Deed Trust Property With Moat

Description

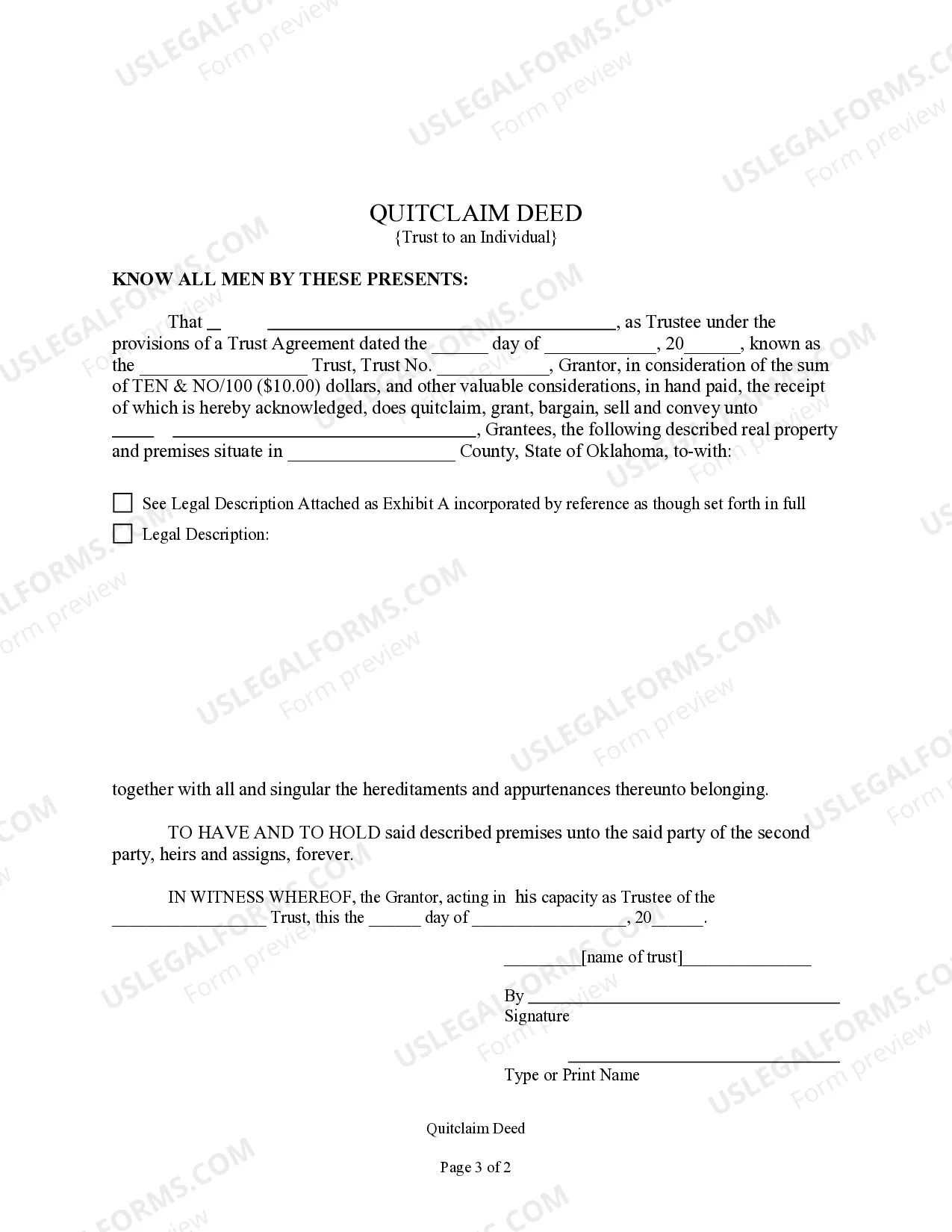

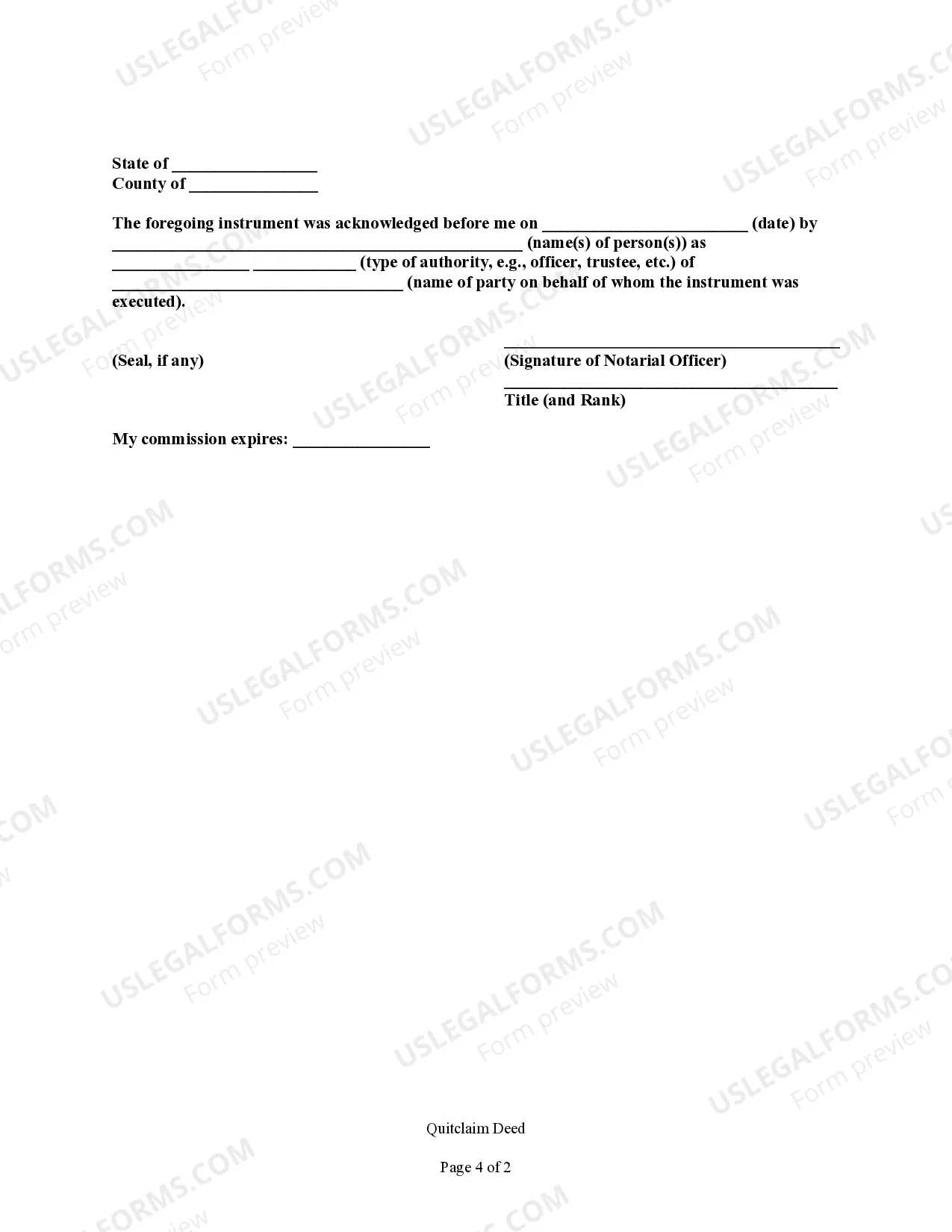

How to fill out Oklahoma Quitclaim Deed - Trust To An Individual?

Well-structured official paperwork is one of the essential safeguards for preventing issues and legal disputes, but acquiring it without an attorney's help may require time.

Whether you need to swiftly locate an up-to-date Deed Trust Property With Moat or any other templates for employment, family, or business scenarios, US Legal Forms is always here to assist.

The procedure is even simpler for current users of the US Legal Forms library. If your subscription is active, you merely need to Log In to your account and click the Download button next to the selected file. Additionally, you can access the Deed Trust Property With Moat at any time later, as all documents ever acquired on the platform remain available under the My documents tab of your profile. Save time and funds on preparing official paperwork. Experience US Legal Forms today!

- Verify that the form aligns with your case and region by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the page header.

- Click Buy Now when you identify the appropriate template.

- Choose the pricing plan, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your Deed Trust Property With Moat.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

One disadvantage of a trust deed is that it can sometimes lead to a lengthy foreclosure process if the borrower defaults. Additionally, if the terms are unclear or not understood, it might create misunderstandings between parties. In the realm of deed trust property with moat, it is vital to address these potential disadvantages through thorough planning and consultation with legal experts to ensure that all parties are well-informed.

The purpose of a trust deed is to formally record the transfer of property rights from the borrower to a trustee. This instrument acts to protect the lender's investment in the property while ensuring the borrower maintains control as long as they meet their obligations. A deed trust property with moat provides a structured framework within which all parties can operate, minimizing potential disputes.

The primary objectives of a trust deed include safeguarding the lender’s interest while providing the borrower access to funds. It outlines the rights and responsibilities of all parties involved in a transaction. In a deed trust property with moat, having clear objectives ensures a smoother operation and enhances overall trust and cooperation.

The trust deed is typically created by the property owner, also known as the grantor. This individual establishes the trust and outlines its terms, including who will hold the property on behalf of the beneficiaries. When engaging in a deed trust property with moat, it's essential to have accurate documentation to ensure all parties understand their rights and duties. Consulting legal professionals can provide clarity and guidance in this process.