Oregon Filing Form File For Llc

Description

Form popularity

FAQ

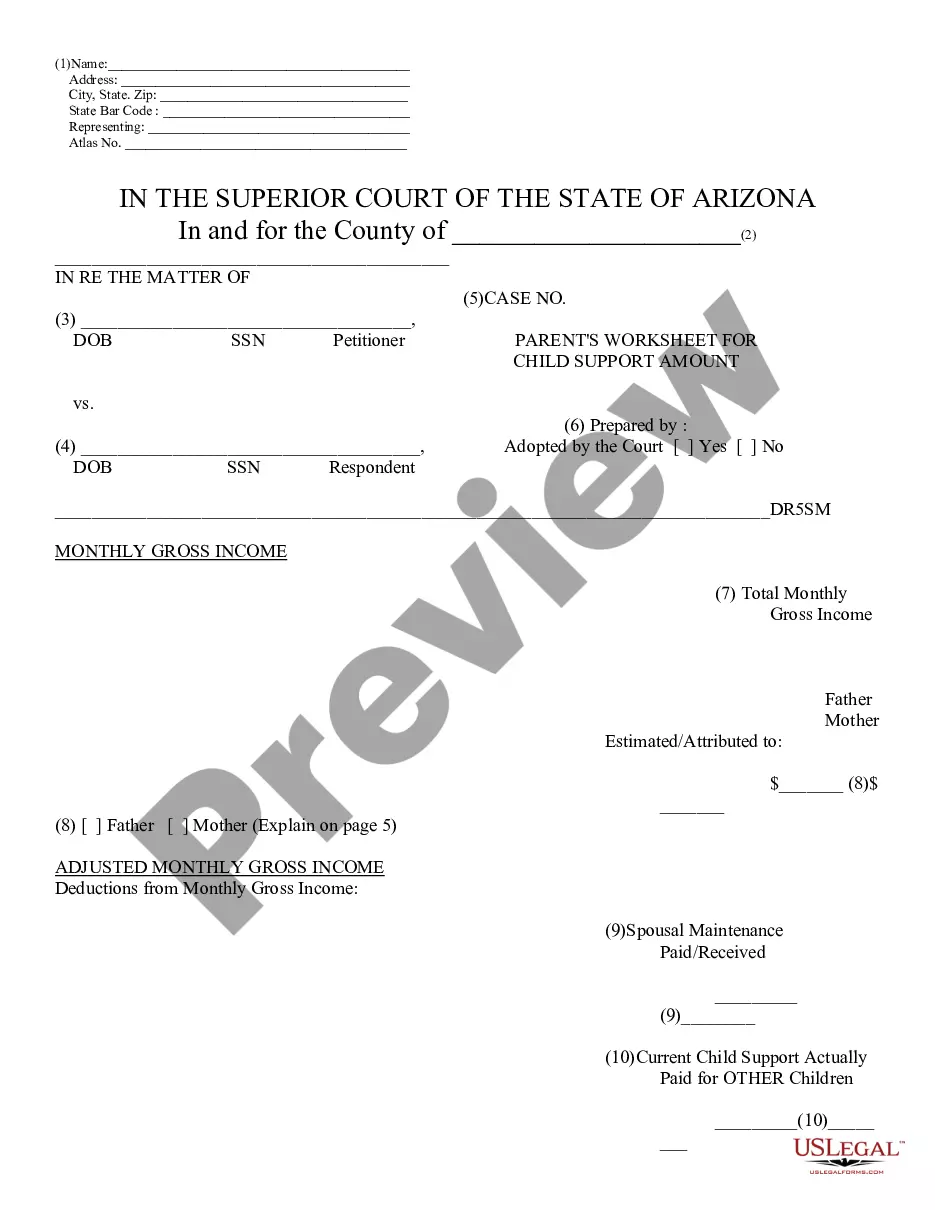

Yes, LLCs in Oregon are required to file an annual report. This report helps maintain your LLC's active status with the state. It’s essential to meet this obligation to avoid potential dissolution of your business. Consider using resources like US Legal Forms to simplify your Oregon filing form file for LLC and ensure timely submissions.

The biggest disadvantage of an LLC is often the complexity of ongoing compliance requirements. While LLCs protect your personal assets, you must understand things like self-employment tax implications and periodic state filings. Failing to keep up with these responsibilities can lead to penalties. Always keep in mind how the Oregon filing form file for LLC fits into your overall strategy.

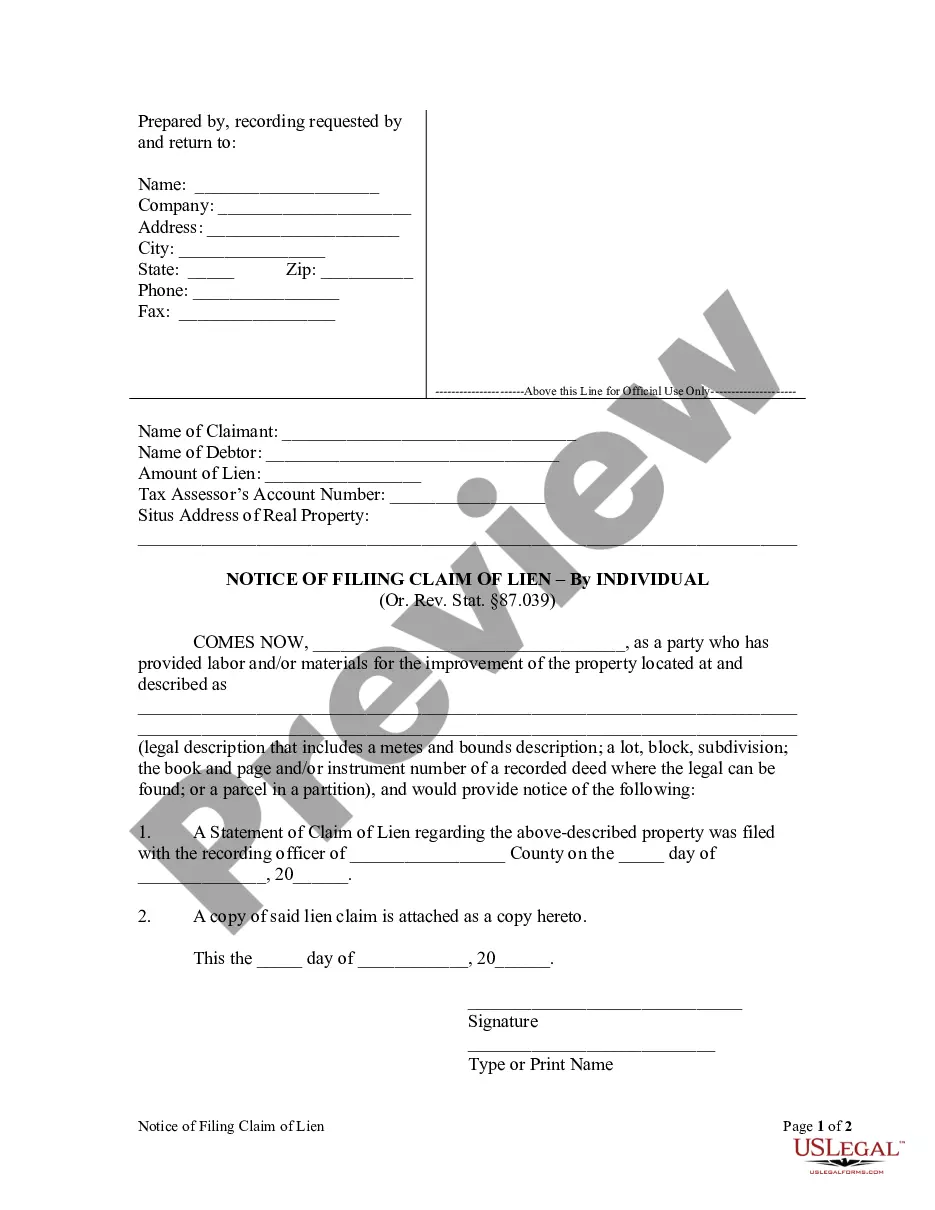

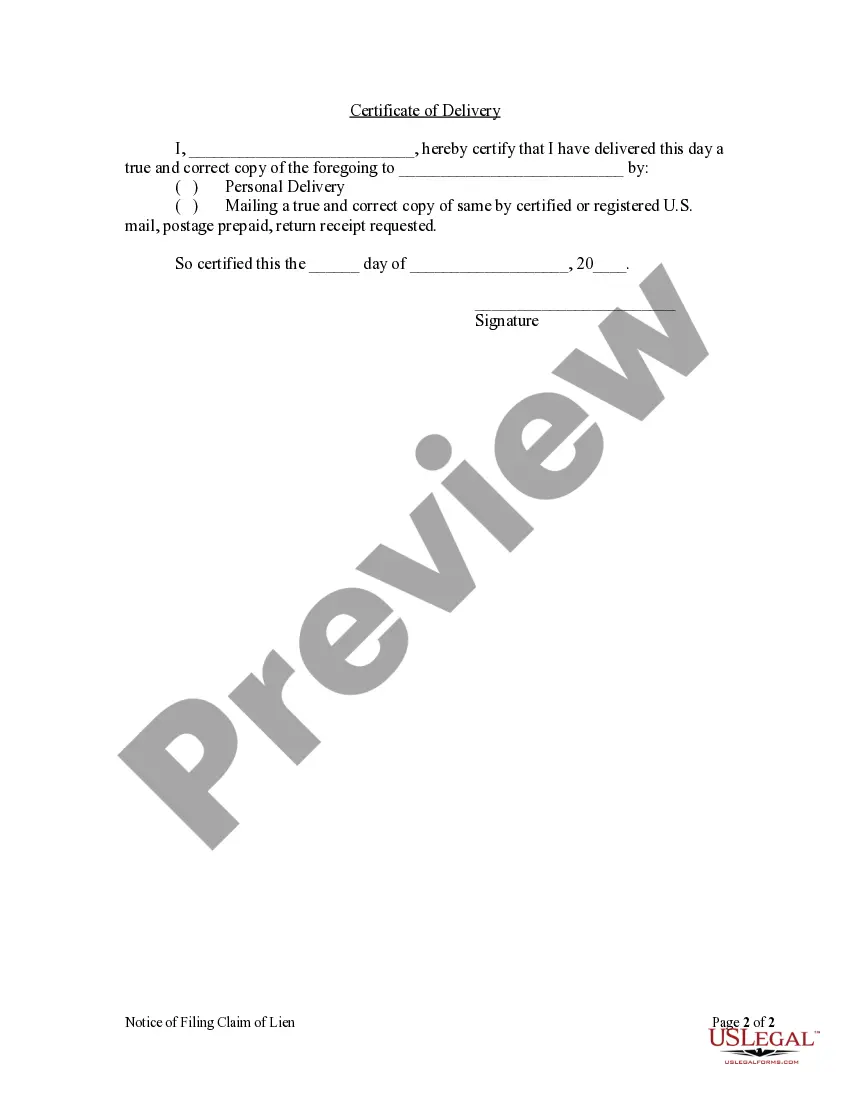

To file for an LLC in Oregon, prepare your Oregon filing form file for LLC by gathering essential information. Complete the form with your LLC name, business address, and member details. Once you’ve filled everything out, submit it to the Oregon Secretary of State, either online or by mail. Using a platform like US Legal Forms can streamline this process for you.

Writing an LLC example involves outlining the key components, such as the name, purpose, and members. For instance, consider 'Smith & Co. LLC,' focusing on the services you provide. It’s essential to adhere to state requirements in Oregon, especially when you prepare your Oregon filing form file for LLC. This ensures you include all necessary details for approval.

The most common type of LLC is a single-member LLC, often favored for its simplicity. Many individuals choose this form for its flexibility, especially when filing taxes as a sole proprietor. However, multi-member LLCs are also popular as they provide shared management and liability protection. Regardless of the type, you'll need to utilize the Oregon filing form file for LLC.

Before starting an LLC, many entrepreneurs wish they had a clearer understanding of the Oregon filing form file for LLC. Understanding the fees, paperwork, and regulations is crucial. Additionally, knowing the ongoing responsibilities, such as tax obligations and annual reports can save you from surprises later. Consulting resources like US Legal Forms can provide valuable guidance.

Yes, you typically need an Employer Identification Number (EIN) for your LLC in Oregon. This number is essential for opening a business bank account, filing taxes, and hiring employees. You can easily obtain an EIN from the IRS, and it is a crucial part of completing your Oregon filing form file for LLC. Using a reliable platform like USLegalForms can help streamline the process and ensure you have all required documents in order.

While not mandatory, having an operating agreement is advantageous for your LLC in Oregon. It serves as a foundational document that outlines the rights, responsibilities, and duties of members. If disputes arise, this agreement can clarify intentions and preserve the integrity of your business operations. Utilizing services like USLegalForms can simplify the creation of this important document.

To file for an LLC in Oregon, you need to complete the Oregon filing form file for LLC, which can be done online or through the mail. You will start by choosing a unique name for your LLC, followed by submitting your formation documents to the Oregon Secretary of State. Don't forget to check if your name is available and include the required fees with your submission. This process is straightforward, especially with the resources available on platforms like USLegalForms.

No, Oregon does not require an operating agreement for LLCs by law. Nevertheless, creating one is wise as it safeguards your business interests. This document lays out the rules and procedures for how your LLC operates. It can also be beneficial if you're seeking financing or facing legal scrutiny in the future.