Oregon Estate Or Form Or-40

Description

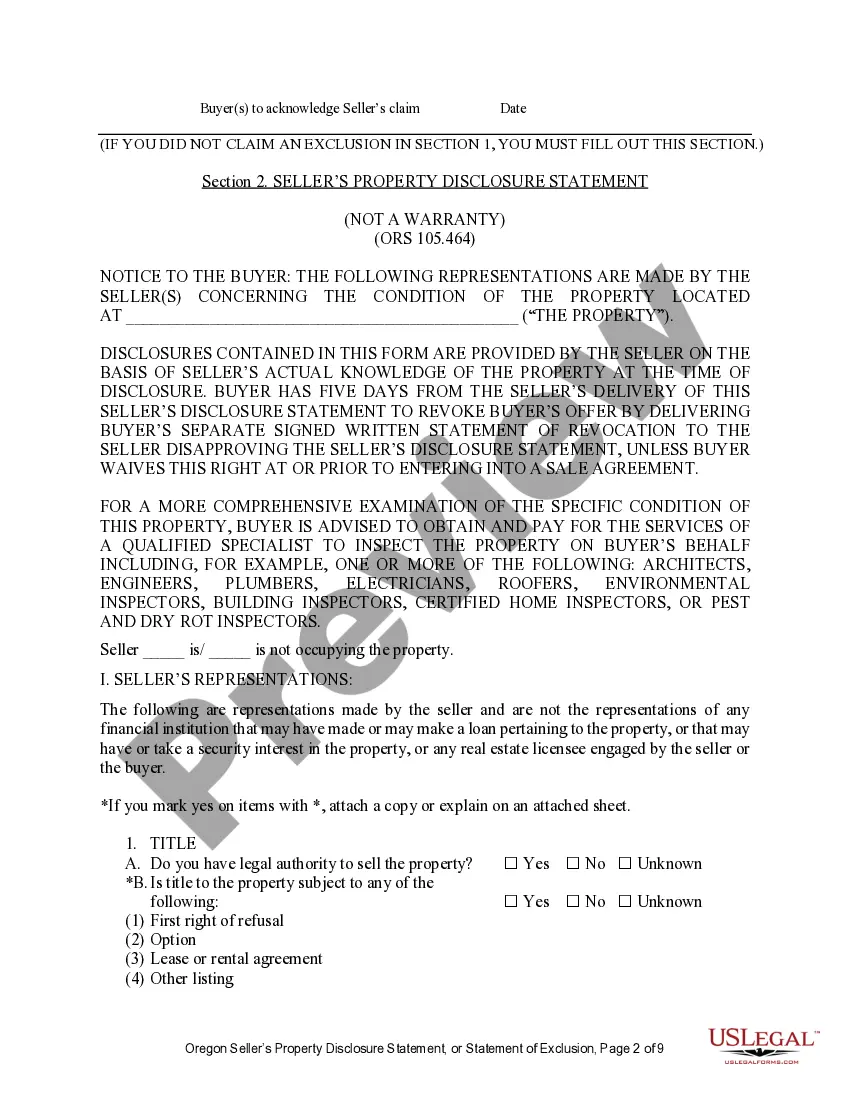

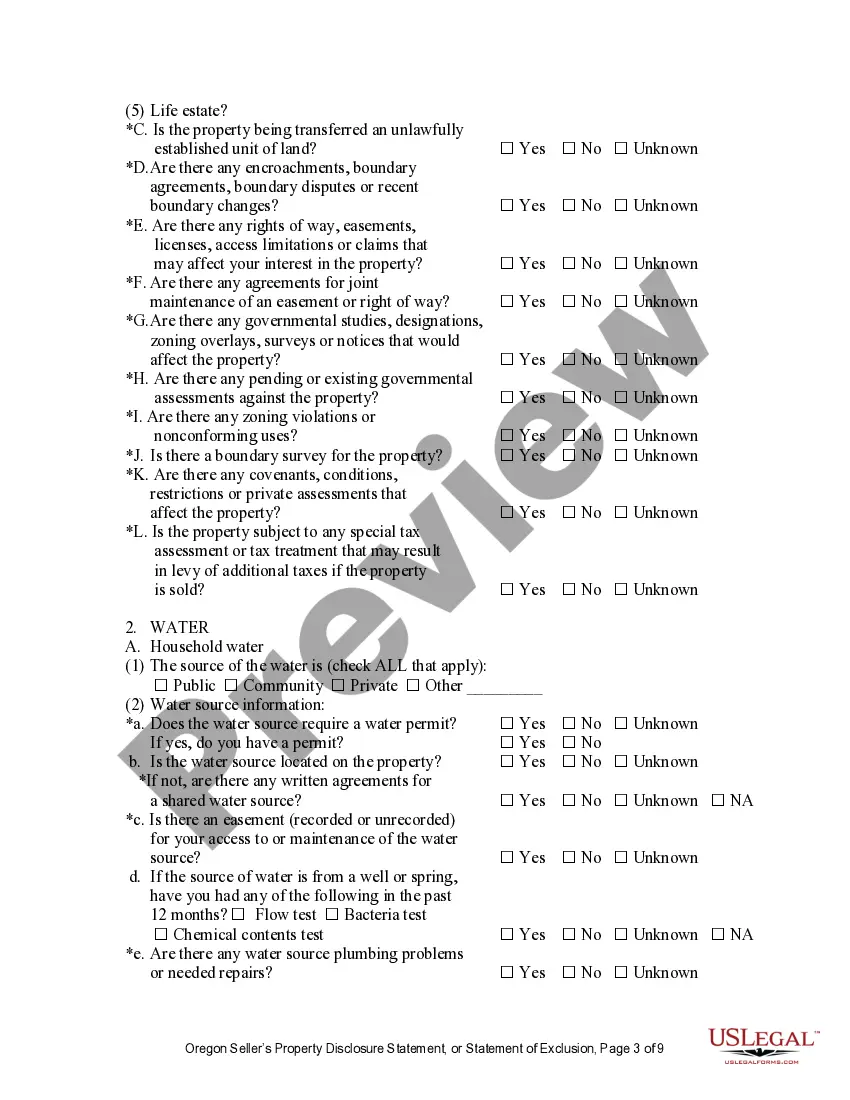

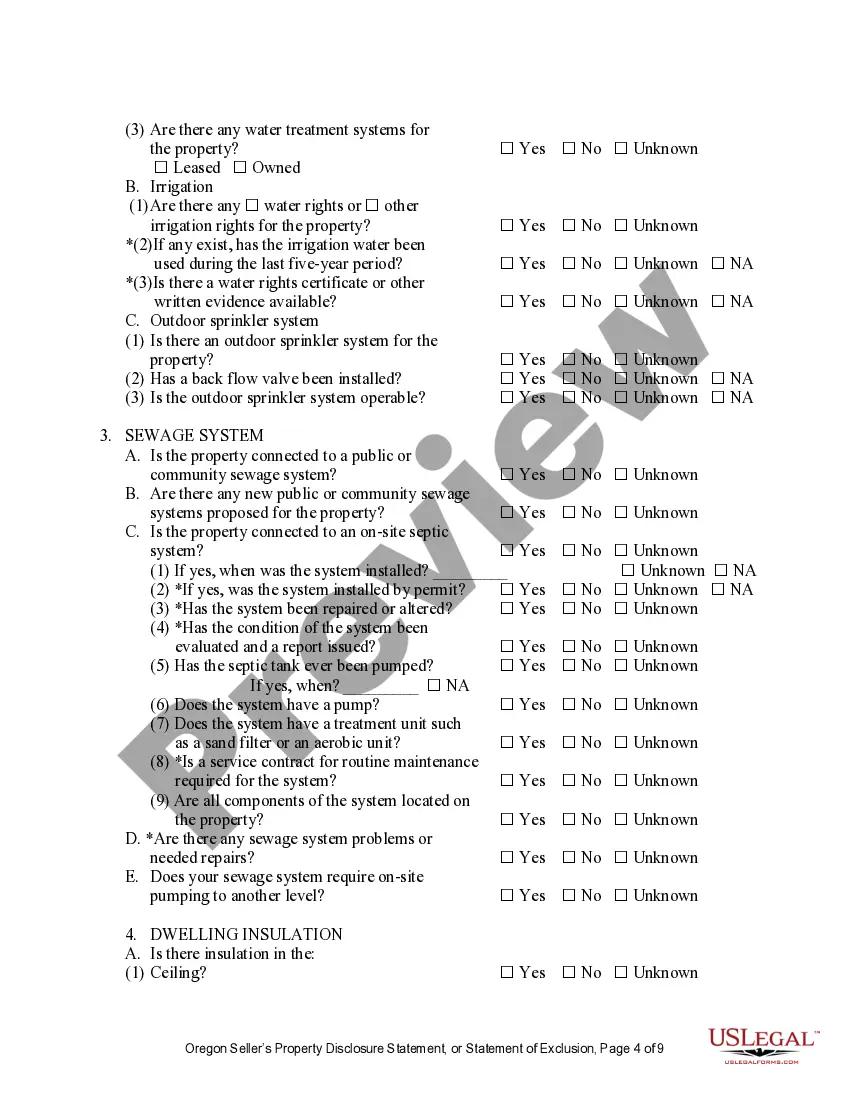

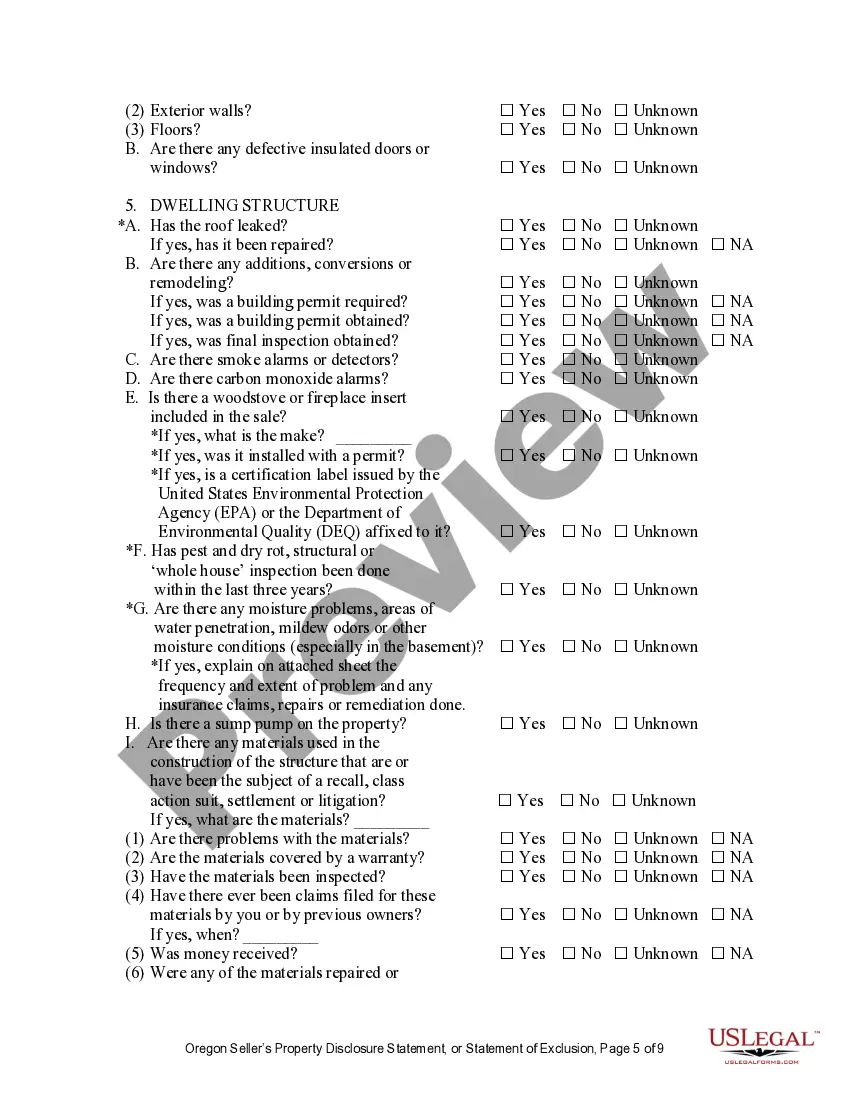

How to fill out Oregon Residential Real Estate Sales Disclosure Statement?

The Oregon Estate Form Or-40 displayed on this webpage is a reusable legal document prepared by expert attorneys in alignment with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, organizations, and lawyers with upwards of 85,000 verified, state-specific forms for various business and personal needs. It’s the fastest, simplest, and most reliable method to acquire the documents you require, with the service ensuring bank-grade data protection and anti-malware safeguards.

Subscribe to US Legal Forms to have reliable legal templates for all of life's circumstances at your fingertips.

- Search for the required document and verify it.

- Browse through the file you seek and preview it or review the form description to ensure it meets your needs. If it does not, utilize the search feature to find the correct one. Click Buy Now once you’ve located the template you require.

- Register and Log In.

- Choose the pricing plan that fits you best and create an account. Make a swift payment using PayPal or a credit card. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

- Select the format you prefer for your Oregon Estate Form Or-40 (PDF, Word, RTF) and download the sample onto your device.

- Fill out and sign the document.

- Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to quickly and accurately fill out and sign your form with a legally binding electronic signature.

- Redownload your documents when necessary.

- Reuse the same document whenever required. Access the My documents tab in your profile to redownload any previously acquired forms.

Form popularity

FAQ

There is no minimum income requirement to file an Oregon estate tax return. Instead, the requirement is based on the value of the estate. If the total value exceeds the $1 million exemption, a return must be filed, necessitating the use of Oregon Form OR-40. Seeking assistance from uslegalforms can help you navigate this requirement smoothly.

Form WR is required for certain estates in Oregon but is distinct from the Oregon estate tax return. This form relates specifically to the Oregon property tax exemption for surviving spouses. If you are navigating the complexities of estate and property tax in Oregon, platforms like US Legal Forms can provide guidance to simplify the process.

A Nevada mechanic's lien release bond is an important mechanism available to contractors which "bonds off" a lien so that a project owner can receive a lien-free completed property. Mechanic's lien discharges are addressed under Nevada Revised Statutes (105.2415).

Lien must be filed within 90 days of last providing labor or materials, or completion of work (whichever is later). In Nevada, an action to enforce a mechanics lien must be initiated within 6 months from lien's filing. This deadline may not be extended, and failure to meet the deadline renders the lien unenforceable.

Nevada has specific regulated statutory lien waiver forms that must be used. To waive lien rights in Nevada, the waiver must use the statutory form and have it signed by the claimant.

A Nevada mechanics lien is only valid for 6 months after it is recorded, unless a lawsuit to enforce the Notice of Lien is commenced in Court or a written extension of that time is recorded before that 6 months has expired.

No, of the 12 states that provide statutory lien waiver forms, only 3 states require them to be notarized. Nevada's lien waivers don't require notarization to be valid, In fact, an argument could be made that notarizing a Nevada lien waiver, could actually invalidate it.

If a mechanics' lien has been filed against your property, it can only be voluntarily released by a recorded "Release of Mechanics' Lien" signed by the person or entity that filed the mechanics' lien against your property unless the lawsuit to enforce the lien was not timely filed.

About Nevada Final Unconditional Lien Waiver Form Signing this waiver signifies that payment has been received and no further payments are expected following the payment described in the waiver. Because this nv lien waiver form is unconditional, it should only be used when payment has actually been received.