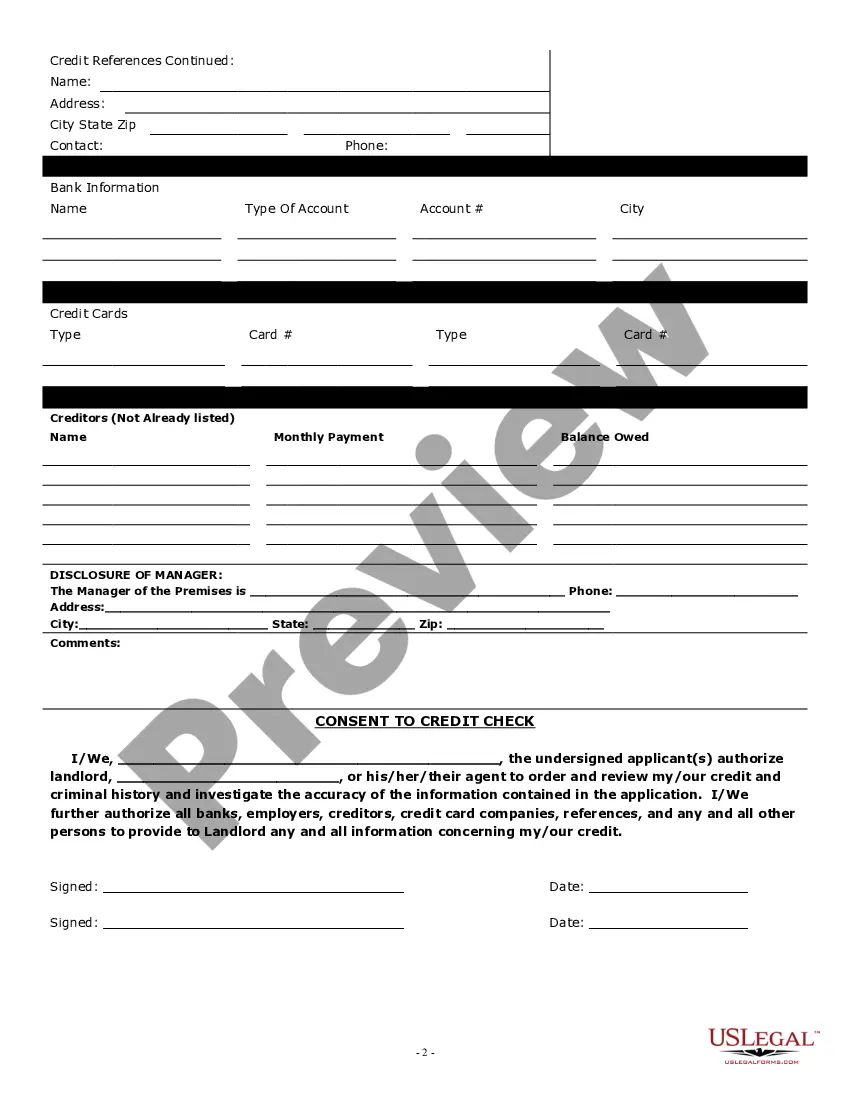

Oregon Rental Application With No Credit Check

Description

How to fill out Oregon Commercial Rental Lease Application Questionnaire?

Finding a go-to place to take the most recent and relevant legal templates is half the struggle of handling bureaucracy. Choosing the right legal papers requirements accuracy and attention to detail, which explains why it is important to take samples of Oregon Rental Application With No Credit Check only from reputable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and view all the information about the document’s use and relevance for the circumstances and in your state or region.

Take the following steps to complete your Oregon Rental Application With No Credit Check:

- Make use of the library navigation or search field to locate your template.

- Open the form’s information to check if it suits the requirements of your state and region.

- Open the form preview, if there is one, to ensure the template is definitely the one you are looking for.

- Resume the search and find the appropriate document if the Oregon Rental Application With No Credit Check does not match your needs.

- If you are positive regarding the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Select the pricing plan that suits your needs.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by choosing a transaction method (credit card or PayPal).

- Select the file format for downloading Oregon Rental Application With No Credit Check.

- Once you have the form on your device, you can modify it with the editor or print it and finish it manually.

Eliminate the inconvenience that comes with your legal paperwork. Explore the extensive US Legal Forms library to find legal templates, check their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

Credit references can include your bank, companies whose bills you pay regularly, or even previous landlords, supervisors, or perhaps your faith leader. Your landlord may contact the credit references you provide to get more information about your payment habits.

If an applicant doesn't have an ideal credit score, landlords have options and can still rent to them. Landlords can ask applicants to provide context about their low score, have a guarantor for the lease, show proof of income, pay a larger security deposit, and have a shorter lease term.

Who do I put for a credit reference? Anyone who has provided the applicant credit or had a financial relationship can serve as a credit reference. Applicant's credit card company, local bank, investment firm, past landlord, or a local business that offered a payment plan are examples.

Your credit score may not prevent you from renting a place to live, but landlords may consider it when deciding whether to approve your rental application. State and federal housing laws regulate what criteria landlords can use to reject a potential renter's application.

RPH will obtain a credit report and Criminal Background check and rental history for each applicant and co-signer 18 years of age or older. Reports supplied by applicants will not be accepted. Discharged bankruptcies are acceptable. A credit score below 625 could be denied or require additional deposit and co-signer.