Joint Tenants In Common

Description

Form popularity

FAQ

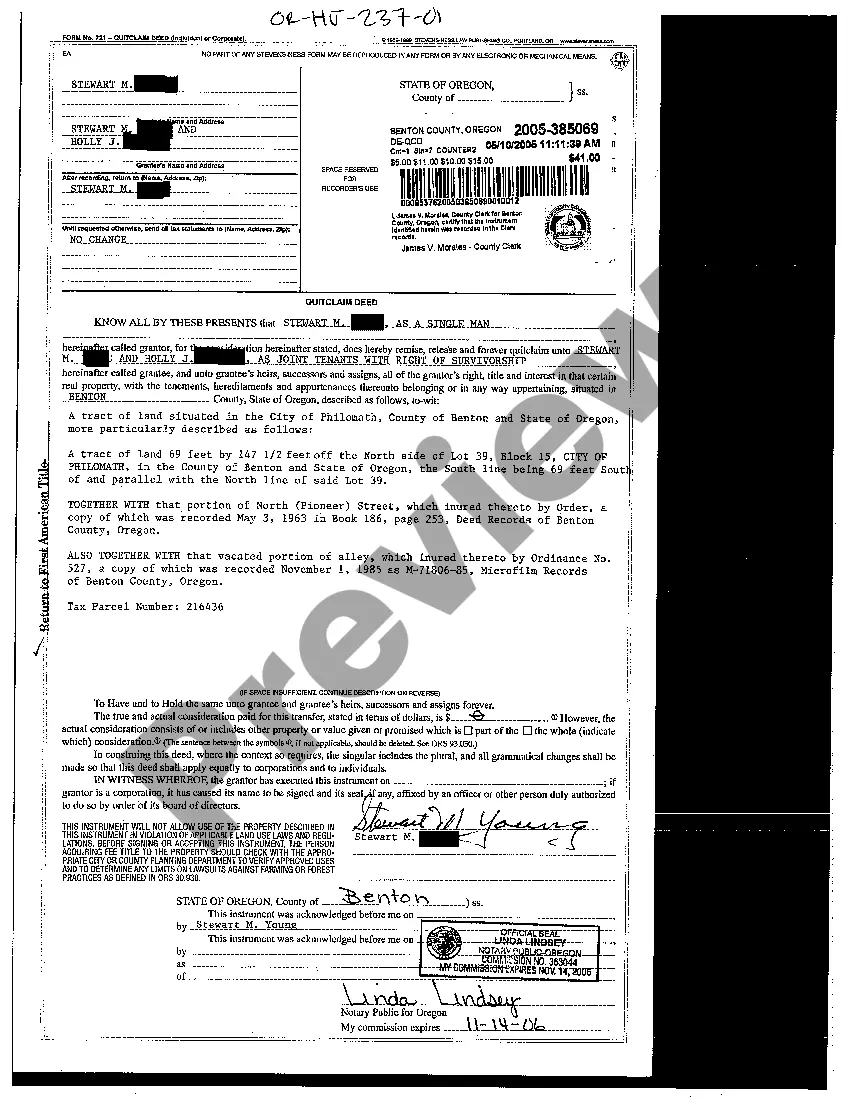

To add joint tenancy to a deed, you need to draft a new deed that explicitly states the intention to create joint tenants in common. This deed must include the names of the new joint tenants and be signed by the current owner. After preparing the new deed, file it with the county recorder’s office to update the public records. Platforms like US Legal Forms offer templates and guidance to help you complete this task seamlessly.

The IRS treats tenancy in common as a form of ownership where each owner has a share of the property. Each co-owner is responsible for reporting their share of any income or deductions associated with the property. It's essential to understand these tax implications, especially if you intend to sell or rent the property in the future. Being informed about joint tenants in common can help you manage your financial responsibilities effectively.

While it is not legally required to have a lawyer, consulting one can be beneficial when adding someone to a deed. A legal expert can help clarify the implications of joint tenants in common and ensure the deed is correctly filed. They can also address any potential tax consequences that may arise from the change in ownership. Utilizing resources like US Legal Forms can simplify this process for you.

Yes, you can add someone to your deed without refinancing. This process allows you to recognize joint tenants in common, meaning both parties share ownership of the property. You typically need to complete a new deed that names both parties as owners. However, consult with a legal expert to ensure all documentation is correct and meets state requirements.

While joint tenancy with right of survivorship offers benefits, it also comes with certain drawbacks. One major disadvantage is the loss of control over your share after death, as it automatically goes to the surviving owner. This could lead to unintended consequences if your wishes involve passing on the property to someone else. It's essential to evaluate your long-term intentions carefully, and you may want to consult platforms like uslegalforms for clear guidance.

The distinction between tenants in common and joint tenants mainly involves ownership structures and rights. Joint tenants in common have an automatic transfer of shares upon death, promoting continuity among surviving owners. In contrast, tenants in common allow for individual ownership of shares, which can be passed on according to a will. Consider the implications of how property will be managed after death when making your decision.

The primary difference between joint tenancy and tenancy in common lies in ownership rights. With joint tenants in common, each owner has equal shares and rights of survivorship. This means that when one owner dies, the remaining owners automatically inherit their share. On the other hand, tenants in common can own unequal shares and have the freedom to will their shares to others.

When considering tenants in common versus joint tenants, it largely depends on your specific goals. Joint tenants in common means you can share property evenly, while also giving rights of survivorship to co-owners. If one owner passes away, their share automatically transfers to the surviving owner. However, if you want the flexibility of passing your share to someone other than your co-owner, tenants in common might be a better fit for you.

Tenancy in common isn't necessarily a bad idea, but it can pose challenges. It offers flexibility regarding ownership shares, which may align with certain circumstances. However, joint tenants in common should be keenly aware of possible conflicts and the complexities of co-ownership before opting for this arrangement.

One significant disadvantage of joint tenancy is the potential loss of control over a portion of the property. If one tenant decides to take on debt or enter into messy legal battles, the other tenants face risks that they did not choose. Joint tenants in common should always assess these risks before proceeding.