Affidavit Of Heirship Oregon With Special Power Of Attorney

Description

How to fill out Oregon Heirship Affidavit - Descent?

What is the most reliable service to acquire the Affidavit Of Heirship Oregon With Special Power Of Attorney and other up-to-date versions of legal documents.

US Legal Forms is the solution! It's the largest assortment of legal papers for any situation.

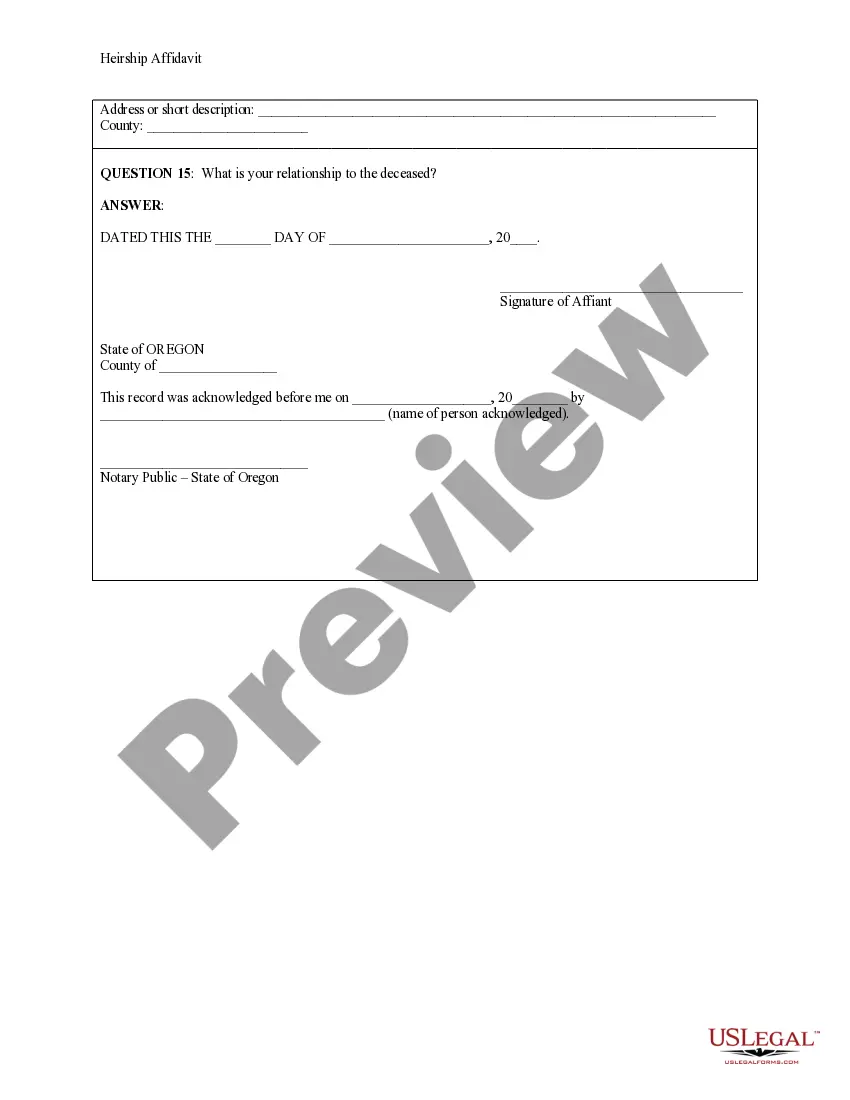

If you haven't created an account in our library yet, here are the steps you should follow to obtain one: Evaluate form compliance. Before you obtain any template, ensure it meets your use case requirements and your state's or county's regulations. Review the form description and utilize the Preview if available. Search for alternate forms. If there are any discrepancies, use the search bar in the page header to locate another template. Click Buy Now to select the appropriate one. Register and obtain subscription. Choose the most fitting pricing plan, Log In or register for your account, and pay for your subscription through PayPal or credit card. Download the document. Choose the format you prefer to save the Affidavit Of Heirship Oregon With Special Power Of Attorney (PDF or DOCX) and click Download to retrieve it. US Legal Forms is an excellent option for anyone needing to manage legal documentation. Premium users can benefit even more as they can complete and sign the previously stored documents electronically at any time using the integrated PDF editing tool. Try it now!

- Every template is properly drafted and validated for adherence to federal and local regulations.

- They are organized by area and state of application, making it simple to find the one you need.

- Experienced users of the site only need to Log In to the platform, verify if their subscription is active, and click the Download button next to the Affidavit Of Heirship Oregon With Special Power Of Attorney to receive it.

- When stored, the template remains accessible for further use within the My documents section of your profile.

Form popularity

FAQ

Probate can be started immediately after death and takes a minimum of four months. If the estate includes property that takes a while to sell, or if there are complicated tax or other matters, probate can last much longer. A small estate proceeding cannot be filed until 30 days after death and is complete upon filing.

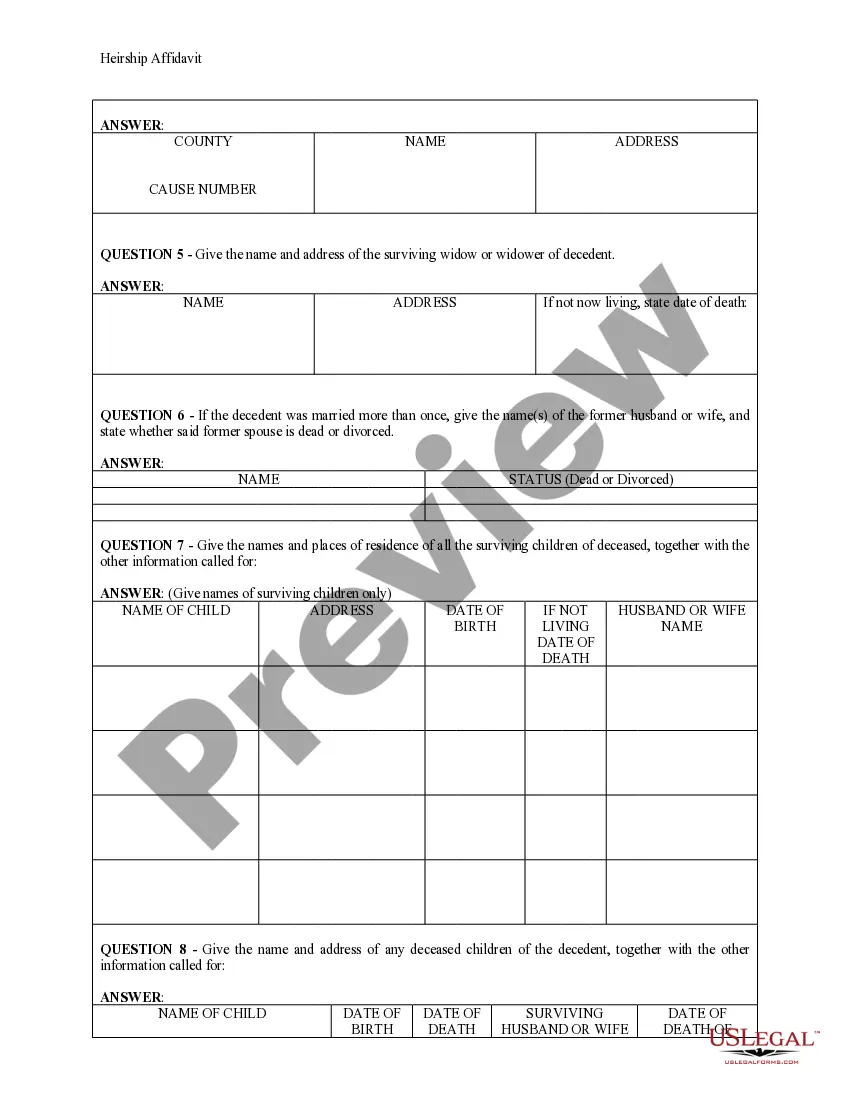

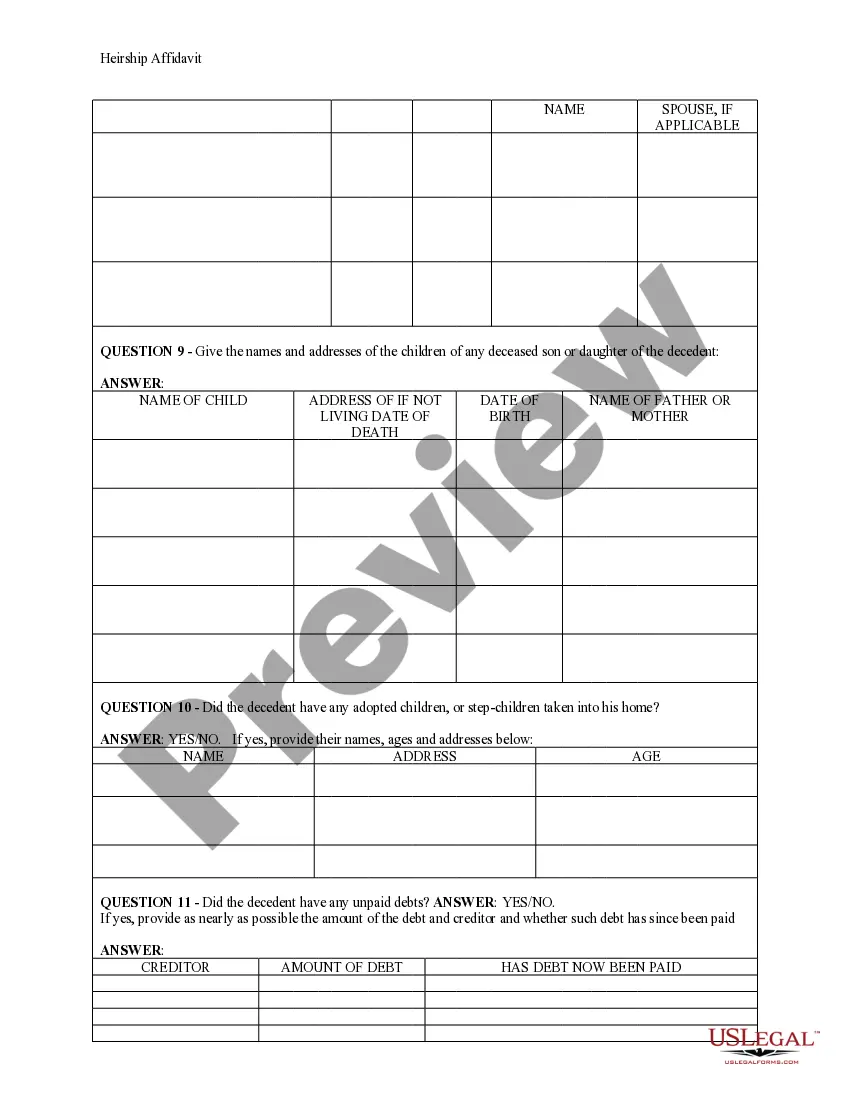

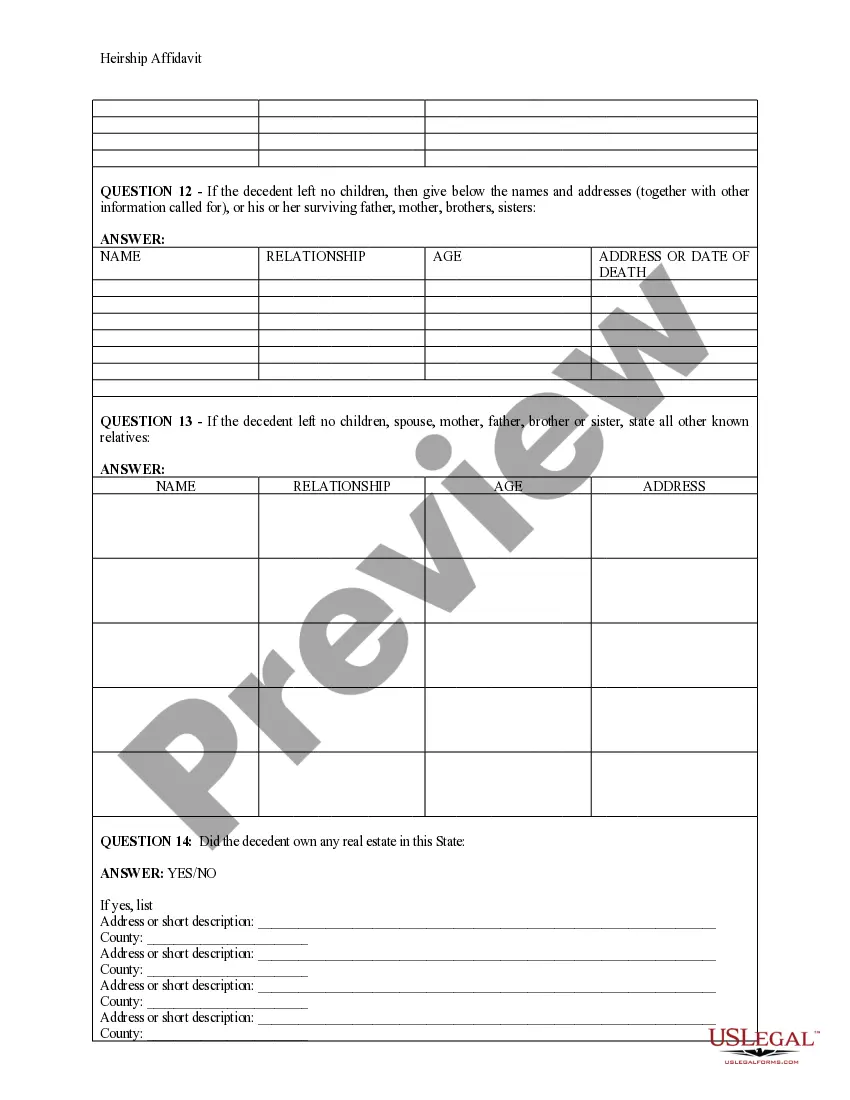

ChecklistThe name and address of the deceased party (called the "Decedent")The name and address of the party providing sworn testimony in this affidavit (called the "Affiant")The date and location of the Decedent's death.Whether or not the Decedent left a will and, if so, the name and address of the Executor.More items...

Step 1 Wait Thirty (30) Days. The small estate affidavit can only be filed after thirty (30) days have passed since the decedent's death.Step 2 No Personal Representative.Step 3 Complete Forms.Step 4 File With Court.Step 5 Send to Estate Recipients.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

Under Oregon inheritance laws, If you have a spouse but no descendants (children, grandchildren), your spouse will inherit everything. If you have children but no spouse, your children will inherit everything. If you have a spouse and descendants (with that spouse), your spouse inherits everything.