Oregon Estate To With Acreage

Description

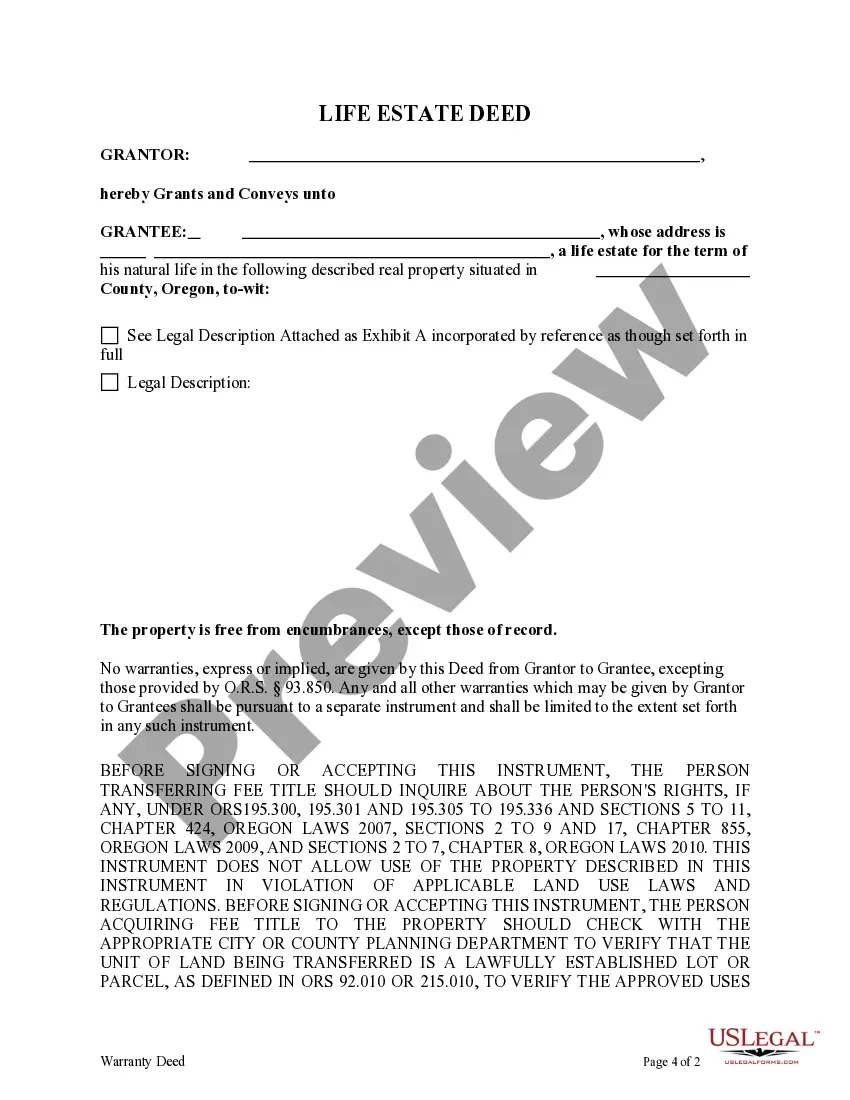

How to fill out Oregon Life Estate Deed From An Individual To An Individual.?

Finding a go-to place to access the most recent and appropriate legal samples is half the struggle of handling bureaucracy. Choosing the right legal papers requirements accuracy and attention to detail, which explains why it is important to take samples of Oregon Estate To With Acreage only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to be concerned about. You may access and check all the details about the document’s use and relevance for your circumstances and in your state or county.

Take the following steps to finish your Oregon Estate To With Acreage:

- Make use of the library navigation or search field to locate your template.

- View the form’s description to see if it fits the requirements of your state and area.

- View the form preview, if available, to make sure the template is definitely the one you are searching for.

- Get back to the search and look for the correct template if the Oregon Estate To With Acreage does not match your requirements.

- When you are positive regarding the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Select the pricing plan that suits your requirements.

- Go on to the registration to complete your purchase.

- Complete your purchase by selecting a transaction method (credit card or PayPal).

- Select the file format for downloading Oregon Estate To With Acreage.

- When you have the form on your gadget, you may modify it using the editor or print it and finish it manually.

Eliminate the headache that comes with your legal paperwork. Discover the comprehensive US Legal Forms catalog where you can find legal samples, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

The Oregon estate tax exemption, like the federal exemption, is a tax exemption that reduces the amount of estate taxes that must be paid. At the state level, the exemption is $1,000,000; in other words, you will pay no Oregon estate tax on estate transfers up to that value.

The Oregon estate tax is a tax that is levied on the transfer of the estate of a deceased person. It is separate from the federal estate tax, which is a tax on the transfer of the estate of a deceased person at the federal level. The Oregon estate tax applies to estates with a value of more than $1 million.

Capital gains tax is charged only on the appreciation that occurs after that step up in basis to the date of death value, if the asset has passed through the decedent's estate. It is not charged on the appreciation that took place during the decedent's life if the asset passes through the deceased person's estate.

Oregon does not have an inheritance tax. The state's estate tax used to be called an inheritance tax, but was still an estate tax in practice. If you're inheriting property or money from someone who lives out of state, make sure to check local laws.