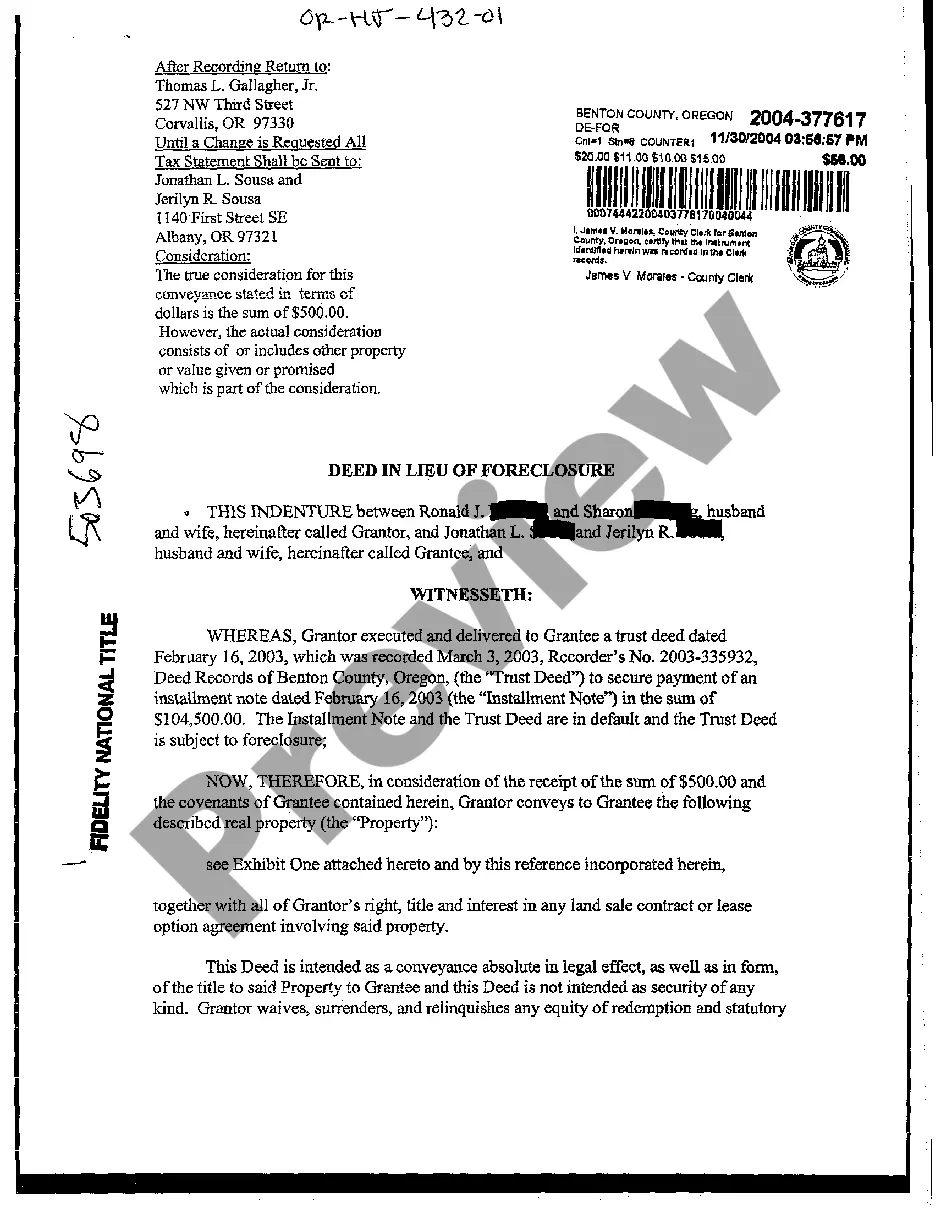

Deed In Lieu Of Foreclosure Form

Description

How to fill out Oregon Deed In Lieu Of Foreclosure?

When you need to present a Deed In Lieu Of Foreclosure Form that adheres to your local state's laws and rules, there may be several choices available.

There's no necessity to scrutinize each form to guarantee it meets all the legal requirements if you are a US Legal Forms member.

It is a dependable source that can assist you in acquiring a reusable and current template on any topic.

Getting professionally created official documents is made easy with US Legal Forms. Additionally, Premium users can also take advantage of the comprehensive built-in solutions for online PDF editing and signing. Try it out today!

- US Legal Forms is the largest online repository with a collection of over 85,000 ready-to-use documents for both business and personal legal situations.

- All templates are verified to comply with each state's laws.

- Therefore, when you download the Deed In Lieu Of Foreclosure Form from our website, you can be confident that you possess a valid and current document.

- Obtaining the necessary template from our platform is very easy.

- If you already have an account, simply Log In to the system, ensure your subscription is active, and save the selected file.

- In the future, you can access the My documents tab in your profile and keep access to the Deed In Lieu Of Foreclosure Form whenever you need it.

- If this is your initial experience with our library, please follow the instructions below.

- Browse the suggested page and verify it for relevance to your requirements.

Form popularity

FAQ

The biggest disadvantage for a lender when opting for a deed in lieu of foreclosure form is the potential inability to recoup the full amount of the mortgage. This loss occurs if the property's value has decreased significantly, resulting in insufficient collateral coverage. Furthermore, lenders may face a lengthy process involving property inspections and legal evaluations, complicating their ability to efficiently manage the asset. Thus, lenders must assess these factors before accepting a deed in lieu of foreclosure.

A deed in lieu of foreclosure form can carry several disadvantages for homeowners. First, it can negatively impact their credit score, making it challenging to obtain future financing. Second, the process could result in tax implications, as some borrowers may have to report canceled debt to the IRS. Lastly, waiving the right to redemption can limit future recovery options, making it essential for individuals to understand the full scope of the deed's repercussions.

The most significant disadvantage for a lender accepting a deed in lieu of foreclosure form is the potential loss of recovery on the outstanding debt. This situation arises if the property's market value is lower than the mortgage balance, leaving the lender unable to recover the full amount owed. Additionally, lenders may face legal and administrative challenges when transferring property ownership, which can further complicate the process. Overall, accepting a deed in lieu can lead to financial implications that lenders must carefully consider.

One significant disadvantage of a deed in lieu of foreclosure is the potential hit to your credit score. This option can appear on your credit report similarly to a foreclosure, impacting your ability to secure loans in the future. While it may help you avoid the emotional strain of a prolonged foreclosure process, it is crucial to consider how it will affect your long-term financial goals.

While a deed in lieu of foreclosure can provide relief, it comes with disadvantages. First, it may have a lasting negative impact on your credit score, much like a foreclosure. Additionally, lenders might not forgive all remaining debts, and you could be liable for any deficiency. Therefore, it’s essential to review your specific situation thoroughly and consult with legal professionals to weigh your options.

When writing a deed in lieu of foreclosure letter, start by addressing your lender directly and stating your intention to surrender the property. Include your account information, property address, and a brief explanation of your financial situation. Clearly express your understanding that the deed in lieu of foreclosure form will transfer ownership to the lender. Finally, offer to discuss the details further and provide your contact information for follow-up.

In the UK, a deed in lieu of foreclosure functions similarly to its counterpart in the US but is often referred to in different terms, such as voluntary surrender or repossession. Homeowners may choose to return their property to the lender to clear debts and avoid the distress of formal foreclosure proceedings. This option can provide a cleaner resolution and may facilitate a fresh start. It’s crucial to know your rights and obligations, so seek advice from a legal expert if considering this route.

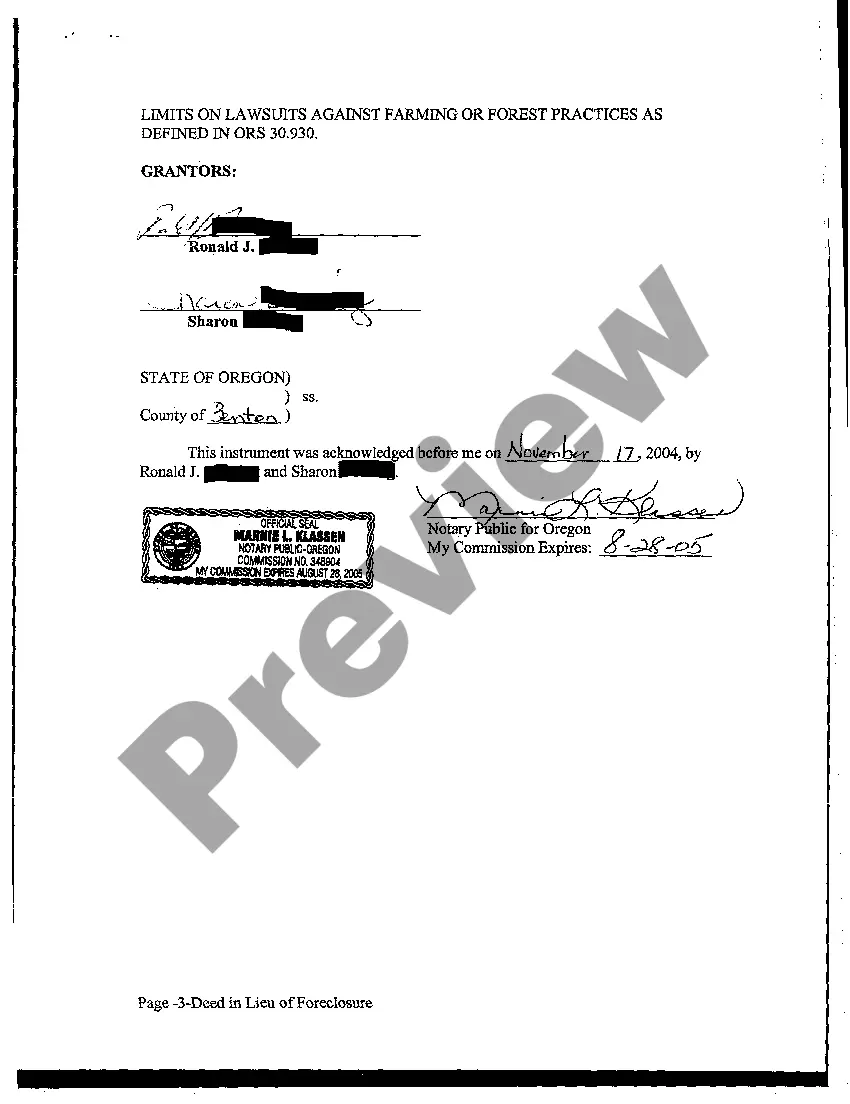

To file a deed in lieu of foreclosure, you need to first contact your lender to express your interest in this option. The lender will provide you with the necessary paperwork, including the deed in lieu of foreclosure form. Once completed, you should sign it in the presence of a notary public and then submit it to your lender for their records. It’s wise to consult a legal professional to ensure all aspects of the process are handled correctly.

A deed in lieu of foreclosure is a legal document that allows a homeowner to transfer the ownership of their property to the lender to avoid foreclosure proceedings. This process can help both parties by eliminating lengthy court processes and saving costs associated with foreclosure. If you’re facing financial difficulties, considering a deed in lieu of foreclosure form may provide a smoother resolution. Platforms like US Legal Forms can guide you through the creation of this document and ensure it meets legal standards.