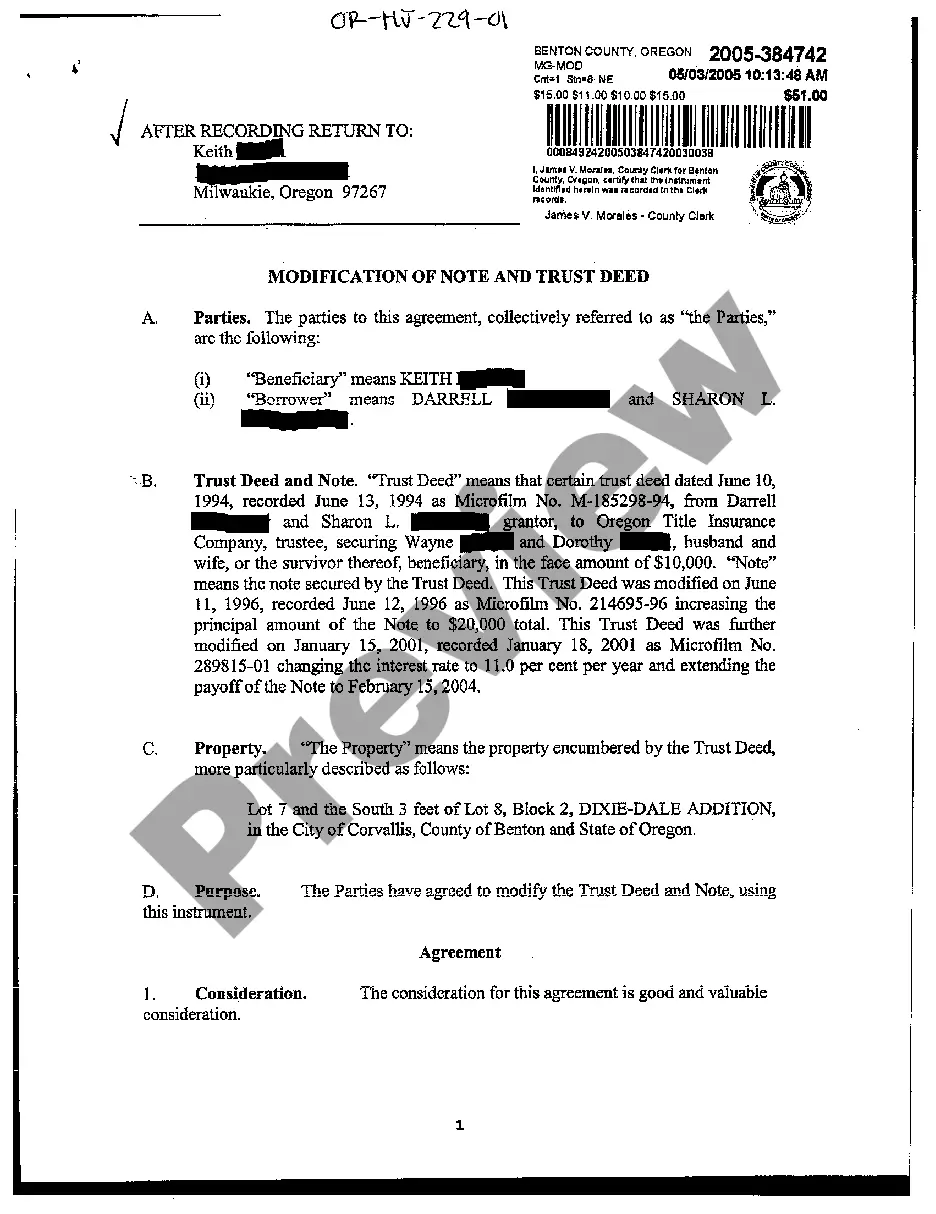

A Trust Deed In Oregon Foreclosure

Description

How to fill out Oregon Change Or Modification Of Note And Trust Deed?

Navigating through the red tape of traditional forms and templates can be tough, particularly when one does not engage in that professionally.

Even locating the appropriate template for a Trust Deed In Oregon Foreclosure will be labor-intensive, as it must be legitimate and precise to the very last digit.

Nevertheless, you will need to invest significantly less time selecting a suitable template from a resource you can depend on.

Acquire the proper form in a few straightforward steps: Enter the title of the document in the search bar. Locate the correct Trust Deed In Oregon Foreclosure among the results. Review the description of the sample or open its preview. If the template meets your specifications, click Buy Now. Proceed to select your subscription plan. Utilize your email and create a password to set up an account at US Legal Forms. Choose a credit card or PayPal as your payment method. Save the template file on your device in the format you prefer. US Legal Forms will conserve your time and energy researching if the form you viewed online suits your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a platform that streamlines the process of searching for the correct forms online.

- US Legal Forms is a single destination where you can find the latest examples of forms, consult their usage, and download these examples for completion.

- It is a compilation of more than 85K forms that are applicable in various sectors.

- While searching for a Trust Deed In Oregon Foreclosure, you will not have to question its legitimacy since all of the forms are authenticated.

- Creating an account at US Legal Forms will ensure you have all the necessary samples at your disposal.

- Store them in your history or add them to the My documents catalog.

- You can access your saved forms from any device by simply clicking Log In on the library website.

- If you do not yet have an account, you can always search anew for the template you require.

Form popularity

FAQ

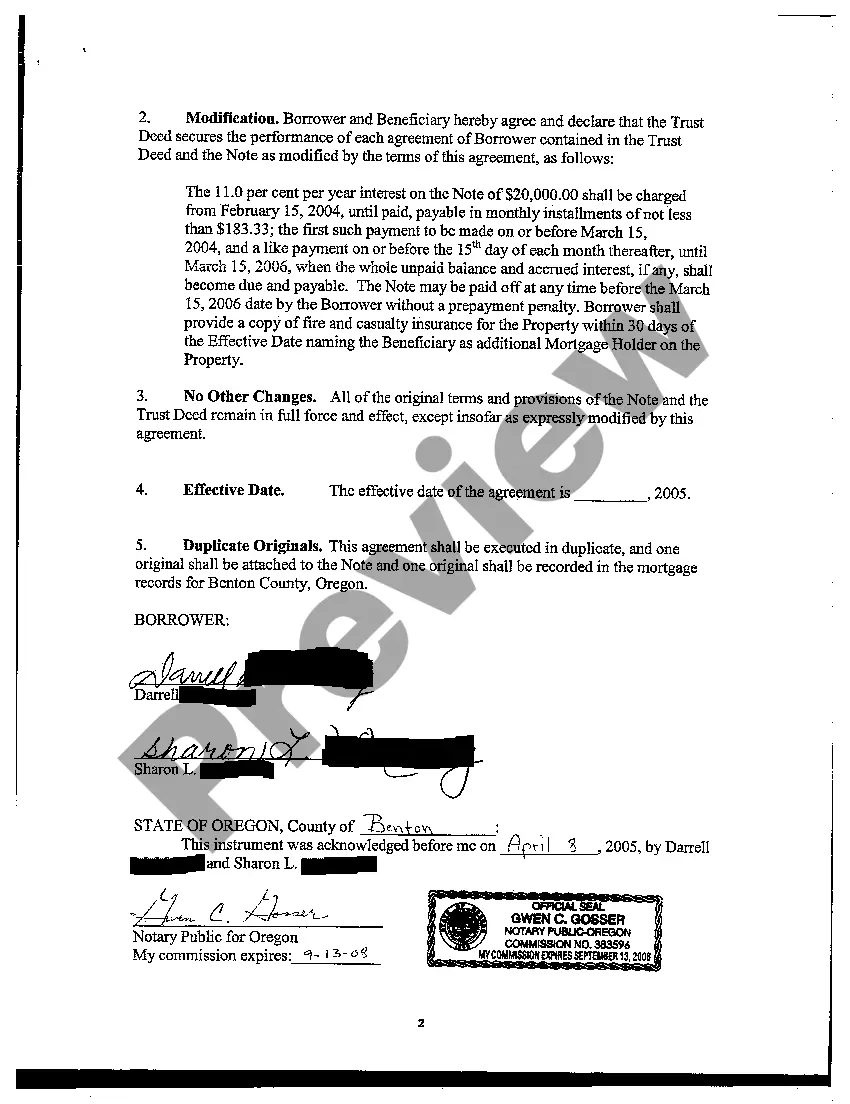

The requirements for a trust deed typically include the identities of the borrower, lender, and trustee, along with a clear description of the property. Additionally, the deed must be signed by the parties involved and properly recorded in the appropriate county office. Complying with these requirements is vital for a valid trust deed in Oregon foreclosure, and utilizing legal resources like US Legal Forms can assist you in gathering necessary information.

When a deed of trust is foreclosed, title is conveyed by the trustee. The trustee, once the borrower defaults, carries out the sale of the property to satisfy the debt. This transfer of title occurs after all necessary legal steps are completed. Understanding this aspect is vital if you are involved in a trust deed in Oregon foreclosure, as it directly impacts the ownership of the property.

The technique commonly used in foreclosing a deed of trust involves a non-judicial foreclosure process. This allows the lender to sell the property without going through court, streamlining the procedure. It’s critical to understand how a trust deed in Oregon foreclosure works to navigate this process effectively. Educating yourself on these steps will prepare you for potential situations concerning property ownership.

Yes, you can write your own deed, including a trust deed in Oregon foreclosure. However, it’s essential to follow the legal requirements to ensure its validity. Using a template from a trusted platform like US Legal Forms can simplify this process. This way, you can be confident that your deed meets the state's guidelines.

Many states in the U.S. utilize deeds of trust, including California, Texas, and Washington, while others predominantly use mortgages, such as Florida and New York. The choice between a deed of trust and a mortgage influences how foreclosure processes are conducted, as evidenced in a trust deed in Oregon foreclosure. Each state's regulations can impact how quickly a lender can reclaim a property. It's crucial to familiarize yourself with your state's laws to understand your situation fully.

Oregon is primarily a deed of trust state, which means that mortgages and trust deeds are commonly used for property loans. This structure allows for a more streamlined foreclosure process when a borrower defaults. By understanding that Oregon favors trust deeds, borrowers can make informed decisions in case they face a trust deed in Oregon foreclosure. Knowledge of this can empower you during financial hardships.

In Oregon, to release a deed of trust, you must first obtain a satisfaction of mortgage from your lender. After securing this document, file it with the county recorder's office to ensure public records reflect the release. This action is vital when handling a trust deed in Oregon foreclosure, as it protects your property rights.

Filing a deed in lieu of foreclosure in Oregon involves a few key steps. First, you must contact your lender to discuss your situation and express your intention to surrender the property. After reaching an agreement, you will need to prepare and sign the deed in lieu document, which transfers ownership from you to the lender. This process can help avoid a lengthy foreclosure, showcasing the value of understanding a trust deed in Oregon foreclosure.