Oklahoma Close Withholding Account

Description

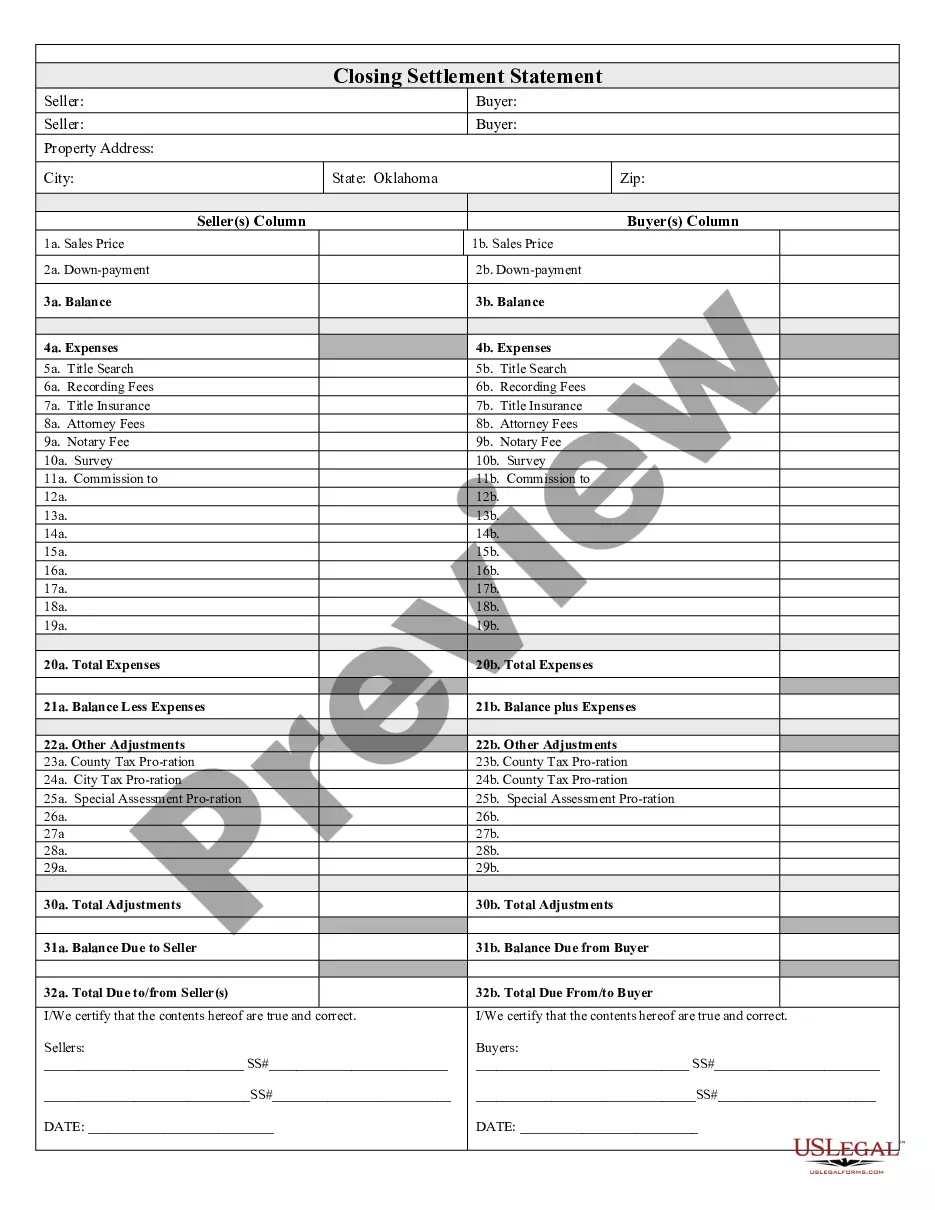

How to fill out Oklahoma Closing Statement?

Drafting legal documents from scratch can sometimes be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for an easier and more affordable way of creating Oklahoma Close Withholding Account or any other documents without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our virtual library of over 85,000 up-to-date legal forms addresses virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-compliant templates diligently put together for you by our legal professionals.

Use our website whenever you need a trustworthy and reliable services through which you can easily locate and download the Oklahoma Close Withholding Account. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the form and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No problem. It takes minutes to register it and explore the library. But before jumping directly to downloading Oklahoma Close Withholding Account, follow these recommendations:

- Review the document preview and descriptions to ensure that you have found the document you are looking for.

- Check if form you choose conforms with the requirements of your state and county.

- Choose the right subscription option to get the Oklahoma Close Withholding Account.

- Download the form. Then complete, certify, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us today and turn document execution into something easy and streamlined!

Form popularity

FAQ

Oklahoma employer's withholding tax accounts can be established online at tax.ok.gov. After registration with the Oklahoma Tax Commission (OTC) employers will be assigned an account number for each registered account. Account numbers must be used by the employer for all returns and correspondence with the OTC.

In order to close your sales tax permit in Oklahoma, you will need to mark the date of request cancellation on your final sales tax return via Oklahoma's Taxpayer Access Point (TAP).

Oklahoma Withholding Tax Account ID If you already have a Withholding Tax Account ID, you can find this number on correspondence from the Oklahoma Tax Commission. For additional assistance, please contact the agency at 405-521-3160.

Remittances: Every employer required to deduct and withhold Oklahoma income tax from an employee's wages must remit the tax withheld each calendar quarter on or before the 20th day of the month following the close of the quarter, except where the amount withheld is more than $500.00 per quarter.

Register online to receive a Withholding Account Number within 5 business days. Find an existing Withholding Account Number: online at the OTC's OK Taxpayer Access Portal (OKTAP). by contacting the OTC.