Ohio Release Land With Mineral Rights For Sale

Description

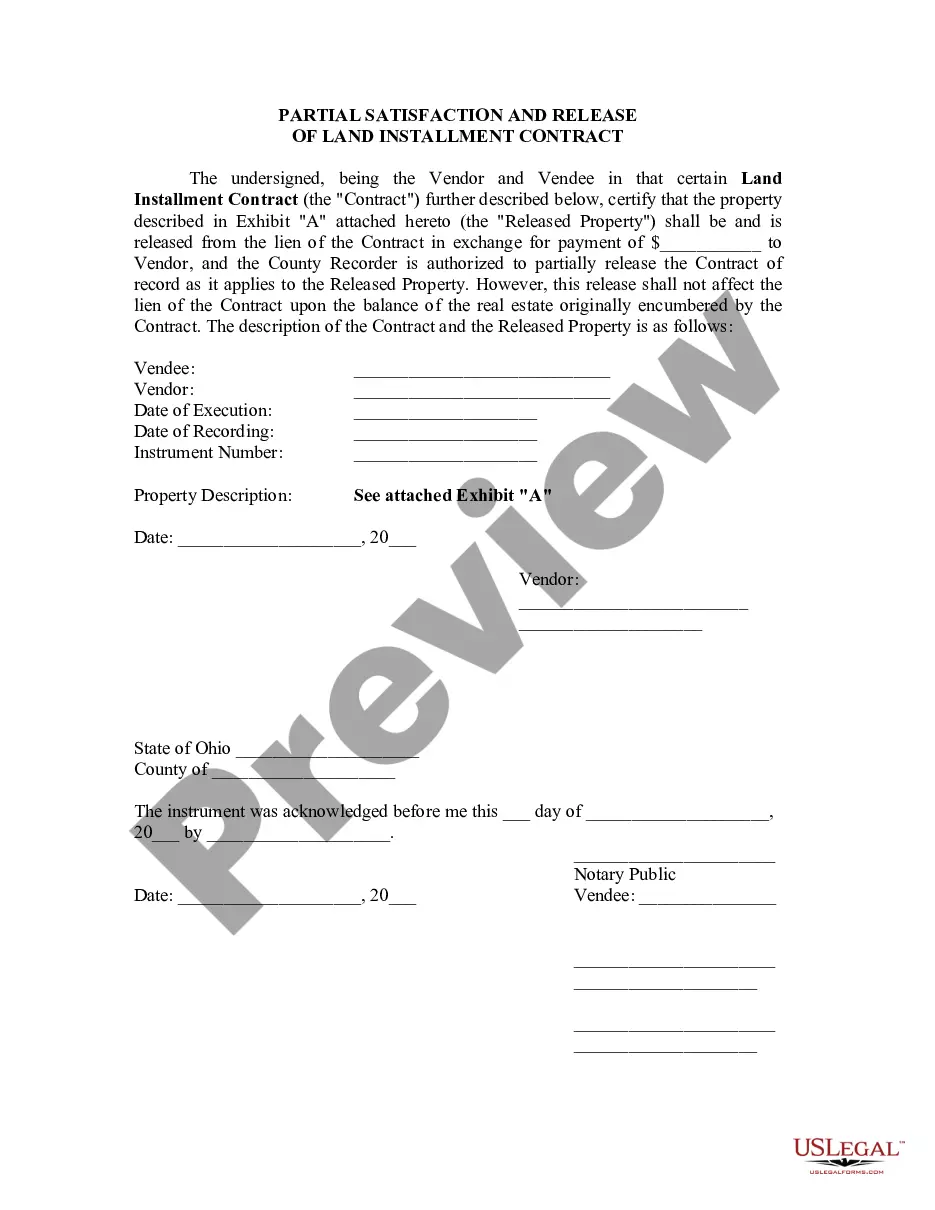

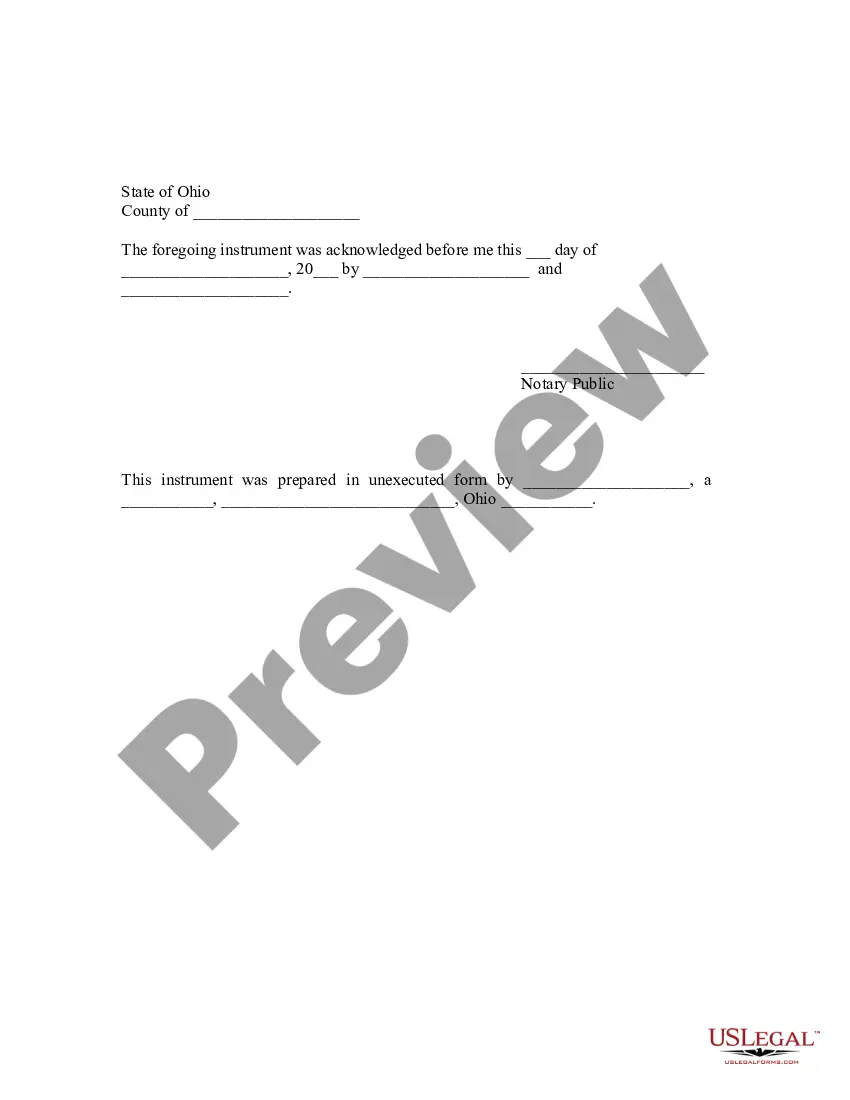

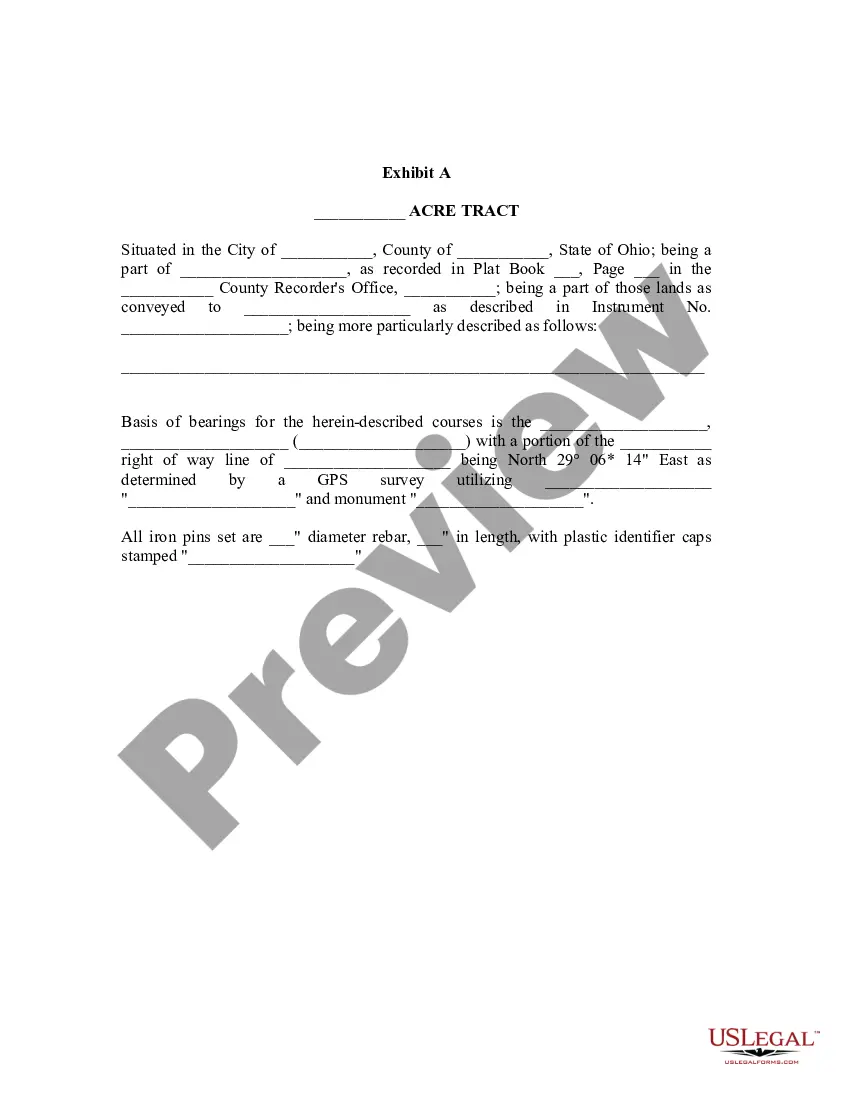

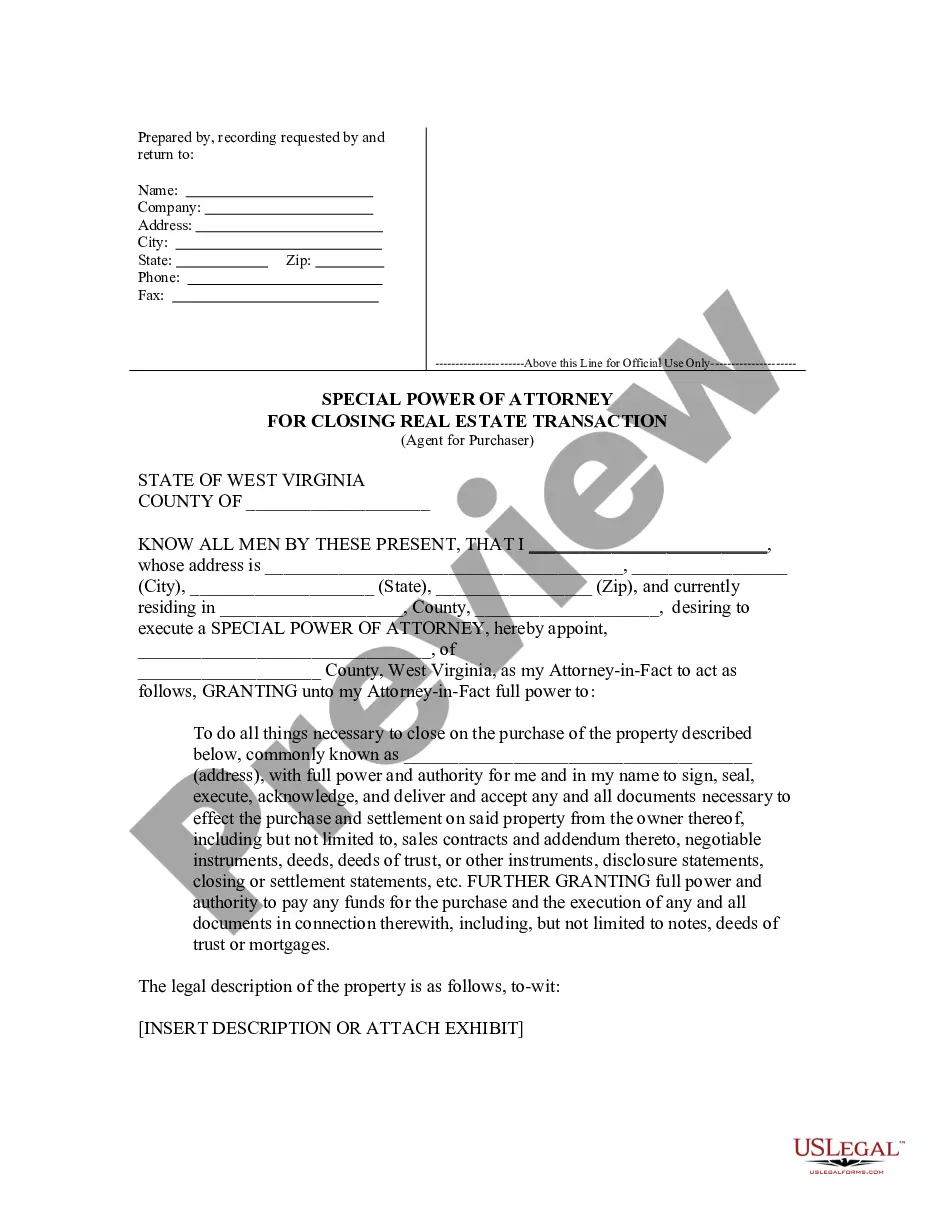

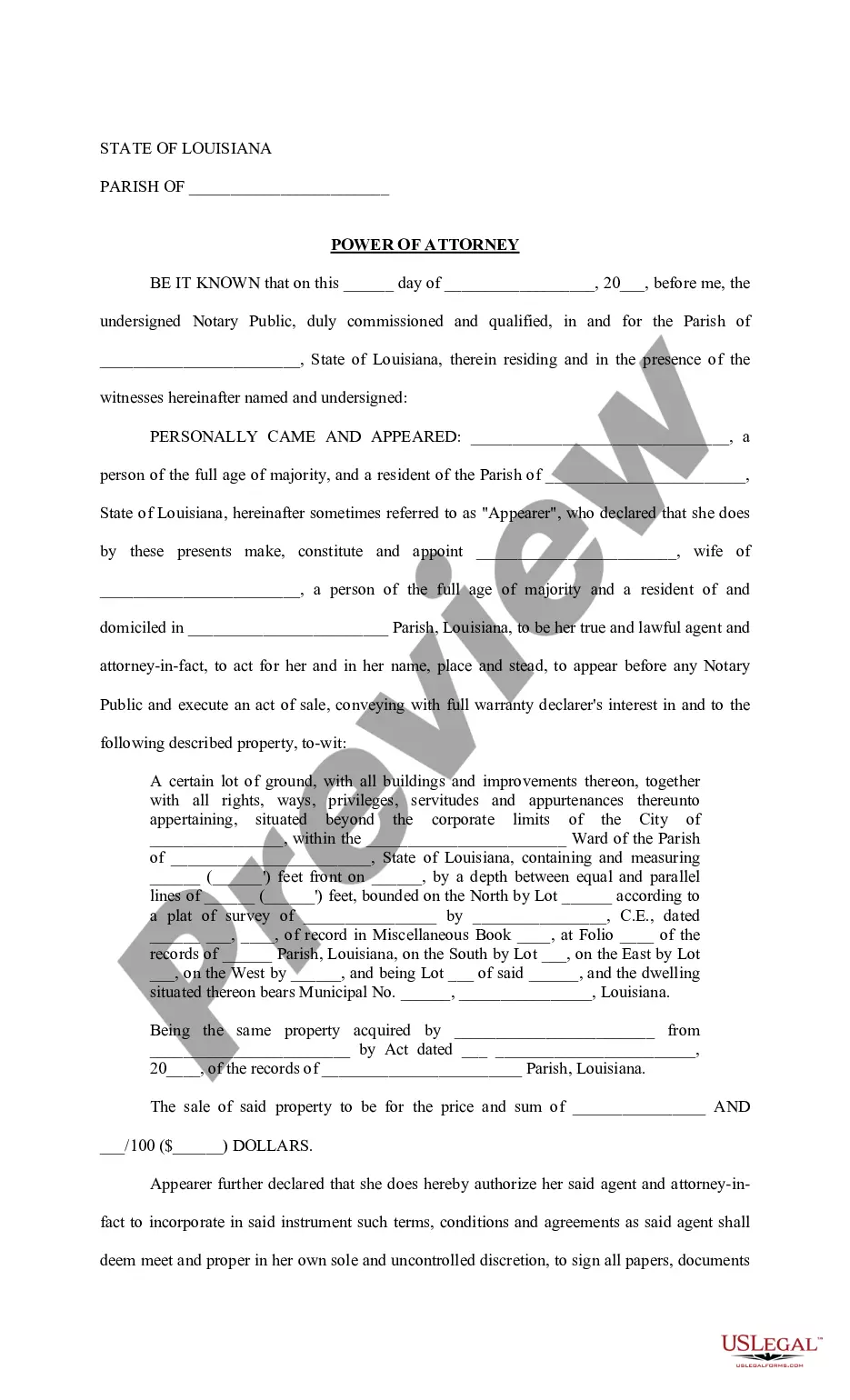

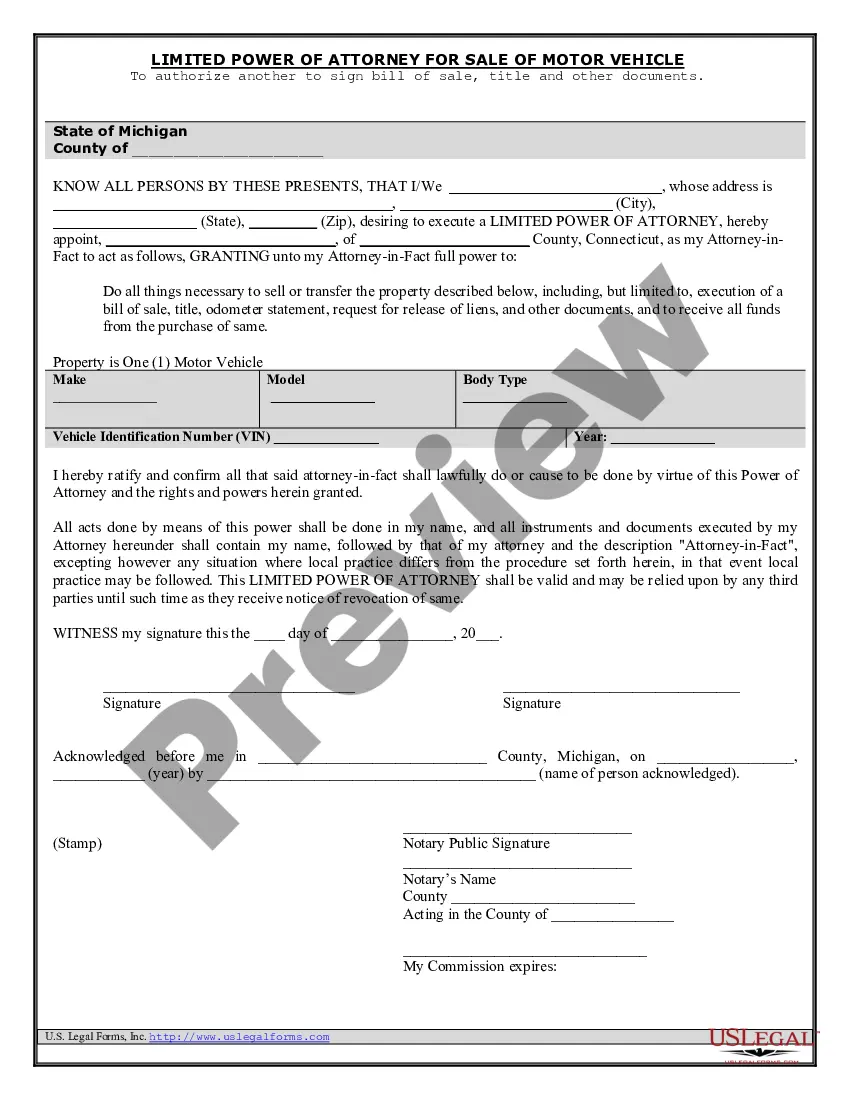

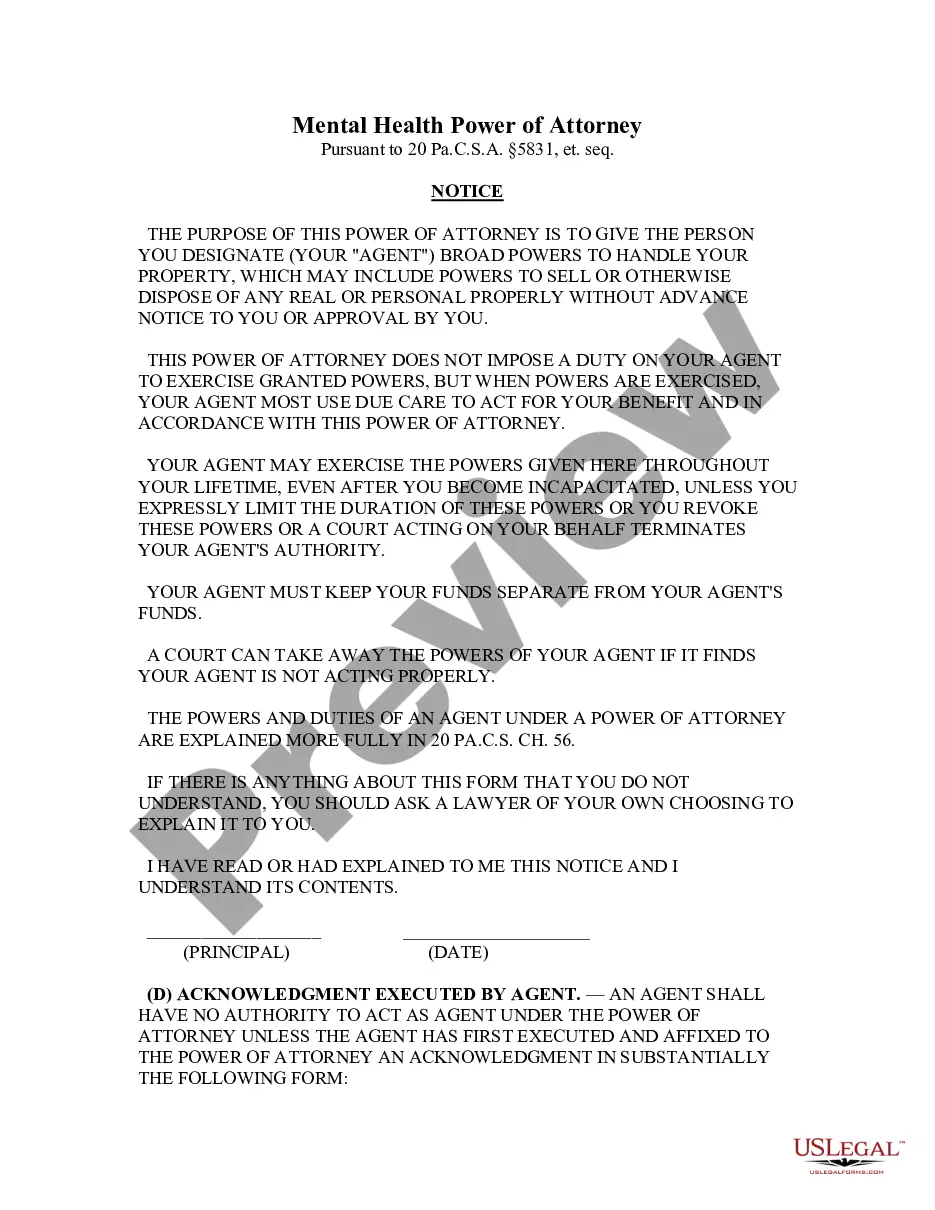

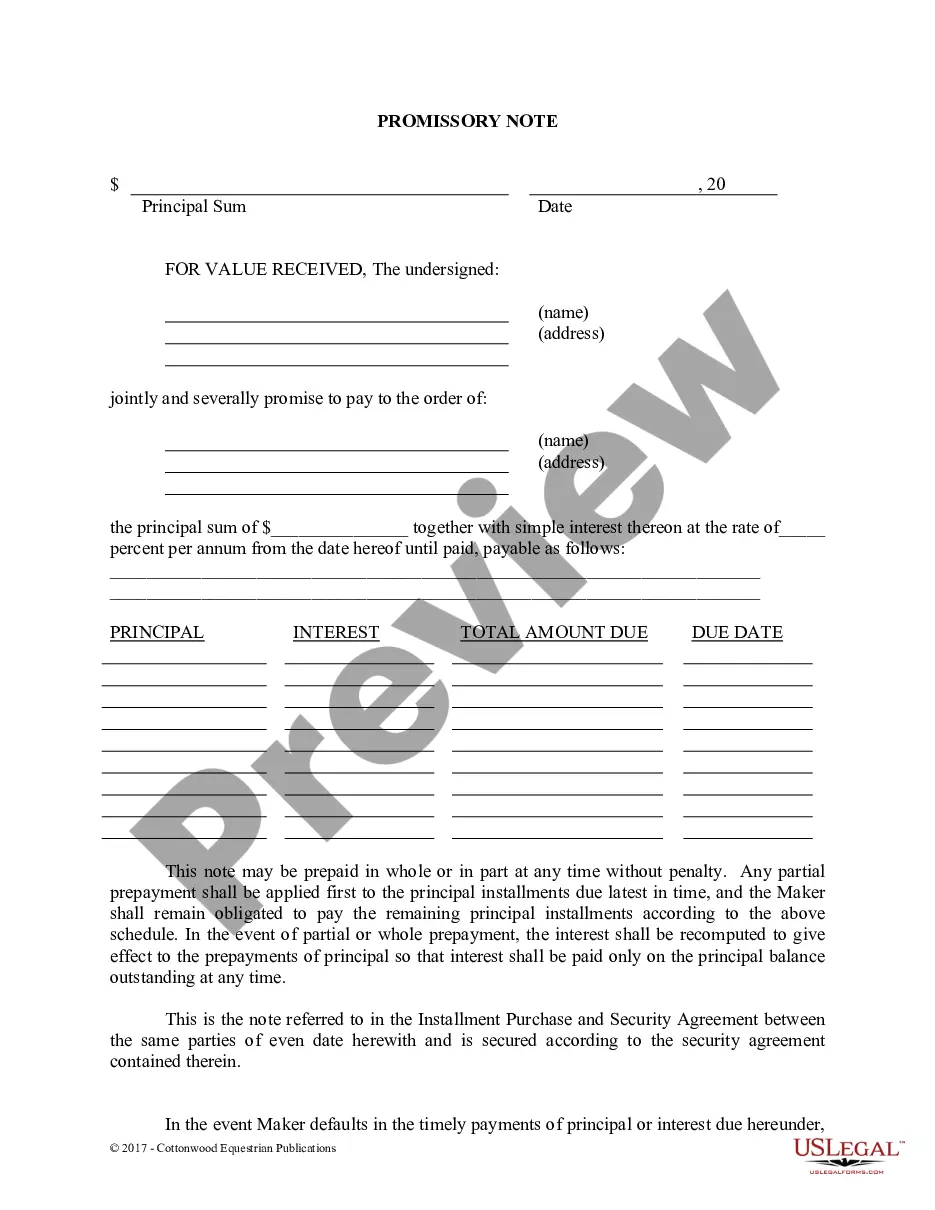

How to fill out Ohio Partial Satisfaction And Release Of Land Installment Contract?

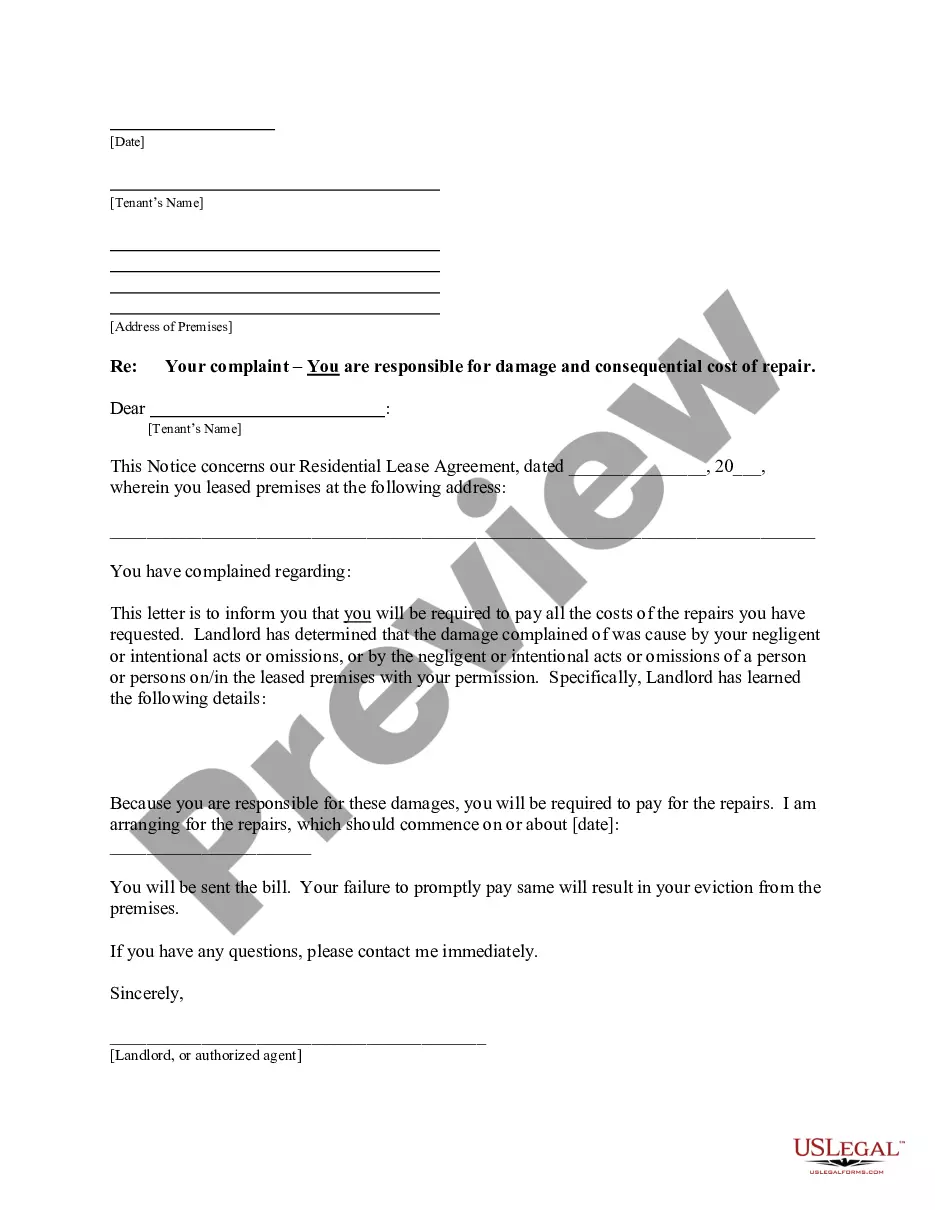

Bureaucracy requires accuracy and exactness.

If you do not manage filling out forms like Ohio Release Land With Mineral Rights For Sale on a daily basis, it may lead to some misunderstanding.

Choosing the correct sample initially will ensure that your document submission proceeds smoothly and avoid any hassles of re-submitting a file or repeating the same task from the start.

If you are not a subscribed user, locating the necessary sample will require a few extra steps.

- Acquire the suitable sample for your documents within US Legal Forms.

- US Legal Forms is the largest online repository of forms that houses over 85 thousand templates across various subjects.

- You can find the latest and most suitable iteration of the Ohio Release Land With Mineral Rights For Sale just by searching the site.

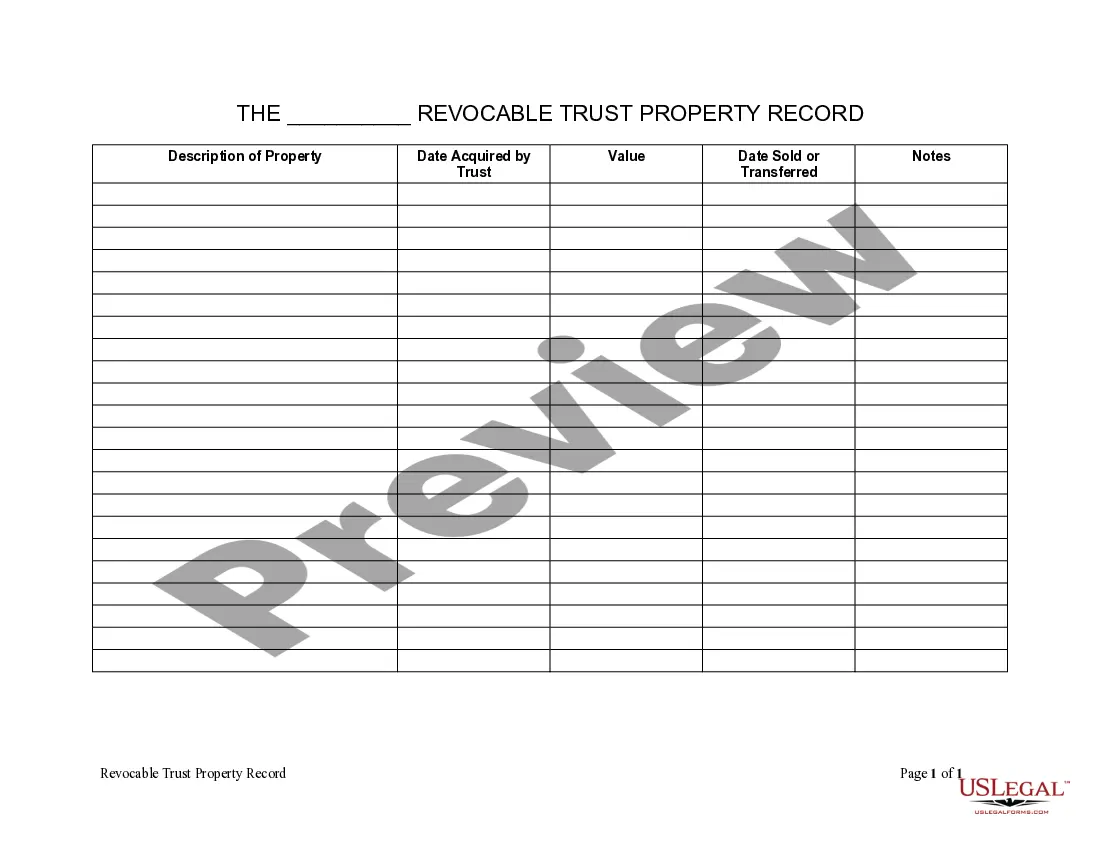

- Locate, store, and download forms to your profile or review the description to confirm you have the correct one readily available.

- With an account at US Legal Forms, you can conveniently obtain, keep in one location, and browse through the documents you save for easy access.

- When on the site, click the Log In button to Log In.

- Subsequently, head to the My documents page, where your forms' history is maintained.

- Review the descriptions of the forms and download the ones you need whenever you wish.

Form popularity

FAQ

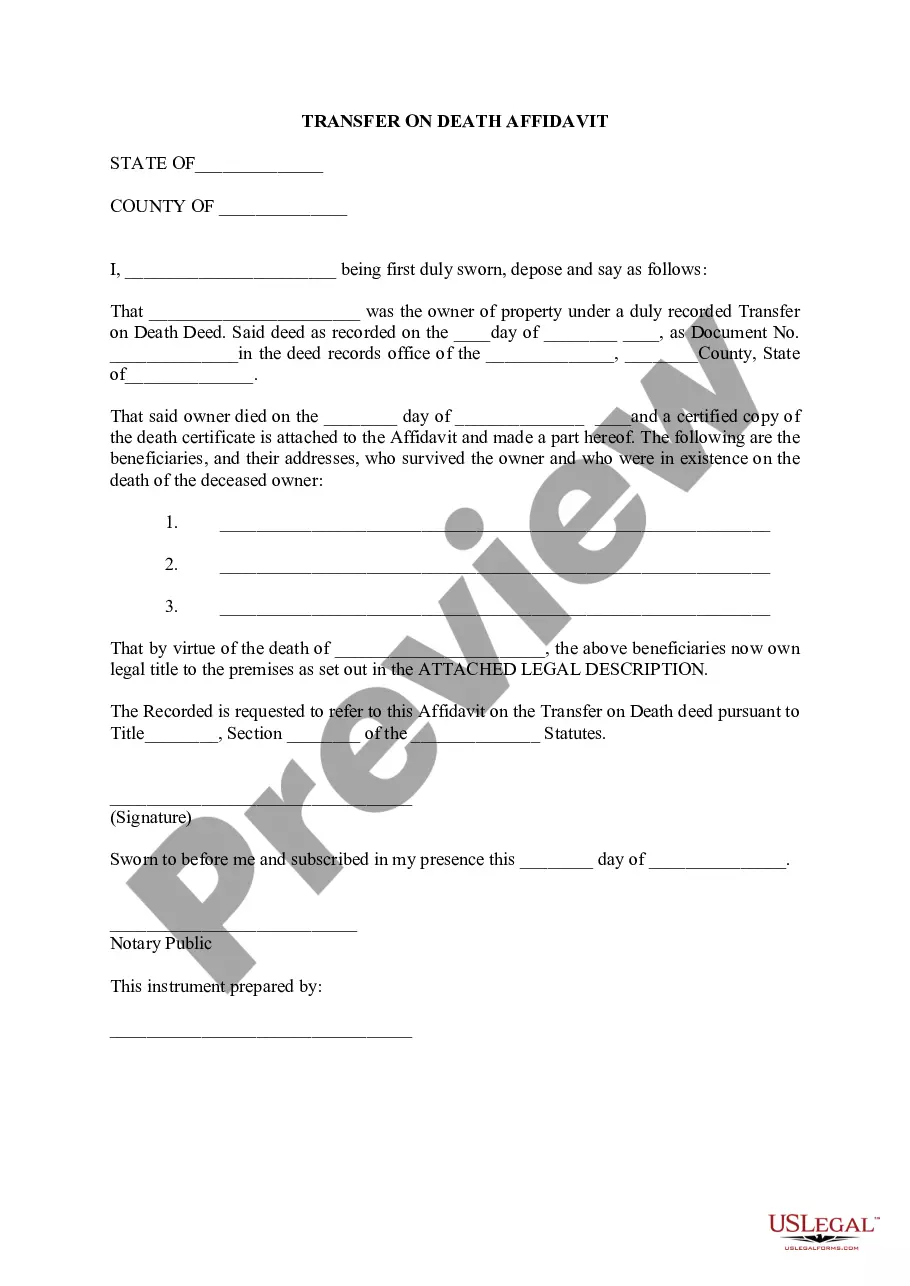

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).

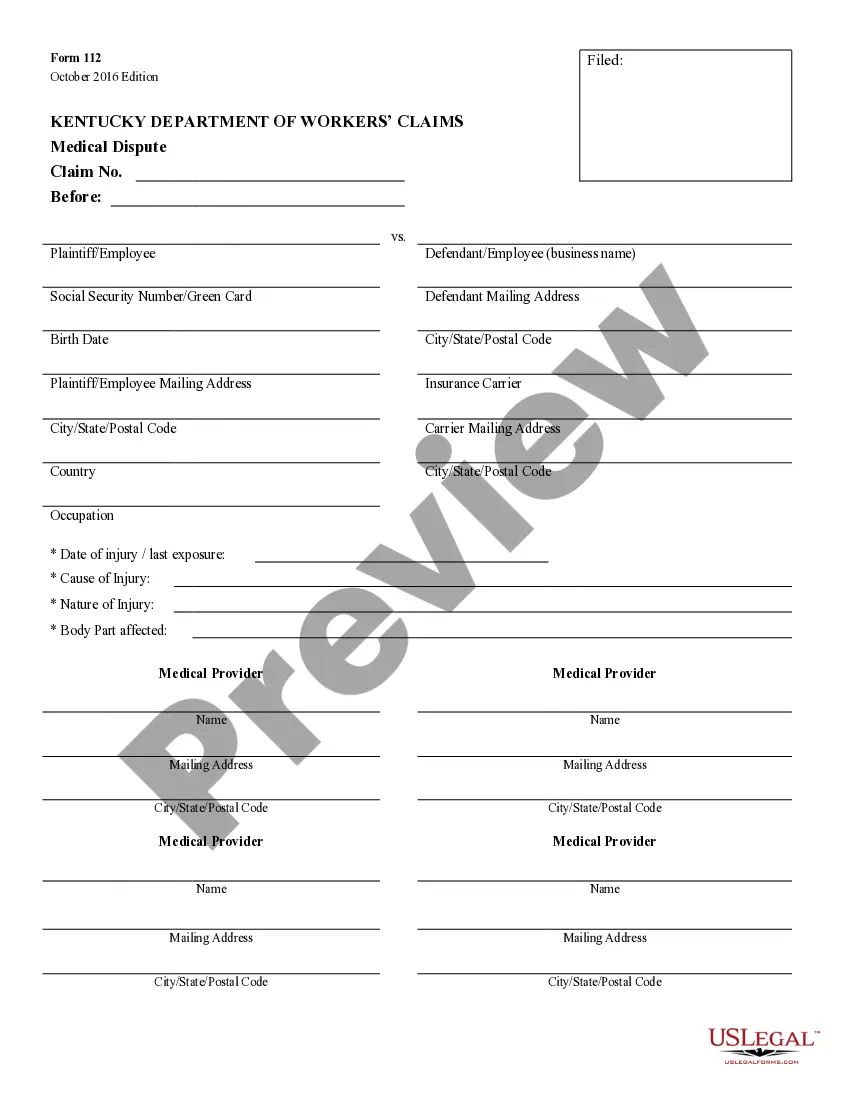

Regardless of whether the Ohio mineral rights are still held by the property owner, have been sold to someone else by the property owner or have been leased to someone else by the property owner, the ownership records will be recorded by a county recorder.

Mineral rights do not necessarily transfer with the property. Typically, a property conveyance (sale) transfers the rights of both the surface land and the minerals underneath until the mineral rights are sold. Mineral rights are conveyed meaning transferred to a new owner through a deed.

However, several steps need to be taken to claim mineral rights in Ohio, they include; After confirming your ownership with a lawyer, you should draw up a deed of transfer of the dormant mineral in your name and file it with your local county records office as the new mineral owner according to the state laws.

Buyers will pay an average of your monthly royalty checks multiplied by 50. Unleased acreage can be below $500 an acre to $3,000 an acre depending on location. Acreage leased but not in production can be anywhere from $500 to $5,000 an acre based on activity in your area and production nearby.