Transfer On Death

Description

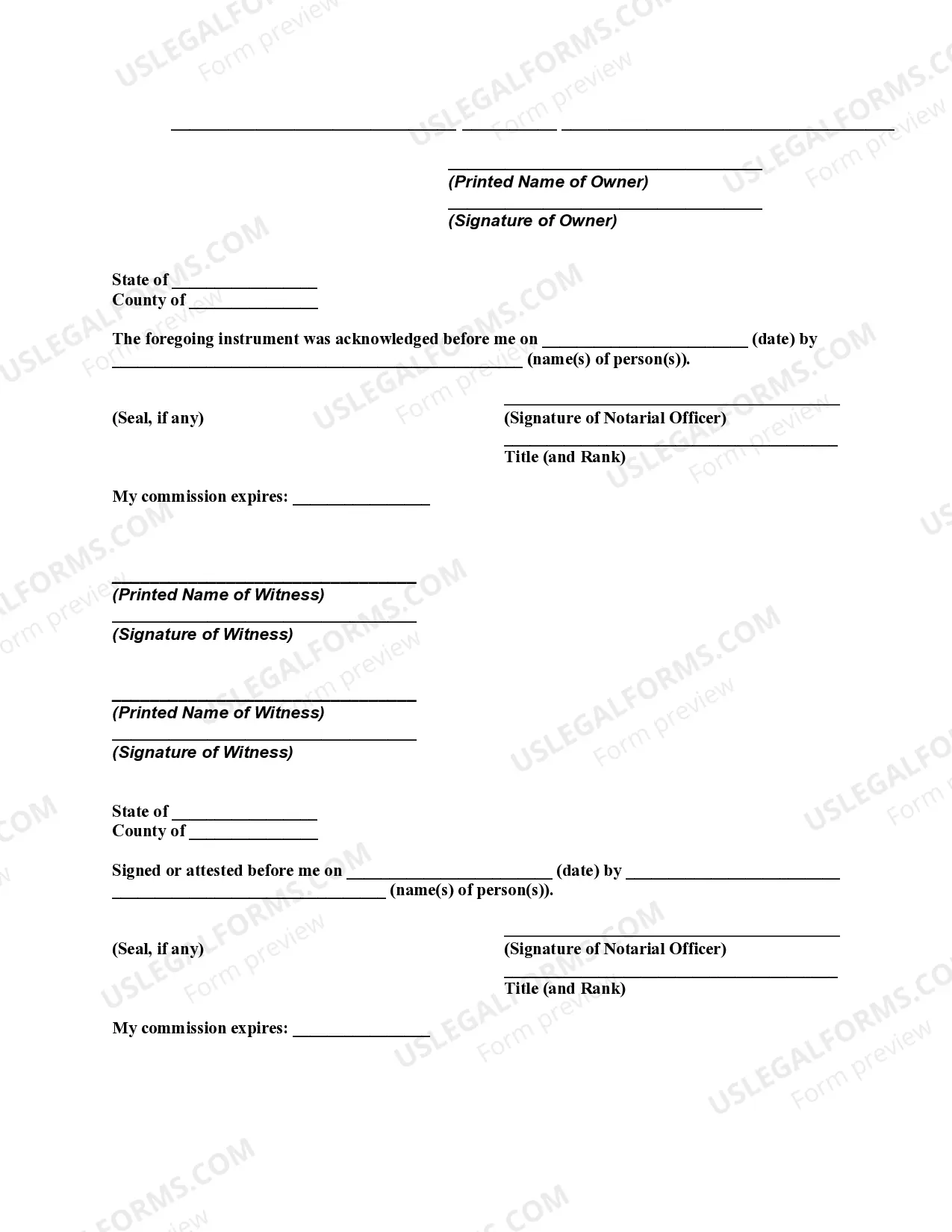

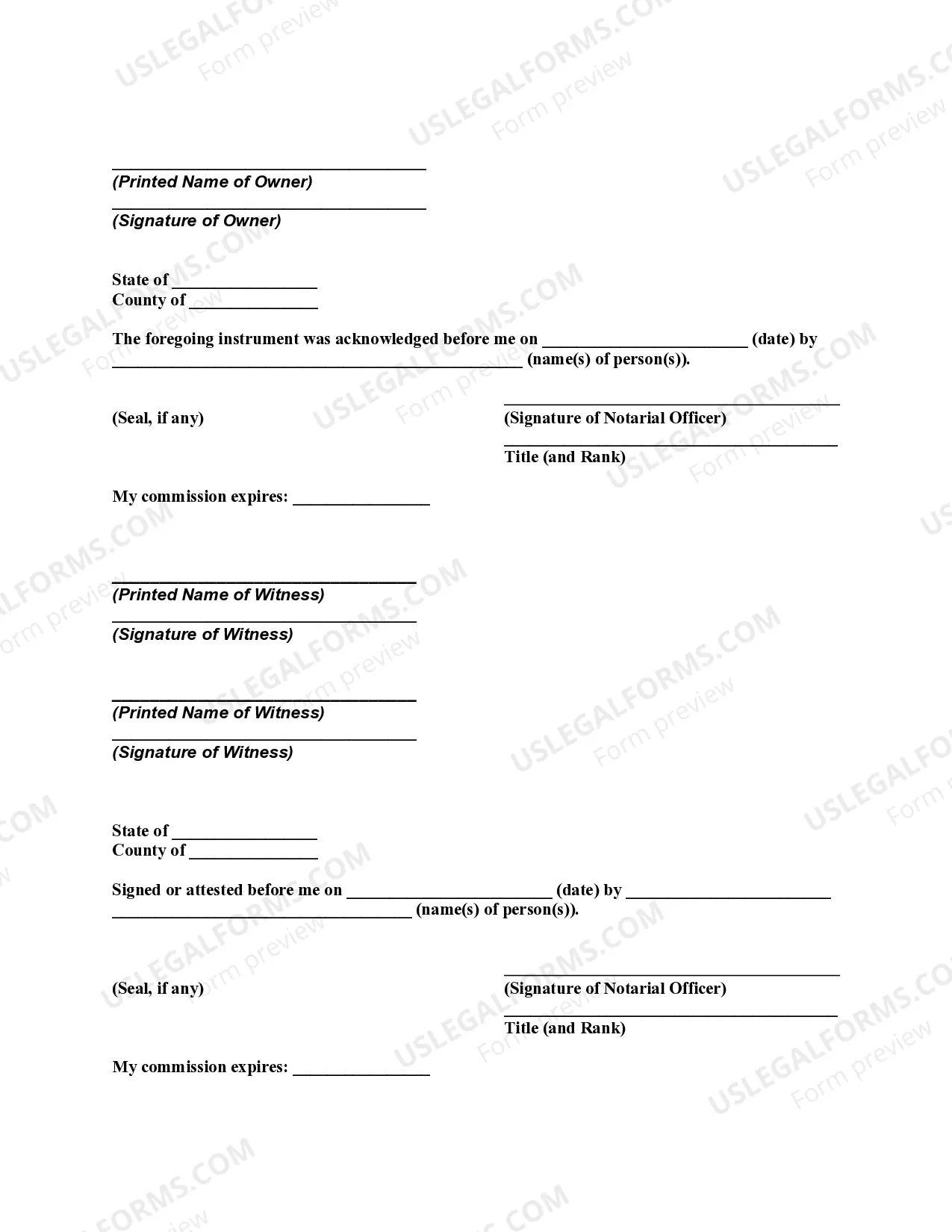

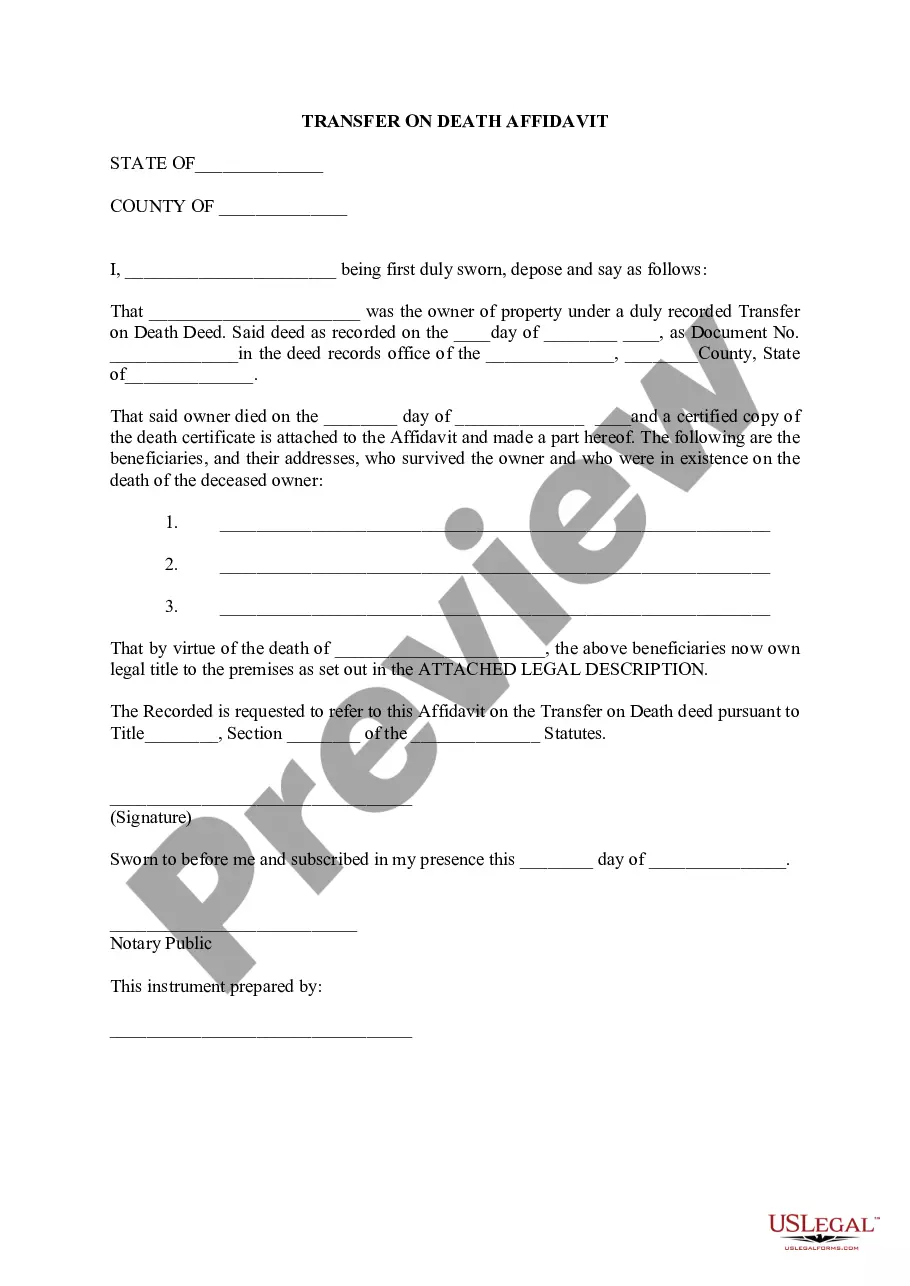

How to fill out Oklahoma Transfer On Death Deed?

- Start by logging in to your US Legal Forms account. If you're a first-time user, create a profile to enjoy full access.

- Explore the extensive library and find the 'Transfer on Death' form that fits your requirements. Use the preview mode for a detailed look.

- If the initial form doesn't match your needs, utilize the search feature to locate alternative templates that comply with your jurisdiction.

- Once you find the suitable form, select the 'Buy Now' option and choose a subscription plan that works for you.

- Complete your purchase by providing your payment details. You may use a credit card or PayPal for convenience.

- Download the document. The form will be saved to your device, and you can access it anytime from the 'My Forms' section in your profile.

With US Legal Forms, you gain access to a robust collection of over 85,000 legal forms, ensuring that you have all the resources you need at your fingertips. Whether you're a newcomer or an experienced user, their platform offers unmatched convenience and efficiency.

Ready to manage your estate effectively? Start your journey with US Legal Forms today and ensure your legal documents are prepared accurately. Your first step towards a smooth transfer process awaits!

Form popularity

FAQ

A transfer on death deed does not inherently avoid inheritance tax. The tax implications can vary significantly based on state and federal laws, and property passed through a TOD deed may still be subject to taxation. It's important to consult with a tax professional to understand the implications of transfer on death arrangements fully. Understanding these nuances can help in effective estate planning.

You may not necessarily need an attorney to create a transfer on death deed, but having legal guidance can be beneficial. An attorney can ensure that the deed complies with state laws and all necessary requirements are met. This can help prevent future legal issues related to the transfer on death process. For those unfamiliar with legal documents, using a reliable service like US Legal Forms can simplify the task.

While a transfer on death deed offers great benefits, it can have some disadvantages. It does not offer asset protection, meaning creditors can still pursue assets included in the deed. Additionally, if not properly executed, the deed may face disputes or challenges in probate court. Lastly, if the beneficiary cannot be located or is unable to accept the property, this can lead to complications.

While a Transfer on Death designation offers a quick and efficient way to transfer assets, it does not replace a will. A will allows you to dictate the distribution of all your assets, including those not covered by a TOD designation. Moreover, a will can address guardianship for minors and other important considerations. Therefore, combining both instruments may provide a more comprehensive plan for your estate.

You do not legally need a lawyer to set up a Transfer on Death designation, but having one can prove beneficial. A lawyer can help you navigate any complexities in your estate, ensuring the process is seamless. They can also assist in drafting other essential documents and provide peace of mind that your intentions will be honored. It's always a good idea to explore all available resources when making these arrangements.

The primary disadvantage of a Transfer on Death (TOD) is that it bypasses the probate process, which may limit legal recourse for potential disputes among beneficiaries. Also, TOD does not protect assets from creditors after death; they may still have claims against the estate. It's essential to weigh these factors and consider how a TOD fits into your overall estate plan. Consulting with experts can help mitigate these risks.

While you do not need a lawyer to create a Transfer on Death designation, consulting with an attorney can provide valuable guidance. An attorney can help ensure all forms are correctly filled out and filed according to your state’s regulations. Additionally, legal advice can clarify any complex situations related to assets or beneficiaries. For a straightforward process, consider seeking assistance from professionals.

To transfer assets in case of death using a Transfer on Death designation, beneficiaries need to provide the required legal documents to the financial institution or relevant authority. This typically includes a death certificate and proof of identity. The process is generally simpler compared to probate, ensuring a smoother transfer of assets. Using Transfer on Death can help ensure your wishes are honored efficiently.

Although a Transfer on Death (TOD) has many benefits, there are downsides to consider. One disadvantage is that the transfer occurs automatically, which means you cannot control the distribution after your death. Additionally, if you have liabilities, creditors may claim these assets, potentially leaving less for your beneficiaries. Therefore, it's important to assess your financial situation and discuss your options.

Yes, Transfer on Death accounts generally avoid the probate process, allowing assets to pass directly to beneficiaries upon the account holder's death. This feature can save time and reduce expenses associated with probate court. However, beneficiaries must provide the required documentation to access the assets. Utilizing Transfer on Death accounts can streamline asset transfer after death.