Quitclaim Deed With With A Will

Description

How to fill out Oklahoma Quitclaim Deed From Husband And Wife To Five Individuals As Joint Tenants With Right Of Survivorship?

- If you already have an account, log in to download your required form template by clicking the Download button. Ensure your subscription is active; if not, renew it per your payment plan.

- For first-time users, check the Preview mode and form description to confirm the document meets your needs and adheres to local jurisdiction requirements.

- If you need a different template, utilize the Search tab to find the correct version that suits your requirements.

- Purchase the document by clicking the Buy Now button and selecting your desired subscription plan; registration is necessary for accessing the resource library.

- Complete your purchase by entering your credit card information or using your PayPal account to pay for the subscription.

- Download your form to your device, making it convenient to complete and save in the My Forms section of your profile.

With US Legal Forms, users benefit from a robust collection of over 85,000 fillable legal forms, surpassing what competitors offer at similar costs.

Take control of your legal needs today by utilizing US Legal Forms. Ensure your documents are accurate and meet legal standards with expert assistance. Start your journey now!

Form popularity

FAQ

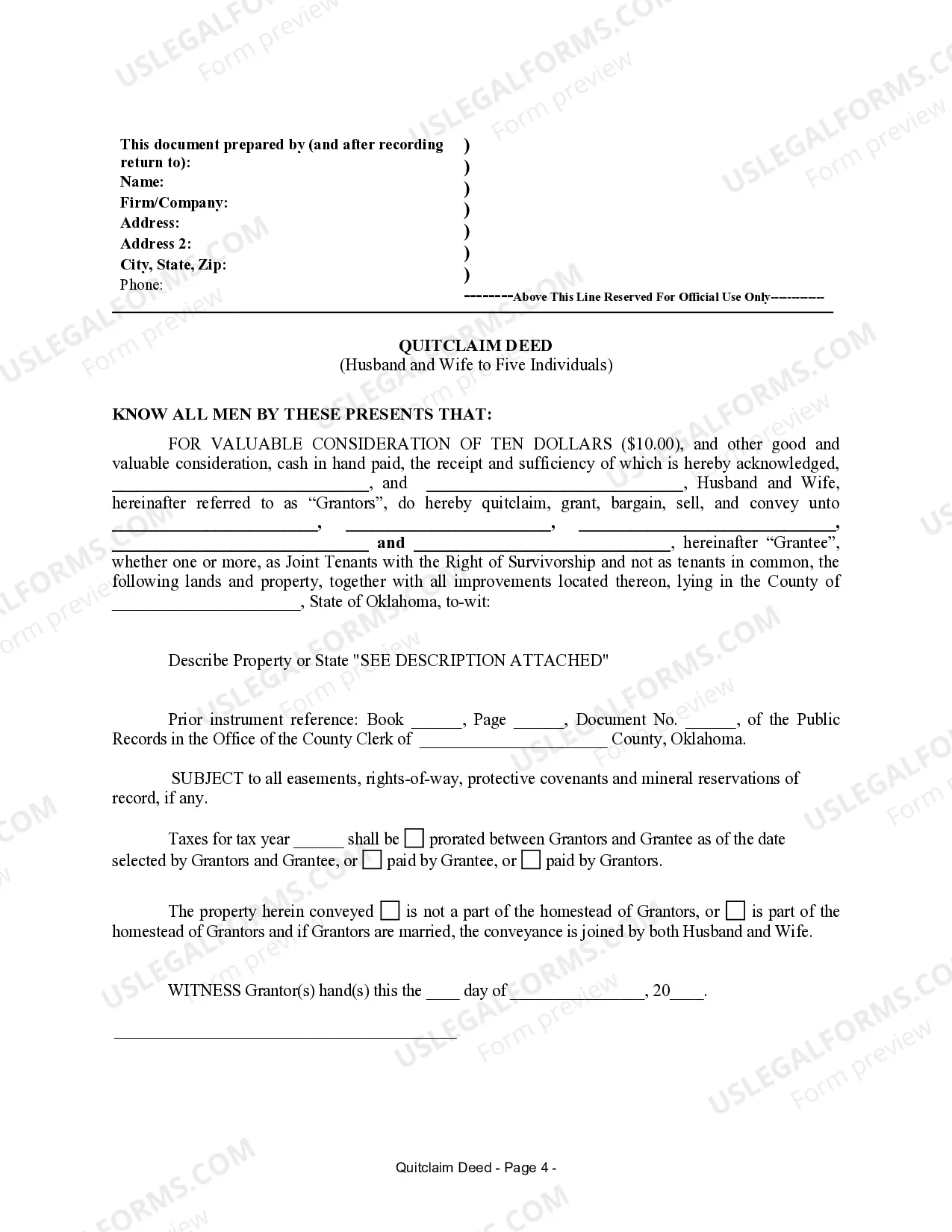

Filling out a quitclaim deed form is straightforward. Begin by entering the names and addresses of both the grantor and grantee, followed by the legal description of the property. Ensure to indicate the date of transfer and sign the form in front of a notary. To simplify this process, consider using USLegalForms, where you can find templates and guidance specifically for a quitclaim deed with a will, increasing your confidence in completing the documentation correctly.

Quitclaim deeds, particularly involving a will, are often viewed with skepticism because they offer no warranties or guarantees of ownership. This means the grantee receives whatever interest the grantor has, which could be limited or even nonexistent. Additionally, if there are existing liens or claims against the property, a quitclaim deed does not protect the buyer from those liabilities. Therefore, it’s crucial to conduct thorough research and understand the implications before proceeding.

To properly fill out a quitclaim deed with a will, start by clearly identifying the grantor and the grantee on the form. Include a legal description of the property, ensuring all details are accurate to prevent future disputes. Once completed, all parties must sign the document in the presence of a notary public. Finally, file the quitclaim deed with the county recorder's office to make the transfer official.

Generally, a will can override a quitclaim deed if the will was executed after the deed and specifies different intentions for property disposition. If the quitclaim deed was intended to be permanent, a will may not change that. To avoid confusion, it's important to align your quitclaim deed with a will, utilizing platforms like USLegalForms to clarify your wishes and prevent future disputes.

Using a quitclaim deed after someone's death is possible but it requires careful attention to the deceased's estate. If the deceased left a will that specifies the distribution of property, the quitclaim deed should align with that intent. Therefore, it's crucial to navigate these procedures carefully, perhaps even consulting resources like USLegalForms to ensure proper handling of the deed with a will.

A quitclaim deed cannot be used to transfer property that is encumbered by legal obligations, such as liens or mortgages, without the debt holder's consent. Additionally, if the property is part of a divorce settlement or if one of the parties is not legally recognized, a quitclaim deed with a will would not be applicable. Understanding these restrictions can save you from future legal complications.

A quitclaim deed remains valid after the death of the grantor, but its effectiveness can depend on the specifics of the situation. If the deed was executed properly before the death and the appropriate legal steps were taken, the property can be transferred as intended. However, if the property owner passed away without a valid will, the quitclaim deed with a will becomes complicated and may require legal advice.

A quitclaim deed can become void for several reasons. If the grantor did not have the legal authority to sell the property, or if the deed was signed under duress, the deed may not hold up in court. Furthermore, if the property is later found to have major legal issues that were undisclosed, this can also void the quitclaim deed with a will.

A quitclaim deed does not necessarily override a will, but it can change property ownership before probate occurs. If a quitclaim deed is executed and recorded, it may take precedence over the distribution outlined in a will. Therefore, it is crucial to be aware of how a quitclaim deed with a will interacts in your specific context. For clarity on your property transfer and inheritance issues, consult with US Legal Forms for tailored solutions.

Filing a quitclaim deed after someone dies is not possible, as the deceased person can no longer sign the deed. Instead, property ownership typically transfers according to the provisions in a will or state inheritance laws. It is important to follow the correct legal process, which usually involves probate court, to handle the estate properly. Platforms like US Legal Forms can help navigate these situations by providing necessary legal documentation.