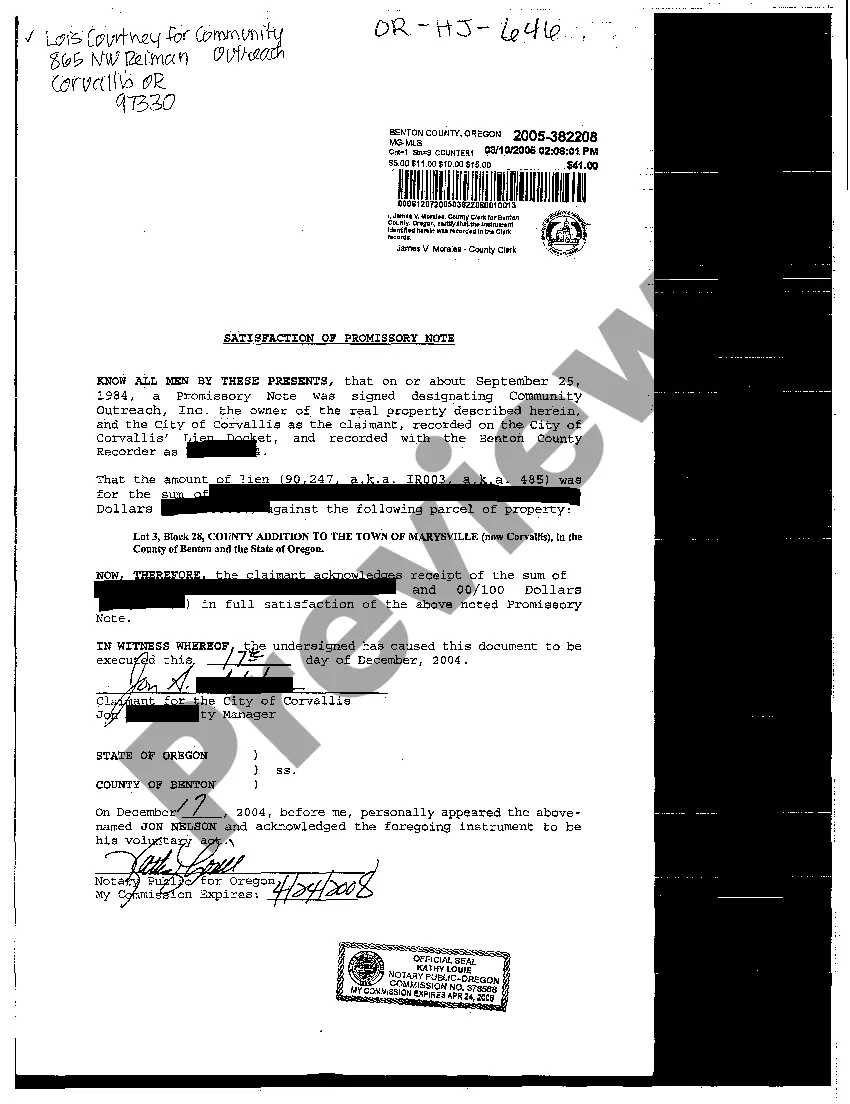

Satisfaction Of Promissory Note With Solution

Description

How to fill out Oregon Satisfaction Of Promissory Note?

Well-constructed official paperwork is one of the essential assurances for preventing issues and legal disputes, but obtaining it without the assistance of a lawyer may require some time.

Whether you are looking to swiftly find a current Satisfaction Of Promissory Note With Solution or any other forms related to employment, family, or business matters, US Legal Forms is always ready to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button adjacent to the selected document. Furthermore, you can retrieve the Satisfaction Of Promissory Note With Solution anytime later, as all documents previously obtained on the platform are accessible under the My documents section of your profile. Save time and expenses on preparing official documentation. Experience US Legal Forms today!

- Ensure that the document is appropriate for your situation and location by reviewing the description and preview.

- Search for another template (if necessary) using the Search bar in the top section of the page.

- Hit Buy Now once you find the suitable template.

- Choose your pricing option, Log In to your account or set up a new one.

- Select your preferred payment method to purchase the subscription (via credit card or PayPal).

- Opt for PDF or DOCX format for your Satisfaction Of Promissory Note With Solution.

- Press Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Refinancing a hard money note is exactly like refinancing a bank mortgage. Find the refinancing lender and loan, go through a qualifications process, have the property appraised, and give contact information for the original note holder to your new lender so it can make arrangements to pay off the privately held note.

If our payments are monthly, then we divide our annual interest rate by 12. The P stands for the fixed monthly payment amount that we will have to pay. To find the total amount that we end up paying, we multiply this fixed monthly amount by the total number of payments.

Circumstances for Release of a Promissory Note The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

When valuing a promissory note, it's necessary to examine the factors that affect its perceived risk, including: Interest rate and duration. Generally, the shorter a note's term, and the higher the interest rate relative to market rates, the greater its value.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.