Transfer Death Estate For The Future

Description

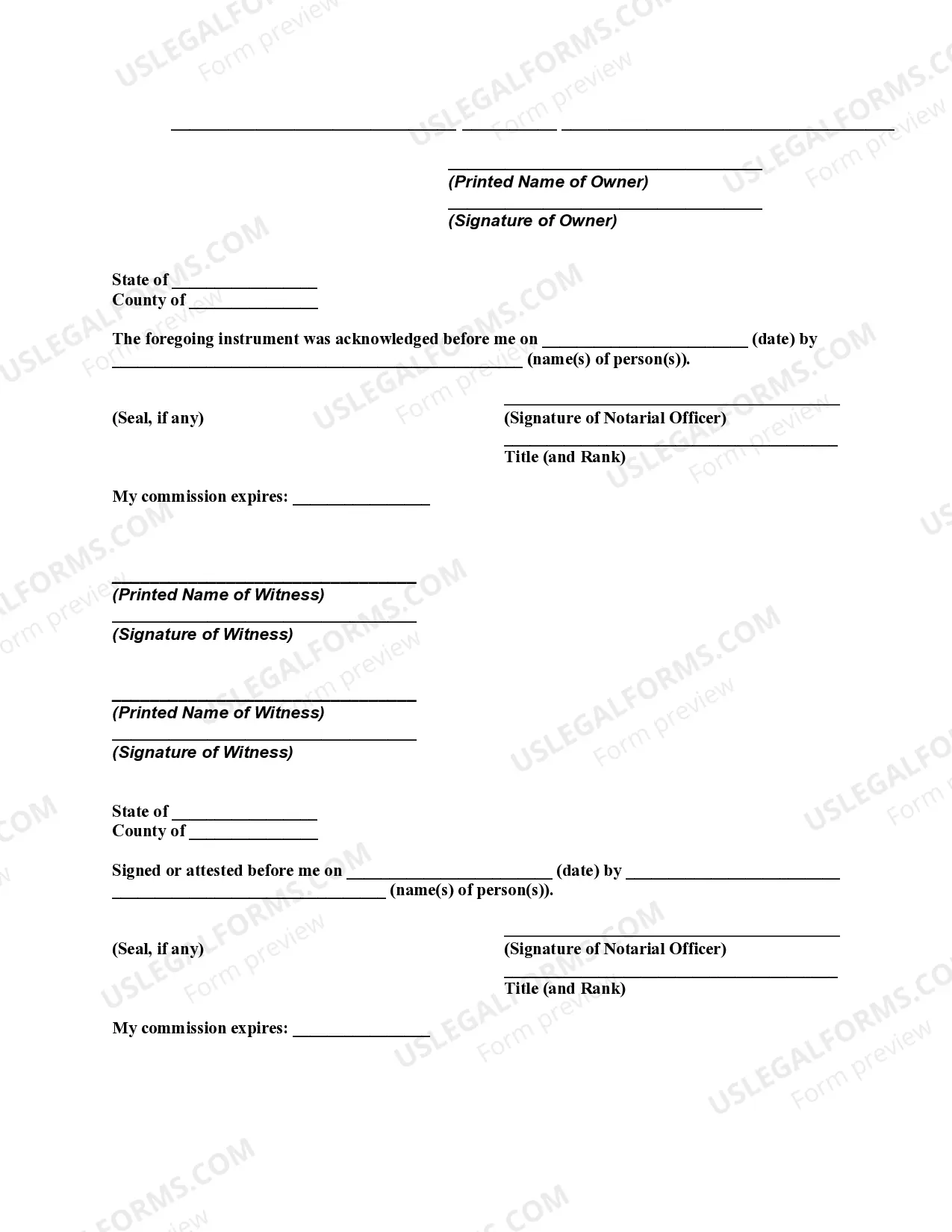

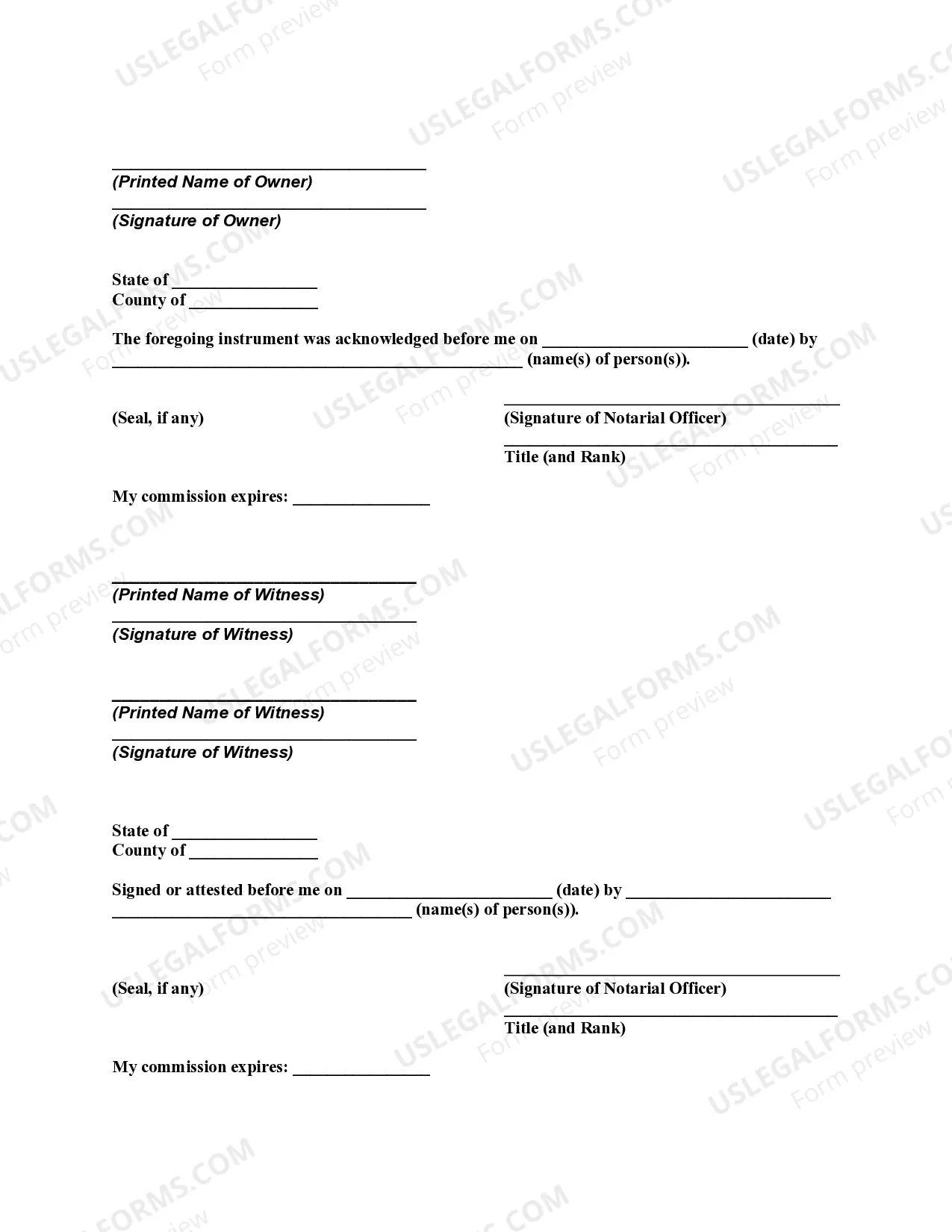

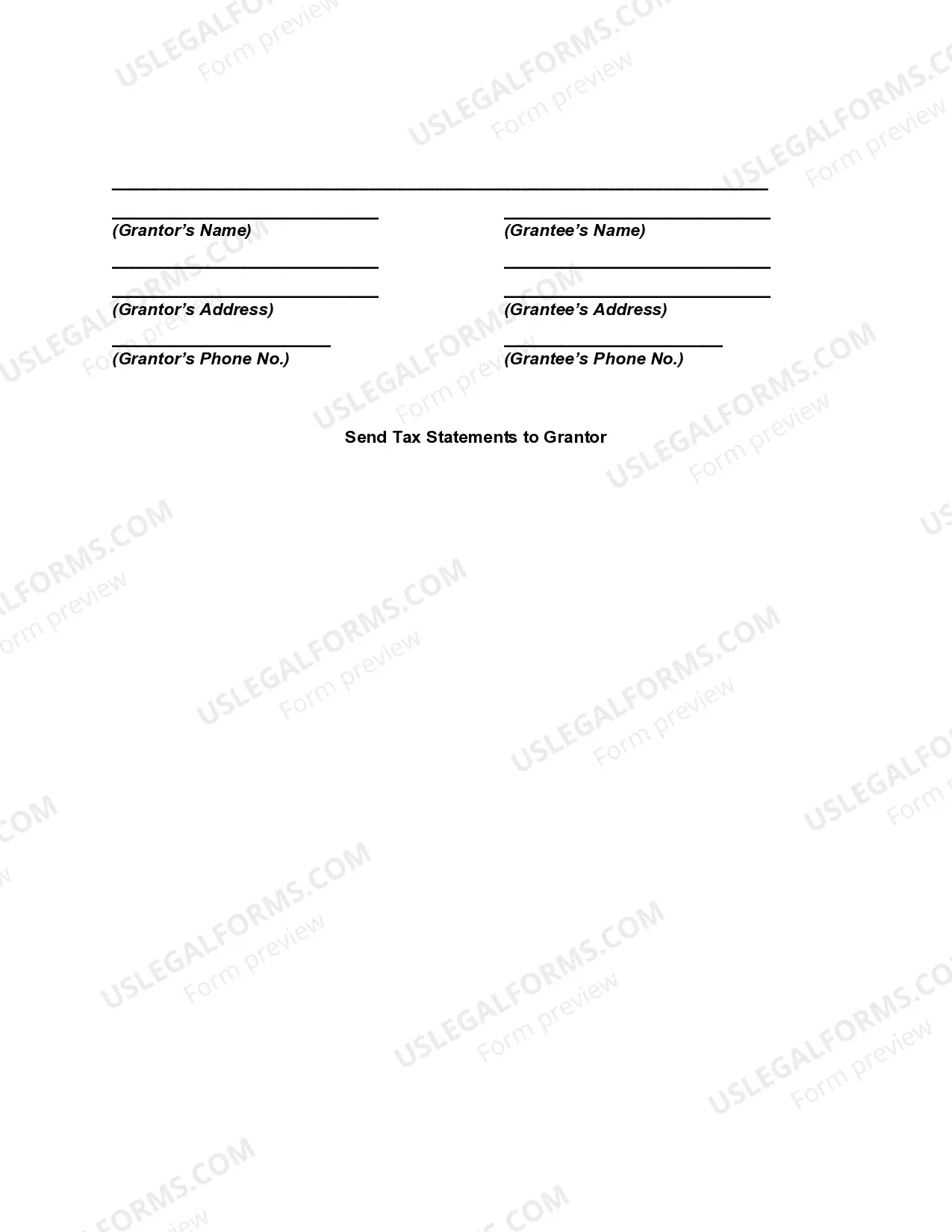

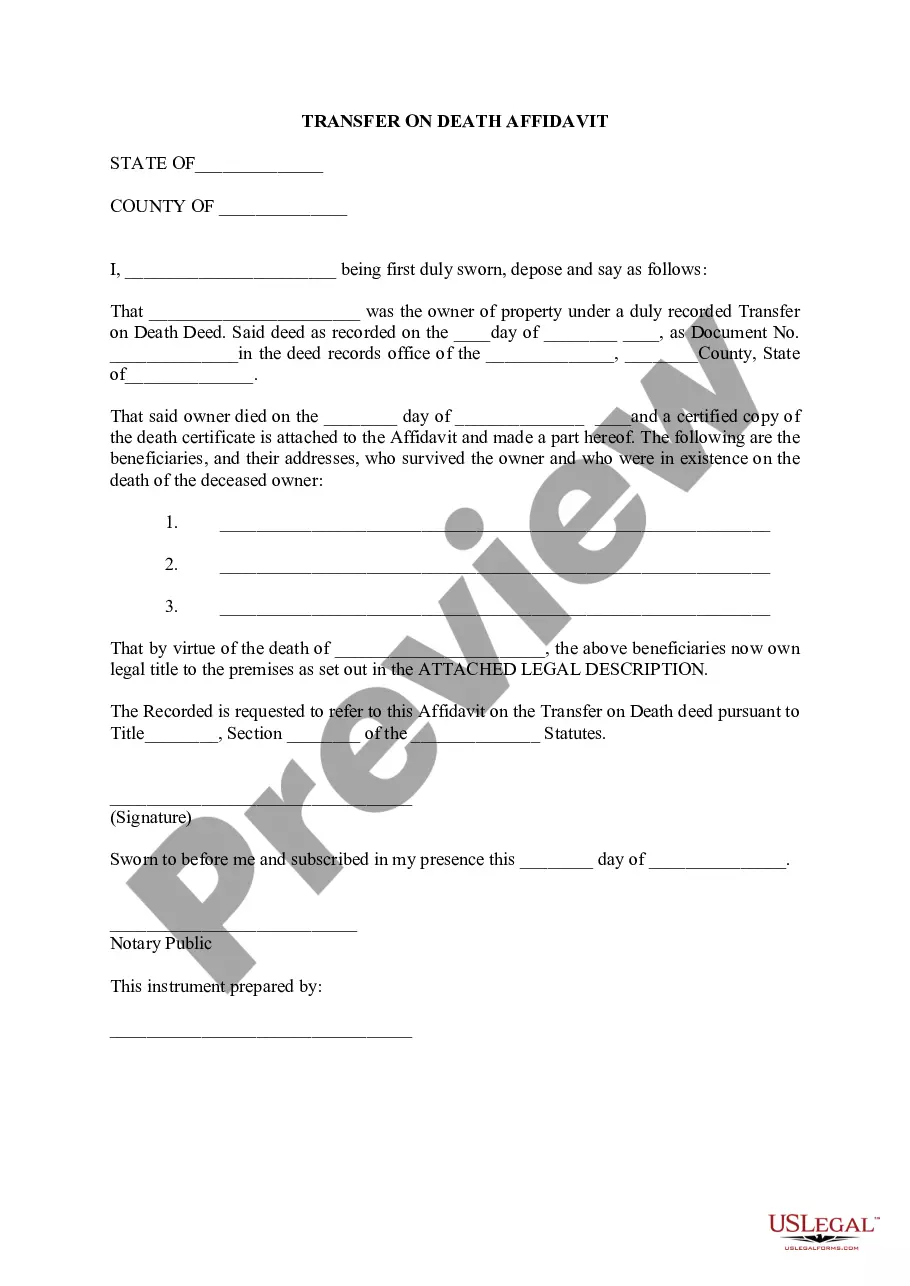

How to fill out Oklahoma Transfer On Death Deed?

- If you are a returning user, log into your account and access the form you need by clicking the Download button. Ensure your subscription is active; if it has expired, renew it according to your payment plan.

- For first-time users, begin by browsing the Preview mode and form descriptions to confirm you have selected the correct document that aligns with your requirements and local jurisdiction.

- If the initial form you viewed isn’t right, utilize the Search tab above to locate a more fitting template before moving forward.

- After finding the correct document, click the Buy Now button and select a subscription plan that suits your needs, then create an account to gain access to the library.

- Complete your purchase by providing payment information using a credit card or PayPal. After your payment is processed, you can download the form.

- Save the template to your device to fill it out at your convenience, and you can always revisit it anytime from the My Forms section of your account.

By utilizing US Legal Forms, users can take advantage of a robust collection of over 85,000 legally sound and editable forms. This resource not only saves time but also ensures that your documents are completed accurately.

Start the process now to ensure your estate is handled smoothly and efficiently. Visit US Legal Forms and take control of your legal needs today!

Form popularity

FAQ

A Transfer on Death (TOD) designation is often simpler and allows for direct transfer of property to beneficiaries without going through probate. However, a trust might provide more control and additional benefits for complex estates. Both options have unique advantages, and using US Legal Forms can help you weigh them, ensuring you choose the best way to transfer death estate for the future.

Passing property to heirs can be done either through a will or a trust. A trust may provide more flexibility and help avoid probate, which can be time-consuming. However, using services like US Legal Forms can help you create comprehensive documents that best suit your needs, ensuring you effectively transfer death estate for the future to your heirs.

Transferring property title between family members can often be done through a quitclaim deed. This method allows one family member to transfer their interest to another without needing to go through a lengthy process. Additionally, using online platforms like US Legal Forms can simplify the process and ensure that all paperwork is handled correctly. Remember, a well-planned property transfer can help you efficiently transfer death estate for the future.

The disadvantages of a Transfer on Death deed include the potential for disputes among heirs and the lack of control over the property during the owner's lifetime. Additionally, a TOD does not shield the property from creditors or other claims, which can complicate the process. When considering how to transfer death estate for the future, fully understanding these challenges is important. A platform like uslegalforms can provide the necessary resources to navigate these issues effectively.

TOD accounts can be a good idea for simplifying asset transfer to beneficiaries while avoiding probate. They offer a straightforward way to achieve your estate planning goals. However, it's vital to consider your financial situation and family dynamics before proceeding. With the right approach, you can effectively use TOD accounts to transfer death estate for the future in a way that best suits your needs.

While you can create a Transfer on Death deed without a lawyer, it is highly recommended to seek legal assistance. A lawyer can ensure the deed is legally valid and properly executed, reducing the chance of future disputes among heirs. Using platforms like uslegalforms can also guide you through the process, making it easier to successfully transfer death estate for the future. Doing it right the first time helps avoid complications later.

A Transfer on Death deed does not directly avoid capital gains tax when the property is sold. However, heirs may benefit from a stepped-up basis, which means that the property's value adjusts to its fair market value at the time of the owner's death, potentially reducing taxable gains. This aspect can be an advantage when looking to transfer death estate for the future. To fully understand your tax implications, consulting a financial or tax professional is wise.

Some disadvantages of TOD include the lack of control over the asset during the owner's lifetime and the possibility of disputes arising among heirs. If the property owner encounters financial difficulties, creditors may still claim the asset despite the TOD. Moreover, a TOD does not protect the estate from probate, meaning that assets may still need to go through court proceedings. Understanding these points can help you plan better when considering how to transfer death estate for the future.

One downside of a Transfer on Death (TOD) deed is that it does not provide immediate access to the property upon death. Instead, heirs must wait for the transfer process to be completed, which can create delays. Additionally, a TOD may not consider all potential debts or taxes associated with the estate, potentially leading to complications. Therefore, while a TOD is beneficial for transferring death estate for the future, it is essential to fully understand the implications.

Yes, New Jersey allows transfer on death deeds, providing a reliable way to transfer your death estate for the future. With a TOD deed, you can directly transfer property to your chosen beneficiaries, which helps streamline the transition and avoids probate. It's crucial to understand the specific rules in New Jersey for creating valid TOD deeds. US Legal Forms can assist you in the preparation and ensure that your documents meet state regulations.