Oregon And Living Trust And Assignment Of Property With Mortgage

Description

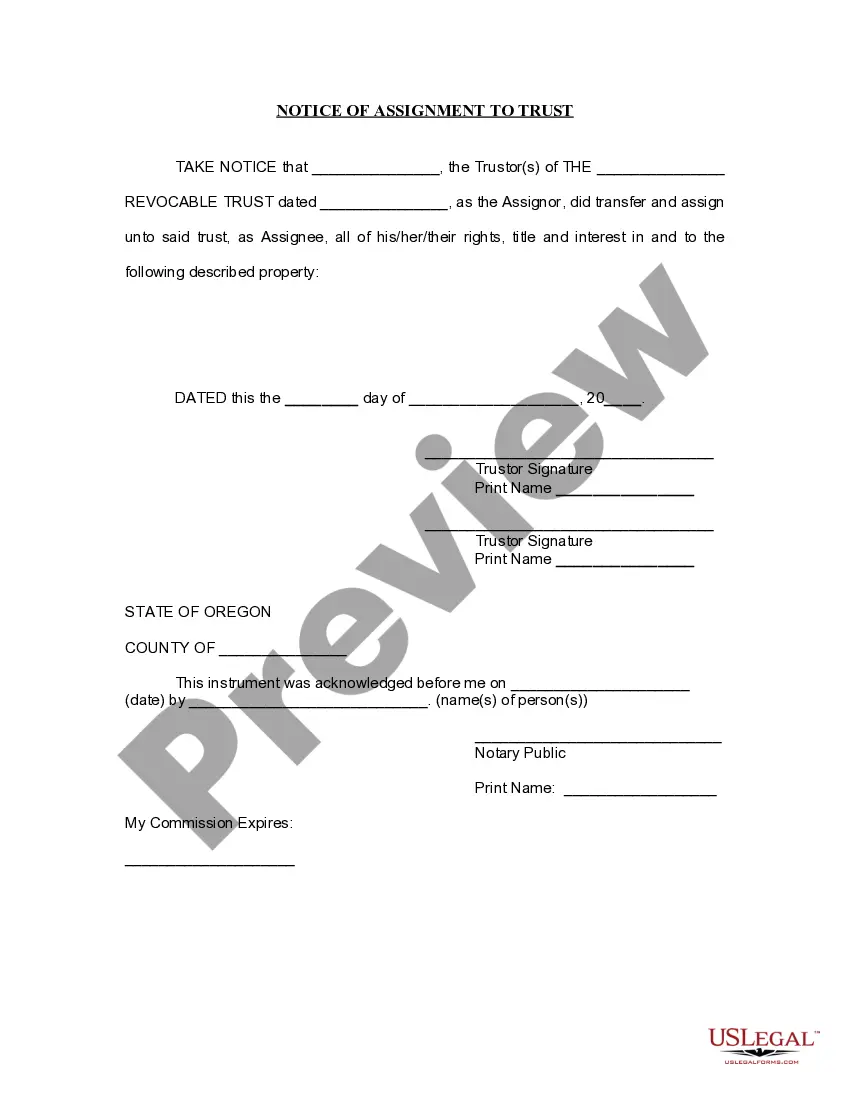

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Form popularity

FAQ

One of the most significant mistakes parents make when setting up a trust fund is failing to fund the trust properly. Simply creating a living trust is not enough; you must transfer assets into it to ensure it serves its intended purpose. Additionally, parents often overlook the need to communicate their plans with family members, leading to confusion later. Using resources like USLegalForms can guide you in making informed decisions about funding your Oregon living trust effectively.

To transfer your property to a trust in Oregon, you will first need to create a living trust document. Once established, you must execute a new deed that transfers the property into the trust. It is highly recommended to work with an attorney or a platform like USLegalForms to ensure that all documentation adheres to state laws, especially when dealing with the assignment of property with a mortgage. This approach can help avoid potential legal issues in the future.

Yes, you can transfer a property with a mortgage to a trust in Oregon. However, it is essential to inform your lender about this transfer. The lender may have specific requirements or may want to ensure that the mortgage is still secured against the property. Using a living trust can provide you with a great way to manage your assets efficiently while keeping your financial obligations clear.

In Oregon, lenders typically use a deed of trust rather than a traditional mortgage. A deed of trust involves three parties: the borrower, the lender, and a third-party trustee. This structure allows for a faster foreclosure process, should that become necessary. For those considering an Oregon living trust and assignment of property with mortgage, understanding this distinction is essential for effective estate planning.

Placing a house with a mortgage into a living trust in Oregon requires careful steps. You need to review your mortgage terms, as some lenders may need to approve the transfer. It’s also advisable to create a clear assignment of property while keeping the mortgage intact. Using resources provided by US Legal Forms can simplify this process and ensure that your Oregon living trust and assignment of property with mortgage are completed correctly.

Most states in the U.S. utilize either a deed of trust or a mortgage for real estate financing. Oregon, along with states like California and Texas, predominantly uses a deed of trust. Understanding whether a deed of trust or mortgage applies to your state is vital when establishing an Oregon living trust and making decisions about property assignments, especially if a mortgage is involved.

A deed of trust and a mortgage serve similar purposes, but they are not the same. A deed of trust involves a third party and allows for quicker foreclosure processes in Oregon, while a mortgage typically creates a direct relationship between the borrower and lender. This difference can significantly impact your financial planning, particularly when establishing an Oregon living trust and managing property with a mortgage.

Oregon is primarily known as a deed of trust state, which influences how property transactions occur within the state. This means that when dealing with residential real estate loans, a deed of trust generally protects the lender's interest. Borrowers need to be aware of this distinction, especially when setting up an Oregon living trust and assigning property with a mortgage. Such knowledge can guide you in making informed decisions.