Deferral Fees With Credit Card

Description

How to fill out Deferral Fees With Credit Card?

What is the most reliable service to obtain the Deferral Fees With Credit Card and other current iterations of legal documents? US Legal Forms is the answer!

It's the most comprehensive collection of legal paperwork for any scenario. Each template is properly crafted and verified for adherence to federal and state laws and guidelines. They are categorized by area and jurisdiction, making it simple to find the one you require.

Alternative form search. If there are any discrepancies, use the search bar in the page header to find a different template. Click Buy Now to select the correct one. Account creation and subscription purchase. Choose the most appropriate pricing strategy, Log In or create your account, and pay for your subscription using PayPal or a credit card. Downloading the documents. Select the format you wish to save the Deferral Fees With Credit Card (PDF or DOCX) and click Download to receive it. US Legal Forms is an excellent choice for anyone needing to organize legal documents. Premium users can access even more features as they can complete and authorize previously saved files electronically at any time using the built-in PDF editing tool. Check it out today!

- Experienced users of the website simply need to Log In to the system, verify their subscription status, and click the Download button next to the Deferral Fees With Credit Card to receive it.

- Once saved, the template remains accessible for further use within the My documents section of your account.

- If you do not yet have an account with us, here are the procedures you need to follow to create one.

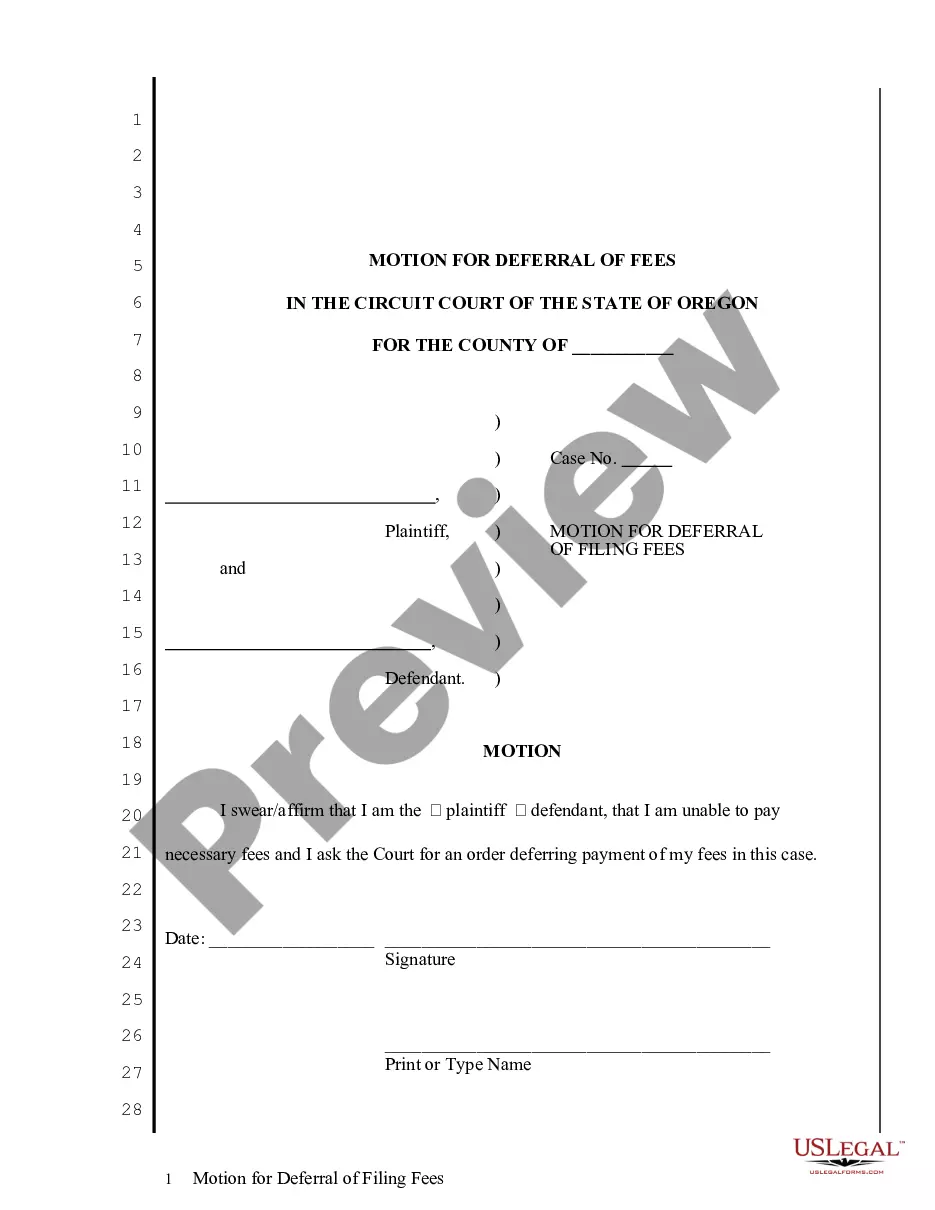

- Form compliance assessment. Prior to acquiring any template, you must verify if it satisfies your usage conditions and your state or county's regulations. Review the form details and utilize the Preview if it is available.

Form popularity

FAQ

Getting a deferred payment on a credit card is often possible by contacting your credit card issuer directly. They may offer specific programs tailored to help customers who need a break from regular payments. Just remember that while this can alleviate short-term stress, it could result in deferral fees with credit card that you should factor into your plans.

Yes, you can request a pause on credit card payments, commonly known as a payment deferral. This option can be helpful if you are facing temporary financial challenges. However, be mindful of the potential impact on your credit score and any deferral fees with credit card that might apply during this period.

Many credit cards do allow for deferred payments, especially during promotions or financial hardships. You might find options such as 0% APR financing for a set period, where you can spread out your payments without incurring interest. It’s important to understand any associated deferral fees with credit card, so always read the terms before opting in.

Yes, you can delay your credit card payments by taking advantage of a grace period or by arranging for a deferred payment plan with your credit card issuer. Many credit card companies offer these options to help you manage your finances better. Delaying payments can help you avoid deferral fees with credit card if done correctly.

A bank can reverse a late payment, but you generally need to provide a valid explanation. Many banks appreciate transparency and may handle your request favorably if you have shown responsible banking behavior in the past. It's important to follow up with your bank and understand their specific process. For managing financial responsibilities, understanding deferral fees with credit card can simplify your interactions.

Yes, a late credit card payment can be forgiven, but it usually depends on the issuer's policies and your prior payment history. Reaching out to your credit card provider to request forgiveness can yield positive results, especially if this is a rare occurrence. Open communication is key, and being polite may lead to favorable outcomes. Preventing late payments can also reduce potential deferral fees with credit card.

Credit card late payment charges can be reversed in certain situations. If you have a strong track record with on-time payments, your credit card issuer may grant your request for a reversal. It is beneficial to explain your situation clearly and respectfully. Keep in mind that being proactive can help you avoid future deferral fees with credit card.

Many banks consider requests to reverse late fees on credit card payments. If you have a valid reason, such as a one-time oversight or issues with payment processing, it's worth contacting your bank. While there's no guarantee, many banks are open to goodwill adjustments, especially if you have a history of timely payments. Understanding your bank's policy on deferral fees with credit card can help set your expectations.

You can ask your credit card company to waive interest, particularly if you are facing financial difficulties. When doing so, clearly explain your situation and emphasize your history as a reliable customer. Many companies value customer retention and may be open to waiving interest to assist you. This could be a wise step to help avoid accumulating high deferral fees with credit card balances.

Yes, negotiating your credit card interest rate is possible and quite common. Many people have successfully lowered their rates by simply asking their credit card issuer. You may need to provide information about competing offers or your current financial situation. Remember to express how reducing your interest rate can help you better manage deferral fees with credit card payments.