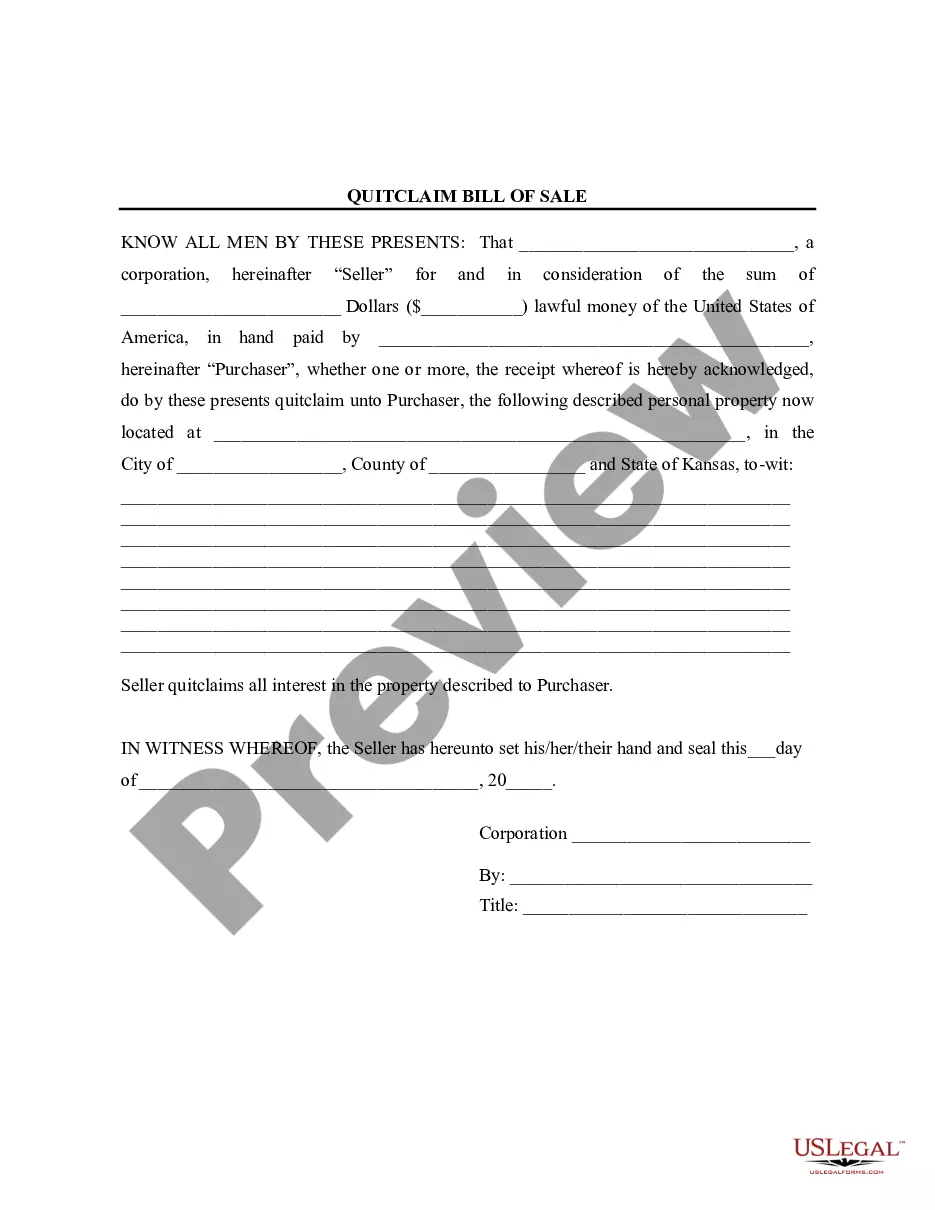

How to fill out Kansas Bill Of Sale Without Warranty By Corporate Seller?

How to locate professional legal documents that comply with your state's regulations and create the Kansas Bill of Sale Form without hiring a lawyer.

Numerous online services offer templates for various legal needs and requirements.

However, it may require time to determine which of the accessible samples meet both your specific application and legal standards.

If you do not yet have an account with US Legal Forms, please follow the instructions below.

- US Legal Forms is a trusted site that assists you in finding official documents drafted in alignment with the latest updates in state laws and helps you save on legal fees.

- US Legal Forms is not merely a typical online catalog; it is a repository of over 85,000 confirmed templates for assorted business and personal circumstances.

- All documents are organized by area and state to expedite your search process and reduce inconvenience.

- Furthermore, it comes equipped with advanced tools for PDF manipulation and e-signature, enabling users with a Premium subscription to swiftly complete their forms online.

- It requires minimal effort and time to acquire the necessary paperwork.

- If you already possess an account, Log In and verify that your subscription is active.

- Download the Kansas Bill of Sale Form by clicking the corresponding button next to the file name.

Form popularity

FAQ

How Do I Write a Kansas Bill of Sale?Their names (printed)The date of the bill of sale.Certain information about the item being sold.The amount the item was sold for.The signatures of the involved parties.In some instances, the bill of sale may also need to be notarized.

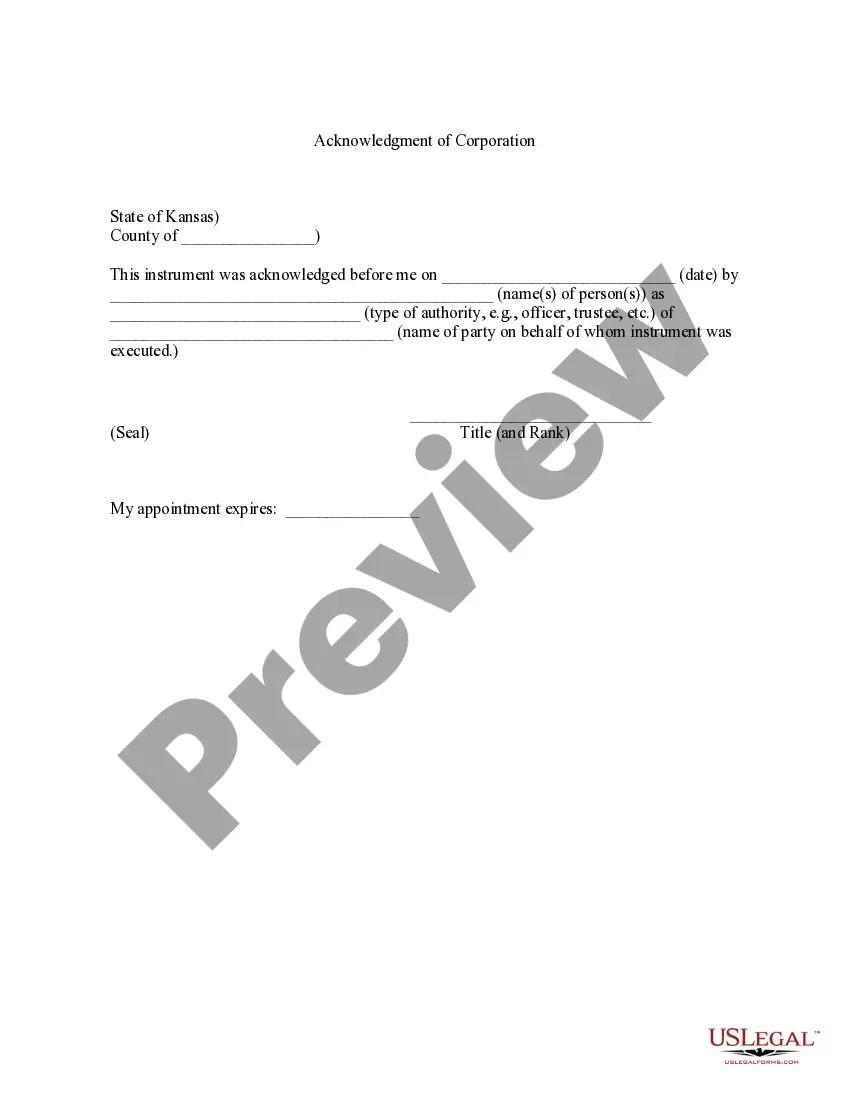

In general, Kansas does not require bills of sale, title assignments, and applications to be notarized. However, it has the right to request notarization in unusual circumstances, such as if document information is incomplete or questionable.

Bill of sale documents in Kansas are not required to be notarized. But, if you are titling a vehicle with a lien, the release of lien form (TR-42) must have the lienholder's section notarized.

A Bill of Sale typically includes:The full names and contact information of the buyer and seller.A statement that transfers ownership of the item from the seller to the buyer.A complete description of the item being purchased.A clause indicating the item is sold "as-is"The item's price (including sales tax)More items...

Is a Bill of Sale required for selling a car in Kansas? No, a bill of sale is not required. However, it's always a good idea to have a bill of sale signed by the seller and the buyer with a copy for both to transfer ownership and give legal protection to both parties.