Ohio Residential Form For Farmers

Description

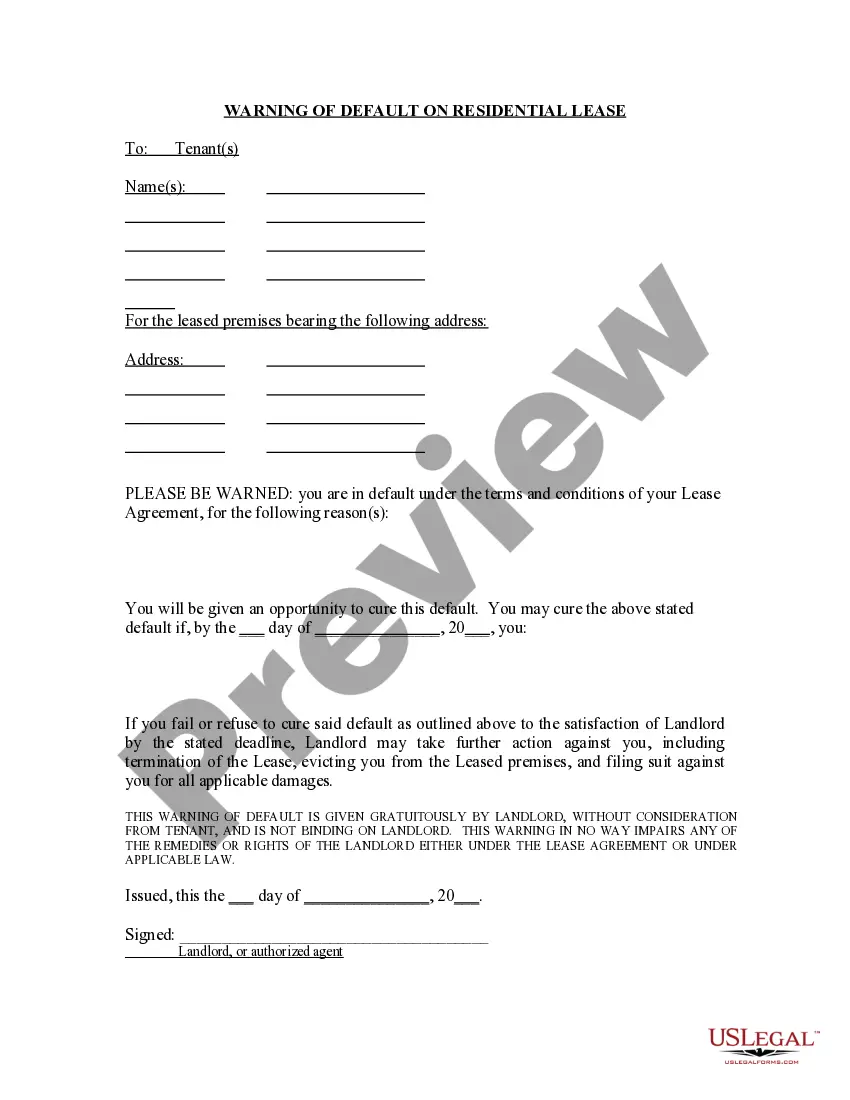

How to fill out Ohio Warning Of Default On Residential Lease?

How to locate professional legal documents that adhere to your state regulations and create the Ohio Residential Form For Farmers without consulting an attorney.

Numerous online services provide templates to address diverse legal scenarios and formalities. However, it may require substantial time to understand which of the accessible samples meet both your usage purposes and legal criteria.

US Legal Forms is a reliable platform that assists you in finding formal papers drafted in accordance with the most recent updates in state legislation and helps you save on legal services.

If you lack an account with US Legal Forms, follow the instructions below: Review the webpage you have opened to confirm whether the form meets your requirements. To achieve this, utilize the form description and preview options if accessible. Look for another template in the header by providing your state if necessary. Click the Buy Now button once you identify the suitable document. Choose the most appropriate pricing plan, then Log In or register for an account. Select the payment method (by credit card or via PayPal). Alter the file format for your Ohio Residential Form For Farmers and click Download. The obtained templates will be retained in your ownership: you can always revisit them in the My documents section of your account. Subscribe to our library and prepare legal documents independently like a seasoned legal expert!

- US Legal Forms is not just a typical online library.

- It's a compilation of over 85,000 authenticated templates for various business and personal situations.

- All documents are categorized by field and state to expedite your search process.

- Moreover, it features powerful tools for PDF editing and eSignature, allowing users with a Premium membership to efficiently complete their documents online.

- Acquiring the necessary paperwork requires minimal time and effort.

- If you already possess an account, Log In and confirm your subscription is current.

- Download the Ohio Residential Form For Farmers using the corresponding button next to the document title.

Form popularity

FAQ

Farmers can write off numerous expenses on their taxes, including costs for equipment, seeds, feed, and maintenance. Additionally, you can deduct for utilities, repairs, and other necessary operational expenses. To maximize your deductions, utilize the Ohio residential form for farmers, which provides comprehensive guidelines on eligible expenses.

You can classify your property as a farm by demonstrating that you use it primarily for agricultural purposes and aim for profit. This includes keeping records of operations, income generated, and expenses incurred. The Ohio residential form for farmers can be a valuable resource in establishing this classification for tax benefits and compliance.

To file taxes as a farm, you must gather all relevant income and expense records. You will file the appropriate forms, primarily Schedule F, which details your farm's profits and losses. By leveraging the Ohio residential form for farmers, you can navigate state-specific requirements, making your filing more straightforward and accurate.

There is no specific number of acres that defines a farm for tax purposes, but farms typically start at 10 acres in many regions. The IRS focuses more on the intent and income-generating capabilities of the land rather than the size alone. If your operation meets certain criteria, you can use the Ohio residential form for farmers to support your classification, regardless of the acreage.

Filing taxes as a farm involves determining whether you operate as a business or a hobby. You will need to report your income and expenses on Schedule F, Profit or Loss from Farming, along with your federal tax return. Utilizing the Ohio residential form for farmers simplifies this process by providing necessary guidelines and ensuring compliance with state regulations.

The IRS defines a hobby farm as a farming operation that generates minimal profit and is primarily for personal use. To qualify as a business, it must show a profit in three out of five years. Understanding this distinction is crucial for Ohio farmers, as tax regulations differ for hobby farms compared to actual businesses. By using the Ohio residential form for farmers, you can help clarify your operational status.

Generally, you need at least 10 acres of land to qualify for claiming farm status on your taxes in Ohio. However, keep in mind that this can vary based on the type of farming and local regulations. It is advisable to keep thorough records, as this will facilitate the claiming process. Using the Ohio residential form for farmers can make this task more efficient and straightforward.

The primary tax exempt form for farmers in Ohio is the 'Application for the Agricultural Use Valuation'. This form helps in applying for various tax exemptions related to your farming activities. By filling out the Ohio residential form for farmers accurately, you can maximize your potential tax benefits. Before submission, always review the instructions to ensure compliance.

To qualify for farm tax exemption in Ohio, you must use your property primarily for agricultural purposes and register the necessary documentation. This usually involves submitting the Ohio residential form for farmers, which lays out key information about your farming activities. It's also essential to maintain adequate records of farming income and expenses to support your application for tax exemption.

Yes, you can build a house on agricultural zoned land in Ohio, but certain regulations apply. Typically, you must demonstrate that the residence is necessary for farming operations. Additionally, it's vital to check with local zoning boards to ensure compliance with all requirements. Utilizing the Ohio residential form for farmers may help navigate these regulations more smoothly.