Transfer-on-death Deed

Description

How to fill out Oregon Transfer On Death Deed From An Individual Owner/Grantor To An Individual Beneficiary.?

- If you're an existing user, log in to your account to access your form library. Verify that your subscription is active; renew if necessary.

- For first-time users, start by browsing the extensive selection of legal forms. Preview specific documents to confirm they meet your requirements and comply with local laws.

- Utilize the search feature to find alternative templates if needed. Ensure you select the most suitable option before proceeding.

- Click 'Buy Now' to select your desired subscription plan, which grants you access to US Legal Forms' extensive library.

- Complete your purchase by entering your payment details, using either a credit card or PayPal for convenience.

- After payment, download your transfer-on-death deed. Access it directly from your device or revisit it anytime in the My Forms section of your profile.

US Legal Forms is a trusted resource that simplifies legal documentation, offering more forms than competitors at a similar cost. Their library exceeds 85,000 easy-to-edit legal templates, catering to a wide range of individual and legal needs.

With premium expert assistance available, you can be confident your documents are completed accurately. Start your estate planning today, and make the most of the invaluable resources available at US Legal Forms.

Form popularity

FAQ

Many states allow a transfer on death deed, with a growing number recognizing its benefits for estate planning. States such as Arizona, Missouri, and New York have provisions enabling this form of transfer. By utilizing a transfer-on-death deed, property owners can ensure their assets pass directly to their beneficiaries, avoiding probate. For tailored assistance in your state, explore US Legal Forms, which simplifies the process.

Transfers on death deeds are recognized in several states across the U.S., including California, Florida, and Texas, among others. Each state has its own specific rules regarding the execution and validity of these deeds. Understanding these rules is crucial for ensuring a smooth transfer process. You can easily find state-specific guidance on transfer-on-death deeds through resources like US Legal Forms.

After death, you must transfer the deed within a certain timeframe stipulated by state law. Typically, this process needs to occur before the estate is settled. Delaying could complicate the transfer-on-death deed process, making it more challenging for heirs. It is wise to consult with a legal expert or use platforms like US Legal Forms for assistance in navigating these requirements.

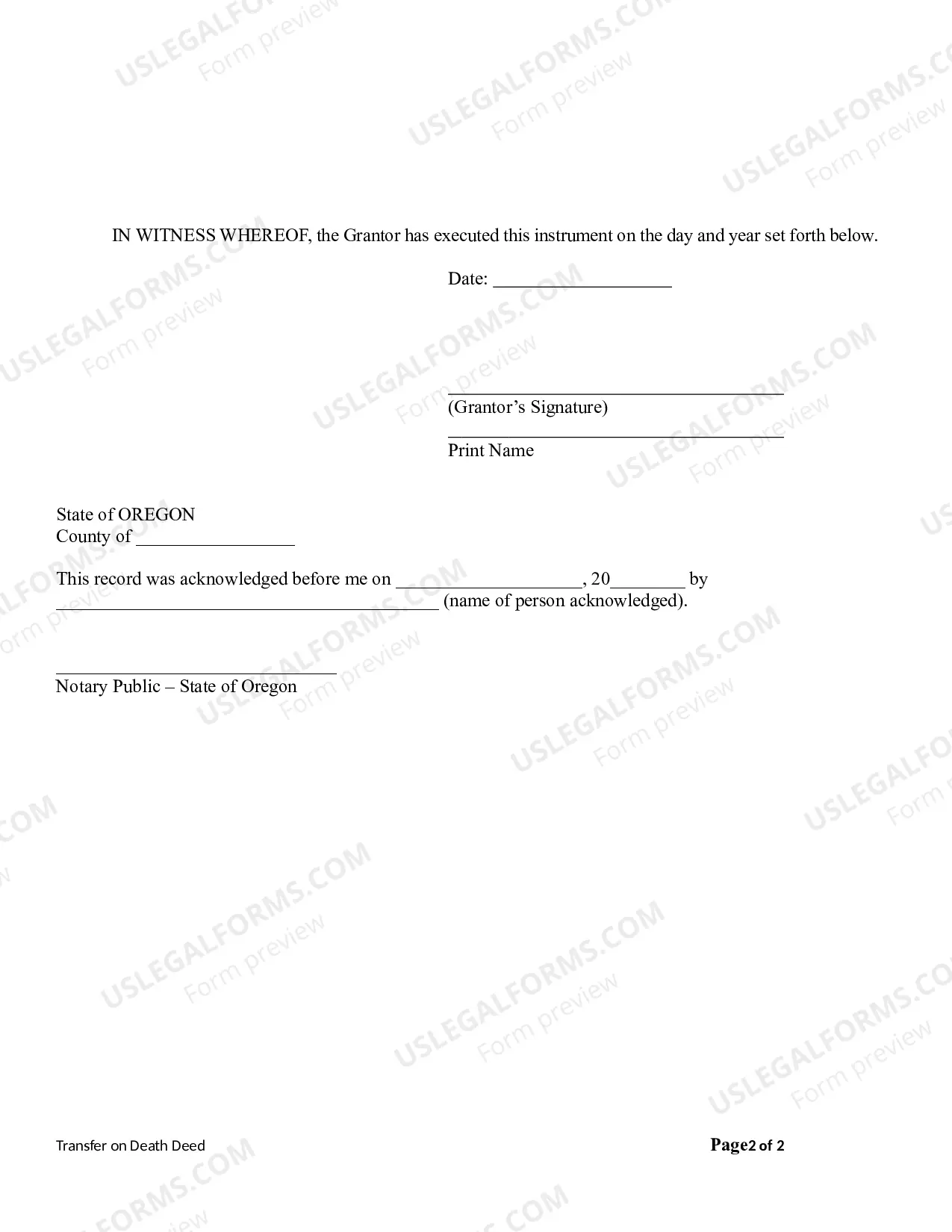

Writing a transfer-on-death deed involves a few important steps to ensure it is valid and effective. First, include a clear description of the property and specify the beneficiary who will receive it. It's crucial to follow your state's requirements, which often include signing the deed in front of a notary. For guidance on your specific situation, consider exploring the resources available on the US Legal Forms platform, which can help streamline the process.

A transfer-on-death deed offers several advantages for those looking to simplify their estate planning. It allows property owners to transfer their real estate directly to beneficiaries without going through probate. This means loved ones can avoid lengthy legal processes, making it a practical solution for many families. Additionally, utilizing a transfer-on-death deed can provide peace of mind by ensuring your wishes are carried out after your passing.

Yes, New Jersey permits the use of transfer-on-death deeds as part of its estate planning options. This legal instrument allows property owners to designate beneficiaries who will receive the property upon their death without undergoing probate. It provides a straightforward solution for transferring property and can streamline the inheritance process. For those in New Jersey looking to implement this option, tools like USLegalForms can be beneficial.

The downside of a transfer-on-death deed includes the lack of control over the property once the owner passes away. Beneficiaries gain immediate ownership, which means you cannot make decisions regarding the property after your death. Furthermore, this type of deed does not eliminate estate taxes or other liens on the property. Understanding these factors can help you decide if a transfer-on-death deed aligns with your overall estate plan.

While you do not necessarily need a lawyer to create a transfer-on-death deed, it is highly recommended. A lawyer can guide you through the legal requirements, help avoid mistakes, and ensure that your deed reflects your intentions correctly. Using services like USLegalForms can simplify the process, but having professional advice can provide additional peace of mind.

Yes, New York State allows transfer-on-death deeds, but with some restrictions. Unlike some other states, New York requires that these deeds be created in a specific format to be valid. If you are considering this option, it is essential to follow state guidelines and possibly seek help from a qualified attorney or use a reliable platform like USLegalForms to ensure compliance.

One disadvantage of a transfer-on-death deed is that it does not provide asset protection from creditors. Once the property passes to the beneficiaries, they may be liable for any debts associated with it. Additionally, if you wish to modify or revoke a transfer-on-death deed, you must follow specific legal procedures to ensure everything remains valid. Consulting with a professional can help you navigate these potential challenges.