Oregon Foreign Judgment Enrollment

Oregon Revised Statutes

Chapter 24 Enforcement and Recognition of Foreign Judgments

Definitions for ORS 24.105 to 24.175.

In ORS 24.105 to 24.125, 24.135 and 24.155 to 24.175 "foreign judgment"

means any judgment, decree or order of a court of the United States or

of any other court which is entitled to full faith and credit in this state.

Chap. 24, §24.105, [1979 c.577 s.1]

Filing of foreign judgment; effect.

(1) A copy of any foreign judgment authenticated in accordance

with the Act of Congress or the statutes of this state may be filed in

the office of the clerk of any circuit court of any county of this state.

The clerk shall treat the foreign judgment in the same manner as a judgment

of the circuit court.

(2) A certified copy of any foreign judgment authenticated in accordance

with the Act of Congress or the statutes of this state shall be recorded

in the County Clerk Lien Record of any county other than the county in

which the judgment is originally docketed, in order to become a lien upon

the real property of the judgment debtor in that county as provided in

ORS 18.320 and 18.350.

(3) A judgment so filed has the same effect and is subject to the

same procedures, defenses and proceedings for reopening, vacating or staying

as a judgment of the circuit court in which the foreign judgment is filed,

and may be enforced or satisfied in like manner. Chap. 24, §24.115

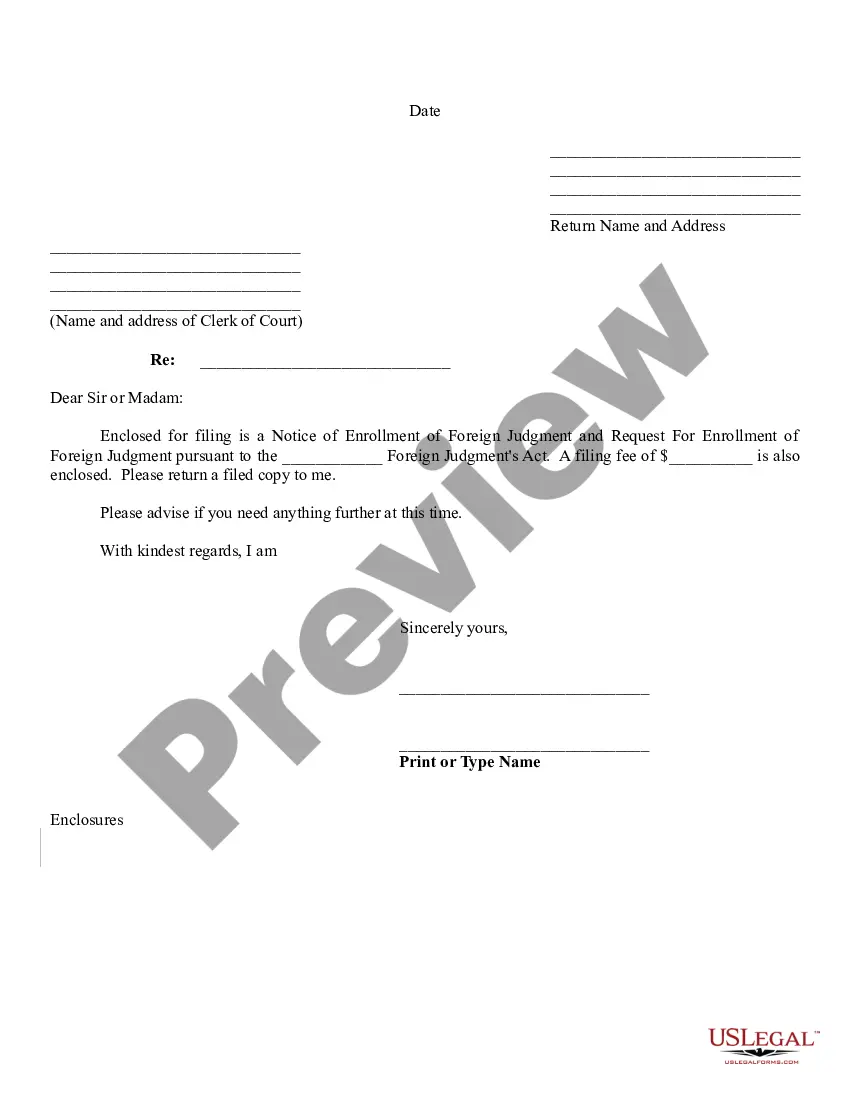

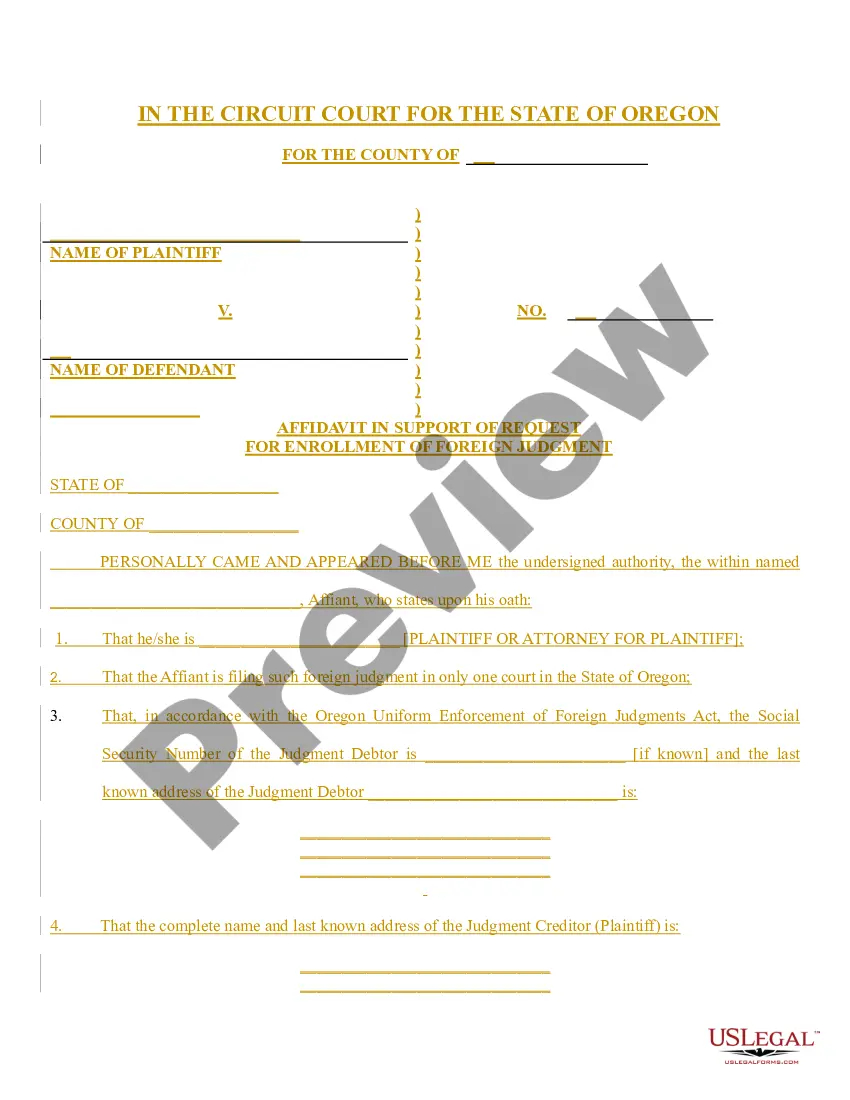

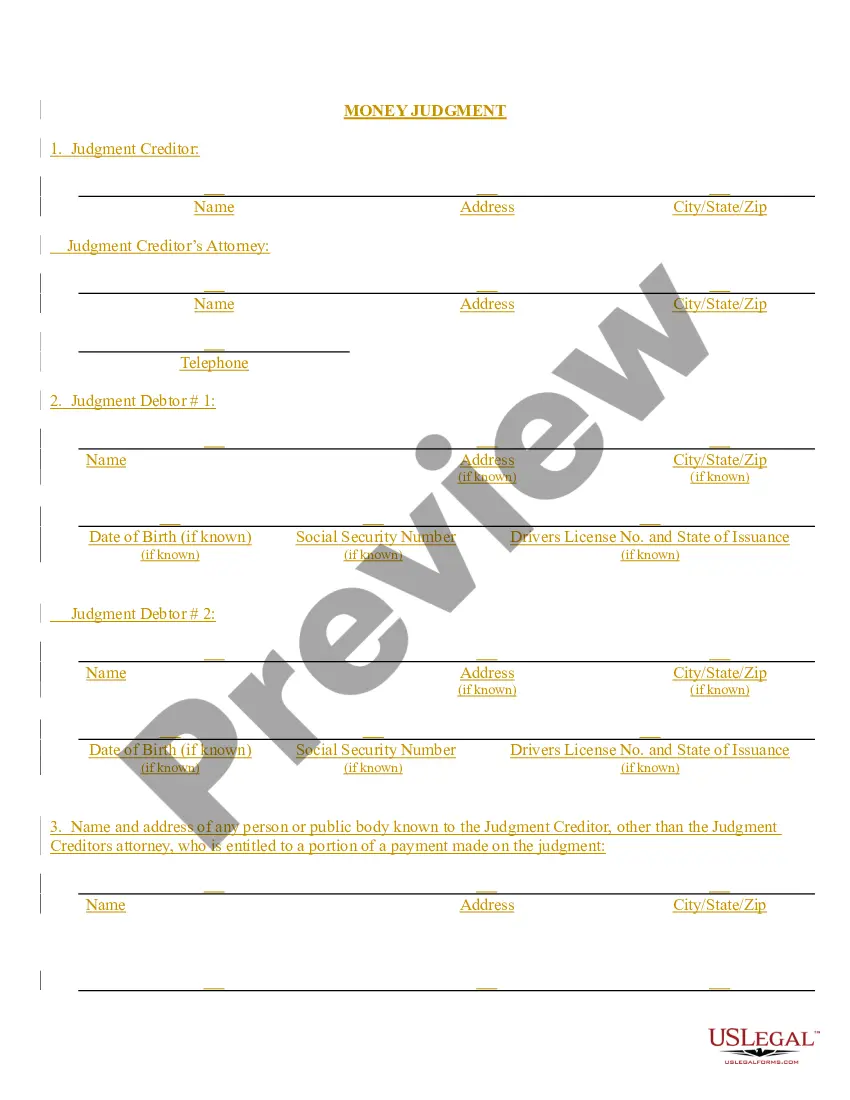

Notice of filing of judgment; delay in enforcement.

(1) At the time of the filing of the foreign judgment,

the judgment creditor or the creditor's lawyer shall make and file with

the clerk of the court an affidavit setting forth the names and last-known

post-office addresses of the judgment debtor and the judgment creditor,

together with a separate statement containing the information required

to be contained in a judgment under ORCP 70 A (2)(a).

(2) Promptly after filing the foreign judgment and the affidavit,

the judgment creditor must mail notice of the filing of the foreign judgment

to the judgment debtor. The notice shall include the name and post-office

address of the judgment creditor and the judgment creditor's lawyer, if

any, in this state. The judgment creditor must file with the court proof

of mailing the notice.

(3) No execution or other process for enforcement of a foreign judgment

filed pursuant to ORS 24.105 to 24.125, 24.135 and 24.155 to 24.175, except

a judgment, decree or order of a court of the United States, shall issue

until five days after the date the judgment, affidavit and separate statement

required in subsection (1) of this section are filed. Chap. 24, §24.125

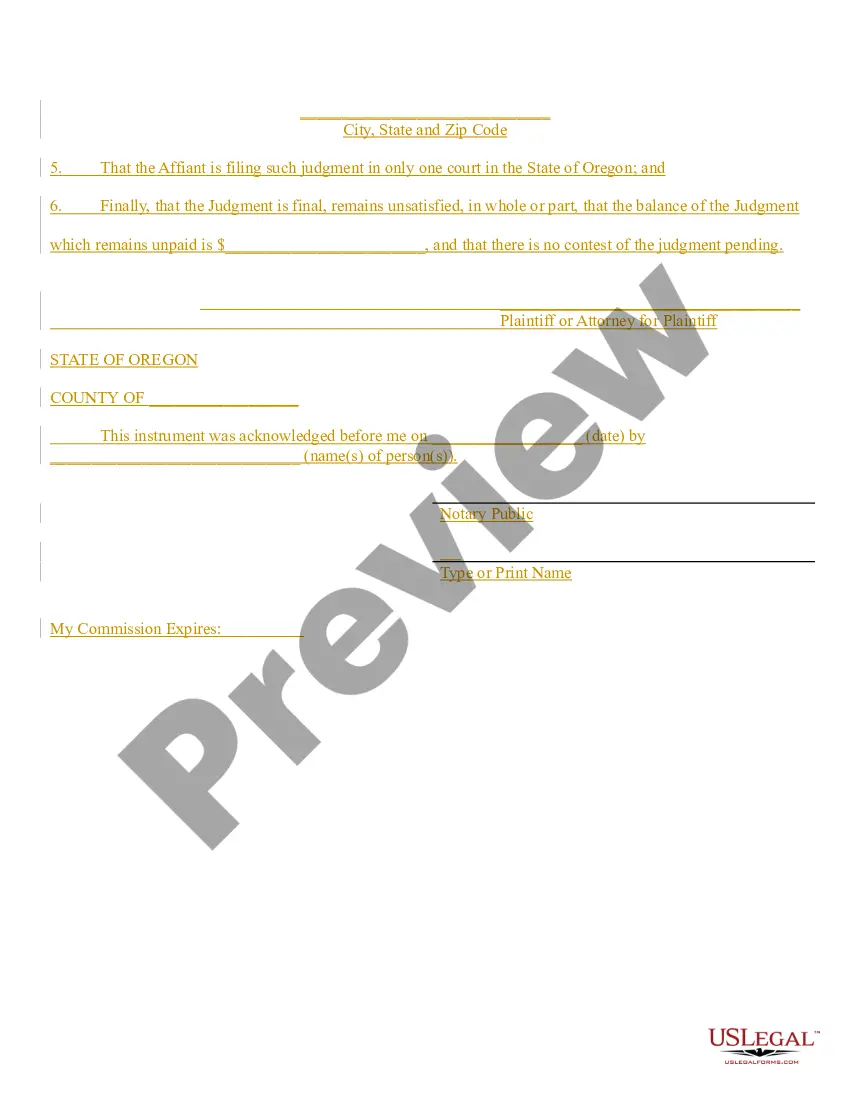

Certification of filing in single court; filing of certified copy

or lien record abstract for other counties.

At the time of filing of any foreign judgment as provided in ORS

24.115, the judgment creditor shall certify that the judgment

creditor is filing such judgment in only one court in Oregon. Thereafter,

a certified copy of the judgment or a lien record abstract may be recorded

in the County Clerk Lien Record of any other county in this state as provided

in ORS 18.320 and 18.350. Chap. 24, §24.129

Grounds for staying enforcement of judgment; security for satisfaction

of judgment.

(1) If the judgment debtor shows the court of any county

that an appeal from the foreign judgment is pending or will be taken, or

that a stay of execution has been granted, the court shall stay enforcement

of the foreign judgment until the appeal is concluded, the time for appeal

expires, or the stay of execution expires or is vacated, upon proof that

the judgment debtor has furnished the security for the satisfaction of

the judgment required by the state in which it was rendered.

(2) If the judgment debtor shows the court of any county any ground

upon which enforcement of a judgment of any court of any county of this

state would be stayed, the court shall stay enforcement of the foreign

judgment for an appropriate period, upon requiring the same security for

satisfaction of the judgment which is required in this state. Chap. 24,

§24.135

Interest and costs.

When a registered foreign judgment becomes a final judgment of

this state, the court shall include as part of the judgment interest payable

on the foreign judgment under the law of the state in which it was rendered, and the cost of

obtaining the authenticated copy of the original judgment. The court shall

include as part of its judgment court costs incidental to the proceeding

in accordance with the law of this state and the costs of recording documents

as permitted by statute. Chap. 24, §24.140

Satisfaction of judgment; filing.

Satisfaction, either partial or complete, of the original judgment

or of a judgment entered thereupon in any other state shall operate to

the same extent as satisfaction of the judgment in this state, except as

to costs authorized by ORS 24.140. When such judgment in this

state has been satisfied, including costs authorized by ORS 24.140, it

shall be the responsibility of the judgment creditor to provide an executed

satisfaction to this judgment debtor. The judgment debtor may file the

satisfaction in the records of the court in which the judgment was originally

filed in this state, and may record the satisfaction in every county in

this state in which a certified copy of the judgment or a lien record abstract

has been recorded. Chap. 24, §24.150

Optional procedure.

The right of a judgment creditor to bring an action to enforce

the judgment instead of proceeding under ORS 24.105 to 24.125, 24.135 and

24.155 to 24.175 remains unimpaired. Chap. 24, §24.155

Construction of ORS 24.105 to 24.175.

ORS 24.105 to 24.125, 24.135 and 24.155 to 24.175 shall be interpreted

and construed in order to effectuate its general purpose to make uniform

the law of those states which enact it. Chap. 24, §24.165

Short title.

ORS 24.105 to 24.125, 24.135 and 24.155 to 24.175 may be cited

as the Uniform Enforcement of Foreign Judgments Act. Chap. 24, §24.175