Seller Affidavit Real Estate Foreign

Description

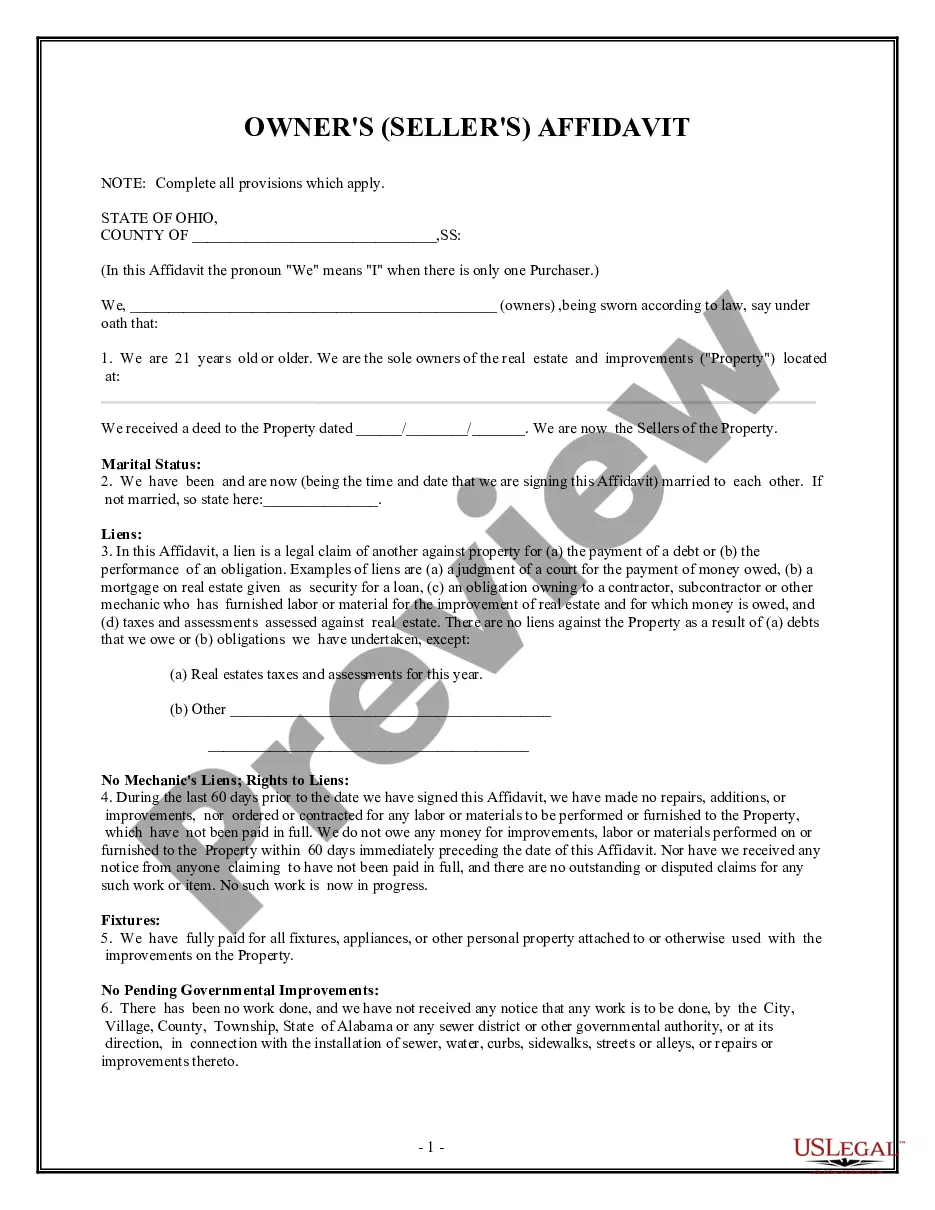

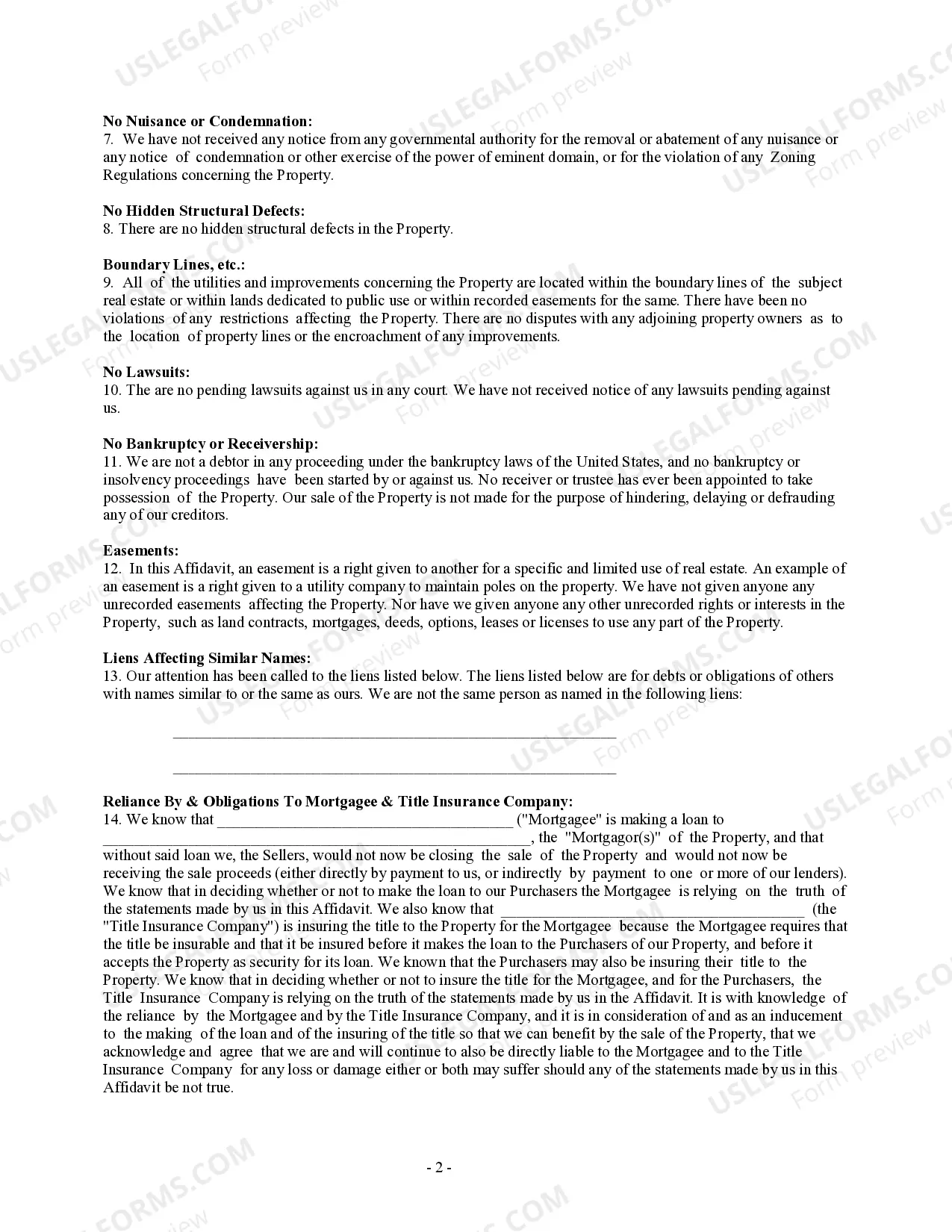

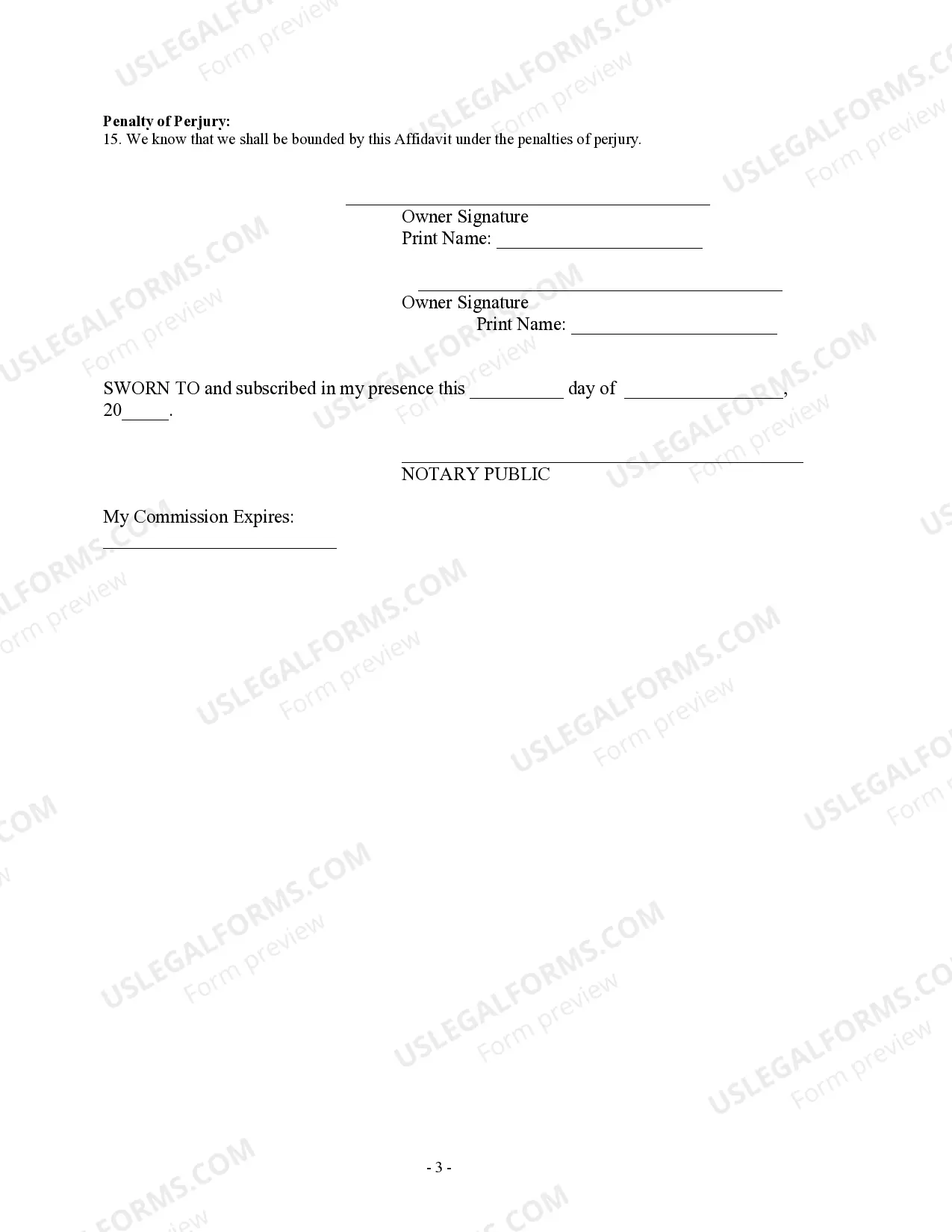

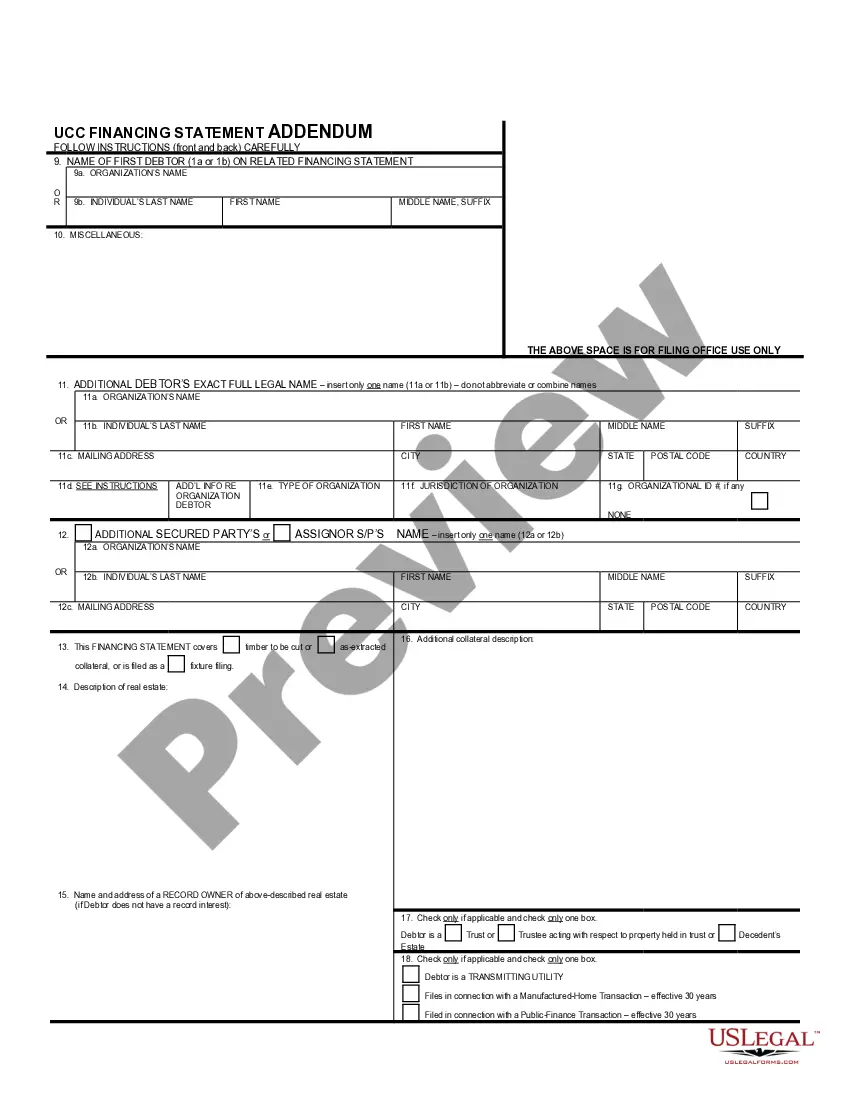

How to fill out Ohio Owner's Or Seller's Affidavit Of No Liens?

There's no longer an excuse to spend hours hunting for legal documents to comply with your local state requirements.

US Legal Forms has compiled them all in a single location and simplified their access.

Our platform offers over 85k templates for any business and individual legal needs organized by state and area of application.

Utilize the Search bar above to look for another sample if the one you are examining isn't suitable.

- All forms are expertly drafted and verified for accuracy, so you can be confident in obtaining a current Seller Affidavit Real Estate Foreign.

- If you are familiar with our platform and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all acquired documents whenever necessary by navigating to the My documents tab in your profile.

- For newcomers to our platform, completing the process will involve additional steps.

- Here is how new users can locate the Seller Affidavit Real Estate Foreign in our catalog.

- Review the page content carefully to confirm it includes the sample you require.

- To assist with this, use the form description and preview options if available.

Form popularity

FAQ

The Foreign Investment in Real Property Tax Act (FIRPTA) of 1980 authorizes the United States to tax foreign persons who are nonresident aliens selling U.S. real property interests. A U.S. real property interest includes sales of interests in parcels of real property.

FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests. A disposition means disposition for any purpose of the Internal Revenue Code. This includes but is not limited to a sale or exchange, liquidation, redemption, gift, transfers, etc.

FIRPTA is a tax law that imposes U.S. income tax on foreign persons selling U.S. real estate. Under FIRPTA, if you buy U.S. real estate from a foreign person, you may be required to withhold 10% of the amount realized from the sale. The amount realized is normally the purchase price.

The FIRPTA law says that if the seller is a foreign person, the transferee i.e. the buyer, is the Withholding Agent3 that is legally responsible for collecting the tax and forwarding it to the IRS.

There are two different types of FIRPTA Certifications: one for individuals (natural persons) and another for entities (e.g., corporation, partnership, limited liability company, etc.). The FIRPTA Certification must be signed by all transferors (sellers).