Transfer Death Designation Form For Canada

Description

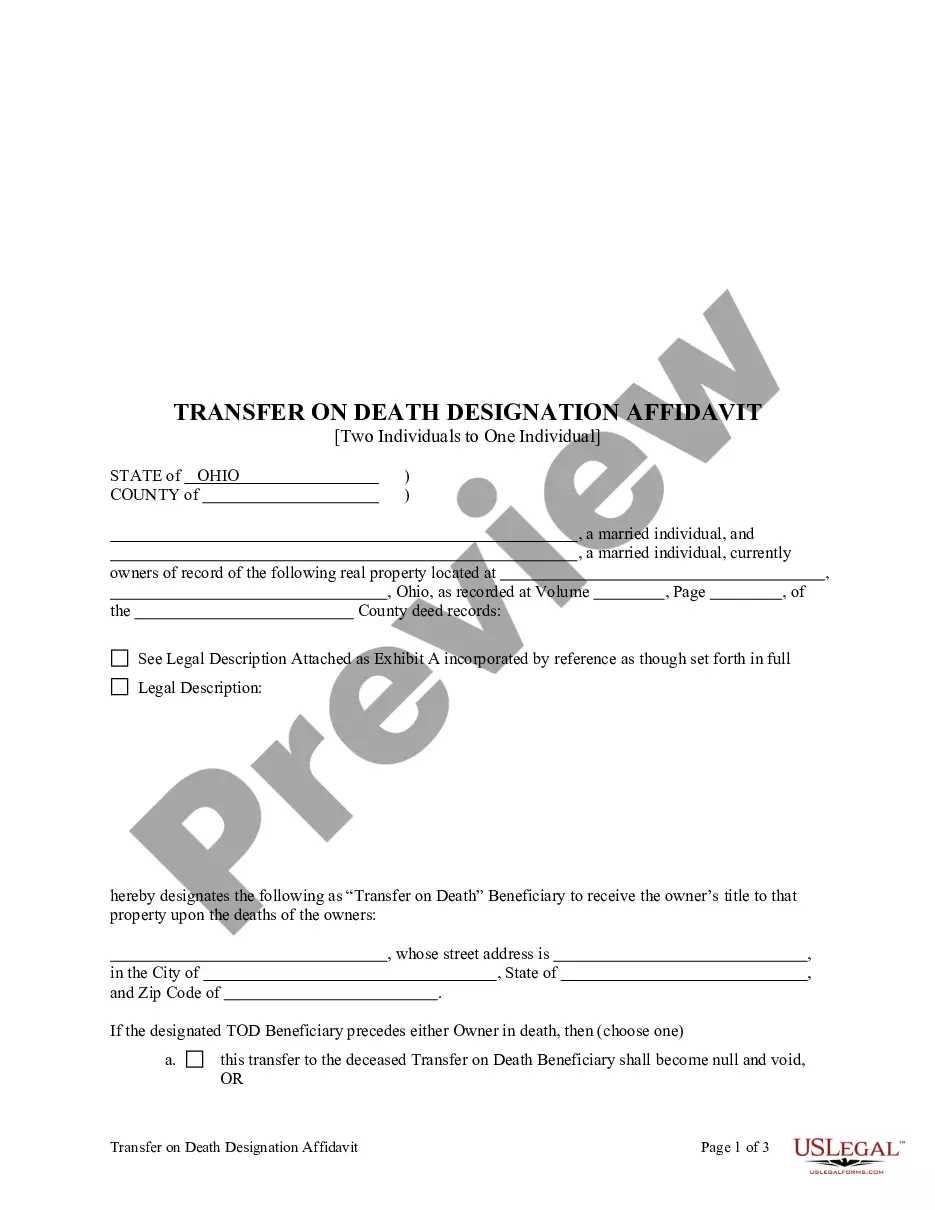

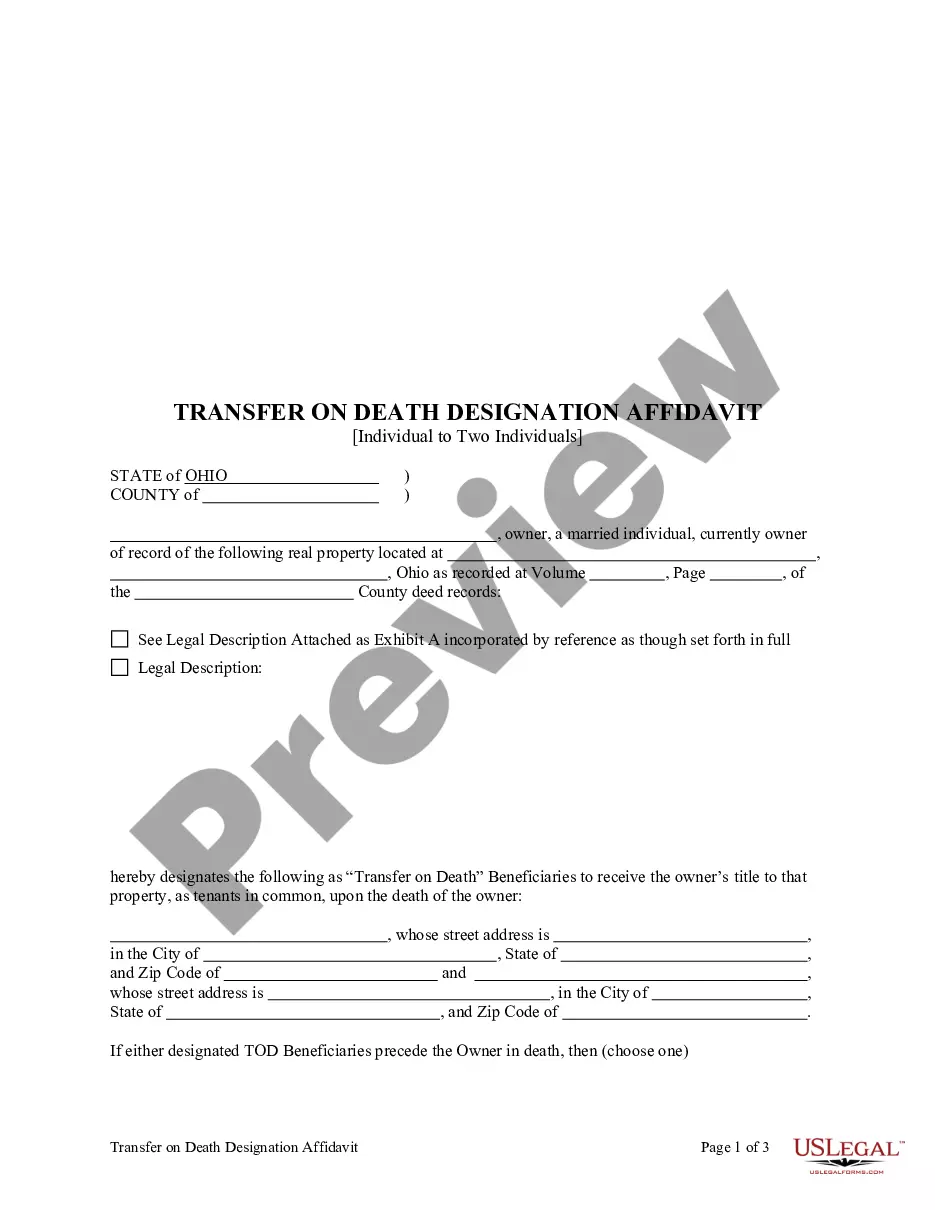

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Two Individuals To One Individual?

The Transfer Death Designation Form For Canada displayed on this site is a reusable legal template created by professional attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal experts with more than 85,000 validated, state-specific documents for any commercial and personal circumstances. It is the quickest, easiest, and most reliable method to acquire the paperwork you require, as the service ensures bank-grade data protection and anti-malware safeguards.

Subscribe to US Legal Forms to have authenticated legal templates for all of life’s scenarios readily available.

- Search for the document you require and examine it.

- Select the pricing option that works best for you and create an account. Use PayPal or a credit card for a swift payment.

- Choose the format you prefer for your Transfer Death Designation Form For Canada (PDF, DOCX, RTF) and store the template on your device.

- Print the template to fill it out manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your form with an eSignature.

- Access the same document again whenever necessary. Open the My documents tab in your profile to redownload any previously acquired forms.

Form popularity

FAQ

An example of a beneficiary designation could be naming your spouse as the sole beneficiary of your life insurance policy. This means that upon your passing, your spouse will receive the policy's benefits directly, avoiding the lengthy probate process. If you need to create a transfer death designation form for Canada, uslegalforms provides a variety of examples and customizable forms to meet your specific needs.

Filling out a beneficiary designation requires careful attention to detail. Start by obtaining the appropriate form, often available through your financial institution or insurance provider. Clearly list your beneficiaries' names, relationships, and contact information. For those looking to create a transfer death designation form for Canada, uslegalforms offers comprehensive guidance and templates that make this process straightforward.

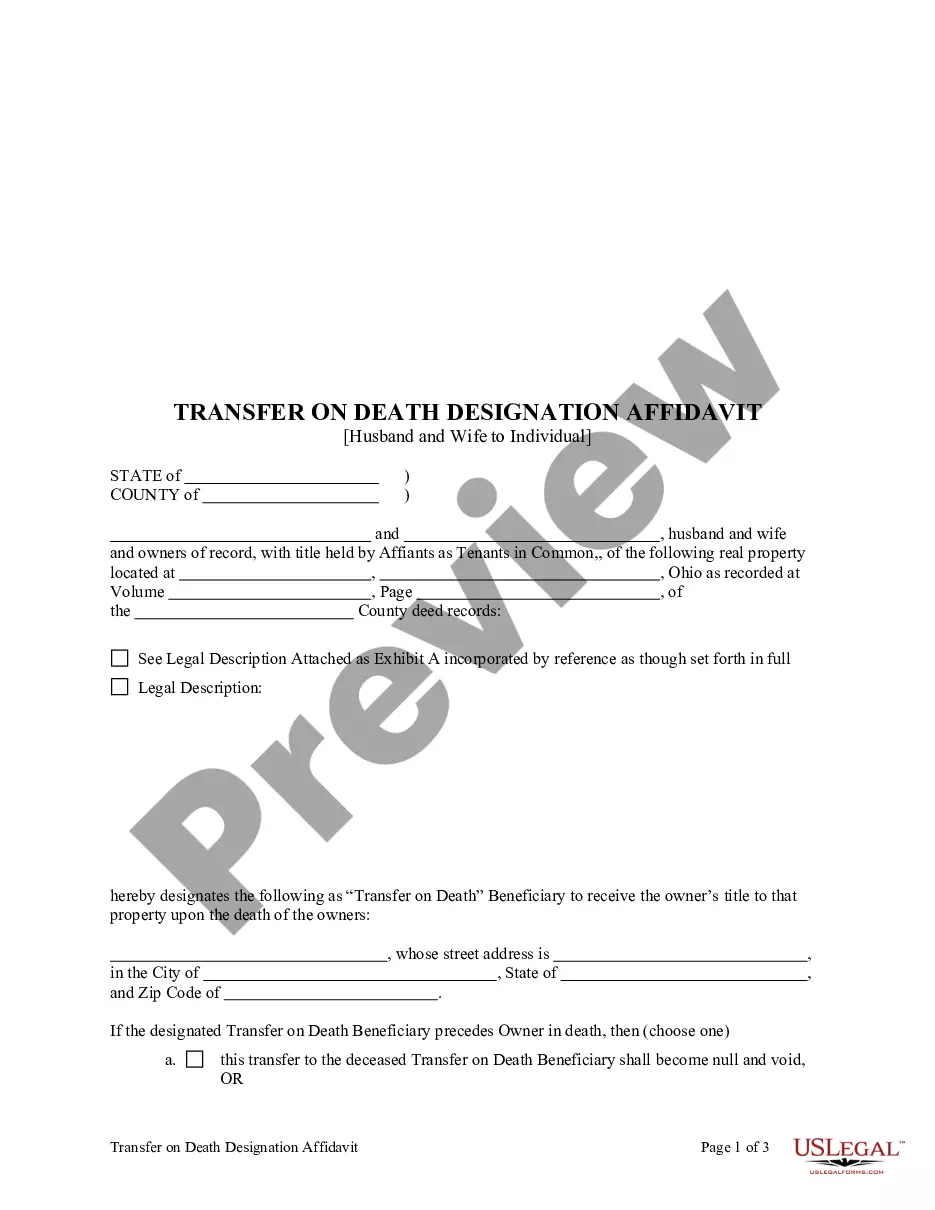

Transfer on death and beneficiary designation are closely related concepts, but they are not identical. A transfer on death designation allows individuals to specify who will receive their assets upon their death, without going through probate. On the other hand, a beneficiary designation is typically used for accounts like retirement plans or insurance policies to name beneficiaries directly. To simplify the process of creating a transfer death designation form for Canada, consider using platforms like uslegalforms, which provide user-friendly templates.

To get a copy of a Canadian death certificate, you should reach out to the appropriate provincial vital statistics office. You will need to fill out a request form and provide necessary identifying information. When you need to use the death certificate for legal purposes, such as a transfer death designation form for Canada, ensure that you follow all provincial guidelines meticulously.

Yes, many provinces in Canada offer online services for requesting a death certificate. This process typically requires you to fill out an application form and submit it electronically. Utilizing these online services can expedite your request, especially if you need the death certificate for purposes like completing a transfer death designation form for Canada.

The best way to obtain a death certificate is to contact the vital records office in the province where the death occurred. Each province has its own procedures, but generally, you will need to provide information about the deceased and possibly a government-issued ID. If you are looking to manage affairs related to a transfer death designation form for Canada, having an official death certificate will help streamline that process.

When the owner of a health savings account (HSA) dies, the account can be transferred to a beneficiary. If the beneficiary is the spouse, they can treat it as their own account. For other beneficiaries, the account value may be subject to taxation. To ensure a seamless transfer, using a transfer death designation form for Canada is advisable.

Yes, an FHSA can have successors. You can designate beneficiaries when you open the account, allowing for a smooth transition upon your passing. Utilizing a transfer death designation form for Canada ensures that your successors receive the funds without unnecessary delays or complications.

Upon the death of the account holder, the FHSA can be transferred to the designated beneficiary. If the beneficiary is a spouse, they can continue to use the account as their own. For non-spouse beneficiaries, taxes may apply, and it's crucial to have a transfer death designation form for Canada to facilitate this process without complications.

In Canada, several parties need to be notified upon a person's death. Family members, close friends, and legal representatives should be informed, as well as financial institutions and government agencies. Additionally, using a transfer death designation form for Canada helps notify relevant entities about asset transfers, making the process smoother for your loved ones.