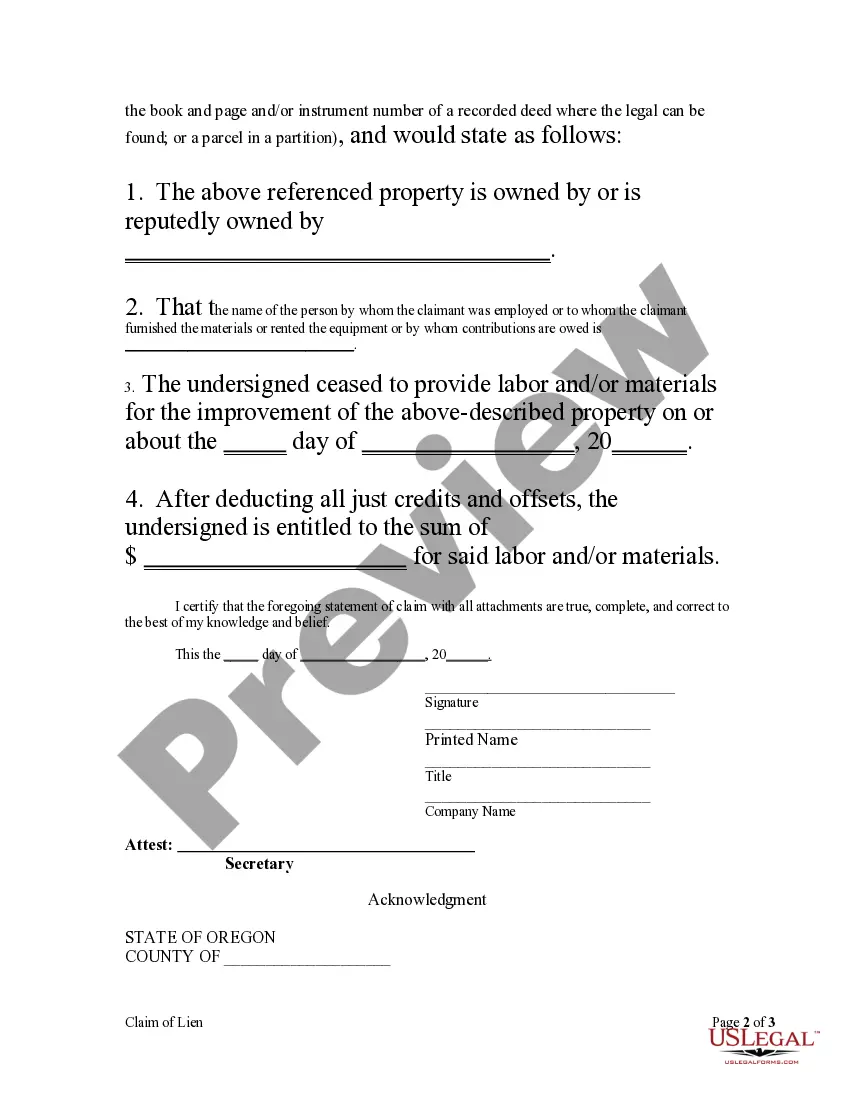

Every person claiming a lien created under ORS 87.010 (1) or (2) shall perfect the lien no later than 75 days after the person has ceased to provide labor, rent equipment or furnish materials or 75 days after completion of construction, whichever is earlier. Every other person claiming a lien created under ORS 87.010 shall perfect the lien not later than 75 days after the completion of construction. All liens claimed shall be perfected as provided by subsections (2) to (4) of this section. A lien created under ORS 87.010 shall be perfected by filing a claim of lien with the recording officer of the county or counties in which the improvement, or some part thereof, is situated.

Llc Limited Liability Company Meaning

Description

How to fill out Oregon Claim Of Lien By Corporation?

- Log in to your existing US Legal Forms account to access previously obtained forms. Ensure your subscription is active; if not, renew it as per your chosen payment plan.

- If you're new to US Legal Forms, start by reviewing the Preview mode and form description to verify you have selected the correct template that aligns with your local regulations.

- If you encounter issues, utilize the Search feature above to find alternative templates that better suit your needs.

- Once you've identified the correct form, click the 'Buy Now' button and select your preferred subscription plan, which will require you to create an account.

- Complete your purchase by providing your payment details, either through credit card or PayPal.

- Finally, download your selected form directly to your device for completion, and access it anytime from the 'My Forms' section of your profile.

In conclusion, US Legal Forms simplifies the legal documentation process, ensuring users can efficiently obtain and manage necessary forms.

Take advantage of this powerful resource today and empower your legal preparations!

Form popularity

FAQ

Choosing between an LLC and an LP depends on your specific business needs. An LLC offers limited liability protection to all its members, which is ideal for many entrepreneurs looking to shield personal assets. In contrast, an LP has at least one general partner with unlimited liability, which may not be suitable for everyone. Understanding the Llc limited liability company meaning can help you make the best choice for your situation.

Yes, forming an LLC before starting your business can be beneficial. An LLC provides you with personal liability protection, which means your personal assets are generally safe from business debts. Additionally, it can enhance your credibility with customers and partners. Keeping the Llc limited liability company meaning in mind will help you understand these advantages fully.

Typically, an LLC does not file taxes as a separate entity; instead, its income passes through to the individual members' personal tax returns. This process simplifies tax filing for many entrepreneurs, as it avoids double taxation found in corporations. Understanding how LLC and personal taxes interact is essential for grasping the implications of the LLC limited liability company meaning.

The best description of a limited liability company is that it is a hybrid business structure that provides personal liability protection to its members while allowing for operational flexibility. This means members can manage the business without risking their personal assets. This unique combination solidifies the LLC limited liability company meaning as a popular choice for many business owners.

A limited liability company, or LLC, is a business entity that combines the flexibility of a partnership with the legal protections of a corporation. This structure allows for pass-through taxation, meaning owners can report profits on their personal tax returns while enjoying protection from personal liability. Grasping the description of a limited liability company is essential for understanding its role in the LLC limited liability company meaning.

Limited liability is best described as a legal structure that protects a business owner’s personal assets from being used to satisfy business debts. This means that if the business incurs debt or faces lawsuits, the owner's personal property is generally protected. Understanding limited liability is key to grasping the LLC limited liability company meaning and its advantages.

An LLC is best suited for small to medium-sized businesses seeking flexibility and protection. It combines the benefits of a corporation, like limited liability, with the simplicity of a partnership. This makes it an attractive choice for entrepreneurs who want to safeguard their personal assets while maintaining operational control, embodying the LLC limited liability company meaning.

In an LLC, all members enjoy limited liability protection, meaning they are not personally liable for the company's debts or obligations. This protection allows members to limit their financial risk while engaging in business activities. Understanding who has limited liability in an LLC is crucial for anyone considering forming this type of business structure, reinforcing the LLC limited liability company meaning.

When writing a limited liability company, you typically include the designation 'LLC' after the business name. This indicates that the business operates as an LLC, thus providing limited liability protection. It’s essential to comply with your state’s specific regulations regarding naming and structure to properly convey the LLC limited liability company meaning.

A limited liability company (LLC) is defined as a business structure that offers personal liability protection to its owners, also known as members. This means that members typically cannot be held personally responsible for the company’s debts or liabilities. The LLC combines features of both a corporation and a partnership, allowing for flexible management and fewer regulatory requirements, ultimately supporting the LLC limited liability company meaning.