Joint Tenants With Right Of Survivorship Vs Tenants In Common

Description

Form popularity

FAQ

While joint tenancy with right of survivorship offers benefits, there are notable cons as well. One major con is the lack of control; any joint tenant can sell or transfer their share without consulting others, which can create disagreements. Moreover, it doesn’t protect against legal claims from creditors or lawsuits, which could jeopardize the property. Evaluating these factors is essential to determine whether this option suits your needs better than tenants in common.

Yes, joint tenancy with right of survivorship can override a will. In this arrangement, the surviving joint tenant automatically inherits the deceased owner’s share, regardless of what the will states. This creates a potential conflict if the deceased had intentions that differ from this arrangement. Understanding the implications of joint tenancy vs tenants in common is crucial for effective estate planning.

Joint ownership can lead to complications, especially in situations where one owner wishes to sell their share. Unlike tenants in common, where shares can be divided and sold independently, joint tenants must agree on any decisions regarding the property. Additionally, creditors can potentially seize a joint owner’s share, placing the property at risk. It's wise to understand these pitfalls before deciding on ownership structure.

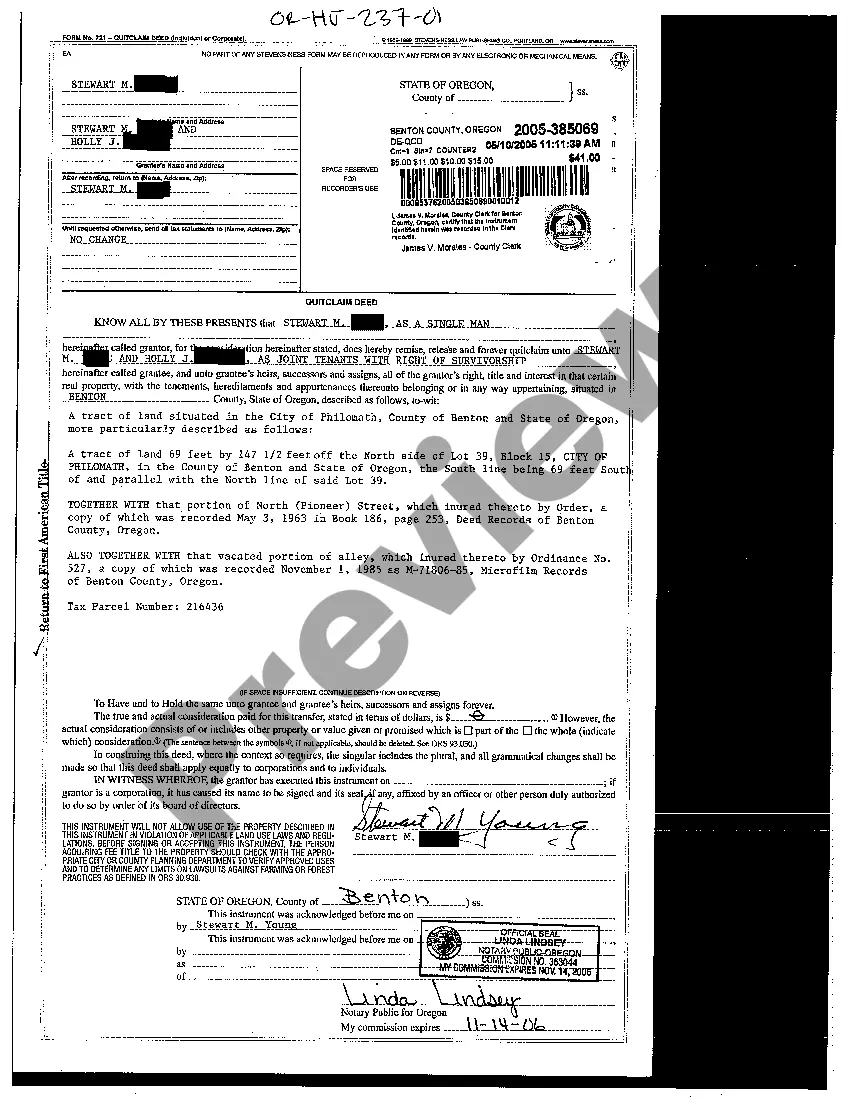

To establish joint tenancy with right of survivorship, you need to take specific steps to ensure all parties are accounted for. Typically, this involves drafting a deed that clearly states the intent to create joint tenancy. Each owner must hold an equal share of the property, and you should include the right of survivorship in the documentation. Consider consulting resources like US Legal Forms for guidance and template forms to facilitate this process.

Joint tenancy with right of survivorship has some drawbacks. One significant concern is that it does not allow for designated inheritance, which means your property transfers automatically to the co-owner upon your death. Additionally, this arrangement can complicate personal financial planning and may not accommodate individual needs during life. Ensuring that your property ownership aligns with your long-term objectives is crucial.

Determining whether tenants in common or joint tenants is best depends on your goals for property ownership. Joint tenants with right of survivorship benefit couples or those looking to simplify inheritance. On the other hand, tenants in common allow for more flexibility in ownership shares and inheritance plans. Evaluating how you wish to manage your inheritance can guide you in making the right choice.

While joint tenancy provides advantages, it may not be ideal for everyone. One of the main disadvantages is that it can create issues if one owner is in debt since creditors can claim the property. Furthermore, unilateral decisions made by one tenant can affect all owners, which may lead to disputes. Users should weigh these factors carefully against their specific situation.

For married couples, joint tenants with right of survivorship often provide the simplest and most effective way to hold property together. This arrangement allows one spouse to automatically inherit the property if the other passes away. In contrast, tenants in common may complicate matters during estate planning and distribution. Therefore, assessing your circumstances and future needs is essential when choosing between these two options.

The terms 'joint tenancy' and 'joint with survivorship' often confuse people, but they refer to similar concepts. Joint tenancy generally means that two or more people own a property together, while joint with survivorship emphasizes that the ownership includes the right of survivorship. This means that if one owner dies, the remaining owners automatically inherit their share. It's essential to understand these distinctions, especially when comparing joint tenants with right of survivorship vs tenants in common.

Most married couples choose to be joint tenants with right of survivorship because this arrangement provides a straightforward transfer of property upon death. This choice ensures that the surviving spouse maintains full ownership, promoting family stability. However, some couples may opt for tenants in common for greater control over individual shares and inheritance planning. The decision ultimately depends on each couple's financial goals and family situation.