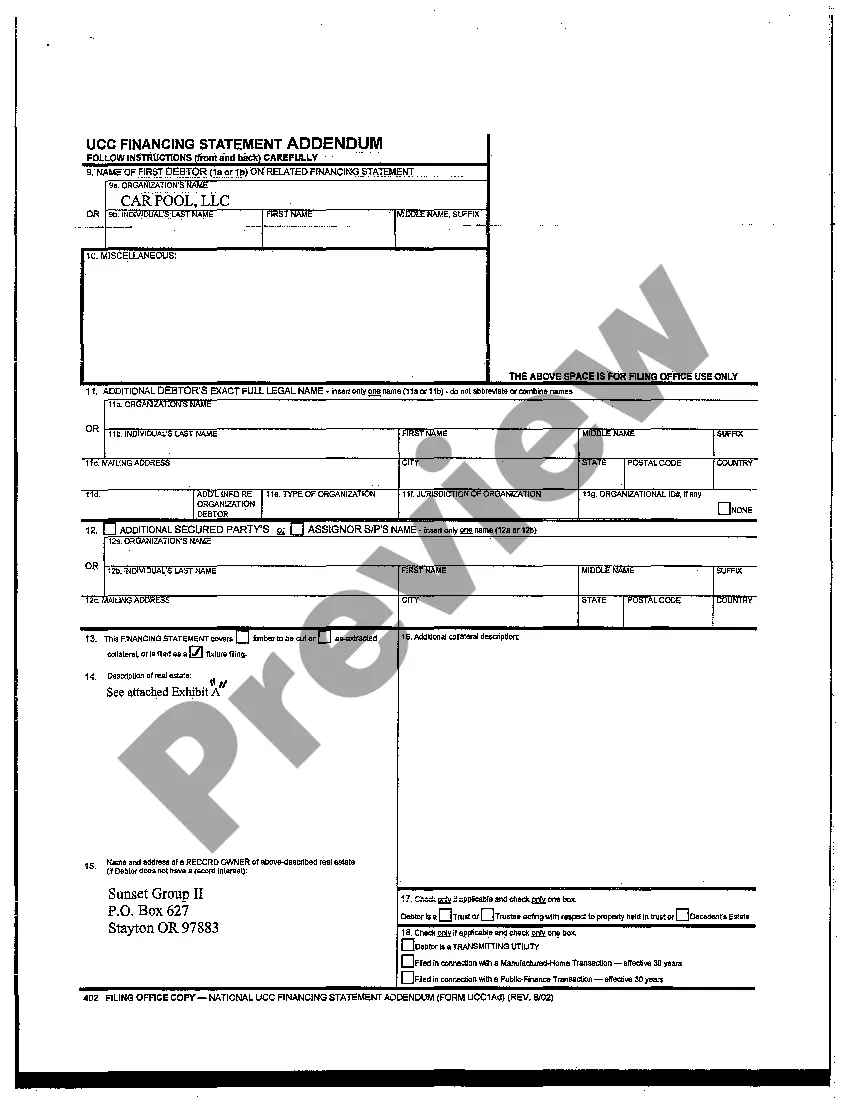

Oregon UCC Filing with State of Florida: A Comprehensive Guide When conducting business transactions or securing loans in the state of Florida, it is essential to understand the laws and requirements surrounding Oregon UCC filing to protect your interests. UCC, short for "Uniform Commercial Code," is a standardized set of laws governing commercial transactions and providing guidelines for the creation and enforcement of security interests in personal property. Oregon UCC filings with the State of Florida involve submitting necessary forms and documentation to officially establish and perfect security interests in collateral located within Florida. This process allows creditors to have legal priority over other claimants in case of default, bankruptcy, or asset distribution. Below, we will explore the different types of Oregon UCC filings in Florida: 1. UCC-1 Financing Statement: The UCC-1 is the most common type of filing and serves as a general notice to other creditors that you have a security interest in the specified collateral. This form includes essential details such as debtor and creditor information, collateral description, and any necessary supporting documents. It is crucial to accurately provide all required information to ensure a valid filing. 2. UCC-3 Amendment: This filing allows creditors to make modifications or amendments to existing UCC-1 Financing Statements. It is typically used to update debtor information, modify collateral descriptions, or terminate a security interest. Timely amendments are vital to maintaining accurate and enforceable filings. 3. UCC-5 Information Statement: While not predominantly used for securing or modifying security interests, a UCC-5 Information Statement provides information about an assignment of a security interest, including any subsequent changes. This filing can be valuable for due diligence purposes or researching a debtor's existing security arrangements. 4. UCC-11 Information Request: The UCC-11 Information Request is utilized when individuals or entities need to retrieve specific UCC documents or search for UCC records related to a debtor, collateral, or financing statement. This request can provide an overview of any existing filings, enabling informed decisions and reducing the risk of missing critical information. Accuracy and attention to detail are paramount during the Oregon UCC filing process. Ensure proper preparation and verification of all information provided in the filings, paying careful attention to relevant keywords such as UCC-1, UCC-3, UCC-5, and UCC-11, as well as debtor and collateral details. Filing fees and specific requirements may vary depending on the type of filing and the complexity of the transaction. In conclusion, when engaging in business activities or seeking financial security in Florida, understanding the intricacies of Oregon UCC filing is essential to safeguard your interests and maintain legal compliance. Familiarize yourself with the different types of filings, their implications, and the associated processes to navigate the complexities effectively. Partnering with legal professionals, such as attorneys or filing services, can provide expert guidance and ensure successful and compliant filings.

Oregon Ucc Filing With State Of Florida

Description

How to fill out Oregon Ucc Filing With State Of Florida?

The Oregon Ucc Filing With State Of Florida you see on this page is a reusable legal template drafted by professional lawyers in compliance with federal and regional laws. For more than 25 years, US Legal Forms has provided people, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, most straightforward and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Oregon Ucc Filing With State Of Florida will take you only a few simple steps:

- Search for the document you need and check it. Look through the sample you searched and preview it or review the form description to confirm it suits your requirements. If it does not, make use of the search bar to get the appropriate one. Click Buy Now once you have found the template you need.

- Sign up and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Pick the format you want for your Oregon Ucc Filing With State Of Florida (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork again. Use the same document again whenever needed. Open the My Forms tab in your profile to redownload any earlier saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

Quality Start is a voluntary program for licensed child care centers, designed to recognize, support and increase the quality of child care throughout Louisiana.

based child care provider may register with the Department. If the provider cares for up to 6 children in the provider's home, it is considered a family child care provider. If the care is being given in the child's home the provider is an inhome provider.

A license is required for all facilities with six or more children.

License exempt (formerly known as unlicensed) Child Care Providers are adults, age 18 or older, who are enrolled to provide child care for up to six children at a time.

Ratio requirements For children under 1 year old: Five children for one staff member () For children 1 year old: Nine children for one staff member () For children 2 years old: Twelve children for one staff member () For children 3 years old: Fourteen children for one staff member ()

The Child Care Assistance Program (CCAP) is run by the Louisiana Department of Education. CCAP helps low- and moderate-income families pay for the child care they need in order to work, look for work, or attend school or training.

Ways to File a Child Care Complaint Online: File a complaint using our online form. By e-mail: Send details of your complaint to CC.ComplaintUnit@msdh.ms.gov. By phone: Call 1-866-489-8734 weekdays between 8 a.m. and 5 p.m. You may also mail your complaint to: Mississippi State Department of Health.

Two years paid experience as a caregiver in a licensed child care facility, and either (1) a current Child Development Associate (CDA) credential from the Council for Early Childhood Professional Recognition (CECPR), or (2) a Mississippi Department of Human Services (MDHS) Division of Early Childhood Care and ...