Transfer Death Designation Form With Decimals

Description

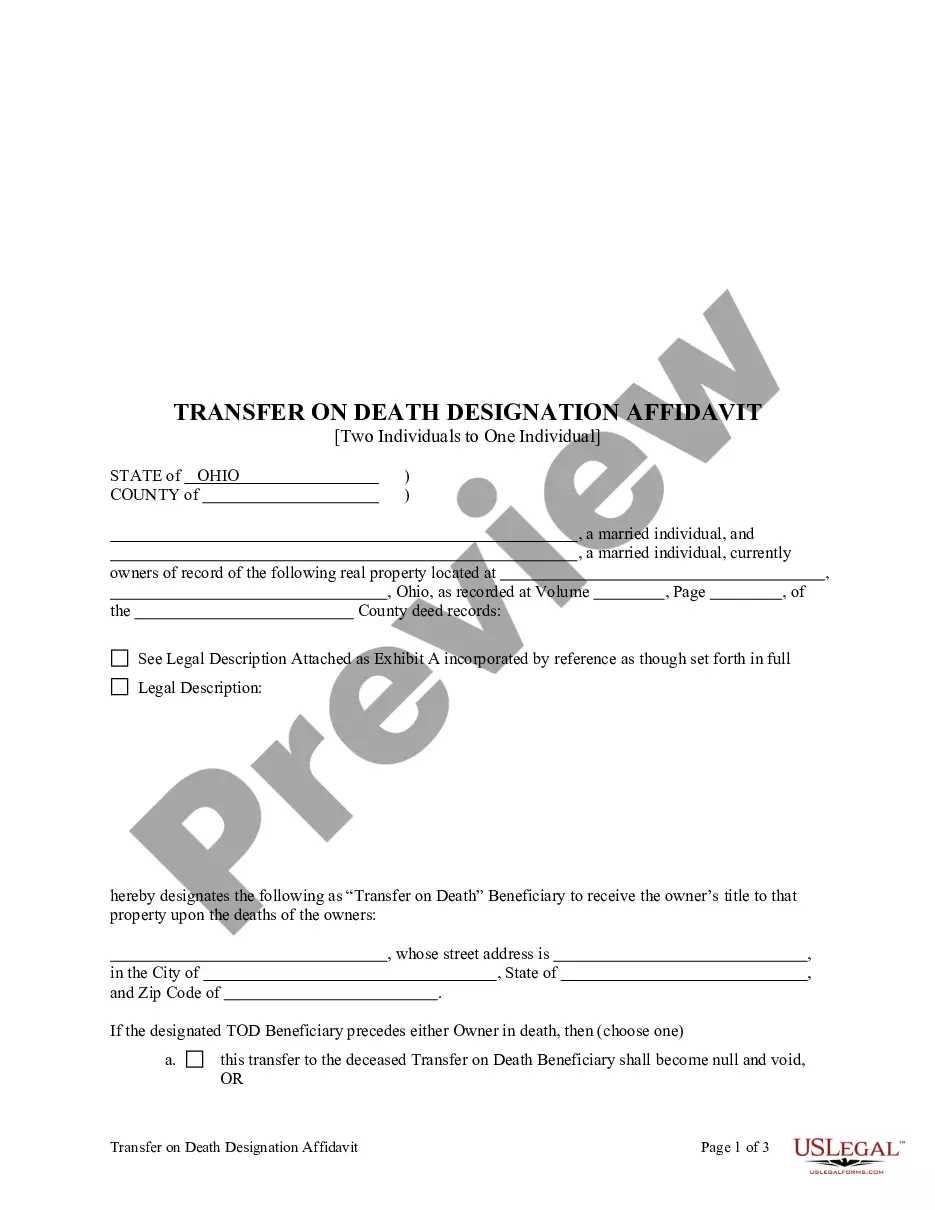

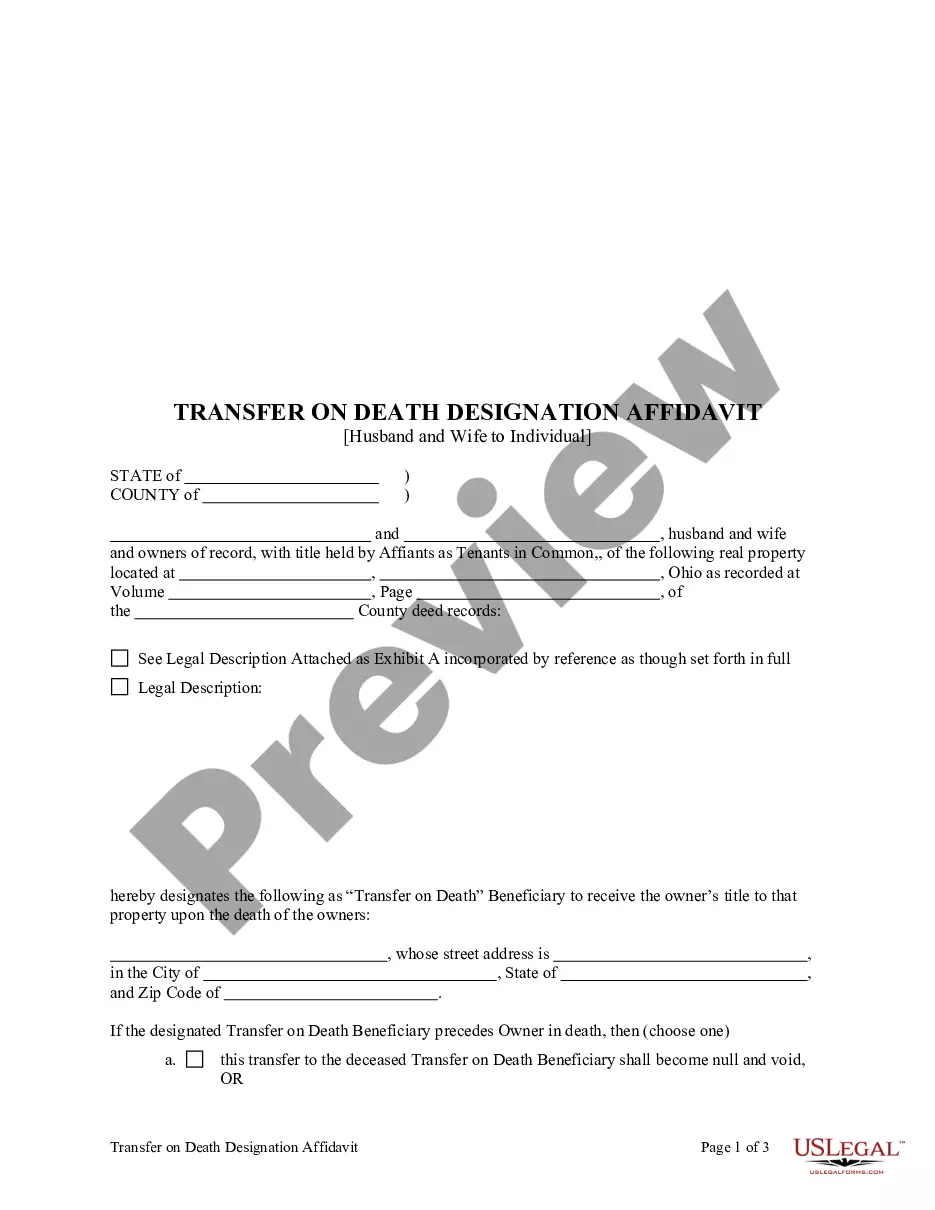

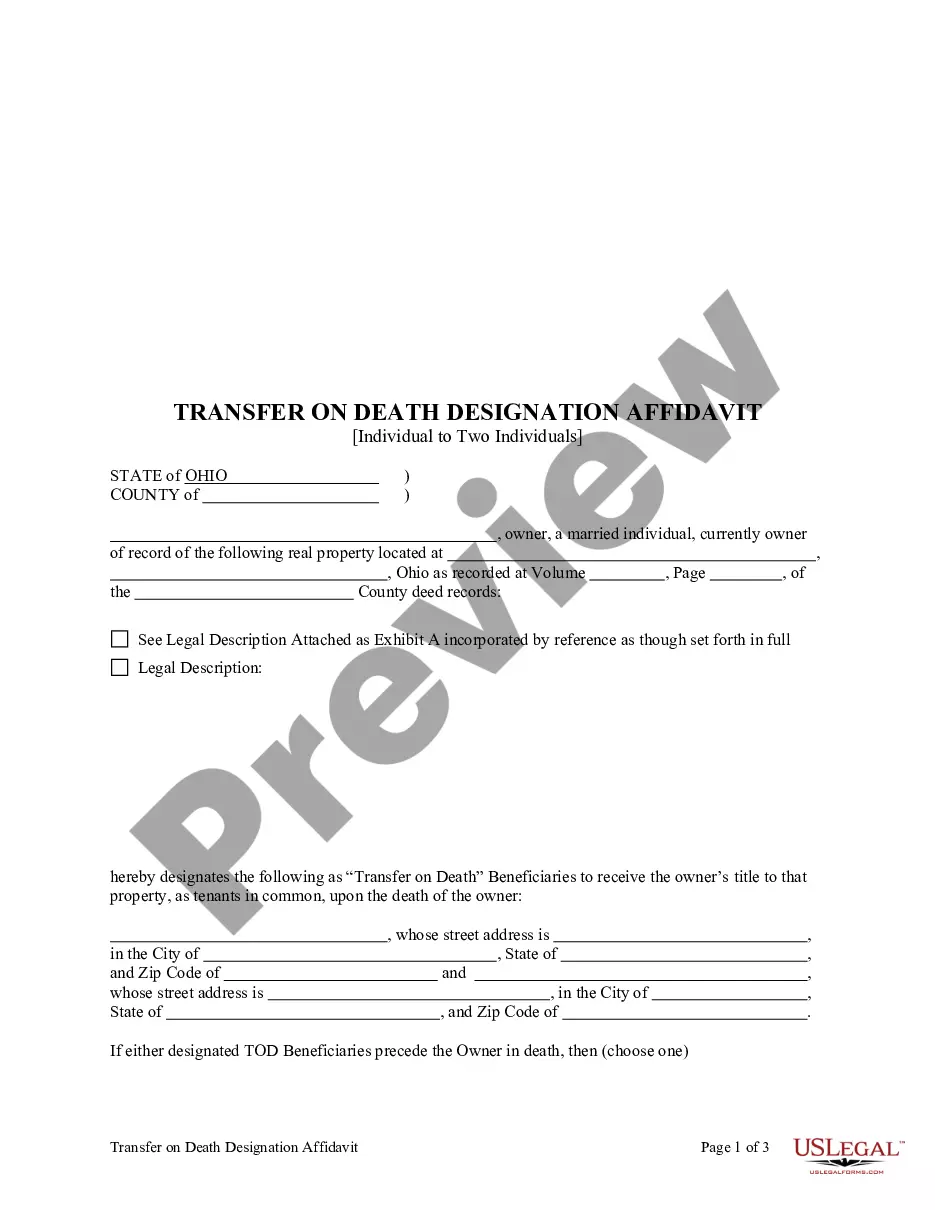

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Two Individuals To One Individual?

The Transfer Death Designation Form With Decimals displayed on this page is a reusable formal template created by expert attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with more than 85,000 authenticated, state-specific documents for any business and personal circumstance. It’s the quickest, easiest, and most dependable method to acquire the paperwork you require, as the service guarantees the utmost level of data protection and anti-malware security.

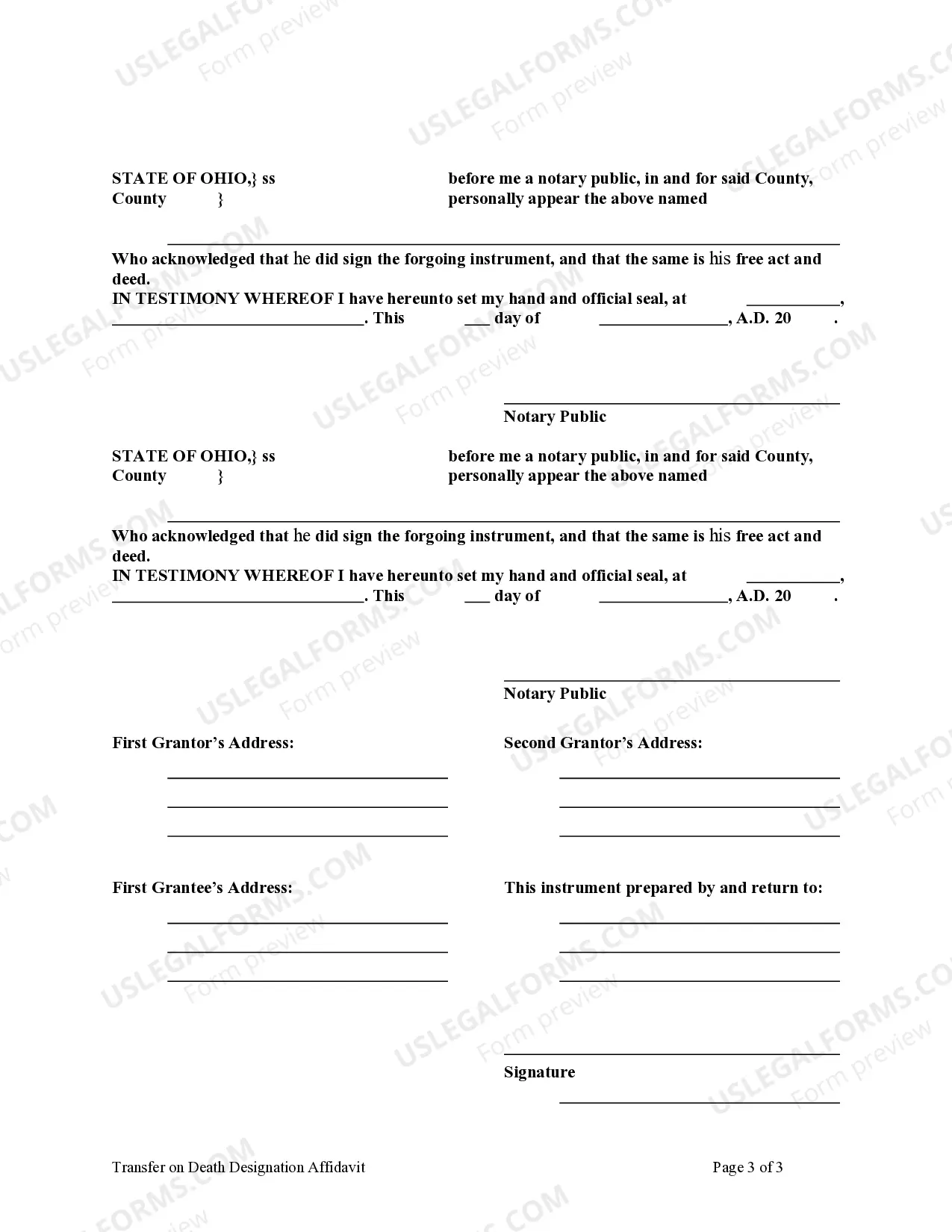

Select the format you desire for your Transfer Death Designation Form With Decimals (PDF, DOCX, RTF) and store the document on your device. Fill out and sign the document. Print the template to complete it manually. Alternatively, use an online multifunctional PDF editor to swiftly and accurately fill out and sign your form with a legally-binding electronic signature. Download your documents again. Utilize the same document once more whenever needed. Access the My documents tab in your profile to redownload any previously downloaded forms. Subscribe to US Legal Forms to have verified legal templates for all of life's situations at your fingertips.

- Search for the document you require and examine it.

- Browse through the file you searched and preview it or review the form description to confirm it meets your needs. If it doesn’t, use the search bar to find the correct one. Click Buy Now when you have found the template you need.

- Subscribe and Log In.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card for a rapid payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

While a transfer on death designation offers benefits, it also has disadvantages. One concern is that it may not cover all property types, potentially leading to complications. Additionally, if beneficiaries are not clearly defined, disputes may arise after your passing. Consulting resources like US Legal Forms aids in understanding these risks better and ensures clarity in your designation.

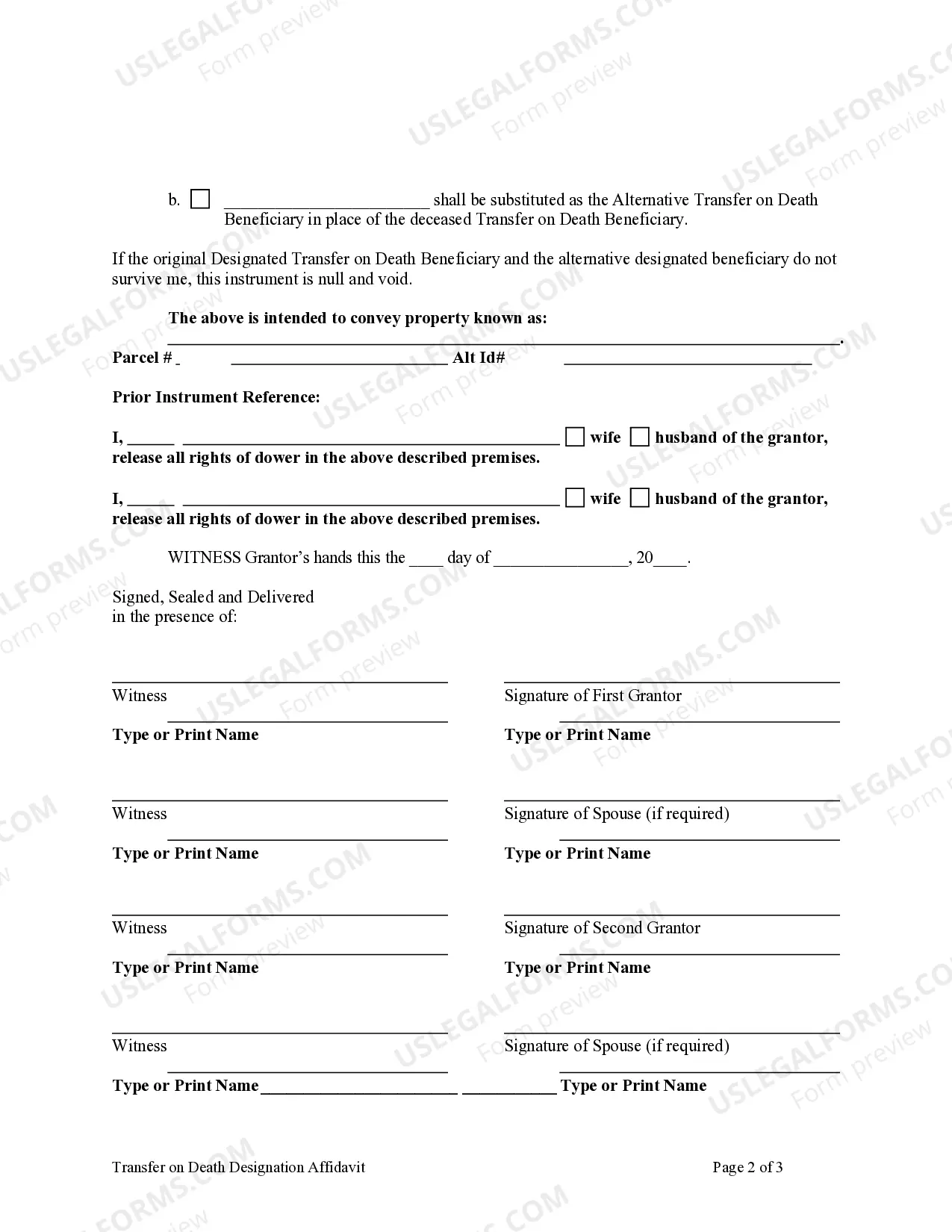

Filling out a transfer on death deed form involves specifying the property owner and the designated beneficiaries. You will need to include all relevant details, such as names, addresses, and the property description, ensuring you use decimals correctly in any financial figures. Consider using US Legal Forms for templates and step-by-step instructions to simplify the process.

To write a transfer on death designation form with decimals, begin by clearly stating the property details. Include the full legal description and ensure the decimal values are accurate. This clarity helps avoid ambiguity in ownership transfer. Using platforms like US Legal Forms can guide you through the precise wording needed for your form.

A downside of a transfer on death (TOD) designation is that it may not cover all aspects of your estate. While a transfer death designation form with decimals streamlines the process, it does not account for debts or taxes that may arise after your passing. Additionally, if you wish to change your beneficiaries, you must complete a new form, which can lead to confusion if not managed carefully. Always consider consulting with an expert when using such forms to ensure your wishes are honored.

The best way to transfer property upon death often involves using a transfer death designation form with decimals. This method allows you to designate beneficiaries directly, bypassing the lengthy probate process. It ensures that your property goes to your chosen heirs efficiently and with minimal hassle. Using US Legal Forms can provide you with the necessary documents to ensure the transfer is executed correctly.

Filling out a transfer death designation form with decimals involves several straightforward steps. Start by providing your personal details, such as your name and address. Next, clearly identify the property you wish to transfer by including its description and any relevant identification numbers. Finally, ensure you sign and date the form to validate your intentions, then consider using US Legal Forms to access templates that simplify the process.

Transfer on Death (TOD) Registration This typically involves sending a copy of the death certificate and an application for re-registration to the transfer agent. State law, rather than federal law, governs the way securities may be registered in the names of their owners.

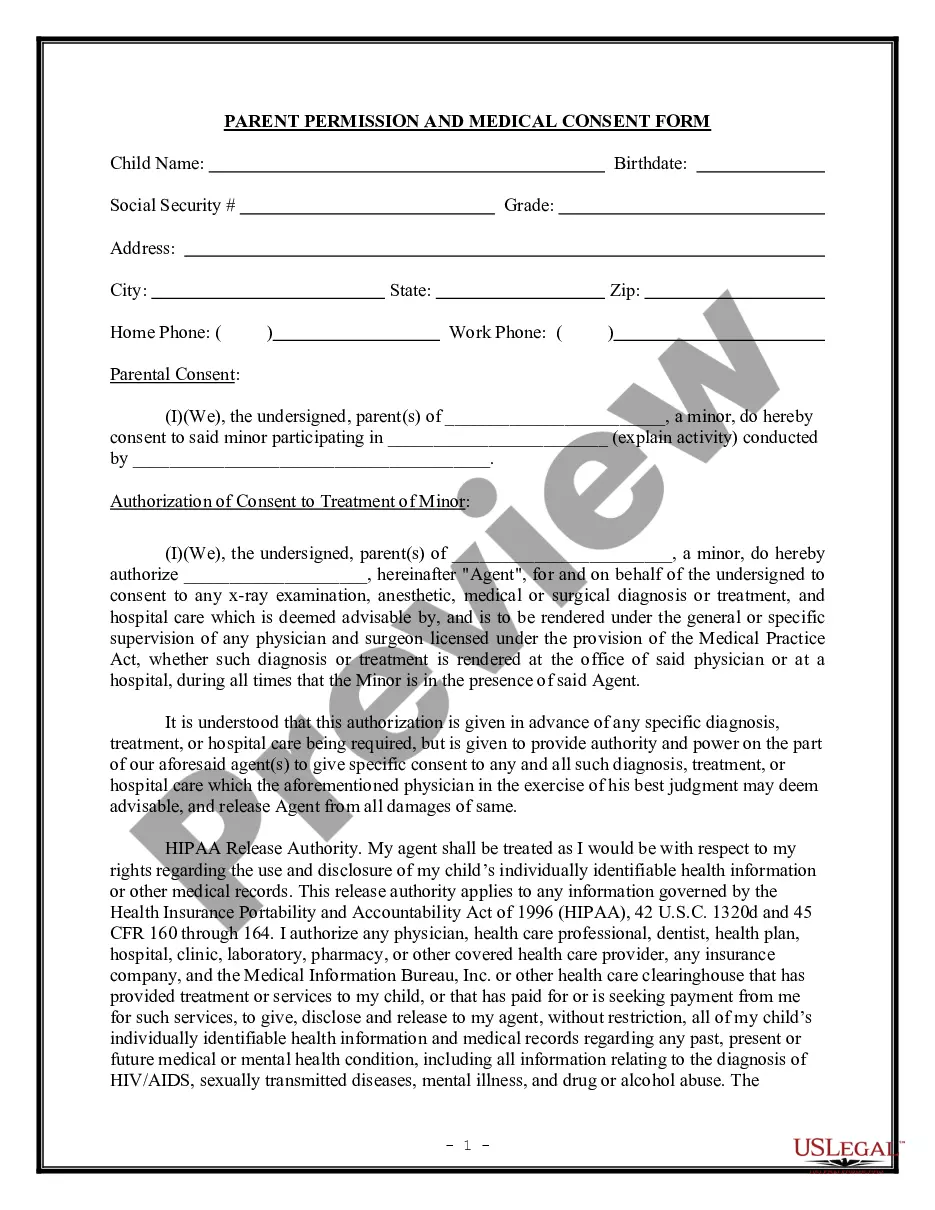

Most beneficiary designations will require you to provide a person's full legal name and their relationship to you (spouse, child, mother, etc.). Some beneficiary designations also include information like mailing address, email, phone number, date of birth and Social Security number.

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.

Disability: If your beneficiary has a disability or acquires one from an accident or illness before death. In that case, the POD and TOD funds could end up with the government or jeopardize their Medicaid and SSI.