Oregon And Living Trust And Assignment Of Property With Section 179 Deductions

Description

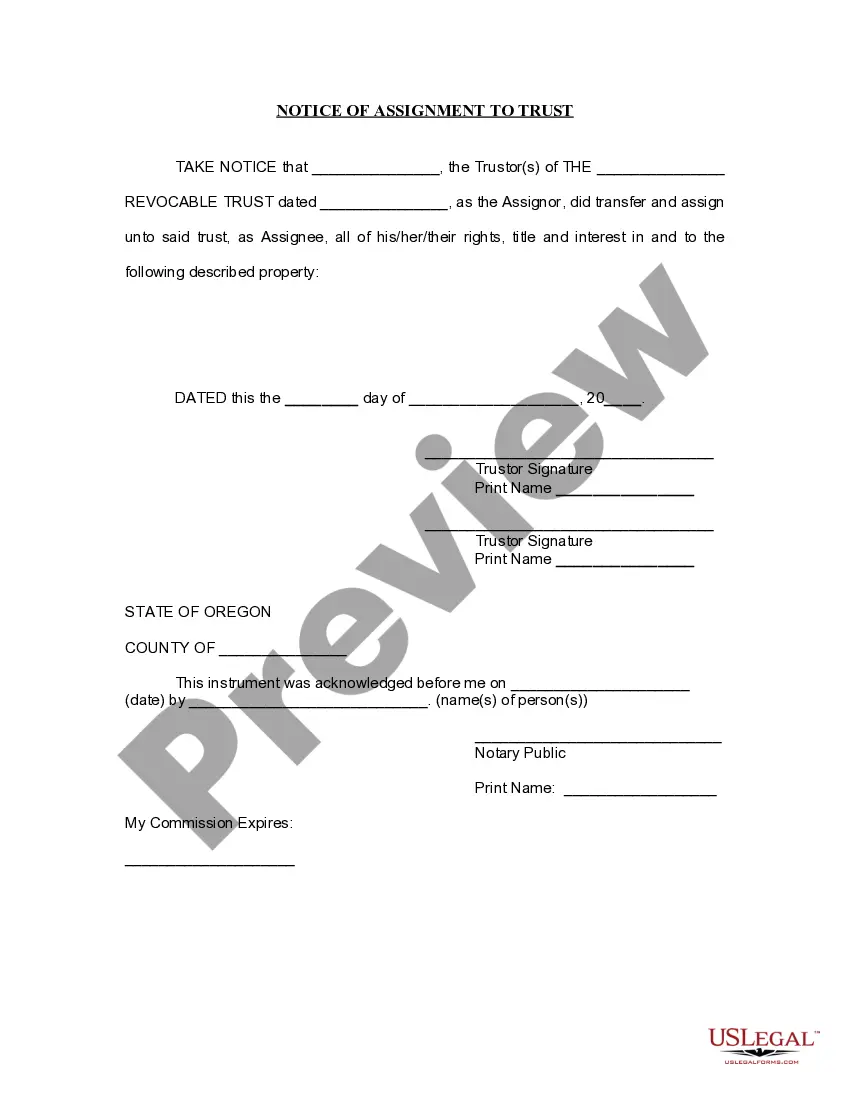

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Form popularity

FAQ

Yes, trusts can claim depreciation on assets they own. This tax deduction helps reduce the taxable income of the trust, benefiting both the trust and its beneficiaries. For individuals involved with Oregon and living trust and assignment of property with section 179 deductions, taking advantage of depreciation can enhance overall financial management and tax efficiency.

In many cases, trusts can function as pass-through entities. This classification allows the income earned by the trust to be reported on the beneficiaries' tax returns, thus avoiding double taxation. This is particularly relevant for individuals in Oregon and living trust and assignment of property with section 179 deductions, as it can optimize tax efficiency while providing for the trust's beneficiaries.

Trusts can indeed take depreciation on their assets. Under IRS guidelines, a living trust may deduct depreciation on property that it holds, provided the property generates income. For residents involved with Oregon and living trust and assignment of property with section 179 deductions, this offers a great method to manage tax liabilities while maintaining asset value over time.

Yes, trusts can utilize Section 179 deductions under certain conditions. When property is owned by a living trust that qualifies as a pass-through entity, the trust may pass through the deduction to its beneficiaries. This can be an effective strategy, particularly for those dealing with Oregon and living trust and assignment of property with Section 179 deductions, allowing for tax savings on eligible property investments.

Qualifying property for the Section 179 deduction typically includes tangible personal property used for business. In Oregon, living trusts can hold various assets, such as equipment and vehicles, which may qualify. It is important to verify that the property is used for business purposes to take advantage of these tax deductions.

Yes, the sale of inherited property generally must be reported to the IRS, even if you held it in a living trust. In Oregon, living trust beneficiaries should report any capital gains from the sale, ensuring compliance with tax laws. Understanding the tax implications helps beneficiaries manage their finances effectively.

Reporting Section 179 recapture occurs via IRS Form 4797 when you dispose of the property that previously qualified for the deduction. For Oregon, living trust owners must include this recapture income in their taxable income for the year of the sale. Proper documentation and accurate reporting are vital to avoid penalties or audits.

To avoid Section 179 recapture, you should not sell or dispose of the property before the end of its useful life. Additionally, in Oregon, living trust owners should plan for the property's use and ensure that it remains in service throughout the necessary timeline. Keeping this in mind helps preserve the deductions you have claimed.

The sale of land typically falls under IRS Form 4797, which is used for reporting sales of business property. If the land is used as part of a trust in Oregon, living trust owners must report any sale on this form to calculate gains properly. It's essential to consult a tax advisor to navigate specific scenarios related to your trust.

Yes, a trust can claim a Section 179 deduction if the trust owns qualifying property. In Oregon, living trusts can be structured to hold income-generating assets, making them eligible for tax deductions. When filing for these deductions, it is essential to follow IRS guidelines to ensure compliance and optimize tax benefits.