Living Trust Nebraska Without Lawyer

Description

Form popularity

FAQ

One downside of establishing a living trust in Nebraska without a lawyer is the potential for oversight during the setup process. If you miss key details or fail to fund the trust properly, your assets may not be protected as intended. Furthermore, while creating a living trust can simplify the transfer of assets, it does not necessarily prevent all estate taxes or avoid probate in every situation. It’s crucial to understand these factors as you make decisions about your estate.

Yes, you can set up a trust fund for yourself, and doing so in Nebraska is possible without a lawyer. A living trust allows you to manage your assets while you are alive and provides instructions for distribution after your passing. Using a service like USLegalForms can simplify the process, offering tools that help you establish a living trust in Nebraska without a lawyer.

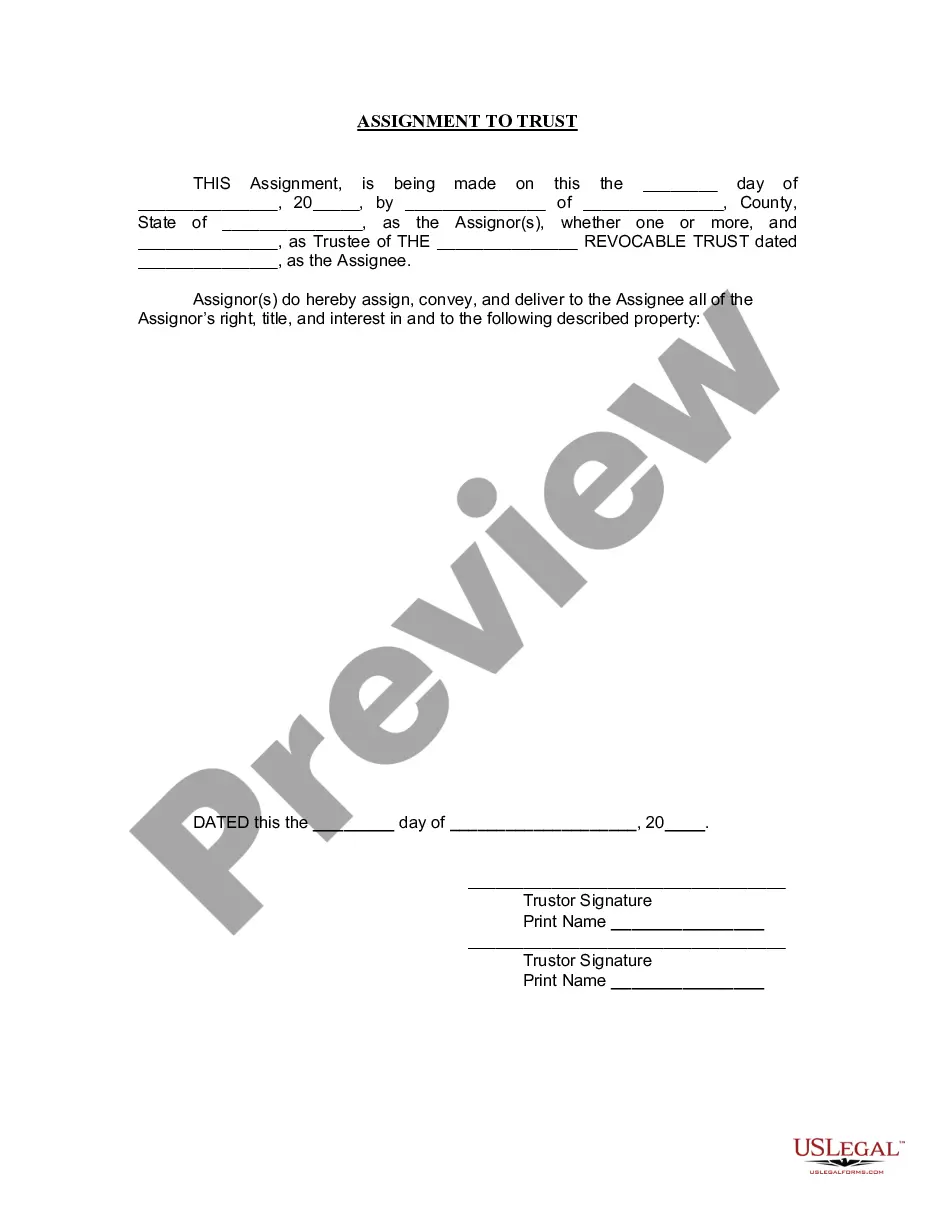

Setting up a living trust in Nebraska without a lawyer is a straightforward process. First, you need to choose the type of trust that fits your needs. After that, gather your assets and outline who will benefit from the trust. You can utilize platforms like USLegalForms, which provide user-friendly guides and templates to help you create a living trust in Nebraska without a lawyer.

One downside of a living trust is the initial setup effort and costs. Although it can save probate fees later, establishing a living trust Nebraska without lawyer help can be daunting without proper guidance. Additionally, you'll need to keep the trust updated with any new assets or changes in your wishes. Regular maintenance is crucial to ensure that your trust continues to serve its intended purpose.

To set up a living trust in Nebraska, start by defining your wishes regarding asset distribution. Then, choose a trustee who will manage the trust according to your instructions. Next, create the trust document, which you can do through an online platform. By using resources designed for a living trust Nebraska without lawyer assistance, you can streamline the process and ensure everything is legally sound.

One of the biggest mistakes parents make is failing to fund the trust properly. Setting up a living trust Nebraska without lawyer help can be misleading if you do not transfer assets into the trust. This oversight can lead to complications when it comes time to distribute assets. Always double-check that all your intended assets are included in the trust.

A trust in Nebraska functions as a legal arrangement where you designate a trustee to manage your assets for the benefit of your beneficiaries. The creator of the trust, or grantor, transfers assets into the trust, allowing for efficient management and distribution. Living trust Nebraska without lawyer assistance often simplifies the process, providing clarity on managing your property. It's a great way to ensure your wishes are followed after your passing.

The average amount in a trust can vary widely based on individual circumstances. In Nebraska, many trusts contain anywhere from $100,000 to several million dollars. These amounts reflect personal assets, family needs, and financial goals. A living trust Nebraska without lawyer involvement can help you determine how much to set aside based on your situation.

While a living trust offers many benefits, there are drawbacks to consider. For instance, creating and funding a trust can involve upfront costs, and it may require more ongoing management than a simple will. Additionally, a living trust does not cover all scenarios, such as incapacity, without extra provisions. It’s important to weigh these factors when deciding on a living trust in Nebraska without a lawyer.

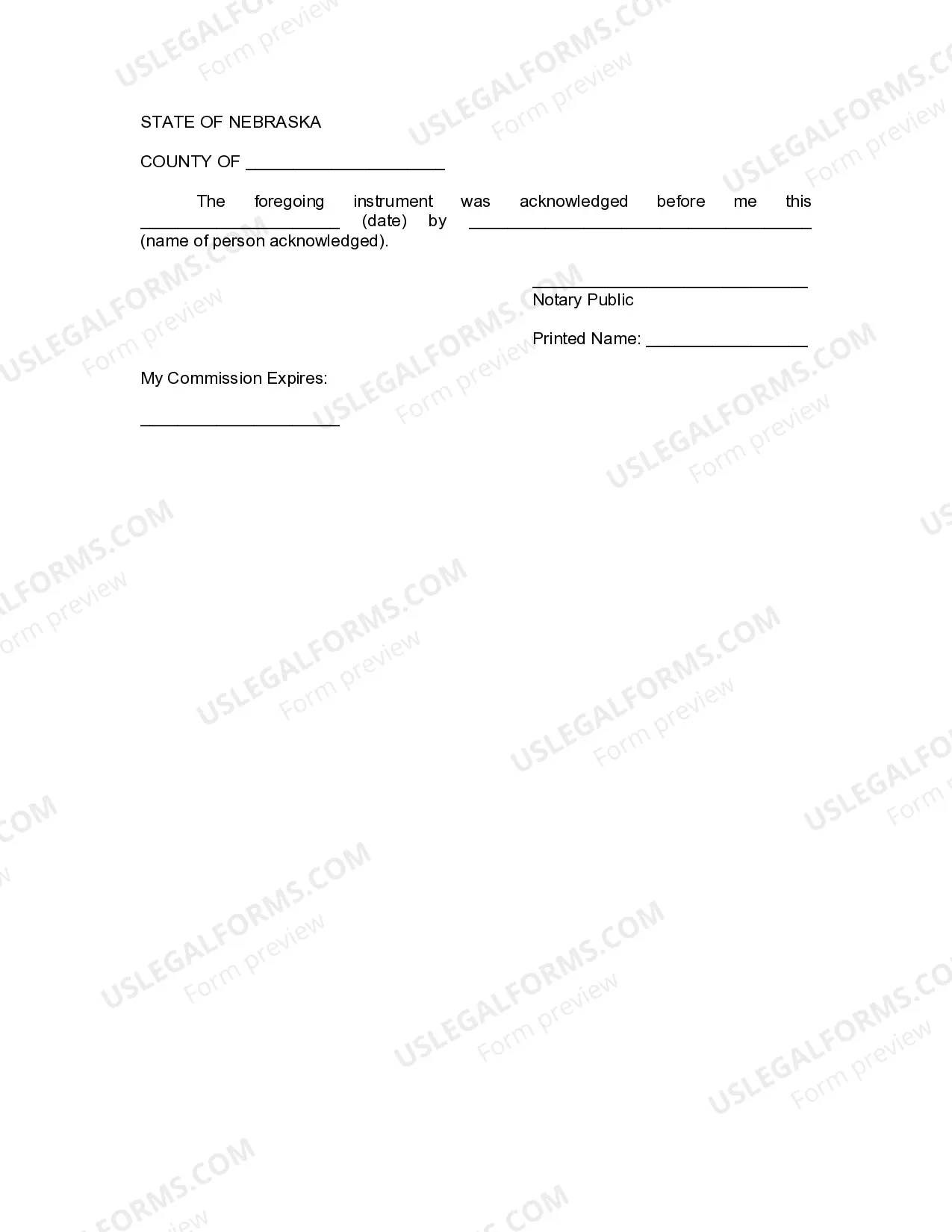

To create a living trust in Nebraska without a lawyer, begin by gathering all necessary information about your assets and beneficiaries. Use a reliable template to draft your trust document, ensuring it reflects your intentions clearly. You will then need to sign the trust in front of a notary to make it valid. US Legal Forms is an excellent resource for templates and helpful instructions.