Lien Individual For The Future

Description

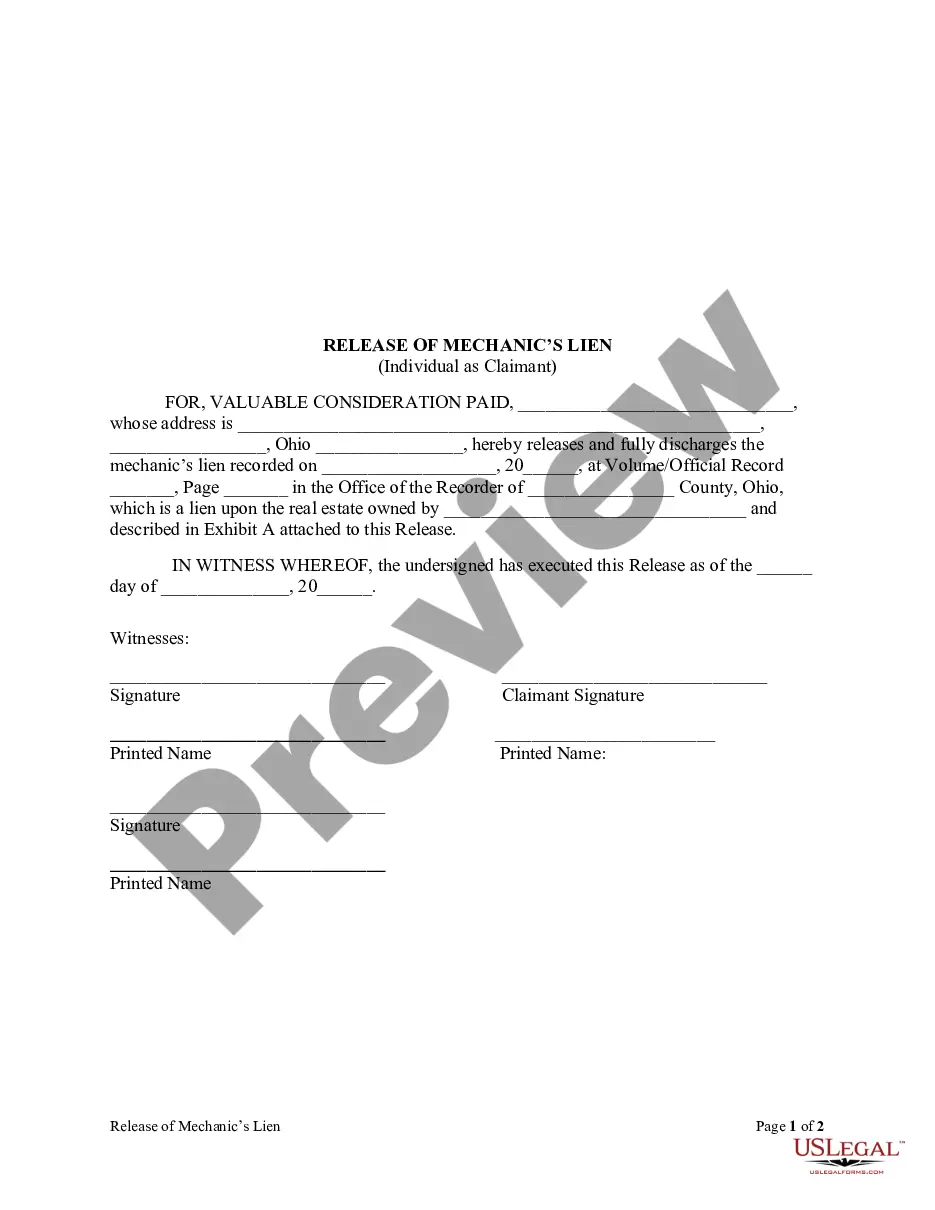

How to fill out Ohio Release Of Mechanic's Lien - Individual?

- Log into your US Legal Forms account if you're a returning user. Ensure your subscription is active, and click the Download button for the form you need.

- For new users, browse the extensive library. Review the form description and Preview mode to confirm it fits your requirements and complies with local laws.

- If the current form isn't suitable, utilize the Search tab to find an alternative that meets your needs.

- Purchase the document by clicking the Buy Now button. Select a subscription plan that suits you, and register an account to access a wealth of resources.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Once payment is confirmed, download the form to your device, making it accessible anytime in the My Forms section of your profile.

Utilizing US Legal Forms not only simplifies the documentation process but also ensures that your legal forms are comprehensive and straightforward.

Start safeguarding your future today by accessing expertly crafted legal documents. Sign up with US Legal Forms and take the first step toward protecting your interests!

Form popularity

FAQ

To fill out a conditional waiver of a lien, begin by entering the project details, including the address and parties involved. Clearly state the amounts received and those that are pending, ensuring all information aligns with the agreement. It is essential to check for errors before submission, as these can affect the validity of your waiver. Using platforms like uslegalforms can simplify this process for a lien individual for the future.

Filling out a lien affidavit requires you to include specific information such as claimant details, property information, and the amount owed. Be sure to provide accurate project dates and any supporting documentation to substantiate your claim. A thorough affidavit strengthens your position and can help in eventual recovery. Familiarize yourself with resources like uslegalforms to streamline this process as a lien individual for the future.

Generally, unconditional lien waivers do not require notarization, but this may vary by state. It is important to verify your local laws to ensure compliance. Notarization adds an extra layer of validation but is not always necessary for binding agreements. Knowing these details can empower a lien individual for the future to navigate the legal landscape effectively.

To write a letter of intent for a lien, start with a clear statement of your intention to file a lien. Include specific details such as the amount owed, the nature of services provided, and your relationship to the property. A well-crafted letter helps communicate your position and can encourage resolution before filing. This proactive approach is beneficial for every lien individual for the future.

A lien waiver should be signed at the time when payment is exchanged or as part of the closing documentation for a construction project. It is crucial to sign the waiver after receiving payment to ensure security for both parties. This practice minimizes risk and establishes trust in business transactions. Always remember that a properly executed lien waiver serves as a safeguard for every lien individual for the future.

The claimant on a conditional waiver is typically the party who provides services or materials for a construction project. They hold the right to file a lien against the property if their payment is not received. This type of waiver protects the property owner while also securing the rights of the claimant. Understanding this process is essential for any lien individual for the future.

When someone puts a lien on your property, they are legally asserting their right to claim that property due to an unpaid debt. This process formally notifies you and other interested parties about the creditor's claim. Understanding this action is crucial to preparing for any legal or financial implications, helping you strategize for a lien individual for the future.

A lien can be both good and bad, depending on your perspective. On one hand, liens serve as a security measure for lenders, encouraging responsible borrowing. On the other hand, having a lien against you can negatively affect your credit and limit your financial options. It's important to understand the implications of a lien individual for the future to make informed decisions.

When a lien is placed on you, it can significantly impact your financial situation. The lien can prevent you from selling or refinancing your property until the debt is resolved. It is crucial to address the situation quickly to minimize the consequences and protect your interests, especially if you are considering a lien individual for the future.

The three main types of liens are consensual liens, statutory liens, and judgment liens. Consensual liens occur when you agree to give the creditor a claim on your property, while statutory liens arise from laws governing specific situations, such as taxes. Judgment liens are enforced when a court awards a creditor the right to collect a debt. Knowing these types is important for preventing issues with a lien individual for the future.