Certificate Of Non Military Service For Disabled Parking-military

Description

How to fill out Certificate Of Non Military Service For Disabled Parking-military?

Individuals often link legal documentation with something intricate that only an expert can manage.

To some extent, this is accurate, as creating a Certificate of Non-Military Service For Disabled Parking-military demands considerable knowledge of the subject area, encompassing state and local laws.

However, with US Legal Forms, everything has become more straightforward: ready-to-use legal templates for any personal or business circumstance tailored to state laws are gathered in a single online library and are now accessible to everyone.

Choose the format for your document and click Download. Print your form or upload it to an online editor for quicker completion. All templates in our library are reusable: once purchased, they remain saved in your profile. You can access them anytime needed via the My documents tab. Discover all the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85k current forms categorized by state and usage area, making it quick to search for a Certificate of Non-Military Service For Disabled Parking-military or any other specific form.

- Users who have previously registered with an active subscription must Log In to their account and click Download to obtain the form.

- New users must first create an account and subscribe before they can download any documents.

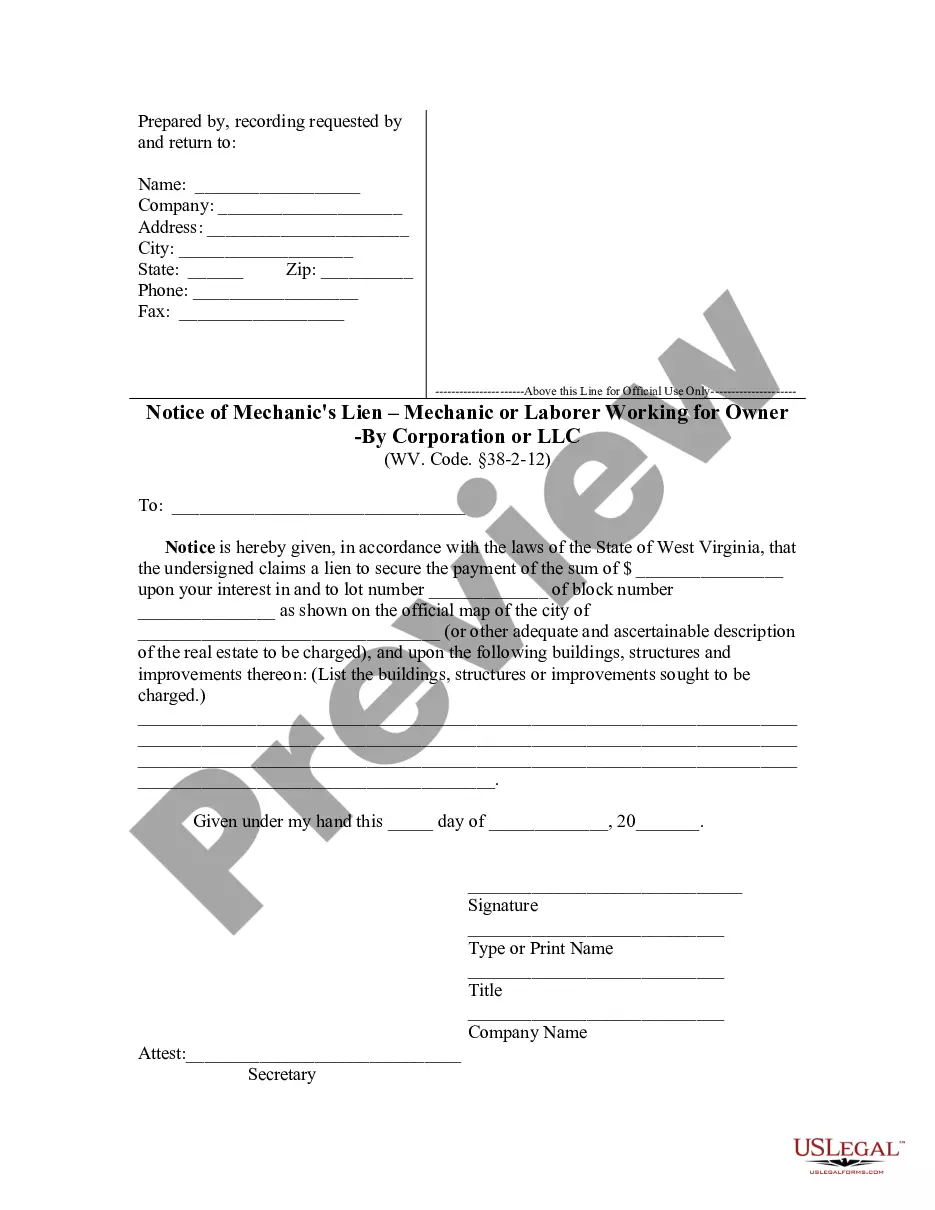

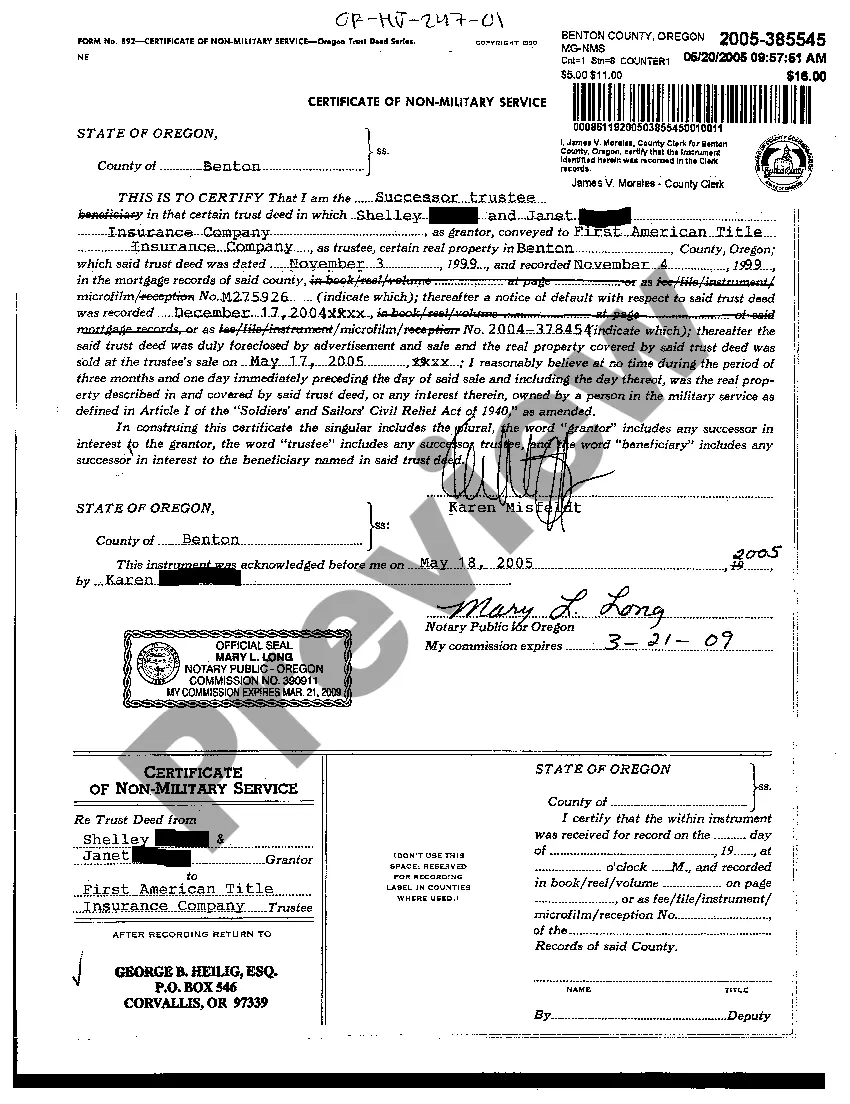

- Follow this step-by-step guide to acquire the Certificate of Non-Military Service For Disabled Parking-military.

- Carefully review the page content to ensure it meets your requirements.

- Examine the form description or check it through the Preview option.

- If the previous form does not meet your needs, search for another sample using the Search bar above.

- When you find the correct Certificate of Non-Military Service For Disabled Parking-military, click Buy Now.

- Select a subscription plan that aligns with your preferences and financial situation.

- Create an account or Log In to continue to the payment page.

- Complete the payment for your subscription using PayPal or a credit card.

Form popularity

FAQ

In order to obtain a placard, Form MV-145A (PDF), "Persons with Disability Parking Placard Application" must be completed by the person with a disability, a health care provider, or a police officer and returned to PennDOT. Permanent placards are valid for five years and renewed in March or September.

In order to obtain a placard, Form MV-145A (PDF), "Persons with Disability Parking Placard Application" must be completed by the person with a disability, a health care provider, or a police officer and returned to PennDOT. Permanent placards are valid for five years and renewed in March or September.

One vehicle is eligible for a $3 Disabled Veteran (DV) license plates. Additional vehicles may display a DV license plate; however, registration and local fees will apply.

Visit or call 312-836-5200 for more information. physician has certified that because of the service- connected disability the veteran qualifies for the issuance of a disabled placard or plate.

Items installed on motor vehicles to make them adaptable for use by persons with disabilities (such as special controls for paralysis or amputees) may be exempt from Florida sales tax. Only the customized portion would be exempt from sales tax.