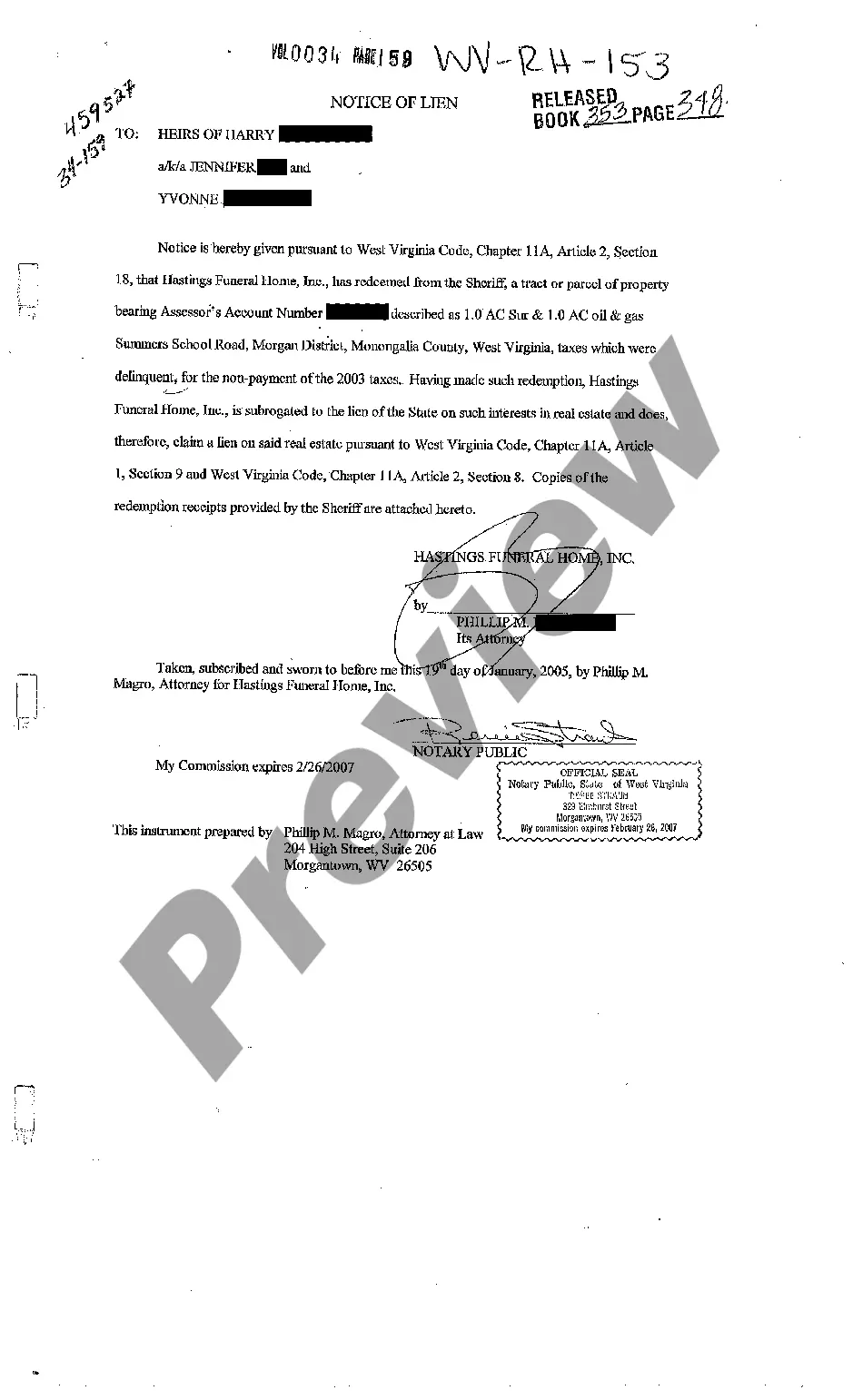

West Virginia Notice of Tax Lien and Certificate of Redemption

Description

How to fill out West Virginia Notice Of Tax Lien And Certificate Of Redemption?

Among lots of free and paid templates that you find on the internet, you can't be certain about their reliability. For example, who made them or if they’re qualified enough to deal with what you need them to. Always keep calm and use US Legal Forms! Get West Virginia Notice of Tax Lien and Certificate of Redemption templates created by professional attorneys and get away from the high-priced and time-consuming procedure of looking for an lawyer or attorney and then paying them to write a document for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you are trying to find. You'll also be able to access your earlier saved documents in the My Forms menu.

If you’re utilizing our service the very first time, follow the guidelines listed below to get your West Virginia Notice of Tax Lien and Certificate of Redemption fast:

- Make certain that the file you see applies in the state where you live.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering process or look for another sample utilizing the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

Once you’ve signed up and paid for your subscription, you can utilize your West Virginia Notice of Tax Lien and Certificate of Redemption as often as you need or for as long as it remains active where you live. Change it in your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

A property-tax lien is a legal claim against a property for unpaid property taxes. A tax lien prohibits a property from being sold or refinanced until the taxes are paid and the lien is removed.

Louisiana. This is one of the best states to shop for a tax lien. Mississippi. Mississippi tax liens may not have the most favorable auction policies, but its 18% interest rate and 2-year waiting period are attractive to investors. Iowa. Iowa is another state with a unique way of selling tax liens. Florida.

The IRS is a government agency, so it can work directly with local governments and even your creditors to place a lien on your property. It does this through a notice directly to those entities. To find out if there's a lien on your property, you can contact the IRS Centralized Lien Unit at (800) 913-6050.

A tax lien sale is a method many states use to force an owner to pay unpaid taxes.The highest bidder gets the lien against the property. The tax collector uses the money earned at the tax lien sale to compensate for unpaid back taxes. The homeowner has to pay back the lien holder, plus interest, or face foreclosure.

Worthless Property. Sometimes owners stop paying their property taxes because the property is worthless. Foreclosure Risks. When you purchase a tax lien, state statutes limit the amount of time you have to foreclose on the property before the lien expires worthless. Municipal Fines and Costs. Bankruptcy.

Purchasing a tax lien does not obligate you to pay any future property taxes that become delinquent or pay for other property liabilities.Unlike an investment in a tax lien, an investment in a tax deed requires that your adequately maintain the property until you are able to sell it.

Is there a difference between a lien and a levy? Yes! When a tax lien is filed by the government, the property owner still owns the property, whereas in the case of a levy, a legal seizure of property is made to satisfy the tax debt.

Most tax liens purchased at auction are sold at rates between 3 percent and 7 percent nationally, says NTLA's Executive Director Brad Westover. The property owner has a redemption period generally one to three years to pay the taxes plus interest.

A tax lien certificate is a certificate of claim against a property that has a lien placed upon it as a result of unpaid property taxes. 1feff Tax lien certificates are generally sold to investors through an auction process.