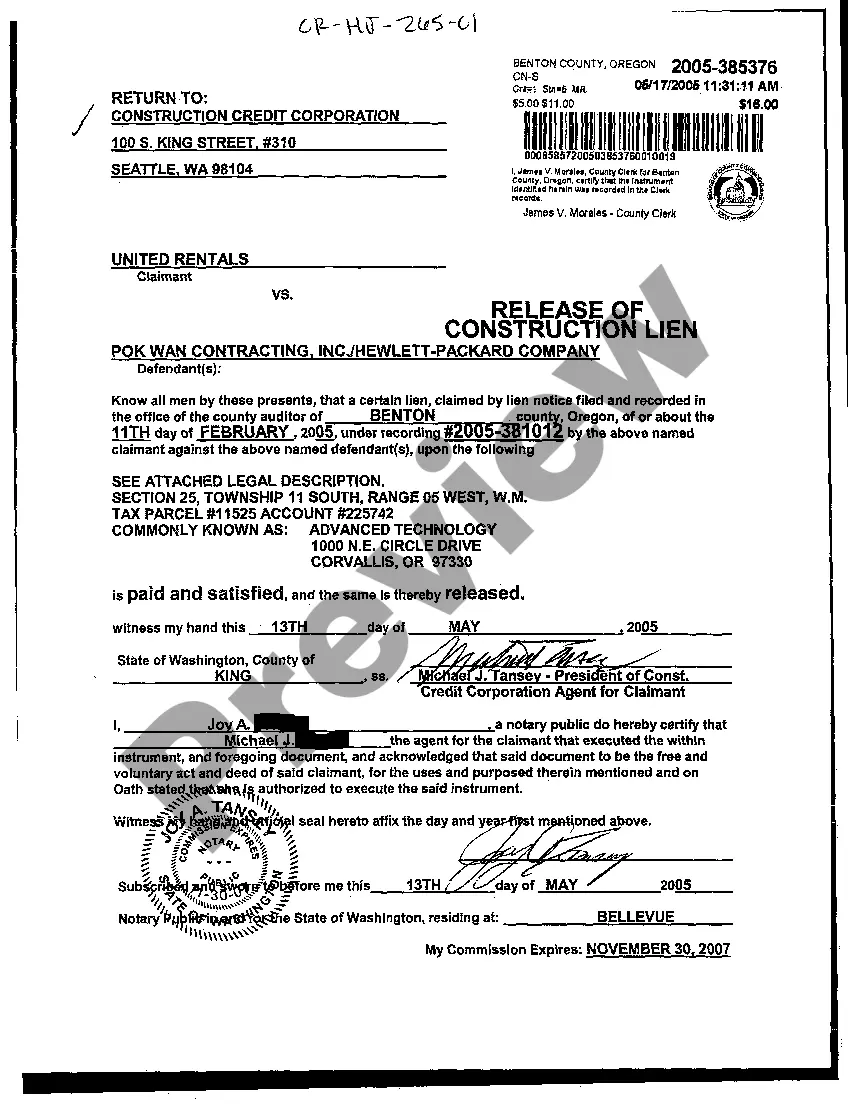

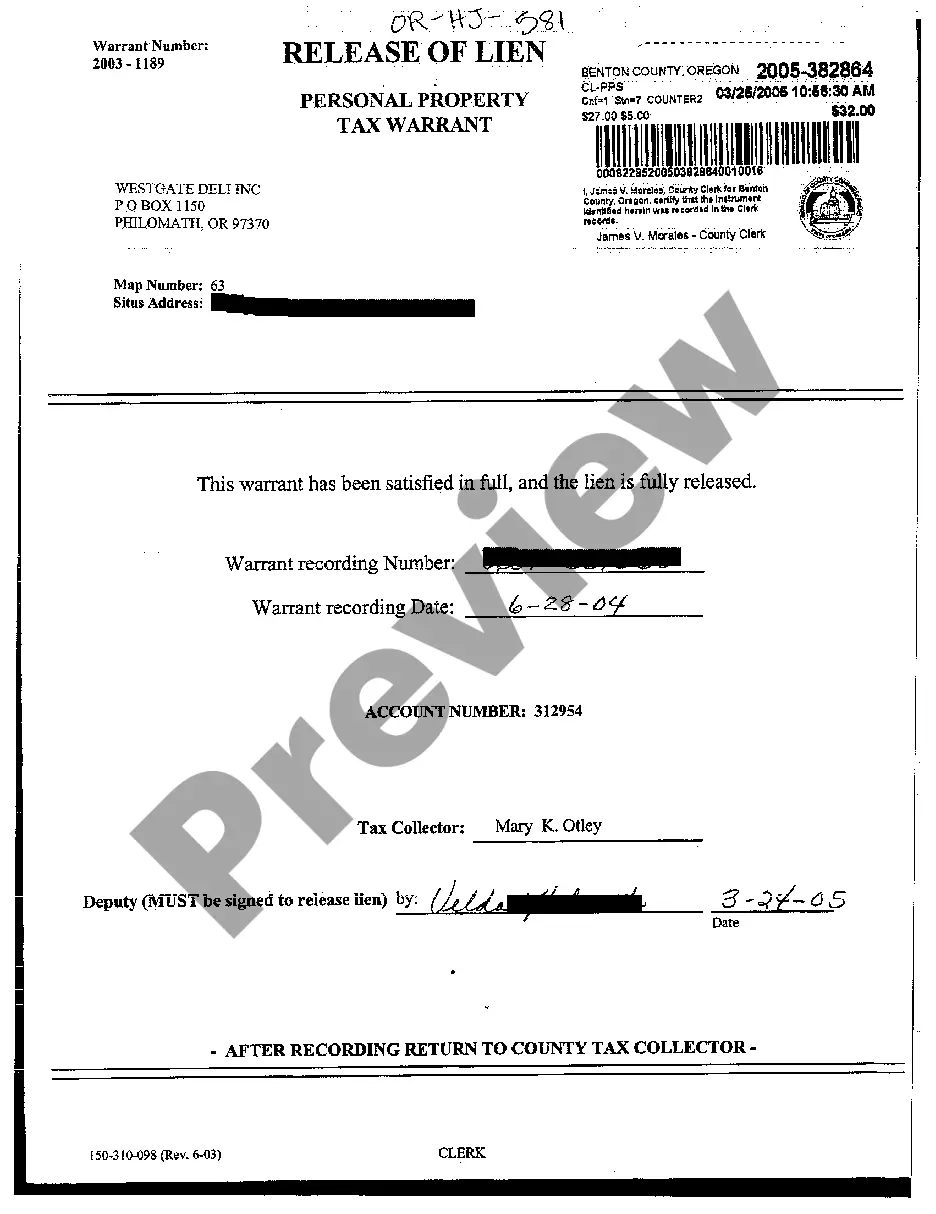

Oregon Release Of Lien Form With Notary

Description

How to fill out Oregon Release Of Lien?

How to obtain professional legal documents that comply with your state's regulations and prepare the Oregon Release Of Lien Form With Notary without seeking a lawyer's help.

Numerous online services provide templates for various legal scenarios and requirements. However, it might take some time to determine which of the available samples align with both your use case and legal obligations.

US Legal Forms is a trustworthy platform that assists you in finding official documents crafted according to the most recent updates in state law while saving you money on legal fees.

If you do not possess an account with US Legal Forms, please follow the instructions below: Browse the current webpage and confirm if the form meets your requirements.

- US Legal Forms is not merely a conventional online catalog.

- It features over 85,000 verified templates for diverse business and personal situations.

- All documents are organized by field and state to expedite and enhance your search experience.

- Moreover, it integrates with powerful tools for PDF modification and e-signature, enabling users with a Premium subscription to efficiently finalize their paperwork online.

- It requires minimal time and effort to access the necessary documentation.

- If you already have an account, Log In and verify the validity of your subscription.

- Download the Oregon Release Of Lien Form With Notary by clicking the relevant button adjacent to the file name.

Form popularity

FAQ

The waivers need not be notarized. It is sufficient that it is in writing. The taxpayer is bound to submit his duly executed waiver to the officers of the Bureau and to retain his copy of the accepted waiver.

A Conditional Contractors Lien Release Form is a legal document basically stating that arrangements have been made to pay the lien by issuing a payment to the lien holder. The lien against the property shall be released only upon the condition that the payment clears the lending or banking institution.

Notarization Not RequiredCalifornia does not require lien waivers to be notarized. Notarizing a lien waiver form in California could actually invalidate it.

No. There is no statutory requirement in Oregon that a lien waiver be notarized.

The document you must file to release a mechanic's lien in Oregon is known as a satisfaction of lien form. Once you have received payment from the customer, you must complete and file an Oregon satisfaction of lien form to release a mechanic's lien in Oregon (also known as a construction lien).

No, California lien waivers do not need to be notarized, even though it's common for businesses to ask that waivers be notarized.

No, Oregon does not provide or require statutory forms for lien waivers.