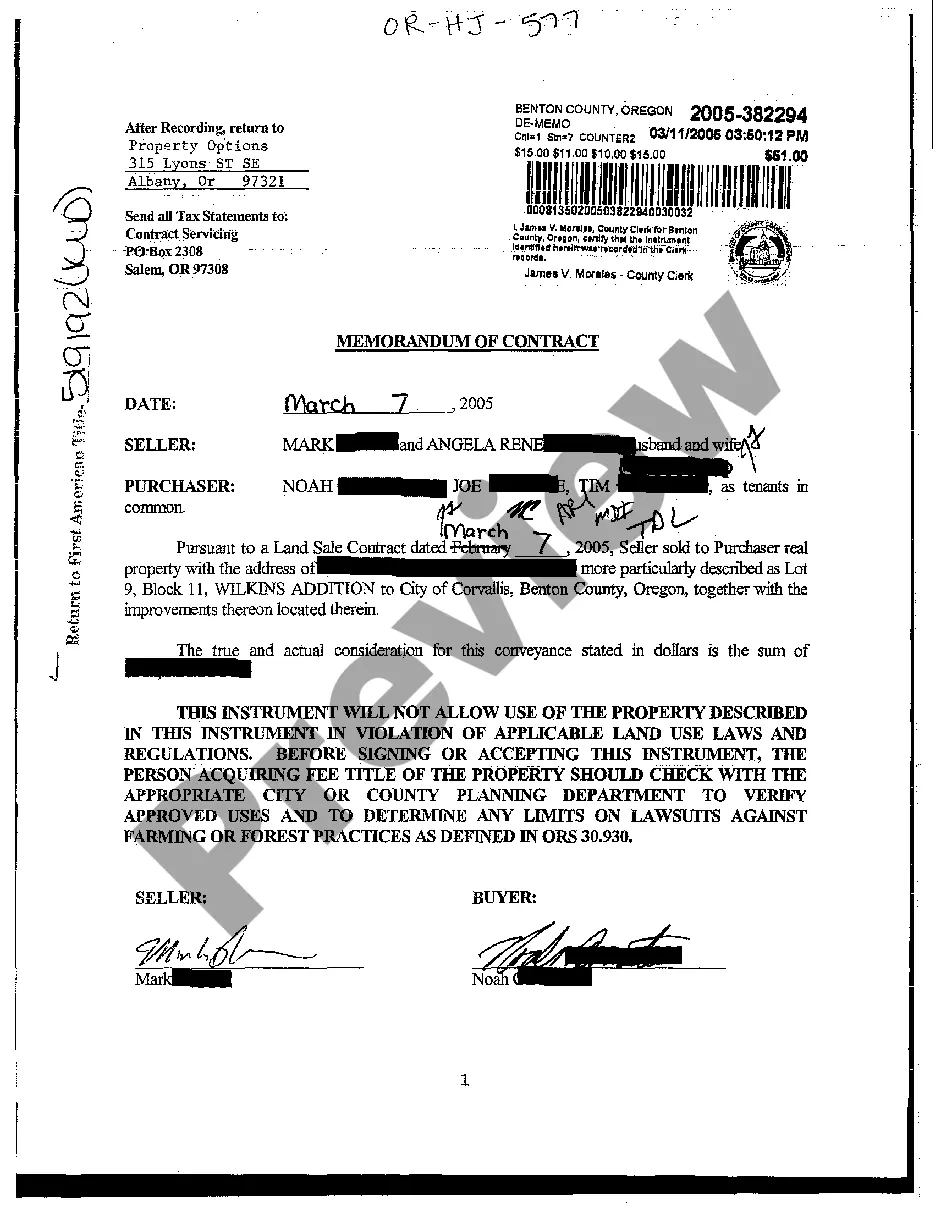

Oregon Data Match Tax Liens Memorandum Of Agreement For Payment

Description

How to fill out Oregon Memorandum Of Contract?

Well-composed official documentation is one of the crucial safeguards for preventing issues and legal disputes, but acquiring it without the assistance of a lawyer may require some time.

Whether you need to swiftly locate a current Oregon Data Match Tax Liens Memorandum Of Agreement For Payment or any other templates for employment, family, or business scenarios, US Legal Forms is always ready to assist.

The procedure is even simpler for current members of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected file. Moreover, you can access the Oregon Data Match Tax Liens Memorandum Of Agreement For Payment at any time in the future, as all documents previously obtained on the platform are accessible within the My documents section of your profile. Save time and money on preparing legal documents. Experience US Legal Forms today!

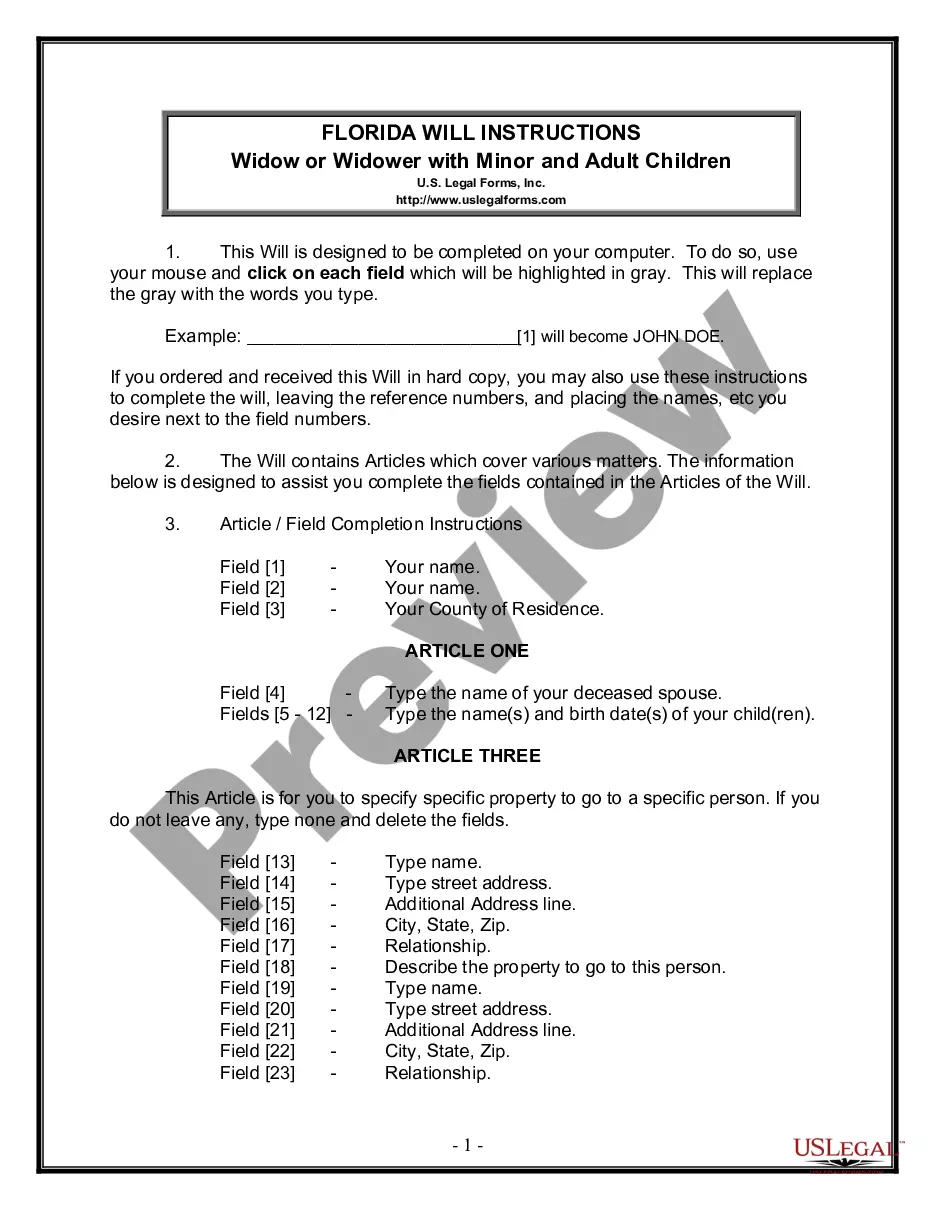

- Ensure that the form aligns with your circumstances and jurisdiction by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the page header.

- Click Buy Now once you find the relevant template.

- Choose the pricing plan, Log In to your account, or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose either PDF or DOCX file format for your Oregon Data Match Tax Liens Memorandum Of Agreement For Payment.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

A state tax lien is the government's legal claim against your property when you don't pay your tax debt in full. Your property includes real estate, personal property and other financial assets. When a lien is issued by us, it gets recorded in the county records where you live.

The Notice of Federal Tax Lien (NFTL) as identified in IRC § 6323 is a public notification filed with designated state and local jurisdictions. Filing the NFTL provides notice to the public of the underlying federal tax lien's claim against the taxpayer's property to secure the debt.

The document used to release a lien is Form 668(Z),Certificate of Release of Federal Tax Lien. Servicewide Delegation Order 5-4 lists those employees who have the authority to approve Federal tax lien releases and other lien related certificates.

If you receive a request for payment letter from Revenue and you cannot pay, you should contact the telephone number in the letter to discuss your options. These will include the option to pay in instalments through a Phased Payment Arrangement (PPA).

Set up a payment planCall us at 503-945-8200.Or sign in to Revenue Online.