A Deed of Re conveyance in Oregon, also referred to as a Release of Deed of Trust, is a legal document that signifies the complete repayment of a mortgage loan. It is primarily used in the context of real estate transactions and serves to release the lender's claim on the property once the borrower has fulfilled their loan obligations. While a regular Deed of Re conveyance in Oregon typically requires notarization, there is also a specific type available without a notary section. The Deed of Re conveyance without notary section in Oregon is designed to accommodate situations where notarization may not be possible or practical. This alternative option allows parties involved in the transaction to proceed with reconveyance without the need for a notary public's presence or seal. Instead, the document may require alternative forms of authentication or signatures from the concerned parties. It is worth noting that while the Deed of Re conveyance without notary section offers flexibility, it is crucial to comply with Oregon's legal requirements to ensure its validity. Proper execution and adherence to the state's specific guidelines are essential to prevent any legal disputes or challenges in the future. Additionally, variations or alternative names for the Deed of Re conveyance document may exist depending on the specific circumstances or preferences of the parties involved. Some possible alternative types of Deed of Re conveyance in Oregon include: 1. Full Re conveyance Deed: This type of reconveyance is used when the borrower has completely paid off their mortgage, and the lender releases their claim on the property without any encumbrances. 2. Partial Re conveyance Deed: In situations where the borrower has made a partial payment or a renegotiation of the loan terms has occurred, a partial reconveyance deed may be used to release the lender's claim on a proportionate share of the property. 3. Subordinate Re conveyance Deed: When a junior lien holder (such as a second mortgage or home equity loan) agrees to release their claim on the property to allow the refinancing or payoff of the primary mortgage, a subordinate reconveyance deed may be utilized. This ensures that the new loan assumes the primary lien position. These are some examples of the types of Deed of Re conveyance in Oregon that may be encountered, though they may not specifically relate to the notary section. It is crucial to consult with a qualified legal professional or title company to ensure the specific requirements and terminology are adhered to for each unique situation.

Deed Of Reconveyance Oregon Without Notary Section

Description

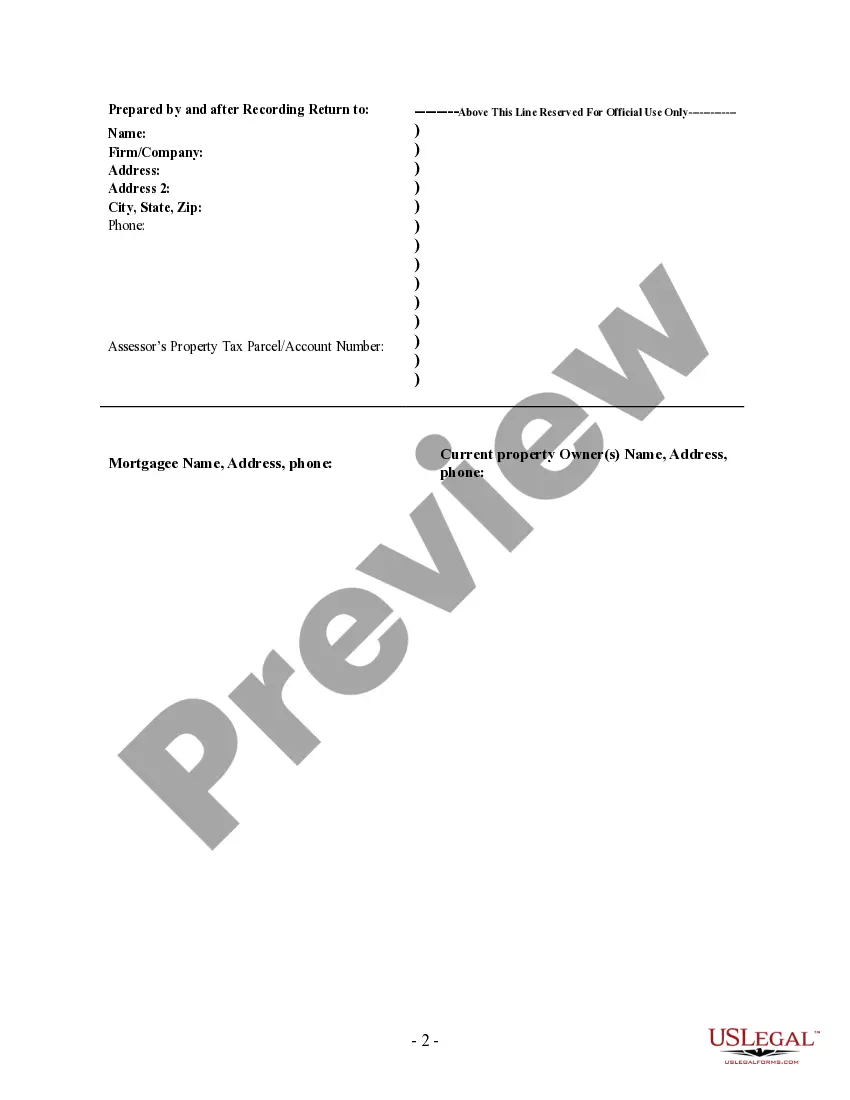

How to fill out Deed Of Reconveyance Oregon Without Notary Section?

Accessing legal document samples that comply with federal and regional laws is crucial, and the internet offers many options to choose from. But what’s the point in wasting time looking for the appropriate Deed Of Reconveyance Oregon Without Notary Section sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and life situation. They are simple to browse with all documents organized by state and purpose of use. Our professionals stay up with legislative changes, so you can always be confident your paperwork is up to date and compliant when obtaining a Deed Of Reconveyance Oregon Without Notary Section from our website.

Getting a Deed Of Reconveyance Oregon Without Notary Section is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, follow the steps below:

- Take a look at the template using the Preview feature or through the text outline to ensure it fits your needs.

- Browse for another sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the right form and opt for a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Deed Of Reconveyance Oregon Without Notary Section and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and fill out previously saved forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

A deed of reconveyance, also known as a satisfaction of mortgage, is a document that proves you've paid off your mortgage. The deed of reconveyance releases the lien the mortgage lender placed on your property. You'll need this document to prove a clear title when you sell your home.

You must have your deed of reconveyance notarized and filed in the public records. Often this means taking your deed of reconveyance to the county offices. Recording this deed of reconveyance accurately is essential to providing proof of your ownership and that you paid your loan back.

As an example, say Sally decides to purchase a house, and in doing so, she needs to take out a mortgage of $300,000 from the bank. The new property acts as collateral under the deed of trust. Once Sally has fully paid off her mortgage, the trustee must then complete a ?Request for Reconveyance.?

The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized. Full Reconveyance form can be purchased at most office supply or stationery stores. Usually the trustee named on your Deed of Trust will also have forms available and will issue the Full Reconveyance.

A deed of reconveyance, also known as a satisfaction of mortgage, is a document that proves you've paid off your mortgage. The deed of reconveyance releases the lien the mortgage lender placed on your property.