Or Liable Companies For Damage

Description

How to fill out Oregon Limited Liability Company LLC Operating Agreement?

Drafting legal paperwork from scratch can often be a little overwhelming. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a an easier and more affordable way of preparing Or Liable Companies For Damage or any other documents without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual catalog of over 85,000 up-to-date legal documents addresses almost every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-specific forms carefully prepared for you by our legal specialists.

Use our website whenever you need a trusted and reliable services through which you can quickly locate and download the Or Liable Companies For Damage. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and explore the library. But before jumping straight to downloading Or Liable Companies For Damage, follow these recommendations:

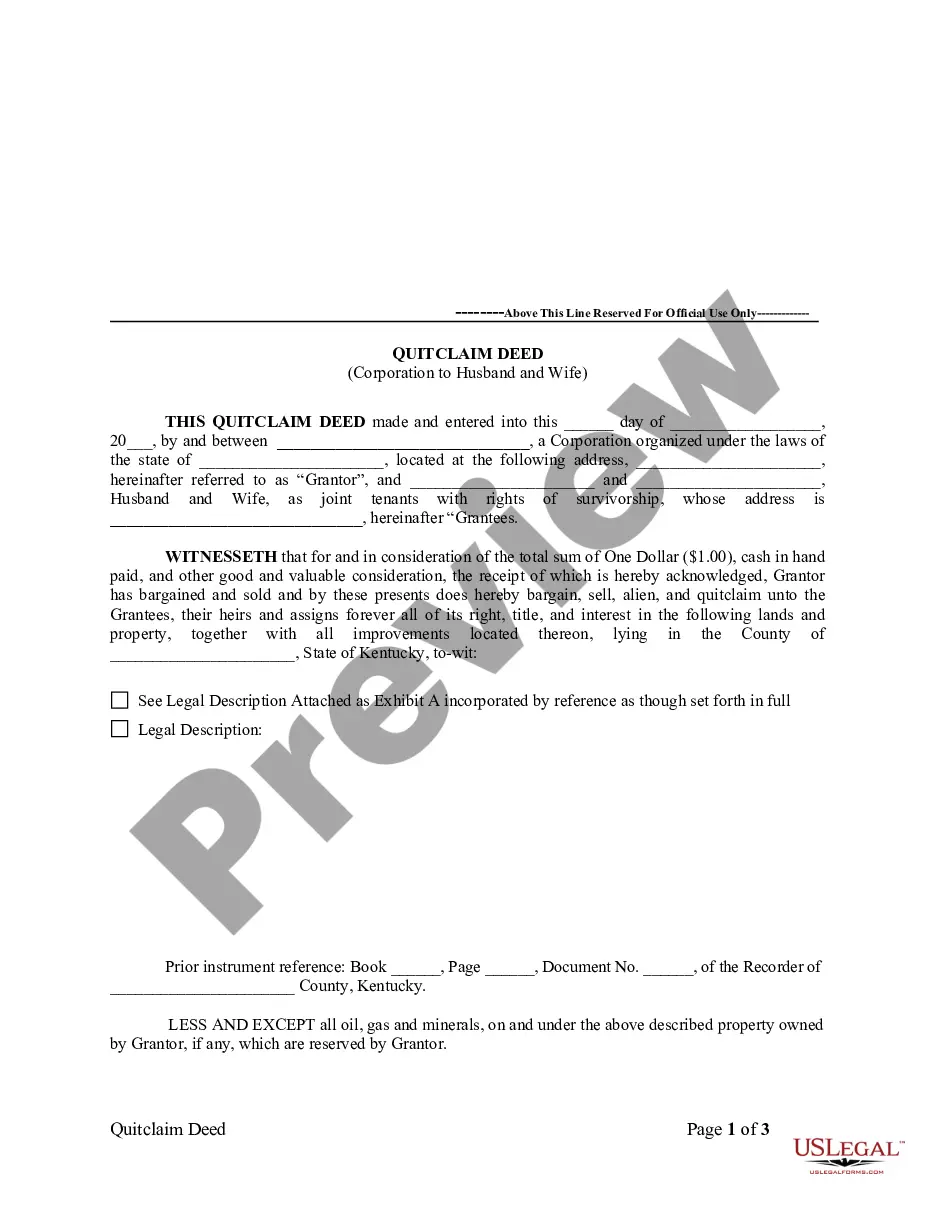

- Check the document preview and descriptions to make sure you are on the the form you are searching for.

- Check if template you choose conforms with the requirements of your state and county.

- Pick the best-suited subscription option to buy the Or Liable Companies For Damage.

- Download the form. Then complete, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of expertise. Join us today and transform form execution into something easy and streamlined!

Form popularity

FAQ

How To File a General Liability Claim Contact Your Insurance Agent or Insurance Carrier. When you find out about an incident or if there's an injury at your business, contact your insurance agent or carrier as soon as you can. ... Collect Information. ... Document Everything. ... Decide How To Resolve the Claim.

Filing a Product Liability Claim Get Medical Attention. The first step to making a claim begins with seeking medical treatment for the injury you sustained from the product. ... Contact a Personal Injury Lawyer. ... Check the Statute of Limitations. ... Gather Evidence and Witnesses.

Liability is a legally enforceable claim against another person or entity. When a party is liable for a personal injury, that party can be held financially responsible for an accident victim's damages. Liability is a crucial element required to recover compensation for personal injury claims.

The most common liability coverage is 100/300/100, which is $100,000 per person, $300,000 per accident in bodily injury liability and $100,000 per accident in property damage liability. But what do 100/300/100 car insurance policy limits mean?

For example, say you cause a vehicle accident and someone that was injured sues you for $1 million to cover their lost income and other expenses. If your auto policy's liability coverage has a limit of $500,000, you could be responsible for coming up with the additional $500,000.