This is an official form from the Oklahoma Secretary of State, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Oklahoma statutes and law.

Amended Certificate Of Qualifications Oklahoma Withholding

Description

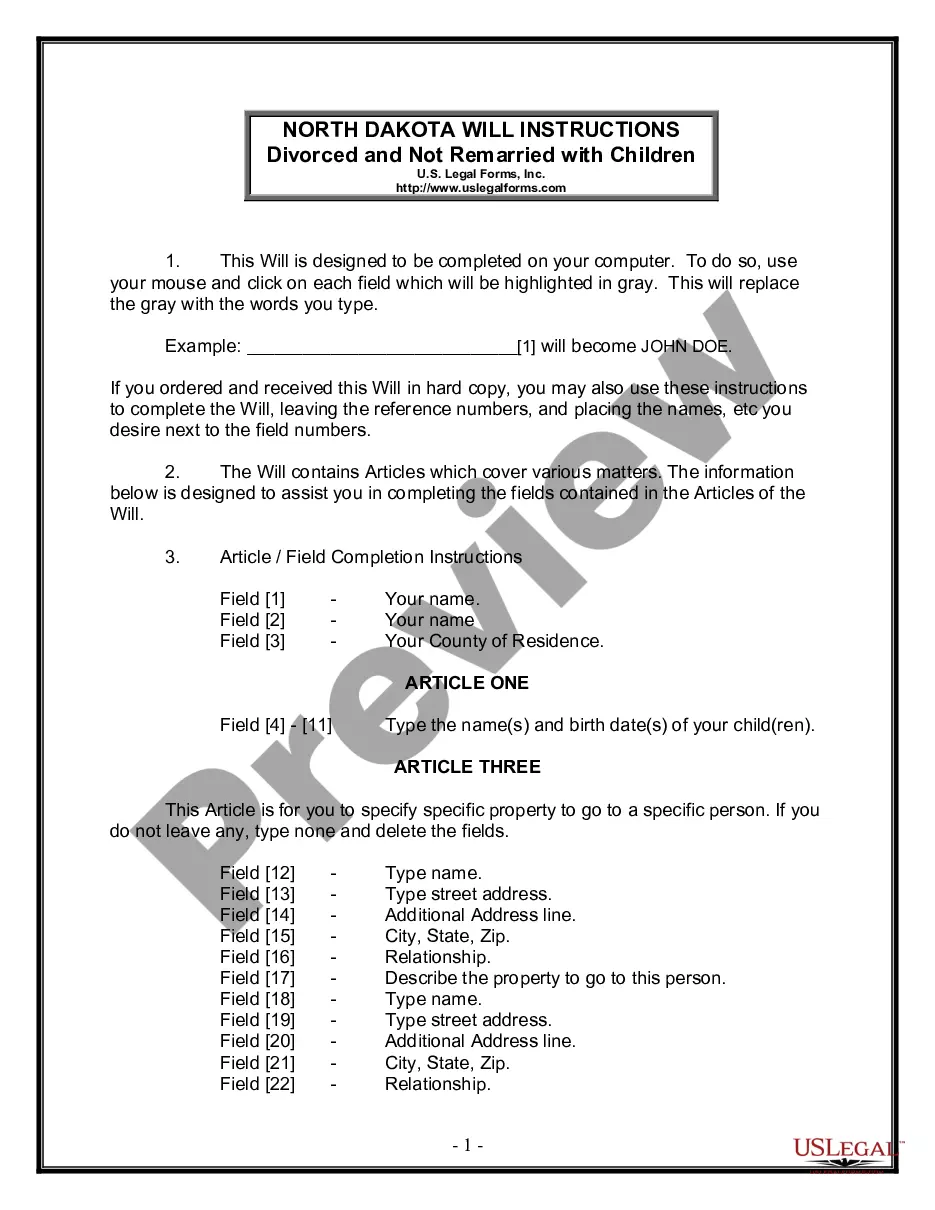

How to fill out Amended Certificate Of Qualifications Oklahoma Withholding?

Individuals commonly relate legal documentation to something intricate that only an expert can manage.

In some respects, that's accurate, as creating an Amended Certificate Of Qualifications Oklahoma Withholding demands comprehensive understanding of the subject matter, including state and county rules.

However, with US Legal Forms, everything has become easier: pre-prepared legal documents for any event related to life and business that align with state laws are gathered in a single digital repository and are now accessible to everyone.

Print your document or transfer it to an online editor for quicker completion. All templates in our collection are reusable: once obtained, they are stored in your profile. You can access them any time needed via the My documents tab. Explore all the advantages of using the US Legal Forms platform. Sign up today!

- US Legal Forms provides over 85k current documents categorized by state and area of usage, making it quick to find the Amended Certificate Of Qualifications Oklahoma Withholding or any other specific template.

- Previously registered users with an active membership should Log In to their account and click Download to obtain the form.

- New users to the platform will first need to create an account and subscribe before they can retrieve any files.

- Here’s a guide on how to obtain the Amended Certificate Of Qualifications Oklahoma Withholding.

- Review the page details thoroughly to confirm it meets your requirements.

- Read the form description or view it through the Preview option.

- Locate another template using the Search bar in the header if the previous one isn’t suitable.

- Press Buy Now when you discover the correct Amended Certificate Of Qualifications Oklahoma Withholding.

- Select a pricing plan that fits your preferences and financial plan.

- Create an account or Log In to go to the payment page.

- Complete your subscription payment via PayPal or with your credit card.

- Choose the format for your template and click Download.

Form popularity

FAQ

The individual employee fills out the W-4 form to specify their tax withholding preferences. It informs the employer how much federal income tax to withhold from their paychecks. Completing this form carefully is crucial in managing your taxes, especially in relation to your amended certificate of qualifications for Oklahoma withholding, which may require specific details.

Employers bear the responsibility for tax withholding on behalf of their employees. They must accurately calculate and send withheld amounts to the proper tax authorities. If you are unsure about how these responsibilities pertain to your amended certificate of qualifications for Oklahoma withholding, U.S. Legal Forms can provide the necessary information and forms to assist you.

To change your withholding override, you need to fill out a new employee's withholding certificate, indicating your desired withholding amount. Make sure to provide this updated certificate to your employer promptly. Changes can affect your tax obligations, highlighting the importance of referring to your amended certificate of qualifications for Oklahoma withholding for clear guidance.

The employee themselves is responsible for completing the employee's withholding certificate. It’s important to provide accurate personal and financial information to ensure the employer withholds the correct tax amount. This step plays a significant role in your overall tax filing process, especially when you consider any changes made through your amended certificate of qualifications for Oklahoma withholding.

Yes, it is essential for employees to fill out an employee's withholding certificate, also known as a W-4 form. This form informs your employer of the correct amount of federal income tax to withhold from your paycheck. Properly completing this certificate influences your tax situation, including adjustments relevant to your amended certificate of qualifications for Oklahoma withholding.

To file an amended Oklahoma tax return, you should complete the appropriate form designated for amendments, typically Form 511-X. Make sure to provide accurate information reflecting any changes from your original submission. If you need guidance on how to handle your amended certificate of qualifications for Oklahoma withholding, consider using U.S. Legal Forms for assistance with the forms needed.

Typically, employers are responsible for filing withholding tax returns. They report the amounts withheld from employee wages for federal, state, and local taxes. If you are an employer in Oklahoma, you must ensure correct submission to comply with the amended certificate of qualifications for Oklahoma withholding. Utilizing a platform like U.S. Legal Forms can simplify this process, ensuring all forms are filled properly.

To fill out your tax withholding form, you should start by entering personal information, followed by detailing your allowances. Be aware of any special situations, such as multiple jobs or dependents, as these can impact your withholdings. Referencing the Amended Certificate of Qualifications Oklahoma Withholding will help guide you through the right process and keep your tax situation optimal.

In step 3 of the employee's withholding certificate, you will need to specify the number of allowances you are claiming. This number directly influences how much tax gets withheld from your paychecks. Make sure to refer back to the instructions in the Amended Certificate of Qualifications Oklahoma Withholding to ensure you are entering an accurate figure.

The number of exemptions you should withhold typically depends on your financial circumstances and family status. It is wise to review your tax liability and the guidelines provided by the Amended Certificate of Qualifications Oklahoma Withholding to determine the right number for your case. Always consider consulting a tax professional for personalized advice.