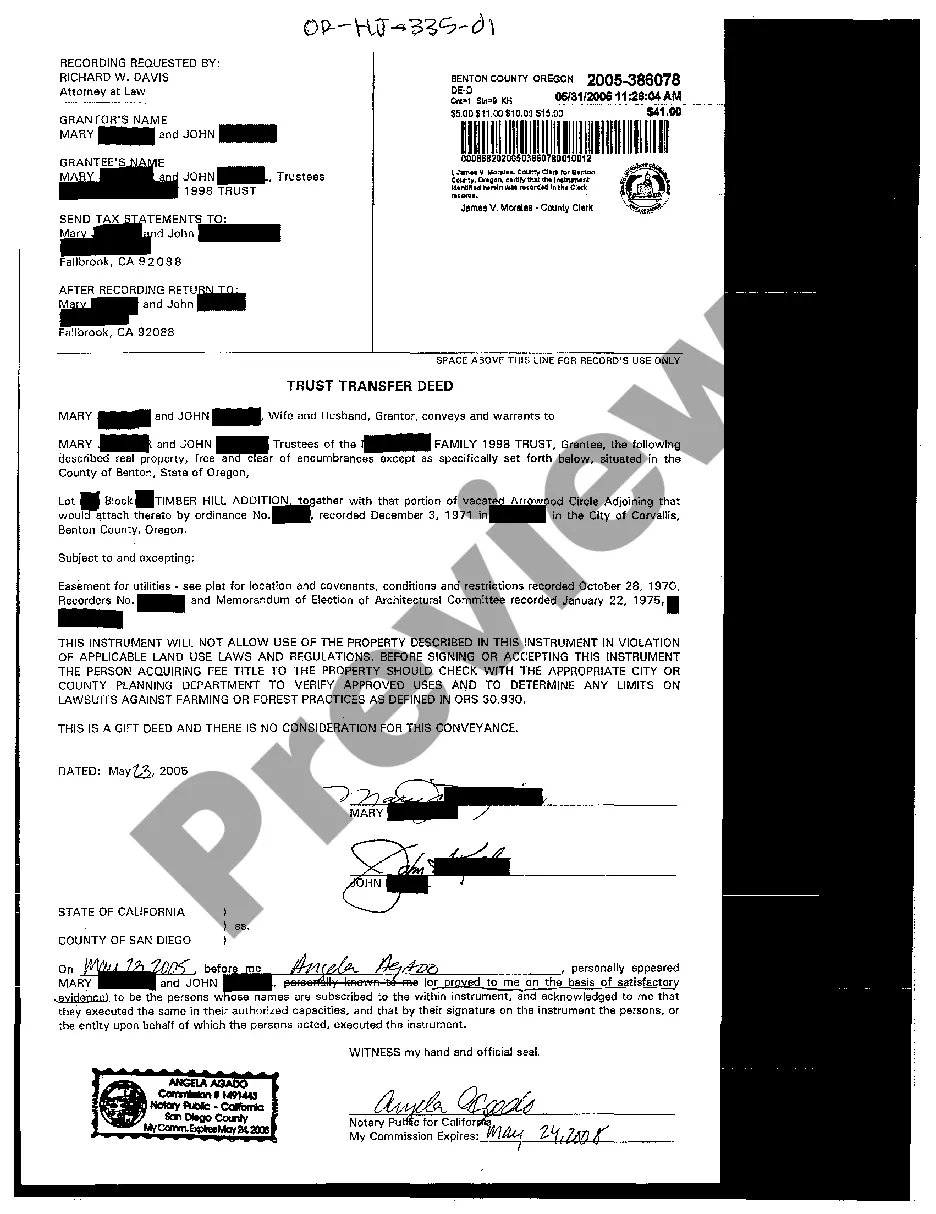

Trust Transfer Deed With Will

Description

How to fill out Trust Transfer Deed With Will?

What is the most dependable service to obtain the Trust Transfer Deed accompanied by Will and other updated versions of legal documents? US Legal Forms is the solution! It possesses the most comprehensive assortment of legal paperwork for any purpose.

Each form is skillfully crafted and verified for adherence to federal and local regulations. They are categorized by region and state of application, making it effortless to find the one you need.

US Legal Forms is an excellent option for anyone who needs to handle legal documents. Premium users can benefit even further as they can complete and electronically sign previously saved forms at any time using the integrated PDF editing tool. Give it a try today!

- Experienced users of the site just need to Log In to the system, confirm if their subscription is active, and click the Download button next to the Trust Transfer Deed with Will to obtain it.

- Once downloaded, the document remains accessible for future reference in the My documents section of your profile.

- If you haven’t created an account with us yet, here are the actions you must undertake to establish one.

- Verification of form compliance. Prior to acquiring any template, you should verify if it aligns with your specific requirements and complies with your state or county's regulations.

Form popularity

FAQ

The best trust to place your house in is often a revocable living trust because it provides flexibility and control during your lifetime. This type of trust allows you to change the terms as needed, and upon your passing, the assets can transfer seamlessly to your beneficiaries without going through probate. Using a trust transfer deed with will can further enhance this process by specifying the transfer and management details related to your property.

One major mistake parents often make when establishing a trust fund is failing to clearly specify the beneficiaries and their conditions. Without clear instruction, disputes may arise over how the assets are distributed and managed. A trust transfer deed with will can help mitigate confusion by outlining your wishes explicitly, ensuring that your family understands your intentions.

The trust transfer theory posits that transferring assets into a trust can provide greater control over how those assets are distributed upon death. This theory emphasizes the idea that the grantor can set specific terms for the management and distribution of assets, giving peace of mind to both the grantor and the beneficiaries. By using a trust transfer deed with will, you clarify these intentions and create a structured plan.

A trust transfer refers to the act of moving assets into a trust for management and distribution purposes. This process safeguards assets and streamlines the transfer of wealth, as the trustee holds and manages these assets on behalf of the beneficiaries. A trust transfer deed with will can effectively detail how these assets will be handled after your passing, ensuring your intentions are honored.

A trust to office transfer is a legal process through which assets are moved into a trust that is managed by an appointed trustee. This type of transfer can help to delineate the duties and responsibilities of the trustee while ensuring that the benefits reach the intended beneficiaries. Utilizing a trust transfer deed with a will can provide clarity and protection for your wishes.

To transfer items into a trust, you need to execute the appropriate legal documents that reflect the transfer of ownership from your name to the trust. This can include a trust transfer deed with will for real estate and personal property deeds for other assets. Ensuring all items are properly documented will facilitate smoother management and distribution as per your wishes.

Yes, you can move stocks into a trust. This process generally requires you to prepare a stock transfer form and submit it to your broker or financial institution. Once completed, the stocks are officially retitled in the name of the trust, streamlining future management and distribution through a trust transfer deed with will.

Moving assets into a trust involves retitling the property or accounts in the name of the trust. This process typically includes executing a trust transfer deed with will, which allows you to formally transfer ownership. Be sure to review all documentation to ensure that you meet the legal requirements needed for a proper transfer.

To transfer accounts to a trust, begin by contacting your financial institution to understand their specific requirements for transferring account ownership. You will often need to provide a copy of the trust documents along with a request to change ownership. Utilizing a trust transfer deed with will can simplify the process, ensuring a clear and secure transfer of assets.

Certain assets typically cannot be placed in a trust, including retirement accounts like IRAs or 401(k) plans. Additionally, personal property that you want to retain control over, such as your primary residence, may not be suited for a trust. However, using a trust transfer deed with will allows for the seamless transfer of specific assets while retaining others according to your needs.