Or Llc With Taxes

Description

How to fill out Oregon Limited Liability Company LLC Operating Agreement?

Creating legal documents from the ground up can frequently be overwhelming.

Certain situations may require extensive research and significant financial investment.

If you are looking for an easier and more affordable method of generating Or Llc With Taxes or any other papers without unnecessary complications, US Legal Forms is consistently available to assist you.

Our online collection of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal affairs.

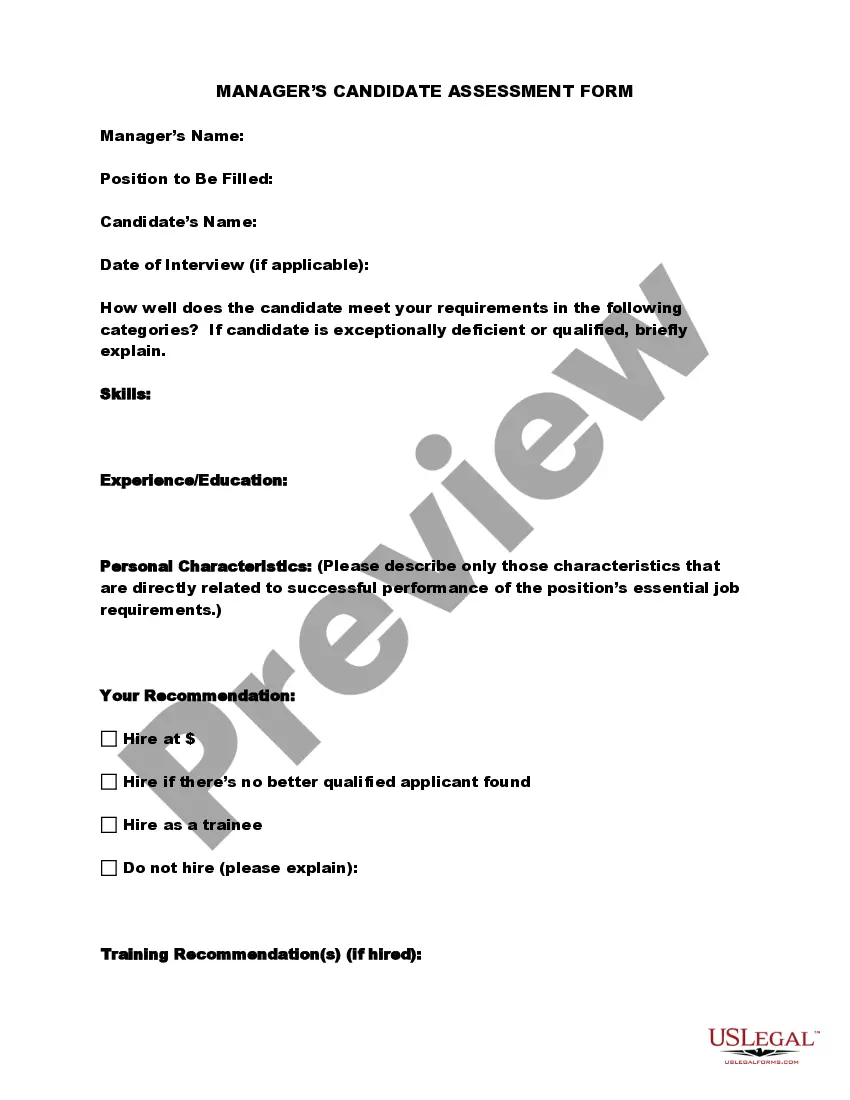

Examine the form preview and descriptions to confirm that you have located the form you need. Verify that the template you select adheres to the rules and regulations of your state and county. Choose the most appropriate subscription plan to acquire the Or Llc With Taxes. Download the document, then complete, validate, and print it out. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and transform form completion into a simple and efficient process!

- With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously crafted for you by our legal experts.

- Utilize our platform whenever you require dependable and trustworthy services through which you can effortlessly find and acquire the Or Llc With Taxes.

- If you are already familiar with our services and have set up an account with us previously, simply Log In to your account, find the form, and download it or re-download it anytime in the My documents section.

- Not signed up yet? No problem. It takes minimal time to register and browse the library.

- Before diving into downloading Or Llc With Taxes, adhere to these tips.

Form popularity

FAQ

Self-employment has its benefits. An LLC can help reduce your liability without reducing your freedom to run your business as you see fit. And we have you covered at tax time, with TurboTax Home & Business for single-member LLCs, and TurboTax Business for multiple-member LLCs.

A personal salary will show a steady, earned employment income and is more likely to help you be eligible. Mortgage brokers may not consider dividends as favourably. On the other hand, dividends tend to be lower in cost, which allows you to have more cash now, but less later, as you forego your CPP contributions.

The business income or loss that you earn isn't taxed separately from your other income. This income ?passes-through? to your personal income tax return because the business profits don't get taxed as a separate entity. Most often, you report your business income and expenses on Schedule C of Form 1040.

The best way to pay yourself as an LLC will depend on your specific circumstances. For most businesses however, the best way to minimize your tax liability is to pay yourself as an employee with a designated salary.

If your business is a partnership, LLC, or S corporation shareholder, your share of the business's losses will pass through the entity to your personal tax return. Your business loss is added to all your other deductions and then subtracted from all your income for the year.