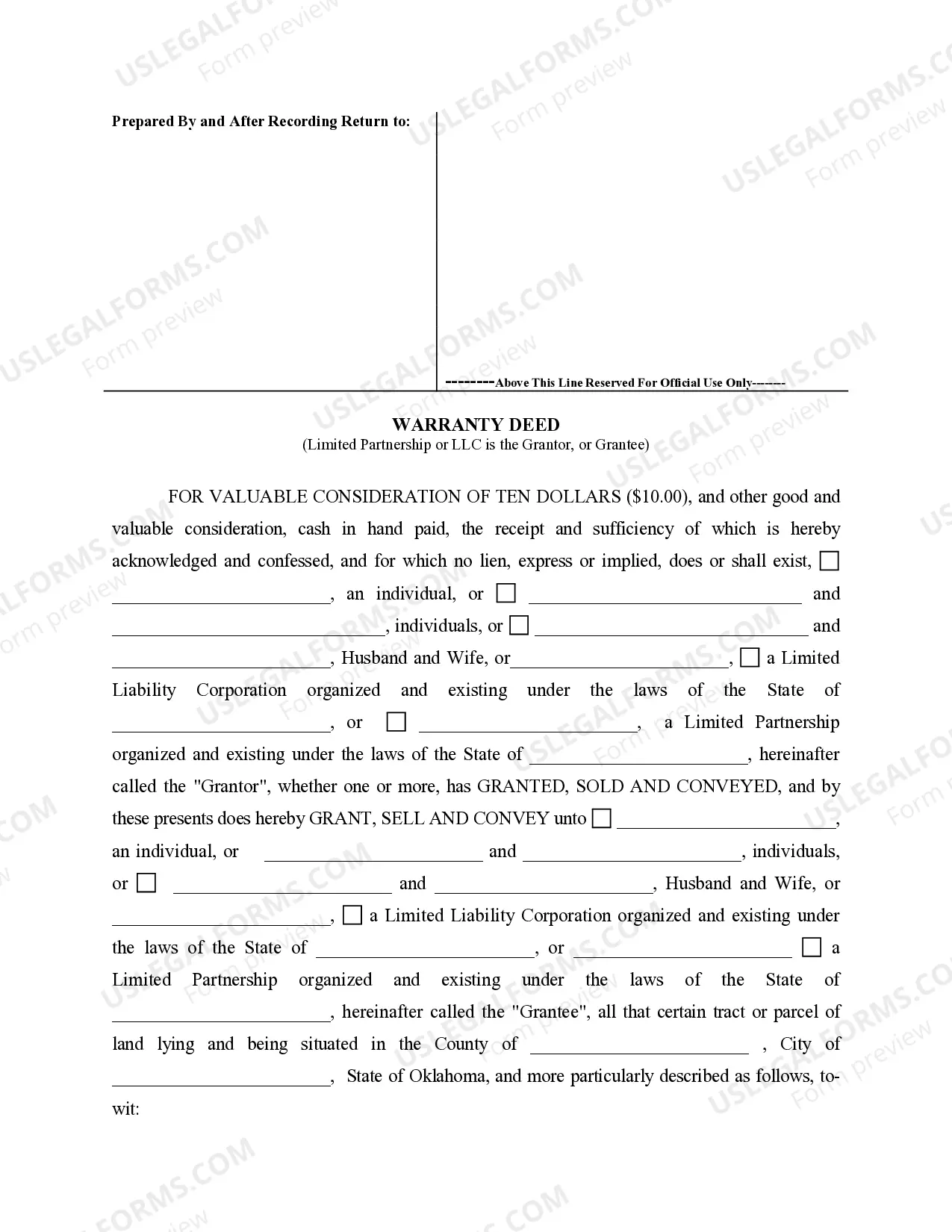

Limited Business

Description

How to fill out Oklahoma Warranty Deed From Limited Partnership Or LLC Is The Grantor, Or Grantee?

- If you're a returning user, log in to your account. Ensure your subscription is still active before proceeding.

- For first-time users, review the form descriptions in Preview mode to ensure you've selected the correct template that meets your requirements.

- Utilize the Search tab to locate a different form if your initial choice doesn't match your needs.

- Click on the Buy Now button for your selected document and choose your preferred subscription plan. Account registration is necessary for continued access.

- Complete the payment process using a credit card or PayPal to finalize your purchase.

- Download and save your form to your device. You can also find it later in the My Forms section of your profile.

Following these steps will allow you to efficiently obtain the legal forms you need for your limited business.

Don't hesitate! Start using US Legal Forms today to access these vital resources and ensure your legal documentation is accurate and compliant.

Form popularity

FAQ

For a limited business, there is technically no minimum income that avoids the requirement of reporting. The IRS requires that any earnings, regardless of amount, be reported on your tax return. Staying compliant helps in avoiding potential issues with tax authorities in the future. Familiarizing yourself with these regulations is essential for managing your business effectively.

As a limited business, if you earn $400 or more in net income, you typically need to file taxes. This threshold considers all your income sources and any deductions you can claim. Understanding your income level is crucial in complying with tax regulations. To stay informed and organized, it is advisable to maintain precise records of your earnings and expenses.

While you don’t need an LLC to operate a limited business, forming one can offer personal liability protection and potential tax benefits. An LLC can create a distinct separation between your personal and business finances, reducing risk and complexity. Additionally, establishing an LLC may enhance your credibility with customers and suppliers. Consider exploring resources like uslegalforms for assistance in setting up your LLC.

Yes, as a limited business owner, you must report all income, including that which is below $600. The IRS guidelines require transparency about your earnings, which aids in establishing an accurate financial history. Consistent reporting can also answer questions about your business's overall performance and help in future growth endeavors. Keeping detailed records helps ensure that you meet all legal requirements.

When operating a limited business as an LLC, you usually file your personal and business taxes separately. An LLC is often considered a pass-through entity, meaning profits are reported on your personal tax return. This separation can simplify your financial strategy while still ensuring compliance with tax laws. Utilizing platforms like uslegalforms can help you navigate the filing process smoothly.

As a limited business owner, the income amount that triggers tax obligations can differ based on various factors, including deductions and filing status. However, generally, if your net business income is $400 or more, you are required to file a tax return. Understanding your specific circumstances is vital, and consulting a tax professional can be beneficial in navigating these rules. Proper accounting can help you stay informed about potential tax liabilities.

Yes, even if your income is under $600, as a limited business, you are required to report it. The IRS establishes that all income should be reported, ensuring that you comply with tax obligations. Additionally, documenting every earnings stream can aid in keeping accurate records for future needs. It’s best to err on the side of caution when it comes to financial reporting.

In the context of a limited business, you generally need to report all earnings, including those below $500. The IRS mandates reporting all income to ensure compliance, regardless of the amount. Reporting helps maintain an accurate financial picture, which is beneficial for future planning. You may also want to consider your state regulations, as they can vary.

A limited partnership can offer distinct advantages over an LLC, particularly in how liability and profit-sharing are structured. In a limited partnership, general partners have full control while limited partners can invest without personal liability for business debts. This arrangement may suit certain investment strategies better than an LLC. Understanding these differences can help you make an informed decision about how to structure your limited business.

Yes, but you must ensure it aligns with the business structure you're establishing. In the US, if you create an LLC, you are required to use 'LLC' in your company name for clarity and legal recognition. Using 'limited' instead can lead to potential confusion or legal issues. Hence, defining your limited business structure correctly from the start is crucial.