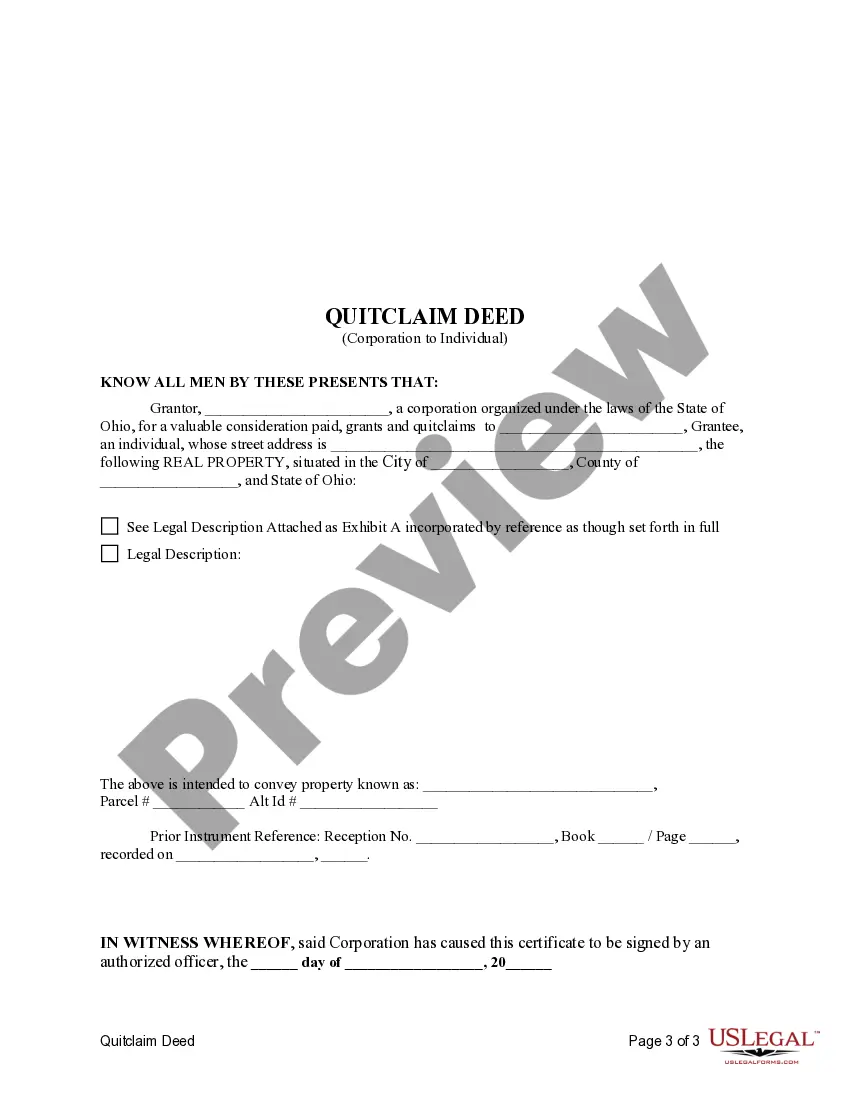

This form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is an Individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

From Corporation To Individual Form

Description

How to fill out From Corporation To Individual Form?

Properly composed official documentation is one of the essential assurances for preventing complications and legal disputes, but acquiring it without the support of an attorney may require time.

Whether you need to swiftly locate a current From Corporation To Individual Form or any other templates for employment, family, or business purposes, US Legal Forms is always available to assist you.

The procedure is even simpler for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the selected document. Furthermore, you can access the From Corporation To Individual Form anytime later, as all the documents ever obtained on the platform are accessible within the My documents tab of your profile. Save time and expenses on preparing official documents. Try US Legal Forms today!

- Confirm that the form is appropriate for your situation and region by reviewing the description and preview.

- Search for another version (if required) using the Search bar in the page header.

- Select Buy Now once you find the related template.

- Choose the pricing option, Log Into your account or create a new one.

- Select the preferred payment option to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your From Corporation To Individual Form.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

To set yourself up as a corporation, you must choose a name, file your articles of incorporation with the state, and obtain necessary licenses and permits. Additionally, you will need to designate a registered agent and create corporate bylaws. If you’re transitioning from another structure, uslegalforms can assist you by providing templates and guidance for a seamless setup process.

Yes, a corporation is recognized as a legal entity separate from its owners, which means it can own assets, incur liabilities, and be held accountable legally. This aspect provides a layer of protection for shareholders against personal liability for corporate debts. When you are transforming your business structure, understanding this distinction can significantly impact your operations and financial planning.

Investors might prefer not to invest in S corporations due to the limitations on ownership, particularly the restriction against foreign investors and the cap on the number of shareholders. These constraints can make S corps less attractive for growth-oriented investors looking to raise substantial capital. It's crucial to weigh these factors when considering which structure to adopt, especially when thinking about going from corporation to individual form.

Yes, you can change your C corporation to an S corporation by meeting specific IRS requirements and filing the appropriate forms. The necessary paperwork includes Form 2553, which must be submitted in a timely manner, typically by March 15 for the election to be effective for the current tax year. If you are unsure of the process, uslegalforms can guide you through the steps required for a smooth transition.

One common disadvantage of an S corporation is that all shareholders must report their share of income, even if they do not receive distributions. This can lead to increased tax liability for shareholders compared to other entity types where distributions may be taxed differently. When evaluating options, consider how this aspect aligns with your financial goals.

A significant downside of S corporations is the stringent eligibility requirements and limitations on types of shareholders. For instance, S corps cannot have non-resident alien shareholders or more than 100 shareholders, which can restrict growth potential. Keywords should play a role in your planning if you're moving from corporation to individual form to ensure you meet your long-term business objectives.

A corporation is a specific type of legal entity formed under state law, while 'entity' is a broader term that encompasses various forms of business structures, including LLCs, partnerships, and sole proprietorships. Each entity type has unique features, regulations, and tax implications. When considering moving from corporation to individual form, understanding these distinctions will help you choose the best structure for your needs.

Yes, a corporation is considered a juridical entity, which means it is a legal construct that can engage in legal activities independently of its owners. This status allows corporations to enter contracts, own property, and be liable for debts. When you transition your business structure, recognizing this legal standing is critical for compliance and operational efficiency.

A legal entity is a recognized organization that can enter contracts, sue, and be sued, such as a corporation or LLC. A business unit, on the other hand, refers to a segment within a company that operates as a distinct entity focusing on specific products or services. Understanding this difference is crucial when deciding how to structure your business, particularly when moving from corporation to individual form.

No, you do not need a new Employer Identification Number (EIN) when changing from a C corporation to an S corporation. The existing EIN remains valid as long as the legal entity remains the same. However, you must file Form 2553 with the IRS to elect S corporation status, so it's important to follow the necessary steps to ensure a smooth transition.