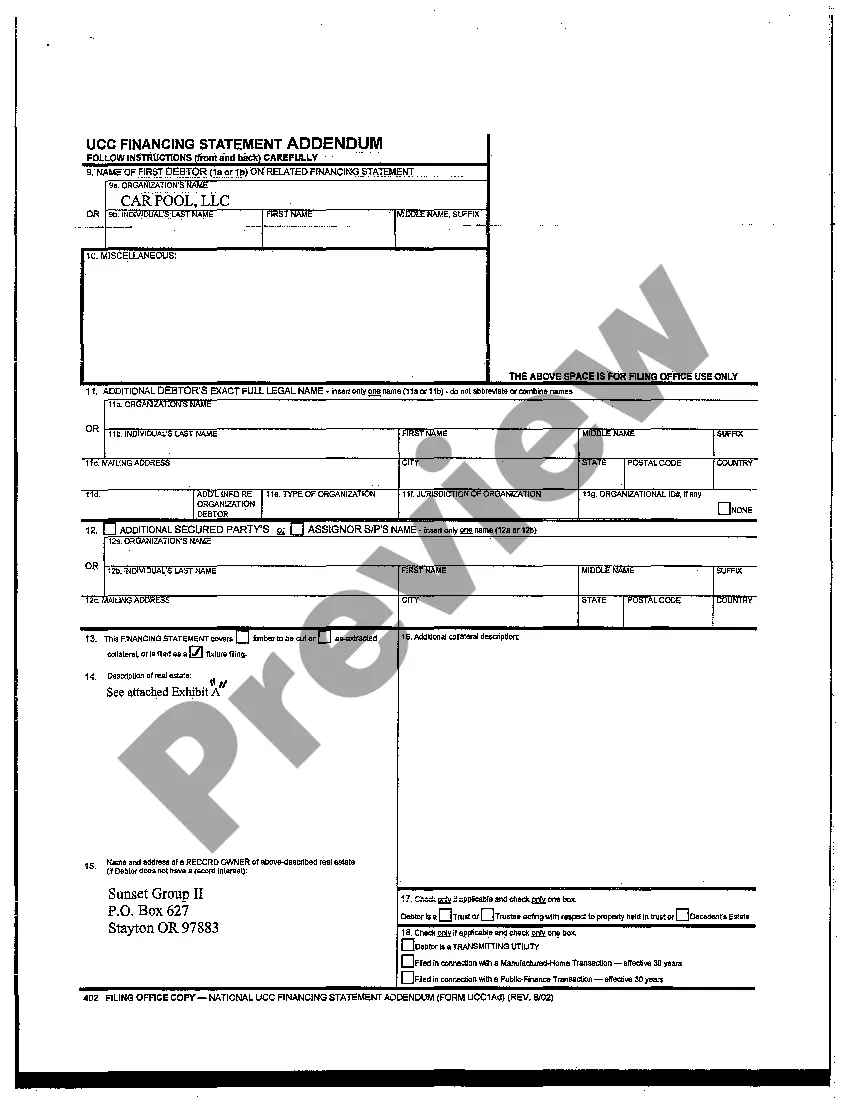

Ucc Filing Oregon With State Of Florida

Description

How to fill out Oregon UCC Financing Statement?

The Ucc Filing Oregon With State Of Florida displayed on this site is a reusable official template created by expert attorneys in accordance with national and local regulations.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal practitioners access to more than 85,000 validated, state-specific documents for any business and personal scenario.

Subscribe to US Legal Forms to have verified legal templates for every aspect of life readily available.

- Look for the document you require and verify it.

- Examine the sample you found and preview it or read the form description to confirm it meets your requirements. If it doesn't, employ the search feature to locate the right one. Click Buy Now once you’ve identified the template you seek.

- Register and sign in.

- Choose the pricing option that fits your needs and create an account. Use PayPal or a credit card to process a swift payment. If you already possess an account, Log In and review your subscription to proceed.

- Obtain the fillable template.

- Select the format you wish for your Ucc Filing Oregon With State Of Florida (PDF, DOCX, RTF) and download the sample onto your device.

- Fill out and sign the document.

- Print the template to complete it manually. Alternatively, use an online multifunctional PDF editor to quickly and precisely fill out and sign your form with an eSignature.

- Re-download your documents as needed.

- Utilize the same document again whenever required. Access the My documents tab in your profile to re-download any previously obtained forms.

Form popularity

FAQ

You should file a UCC Financing Statement in the state where the debtor is located. For those dealing with Ucc filing oregon with state of florida, ensure you file in each state if there are separate debtors. The financing statement needs to reflect the correct jurisdiction to provide the necessary legal protection. uslegalforms offers tools to help you determine the correct filing locations and requirements.

A UCC filing creates a public record showing that a creditor has a claim against a debtor's assets. In simple terms, it helps protect lenders when businesses seek loans by indicating what collateral is tied to the debt. If you're dealing with UCC filing in Oregon with the state of Florida, think of it as ensuring clarity about who owns what in financial agreements.

Typically, the debtor is responsible for the fees associated with a UCC filing. However, it is common for creditors to cover these costs as part of their agreements with debtors. Being clear about who bears these costs can prevent misunderstandings. Using a platform like USLegalForms can help streamline your UCC filing in Oregon with the state of Florida, ensuring everyone is on the same page.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

Bylaws and resolutions are the initial decisions of your corporation's board of directors and basic "operating rules" of your corporation. An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions.

What should a resolution to open a bank account include? LLC name and address. Bank name and address. Bank account number. Date of meeting when resolution was adopted. Certifying signature and date.

Resolutions are usually single-page documents that include: the company name. the date the resolution was passed. a title that describes the action taken such as "resolution to open a checking account"

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

Most LLC Resolutions include the following sections: Date, time, and place of the meeting. Owners or members present. The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.