Joint Tenants In Equity

Description

Form popularity

FAQ

Filing taxes as joint tenants in equity requires both owners to report their share of income and expenses associated with the property. Each tenant should receive their respective tax documents, such as Form 1098, to account for mortgage interest. Additionally, it's crucial to accurately divide costs related to property ownership when preparing your tax return. If you are unsure, seeking assistance through a reliable platform like US Legal Forms can help navigate the process effectively.

Joint tenants in equity share ownership of property, which has specific tax implications. When one joint tenant passes away, their share of the property typically transfers to the surviving tenant without going through probate. This step can lead to tax benefits, as it may reduce the estate's value for tax purposes. However, it's essential to consult a tax professional to understand how your specific situation may affect your taxes.

Yes, you can add someone to your deed without refinancing, particularly if you hold the property as joint tenants in equity. The process generally involves executing a new deed that includes the new joint tenant. This change does not typically affect your mortgage terms unless your lender requires notification or changes. For a smooth process, utilizing resources from US Legal Forms can help simplify the documentation needed.

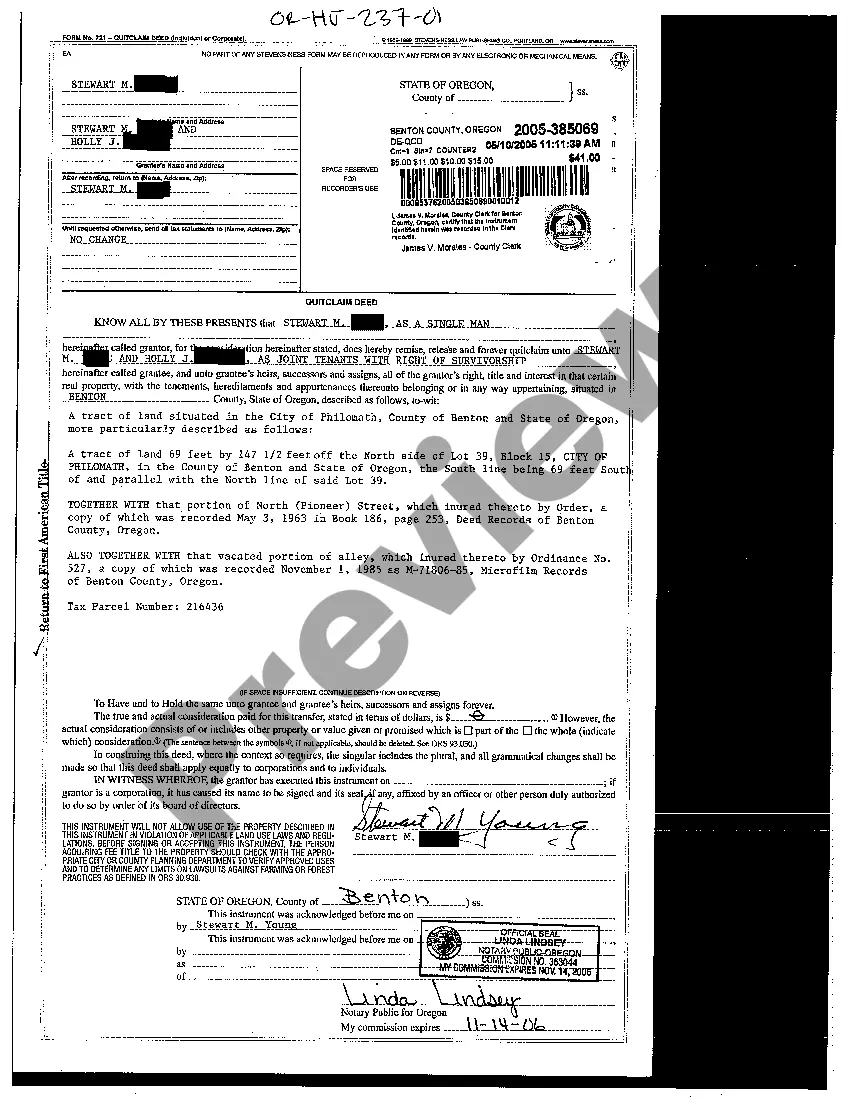

To add joint tenancy to a deed, you typically need to prepare a new deed that specifies the joint tenants in equity. This new deed must then be signed, notarized, and recorded with the appropriate county office to be legally effective. It is crucial to ensure that all parties understand their rights and responsibilities, as the joint tenants share ownership equally. Consider using platforms like US Legal Forms for easy access to the necessary documents and instructions.

You do not necessarily need a lawyer to add someone to a deed, but consulting one can ensure you follow the correct legal procedures. Understanding the implications of becoming joint tenants in equity can help you make informed decisions. A lawyer can provide valuable guidance, particularly if complexities arise. However, you can navigate the process using available resources and tools.

An example of the right of survivorship can be seen in family inheritance situations. Imagine a couple owning a home as joint tenants in equity. If one spouse passes away, the surviving spouse automatically inherits the entire property. This transfer occurs instantly, allowing the surviving spouse to maintain stability without the complexities of probate. It's vital to understand this aspect for effective estate planning.

One major disadvantage of joint tenancy ownership is the exposure to financial liabilities. If one joint tenant incurs debt, creditors can potentially claim the jointly owned assets. Moreover, setting up joint tenants in equity requires mutual trust, and conflicts can arise if disagreements occur regarding the property. It's important to weigh these considerations before entering into such an arrangement.

Assets that typically pass by survivorship include real estate, bank accounts, and investment accounts held in joint tenancy. When one joint tenant in equity passes away, the survivor automatically inherits the deceased's share without the need for probate court. This takes effect because of the right of survivorship associated with the ownership structure. Understanding these assets can help you plan for the future more effectively.

While joint ownership can be beneficial, it may also carry risks that warrant caution. If one owner accumulates debt, creditors may target shared assets, putting both parties at financial risk. Additionally, joint tenants in equity may face complications if a disagreement arises, as both parties share equal decision-making authority. Consulting with a legal professional or using online resources can help you assess the best approach tailored to your situation.

To declare joint tenancy, you must ensure that the property deed explicitly states the arrangement as joint tenants in equity. This typically involves including the names of all owners on the deed, while using the language that specifies joint ownership. You may also need to file the deed with the relevant county office, depending on your locality. Utilizing online resources, such as the US Legal Forms platform, can simplify this process.