Trust Transfer Deed Without Probate

Description

How to fill out Trust Transfer Deed Without Probate?

Properly prepared formal documents are one of the crucial assurances for circumventing complications and lawsuits, but obtaining them without legal counsel may require time.

Whether you need to swiftly locate an up-to-date Trust Transfer Deed Without Probate or any other forms for work, family, or commercial events, US Legal Forms is always available to assist.

The process is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the chosen file. Additionally, you can access the Trust Transfer Deed Without Probate at any time later, as all documents previously obtained on the platform remain accessible within the My documents section of your profile. Save time and money on creating official documents. Try US Legal Forms immediately!

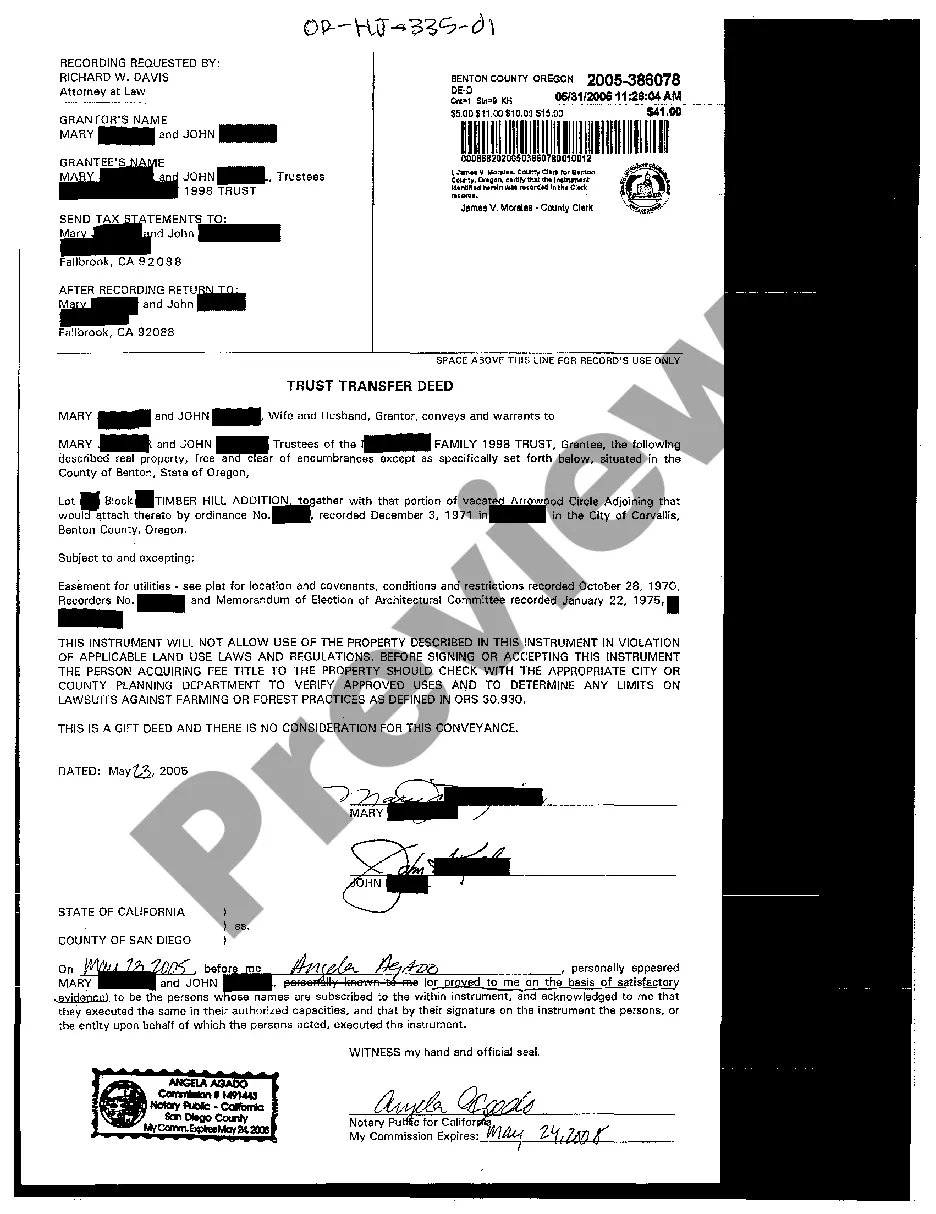

- Verify that the document is appropriate for your situation and locality by reviewing the description and preview.

- Search for another template (if necessary) using the Search bar on the page header.

- Press Buy Now once you find the suitable template.

- Select a pricing plan, sign in to your account or set up a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX format for your Trust Transfer Deed Without Probate.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

After the grantor passes, assets can be transferred out of a trust through the instructions laid out in the trust document. Typically, the successor trustee will manage this process, ensuring beneficiaries receive their assets according to the grantor's wishes. Creating a Trust transfer deed without probate can streamline this transfer, minimizing delays and legal battles for your loved ones.

A revocable land trust can help you avoid probate, allowing you to manage and control your property during your lifetime. Upon your passing, the assets held in the trust can be transferred directly to your beneficiaries without going through probate. Utilizing a Trust transfer deed without probate in your estate planning ensures that your real estate is handled as you wish, swiftly and efficiently.

Yes, transferring assets from one trust to another is possible and often done for various reasons, such as changing beneficiaries or updating the terms. This transfer requires proper documentation, typically in the form of a trust transfer deed, to maintain clear ownership records. Continuing to focus on a Trust transfer deed without probate will simplify this process and alleviate potential legal issues.

To transfer property from one trust to another, you must execute a new trust transfer deed. This deed outlines the specifics of the transfer, ensuring the property moves seamlessly between trusts. Using this method affirms your wishes while preventing any probate complications that may arise, aligning perfectly with the Trust transfer deed without probate approach.

Yes, a Transfer on Death (TOD) account allows the account holder to designate a beneficiary who will receive the assets directly upon their death. This process effectively bypasses probate, making the transfer of property smoother and faster. By using a Trust transfer deed without probate, you can ensure your assets reach your beneficiaries without the complexities of the legal system.

Yes, a trust can be used to pass off ownership of a home immediately through a trust transfer deed without probate. This approach allows the property owner to designate beneficiaries who will receive ownership upon their death without undergoing probate. Establishing a trust provides peace of mind and assures that your property goes to the right people quickly. Utilizing solutions from US Legal Forms can aid in setting up the right trust structure.

The fastest way to transfer a deed is by using a trust transfer deed without probate. This method enables the immediate transfer of property to a beneficiary without the delays associated with probate court. Properly prepare and record the deed to accomplish the transfer efficiently. Platforms like US Legal Forms offer templates that simplify this process and ensure all necessary details are included.

To remove a deceased person from a deed in Texas, you need to execute a new deed that reflects the change in ownership. In many cases, this can be accomplished through a trust transfer deed without probate if the property was held in a trust. You may also need to gather documents like the death certificate and the original deed. Consulting resources from US Legal Forms can help streamline this process and ensure all legal requirements are met.

You can transfer a deed without going through probate by utilizing a trust transfer deed without probate. This legal instrument allows property owners to designate a beneficiary who receives the property directly upon their passing. It’s essential to complete the process with accurate documentation and adhere to state laws. US Legal Forms provides resources that guide you through creating the necessary documents effectively.

To transfer a house without probate in Texas, you can use a trust transfer deed without probate. This process allows you to transfer ownership to a beneficiary directly, bypassing the lengthy probate court procedures. By creating a properly executed deed, you ensure that the property passes seamlessly to the new owner upon your death. Using platforms like US Legal Forms can simplify this process with easy-to-follow templates.