Register For Land Tax

Description

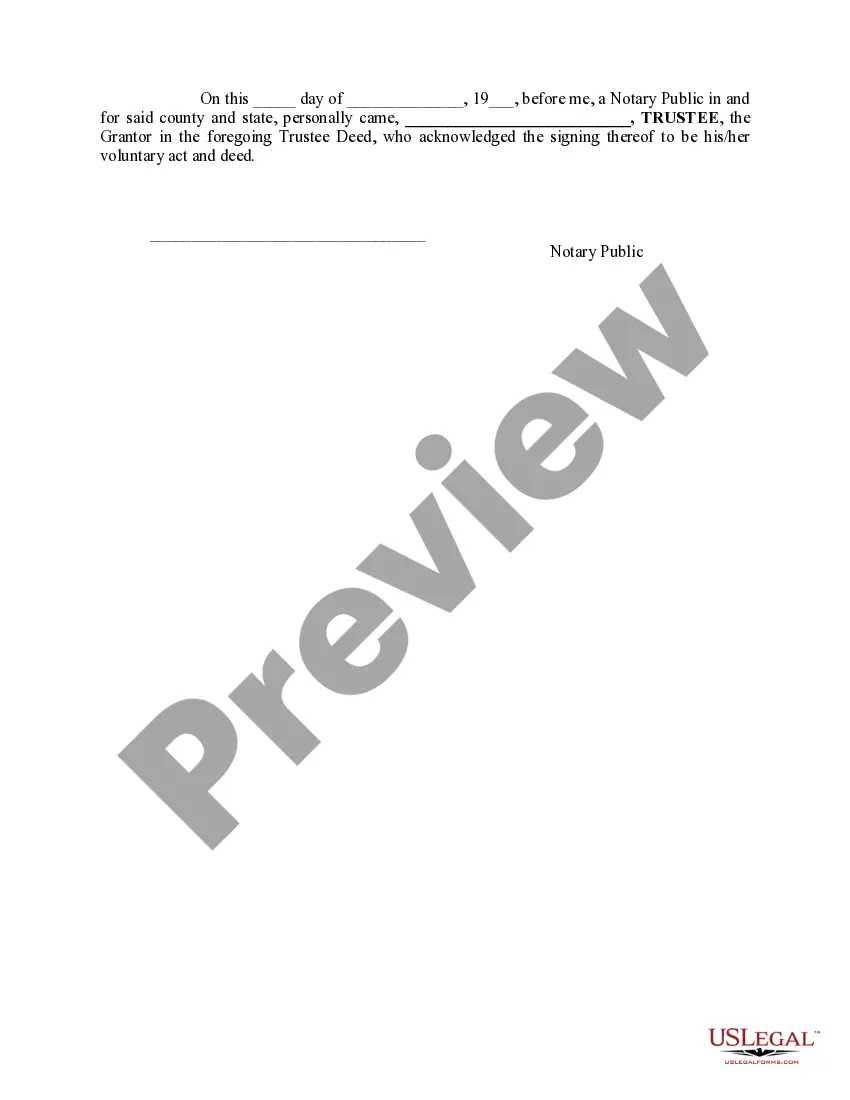

How to fill out Ohio Registered Land - Trustees Deed?

Managing legal paperwork and tasks can be an extensive addition to your daily routine.

Register For Land Tax and similar forms generally necessitate you to search for them and grasp how to fill them out correctly.

Therefore, if you are addressing financial, legal, or personal issues, possessing a comprehensive and functional online library of forms at your disposal will be extremely beneficial.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific forms along with numerous tools to assist you in completing your documents effortlessly.

- Explore the collection of relevant documents accessible to you with just a single click.

- US Legal Forms provides you with state- and county-specific forms ready for download at any moment.

- Safeguard your document management processes with a premium service that enables you to prepare any form in just a few minutes without hidden fees.

- Simply Log In to your account, find Register For Land Tax and download it immediately from the My documents section.

- You can also retrieve previously stored forms.

Form popularity

FAQ

To get a property tax ID, start by visiting your local county assessor's office or their website. You will need to provide necessary details about your property, such as the address and your ownership documentation. The process is straightforward, and having your property tax ID will facilitate your ability to register for land tax seamlessly.

In California, you generally receive your property tax bill in the fall, typically around October. It’s essential to keep an eye on your mailbox during this period. If it hasn’t arrived by November, contacting your local tax collector can prevent any surprises. This proactive approach is vital as you prepare to register for land tax.

You can get a copy of your Illinois property tax bill by visiting your county's treasurer's website. They typically offer online access to property tax bills, which makes retrieval easy. If you prefer, you can also request a copy in person or via mail. Staying updated on these bills will help you manage your obligations when you register for land tax.

To obtain your property tax ID, you can contact your local assessor's office or visit their website. You may need to provide basic information about your property, such as its address and owner details. Once you have your property tax ID, it will simplify the process when you register for land tax.

No, a property ID and a tax ID are not the same. The property ID is a unique identifier assigned to your property for assessment and record-keeping. In contrast, the tax ID essentially relates to your financial obligations regarding property taxes. Understanding these distinctions is crucial when you register for land tax.

You report property taxes by either submitting your tax return that includes the necessary deductions or directly contacting your local tax office. If you register for land tax, you will receive instructions on proper reporting methods from your state. Keeping organized records will make this process easier and ensure you meet all reporting requirements. Trust in established platforms can also simplify this reporting task.

To claim your California property tax refund, you typically need to file a claim with your local county assessor's office. Be prepared to provide evidence of your overpayment and complete any necessary forms. If you have questions about how to register for land tax or understand the refund process, US Legal Forms offers resources and templates for ease. Claiming your refund can be a smoother experience with the right tools.

When filing your tax return online, you will enter property tax information in the section designated for itemized deductions. Many tax software programs guide you through the process, making it easier. Remember, if you have already registered for land tax, ensure all information matches your records. Accurate reporting is essential for successful tax filing.

Yes, property taxes are generally deductible when you itemize deductions on your federal tax return. This means that when you register for land tax, you can take advantage of this deduction to potentially lower your tax liability. However, it’s best to consult with a tax professional to fully understand how these deductions work. Each situation can vary, so tailored advice is valuable.

Yes, you need to report property taxes as they form a crucial part of your financial obligations. When you register for land tax, you ensure that you remain compliant with local regulations. Reporting these taxes helps maintain transparency and prevents future issues with property assessments. Thus, handling property taxes responsibly is vital for every property owner.