Revocation Living Trust Form For A Child

Description

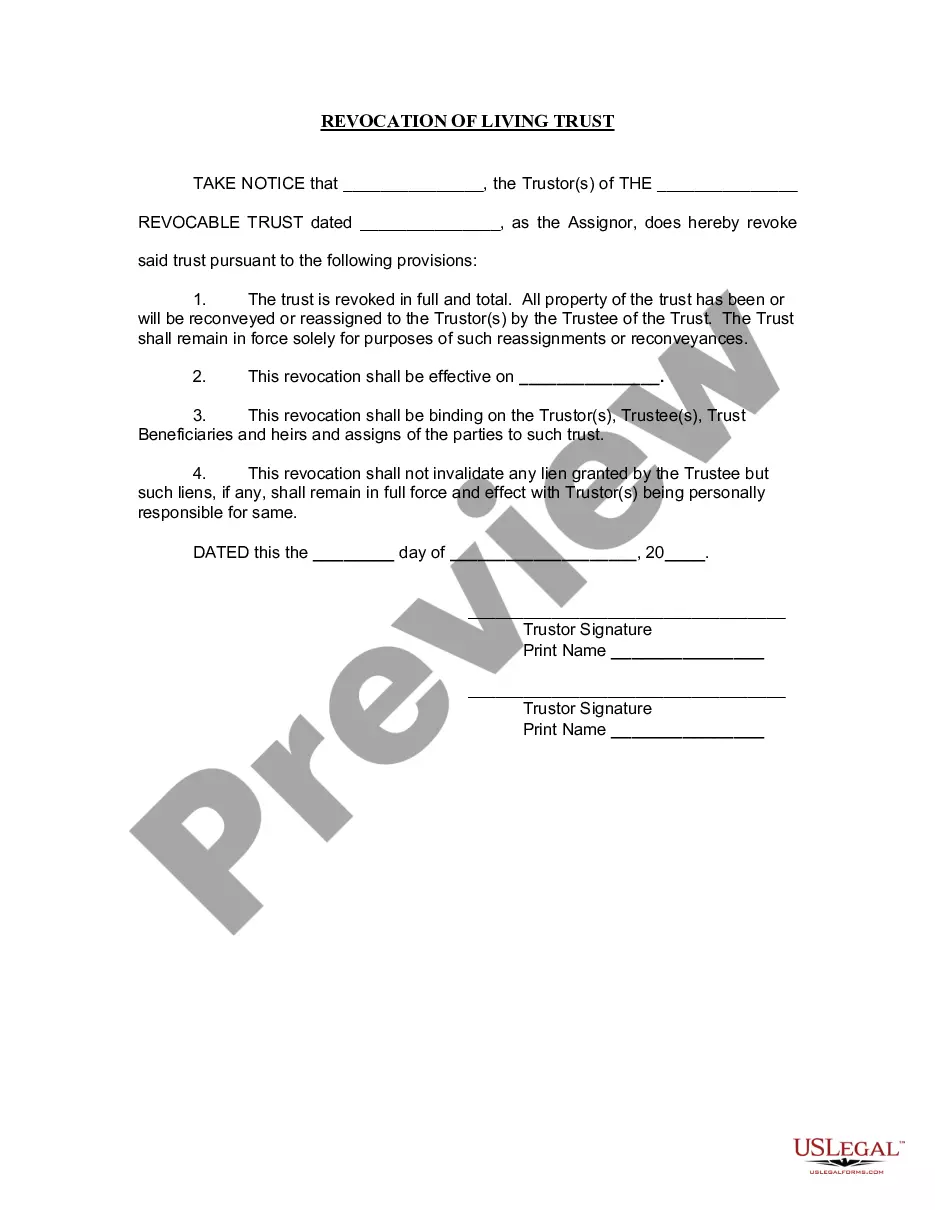

How to fill out Oklahoma Revocation Of Living Trust?

- If you're already a registered user, start by logging in to your account and retrieving the desired form template.

- Verify that your subscription is active. If it's not, follow the prompts to renew your plan before proceeding.

- For first-time users, browse the available options. Use the Preview mode to read the form description and ensure it meets your requirements and complies with your local laws.

- If necessary, search for other document templates using the Search tab to find the exact form you need.

- To purchase the document, click on the Buy Now button and select the subscription plan that fits you best. Create an account to gain access to additional resources.

- Finalize your purchase by entering your payment information, either via credit card or PayPal.

- After your purchase is complete, download the form to your device for completion and easy access in the My Forms section of your profile.

US Legal Forms empowers individuals and attorneys alike to swiftly execute legal documents with its vast and user-friendly library.

Enjoy the benefits of more than 85,000 fillable and editable legal forms. Start creating your revocation living trust form today and ensure your child's future is secure!

Form popularity

FAQ

A form to dissolve a revocable trust is a legal document that formally terminates the trust agreement. This form outlines your intent to revoke the trust and typically requires your signature along with witness or notary verification. Using a revocation living trust form for a child simplifies this procedure, ensuring that all necessary details are included and compliant with legal standards. By preparing this form correctly, you can efficiently close your trust and redirect your assets as you see fit.

Yes, a revocable living trust allows you to revoke or dissolve the trust at any time during your lifetime. This flexibility is one of the key advantages of setting up a revocable trust. By using a revocation living trust form for a child, you can easily document this process when making changes to your estate plan. Remember, this means you can retain control over your assets until you decide otherwise.

Yes, you can amend a revocable trust without an attorney. This process typically involves creating a new document that outlines the changes you wish to make. A well-drafted revocation living trust form for a child can help guide you through this process effectively. However, while it's possible to amend your trust independently, consulting a professional can ensure your amendments comply with the law.

In California, the revocation of a trust generally does not require notarization, especially when using a revocation living trust form for a child. However, having the document notarized provides an extra layer of authenticity and can prevent future disputes. It's important to ensure that the form is executed properly to avoid complications. For added support, consider using uslegalforms to access reliable templates that simplify the process.

Yes, you can amend a revocable living trust anytime while you are alive and capable. Amendments allow you to change terms, add or remove beneficiaries, or update asset distribution. Utilizing a revocation living trust form for a child can facilitate these changes and ensures that your trust reflects your current intentions. Always document any amendments properly to maintain clarity and legal standing.

A trust revocation declaration typically includes a statement indicating that you revoke your existing trust and replace it with a new arrangement. The document should include your name, the original trust date, and a clear statement of revocation. You can use a revocation living trust form for a child as a template to ensure that all necessary information is included. This not only clarifies your intent but also helps in streamlining the process.

You should update a revocable trust whenever significant life events occur, such as marriage, divorce, or the birth of a child. Regular reviews, ideally every three to five years, can help ensure that your trust remains aligned with your current wishes. Using a revocation living trust form for a child can help you adjust your beneficiaries as your family changes. Always consider consulting a legal professional when making significant updates.

To revoke a revocable living trust, you need to create a revocation living trust form for a child that explicitly states your intent to dissolve the trust. First, review the trust documents to understand the terms. Then, sign and date the revocation form, preferably in the presence of a notary. Lastly, notify any beneficiaries about the revocation to avoid confusion.

One of the most significant mistakes parents make when setting up a trust fund is failing to update it as circumstances change. This includes changes in guardianship, beneficiaries, or financial situations. It’s crucial to regularly review and amend your plans as needed. Using a revocation living trust form for a child ensures your intentions stay aligned with your current family dynamics and needs.

A revocable trust typically becomes irrevocable upon the death of the trust creator or if the creator becomes legally incompetent. Once it transitions to an irrevocable trust, no changes can be made without compliant procedures. Understanding this shift is crucial, especially for parents planning their estate. A well-drafted revocation living trust form for a child can help you manage this transition effectively.