Transfer Deed When Someone Dies

Description

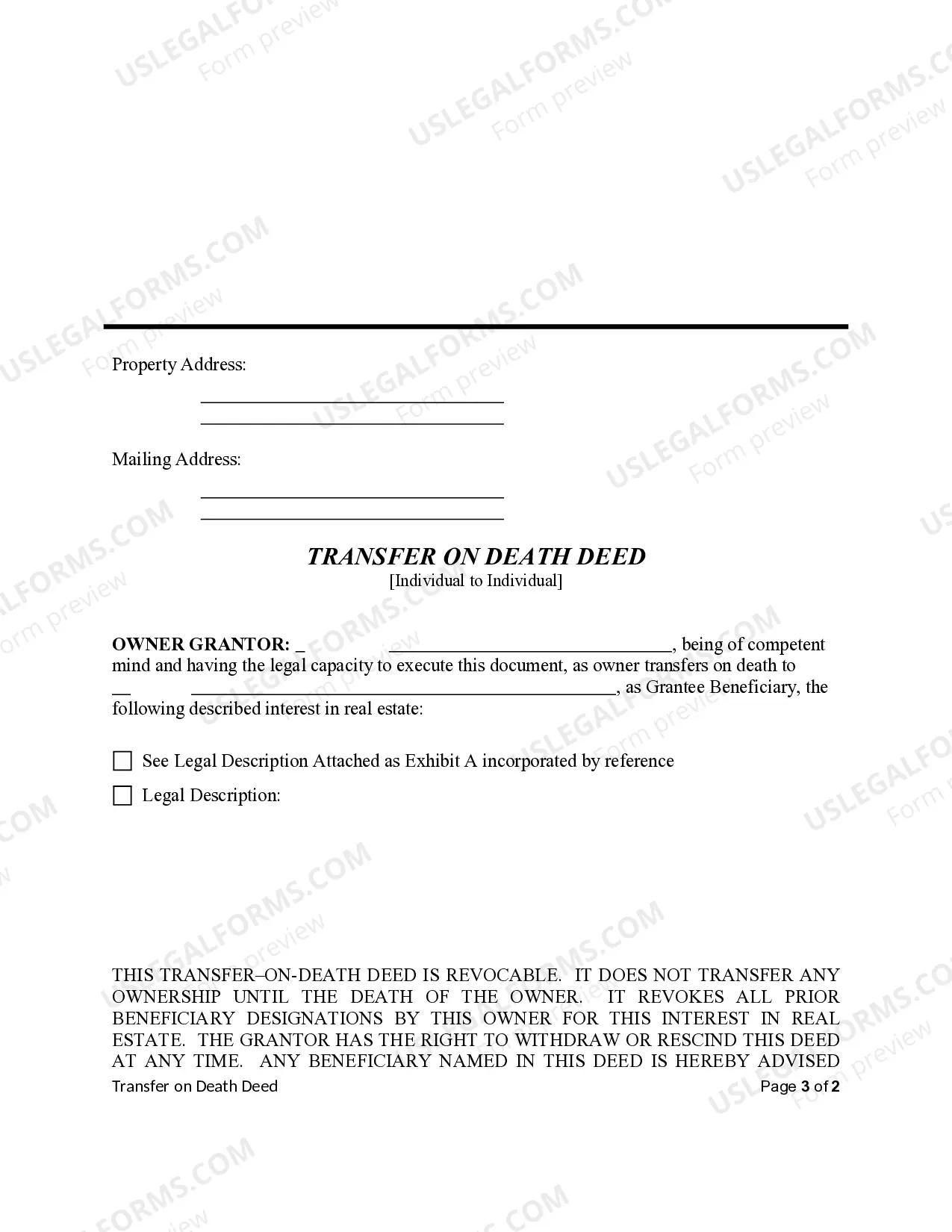

How to fill out Oklahoma Transfer On Death Deed From Individual To Individual?

Creating legal documents from the ground up can frequently be somewhat daunting.

Certain situations might necessitate hours of inquiry and substantial amounts of money spent.

If you’re looking for a more straightforward and economical method of generating a Transfer Deed When Someone Passes Away or other documents without having to go through complex processes, US Legal Forms is always available to you.

Our online repository of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal concerns.

However, before directly downloading the Transfer Deed When Someone Passes Away, consider these recommendations: Review the form preview and descriptions to confirm you are on the correct form you need. Ensure the template you select adheres to the stipulations of your state and county. Pick the appropriate subscription plan to acquire the Transfer Deed When Someone Passes Away. Download the file, then complete, verify, and print it out. US Legal Forms boasts a solid reputation and over 25 years of experience. Join us now and simplify and streamline the form execution process!

- With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously crafted for you by our legal experts.

- Utilize our platform whenever you require a dependable and trustworthy service through which you can conveniently find and download the Transfer Deed When Someone Passes Away.

- If you’re familiar with our website and have previously created an account with us, simply Log In to your account, locate the template and download it or re-download it anytime later in the My documents section.

- Not registered yet? No problem. It only takes a few minutes to set it up and browse the catalog.

Form popularity

FAQ

Yes, New Jersey allows for transfers on death deeds, making it possible to transfer property directly to beneficiaries upon death. This option simplifies the inheritance process and helps avoid probate. To utilize this feature, ensure you follow the state's specific requirements for creating and recording the deed. You can find helpful resources and forms through US Legal Forms to assist you in executing a transfer deed when someone dies in New Jersey.

The best way to transfer property after death often involves using a transfer on death deed, which allows the property to pass directly to the beneficiaries without going through probate. This method can save time and reduce legal complications. It is also essential to ensure all documentation is in order and filed correctly. Platforms like US Legal Forms provide the necessary forms and instructions to help you efficiently transfer the deed when someone dies.

To obtain the deed to your deceased parents' house, you should first locate the original deed, which may be recorded with your county's recorder office. Next, gather the death certificates and any relevant estate documents. After that, you can complete the necessary transfer forms to ensure the deed reflects your ownership. Working with US Legal Forms can simplify this process, offering templates to help you manage the transfer deed when someone dies.

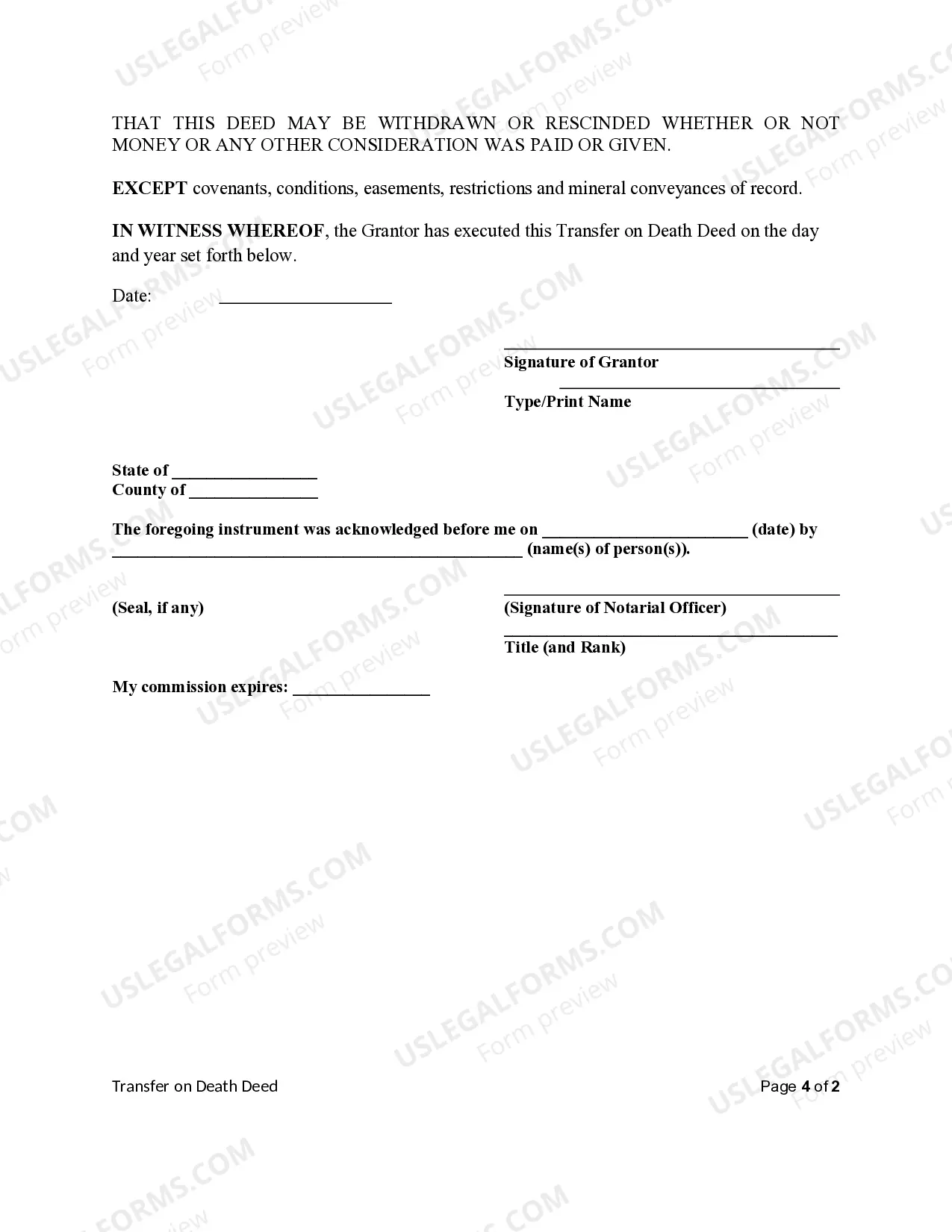

To get a deed transferred after death, you typically need to start by gathering the necessary documents, such as the death certificate and the will if one exists. You may need to file these documents with your local authorities or record office. Utilizing the services of a platform like US Legal Forms can streamline this process, providing you with the right forms and guidance necessary to effectively transfer the deed when someone dies.

If you don't transfer a deed when someone dies, the property may become part of the deceased's estate. This can lead to complications, such as delays in selling or inheriting the property. Additionally, the heirs may face legal challenges if the ownership is not properly established. It is important to address the transfer deed when someone dies to avoid these potential issues.

To transfer ownership of a house after death, you need to gather important documents like the death certificate and the will. Depending on the situation, you may file a transfer-on-death deed or engage in probate proceedings. This transfer solidifies the new ownership and protects the rights of the heirs. US Legal Forms can guide you in preparing the necessary documentation for a successful transfer.

North Carolina does allow transfer-on-death deeds, enabling property owners to name beneficiaries who will receive their property after their passing. This method facilitates a smooth transfer without requiring probate. To ensure your deed meets all legal requirements, consider using US Legal Forms, which provides tailored solutions for North Carolina residents.

Yes, Alabama recognizes transfer-on-death deeds. This type of deed allows property owners to designate a beneficiary who will automatically inherit the property upon their death. It simplifies the transfer process and helps avoid probate. For those in Alabama, US Legal Forms offers resources to create a transfer-on-death deed that complies with state laws.

Yes, house deeds generally need to be changed when someone dies to reflect the new ownership. If the property was solely in the deceased's name, you must update the deed to transfer it to the heirs or beneficiaries. This update is crucial to ensure legal ownership is recognized. Consider using US Legal Forms to access the necessary legal documents for this transfer.

Transferring a deed of a house after death involves obtaining a copy of the death certificate and the will, if available. You must then complete the necessary forms, such as a transfer-on-death deed or a quitclaim deed, and file them with your local county recorder's office. This process ensures the property is officially transferred to the rightful heirs. US Legal Forms provides templates to help streamline this process.