Name Change Form For Irs

Description

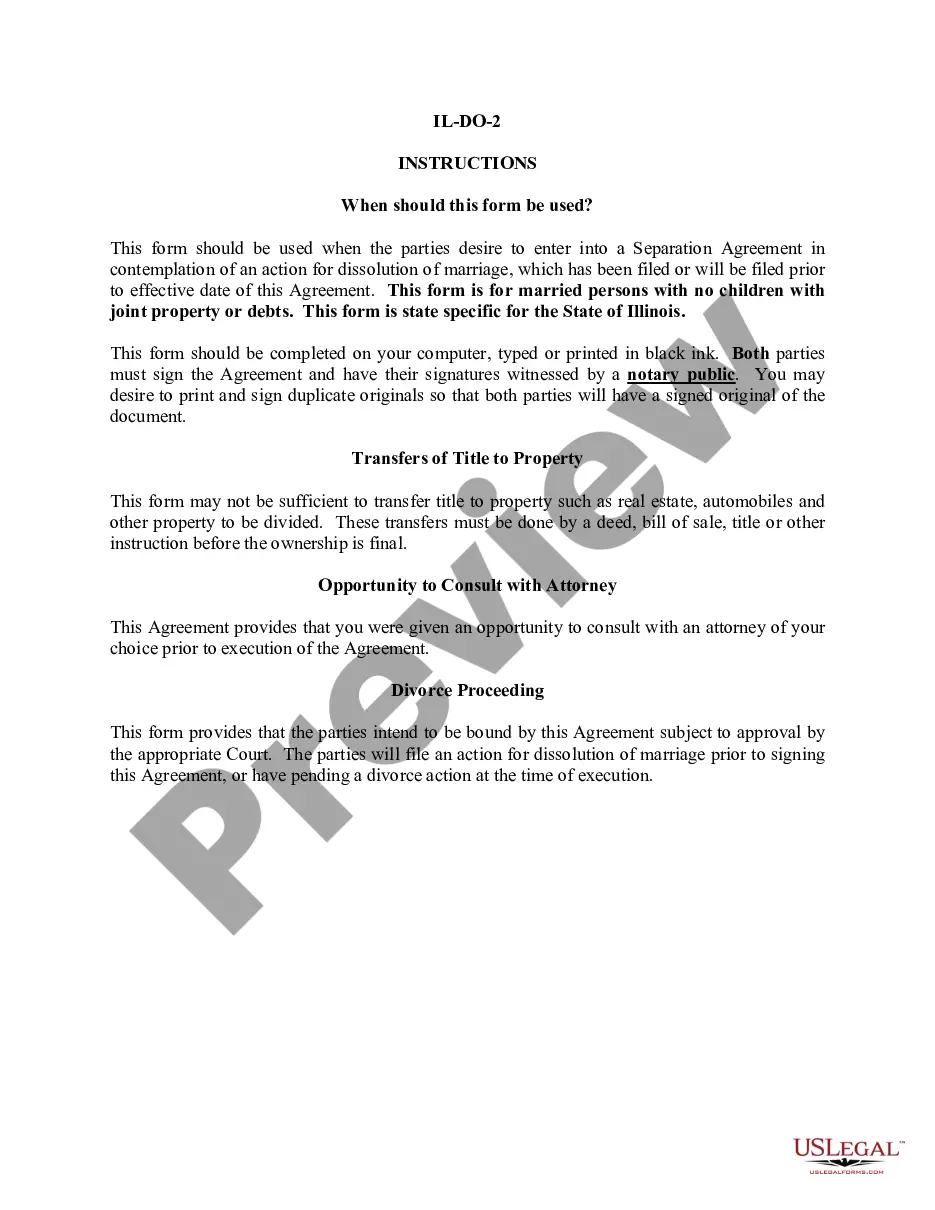

How to fill out Oklahoma Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

- If you're a returning user, log in to your account, ensure your subscription is active, and click on the Download button to get your form.

- For first-time users, start by reviewing the form description in Preview mode to ensure it meets your needs and complies with local jurisdiction requirements.

- If adjustments are needed, utilize the Search tab to find the correct template that fits your situation.

- Once you've found the right document, click the Buy Now button and select your desired subscription plan, then create your account to access the resources.

- Complete your purchase by entering your credit card information or using your PayPal account.

- Lastly, download the completed form to your device and access it whenever you need through the My Forms section.

With US Legal Forms, you benefit from a vast library of over 85,000 customizable legal documents, making it easier to find the exact form you need. Having access to premium experts also aids in ensuring your documents are accurate and legally compliant.

Take control of your legal needs today! Visit US Legal Forms to get started on your name change form for IRS.

Form popularity

FAQ

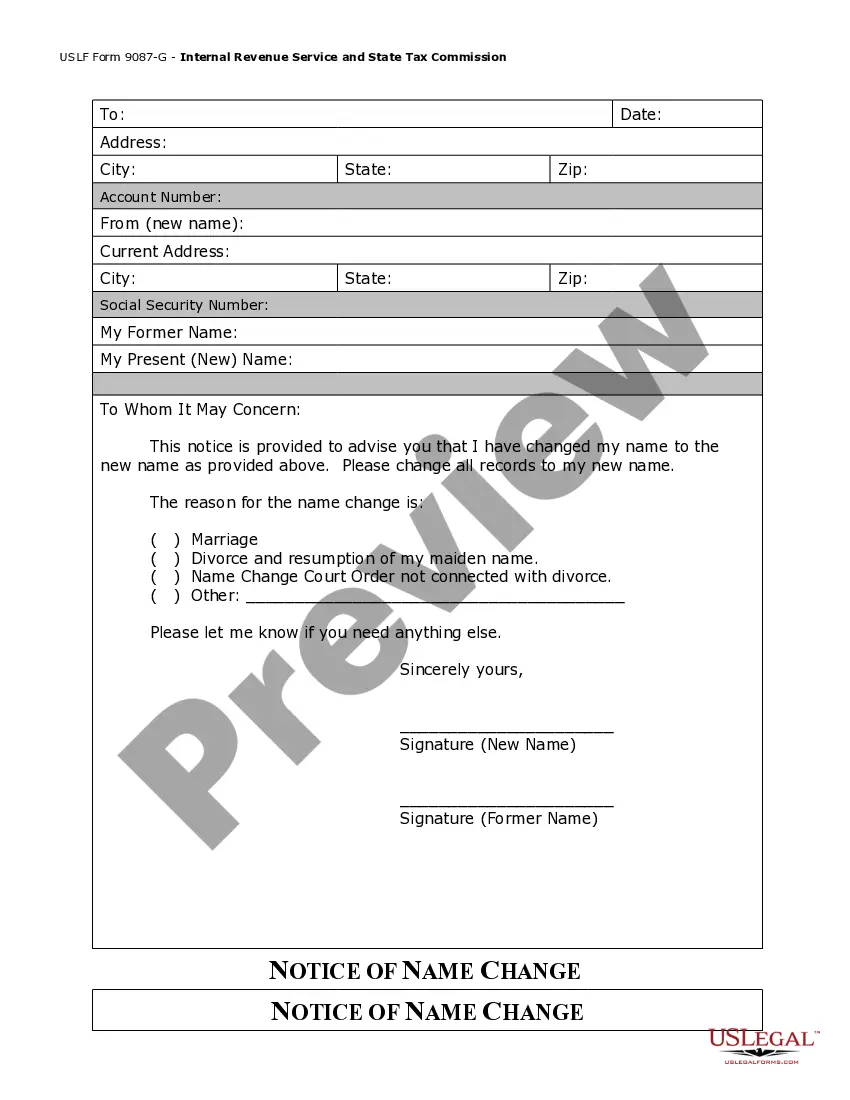

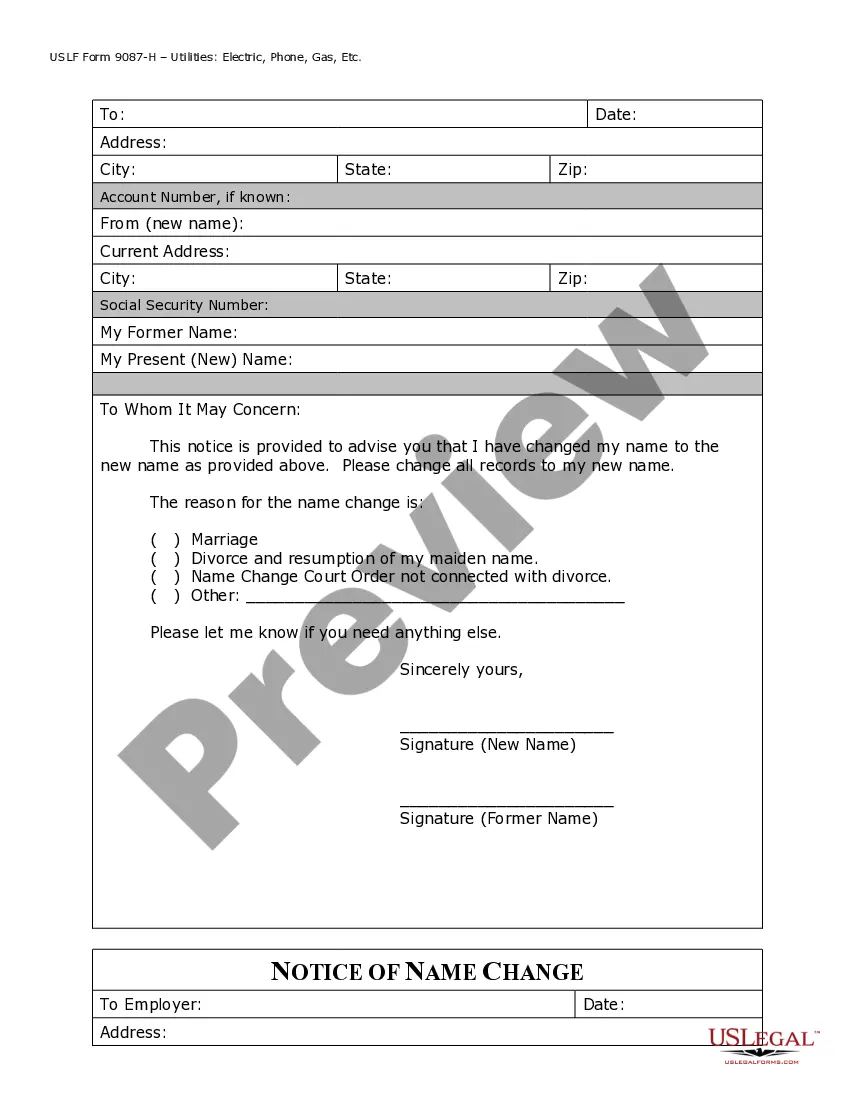

Form 8822-B is used to notify the IRS of changes in the address of businesses, estates, or trusts. This ensures that all tax-related correspondence is sent to the correct location. While it primarily focuses on address changes, it is also a good opportunity to address any name changes by supplementing your filing with the name change form for IRS. Utilize platforms like US Legal Forms to access easy and compliant solutions for these needs.

Form 8822-B must be filed by businesses and entities that experience a change in ownership or a change of address. If you operate a partnership, corporation, or trust, this form is essential for your IRS records. Remember, if your business undergoes a name change, it's advisable to also utilize the name change form for IRS to update your records correctly. US Legal Forms can provide the tools you need for smooth compliance with these requirements.

IRS Form 8822 is necessary if you wish to officially communicate your name or address changes to the IRS. Filing this form is crucial to ensure that all your future correspondence from the IRS reaches you correctly. Specifically, if your business name changes, then using the name change form for IRS is vital to maintain compliance. You can find useful assistance with this form through US Legal Forms.

To change your trust address, you would use Form 8822-B, which is the designated form for notifying the IRS about address changes for businesses and trusts. While it addresses the change of address, it does not serve solely as a name change form for IRS. It is essential to provide accurate information to avoid issues with tax notifications. Consider using US Legal Forms for accessing simplified and user-friendly templates.

You can notify the IRS of a name change by filing the Name change form for IRS, which is typically Form 8822. This form allows you to communicate your new business or personal name directly to the IRS. Be sure to provide supporting documents if applicable, to expedite the update. US Legal Forms offers ready-to-use templates to facilitate this process.

To notify the IRS of a business change of ownership, you must complete a specific IRS form that corresponds with your situation. You often need to use the Name change form for IRS when changing the name under which the business operates. Additionally, it's advisable to inform the IRS in writing about the change, including any applicable documentation, to ensure smooth processing. Using solutions like US Legal Forms can help simplify this process.

Changing your name with the IRS typically takes four to six weeks once you file the appropriate name change form for the IRS. However, delays can happen, especially during peak tax seasons. To avoid any potential issues, submit your form as soon as your name change is official. Utilizing platforms like USLegalForms can streamline this process, ensuring you have the right forms and instructions, so you can manage your tax documents confidently.

The processing time for an IRS name change can vary, but it generally takes about four to six weeks after you submit the name change form for the IRS. Factors such as the volume of requests the IRS is handling at the time can affect this timeline. You can check the status of your request, but it’s best to give it some time before following up. This ensures your details are accurately updated in their system.

To change your name with the IRS, you typically need to complete Form 8822, which is a Change of Address form. This form can be used not only for updating your address but also for notifying the IRS about your name change. Be sure to include your old name, new name, and any other relevant information. Ensure you file this form as soon as possible to keep your records accurate.

To notify the Department of Revenue about your name change, you will need to submit your updated name information along with any required forms. In most cases, the name change form for the IRS can also be used to update your information with the state. Make sure to attach any supporting documents that prove your name change, such as a marriage certificate or court order. Always check your state’s specific requirements to ensure you provide everything necessary.