Ohio Workers Compensation For Independent Contractors

Description

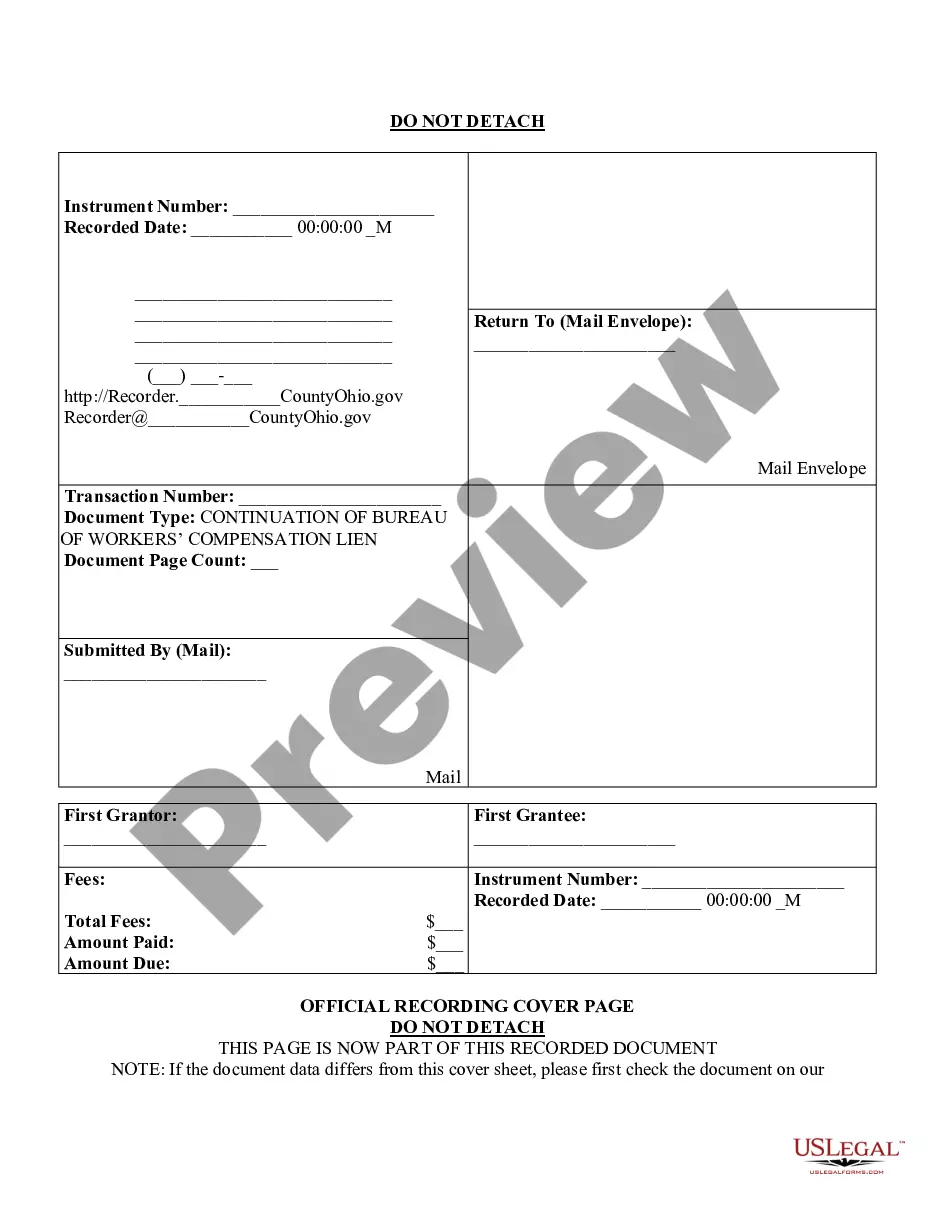

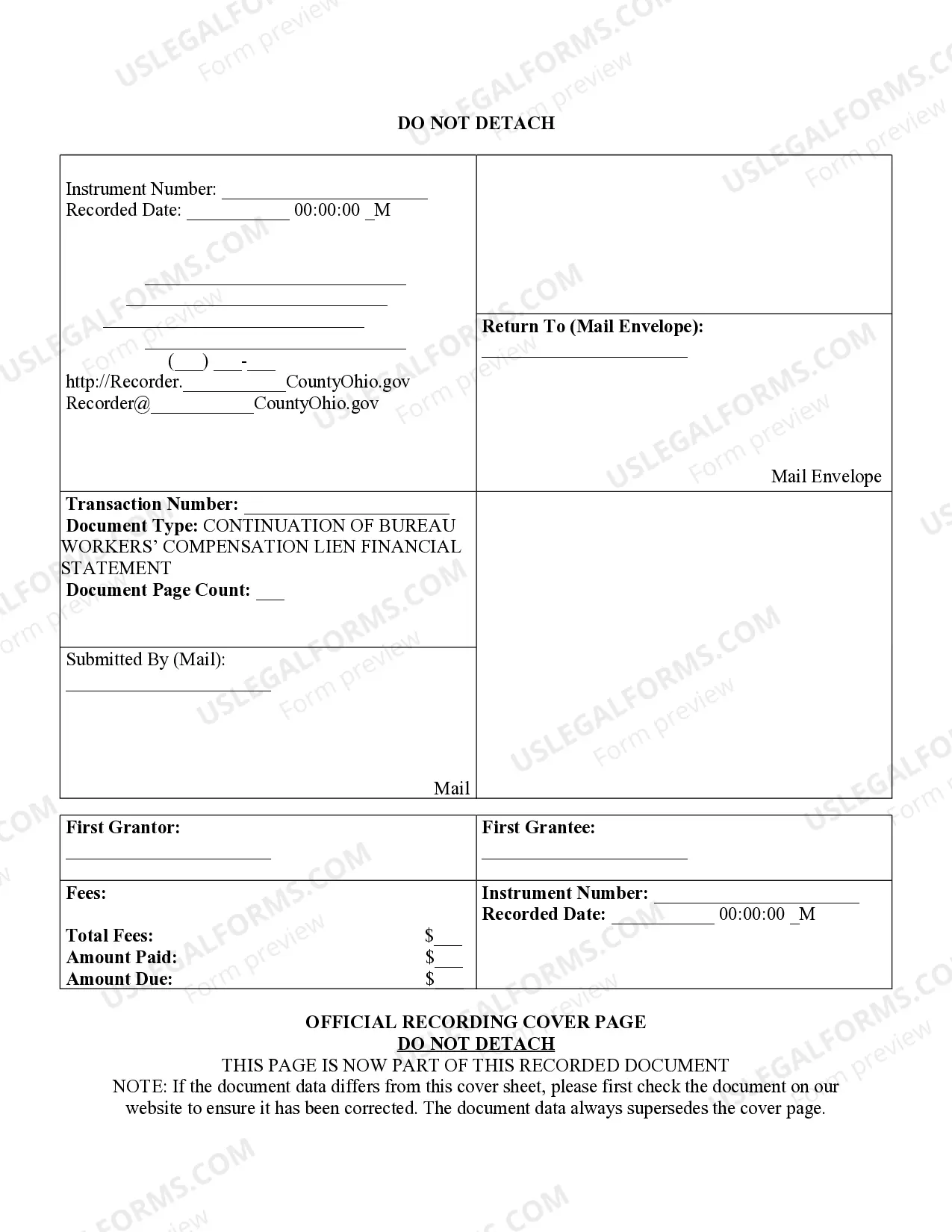

How to fill out Ohio Recording Cover Page For Workers' Compensation Lien?

Bureaucracy requires accuracy and exactness.

If you do not handle completing forms like Ohio Workers Compensation For Independent Contractors on a daily basis, it can lead to some misinterpretations.

Choosing the correct example from the start will ensure that your document submission proceeds seamlessly and avert any hassles of resubmitting a file or undertaking the same task entirely from the beginning.

If you are not a registered user, locating the necessary sample would involve a few extra steps: Locate the template using the search box. Confirm the Ohio Workers Compensation For Independent Contractors you’ve discovered is pertinent for your state or district. Review the preview or examine the description that includes the information on the utilization of the example. When the outcome aligns with your query, click the Buy Now button. Select the appropriate option from the available subscription plans. Log In to your account or sign up for a new one. Complete the purchase using either a credit card or PayPal payment method. Obtain the document in the file format of your preference. Locating the correct and updated samples for your paperwork is a matter of a few minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainties and streamline your document handling.

- Discover the appropriate example for your paperwork on US Legal Forms.

- US Legal Forms is the largest digital collection of forms that provides over 85 thousand templates for various sectors.

- You can find the latest and most suitable version of the Ohio Workers Compensation For Independent Contractors by simply searching on the site.

- Identify, store, and secure templates in your account or review the description to confirm you have the correct one ready.

- With an account at US Legal Forms, you can effortlessly obtain, keep in one spot, and browse the templates you save to reach them in just a few clicks.

- While on the website, click the Log In button to validate your account.

- Next, visit the My documents page, where the compilation of your documents is maintained.

- Review the descriptions of the forms and store those you require at any time.

Form popularity

FAQ

In Ohio, because independent contractors are not considered employees, they are not eligible for workers' compensation benefits. However, if you manage an independent contractor, and regularly control their performance, this freelancer or subcontractor is now considered your employee and requires your coverage.

If an independent contractor or subcontractor controls the selection of materials, traveling routes and quality of performance of another worker, that independent contractor or subcontractor is considered an employer and, as such, is required to provide workers' compensation coverage for that worker.

Ohio law requires every employer, including self-employed individuals or partners, to obtain workers' compensation coverage for their employees. However, it is optional for you as a sole proprietor or partner to carry coverage on yourself.

An employee under Ohio Workers' Compensation law is a term of art and can include persons denominated by employers as independent contractors. Legitimately actual independent contractors are legally self-employed, and as such doesn't qualify for benefits.

Independent contractors are not eligible for workers' compensation coverage; employers are not required by state law to purchase coverage for independent contractors. However, some employers misclassify employees as independent contractors to avoid paying payroll taxes and workers' comp premiums for them.