Transfer On Death Designation Within 2 Years Iht

Description

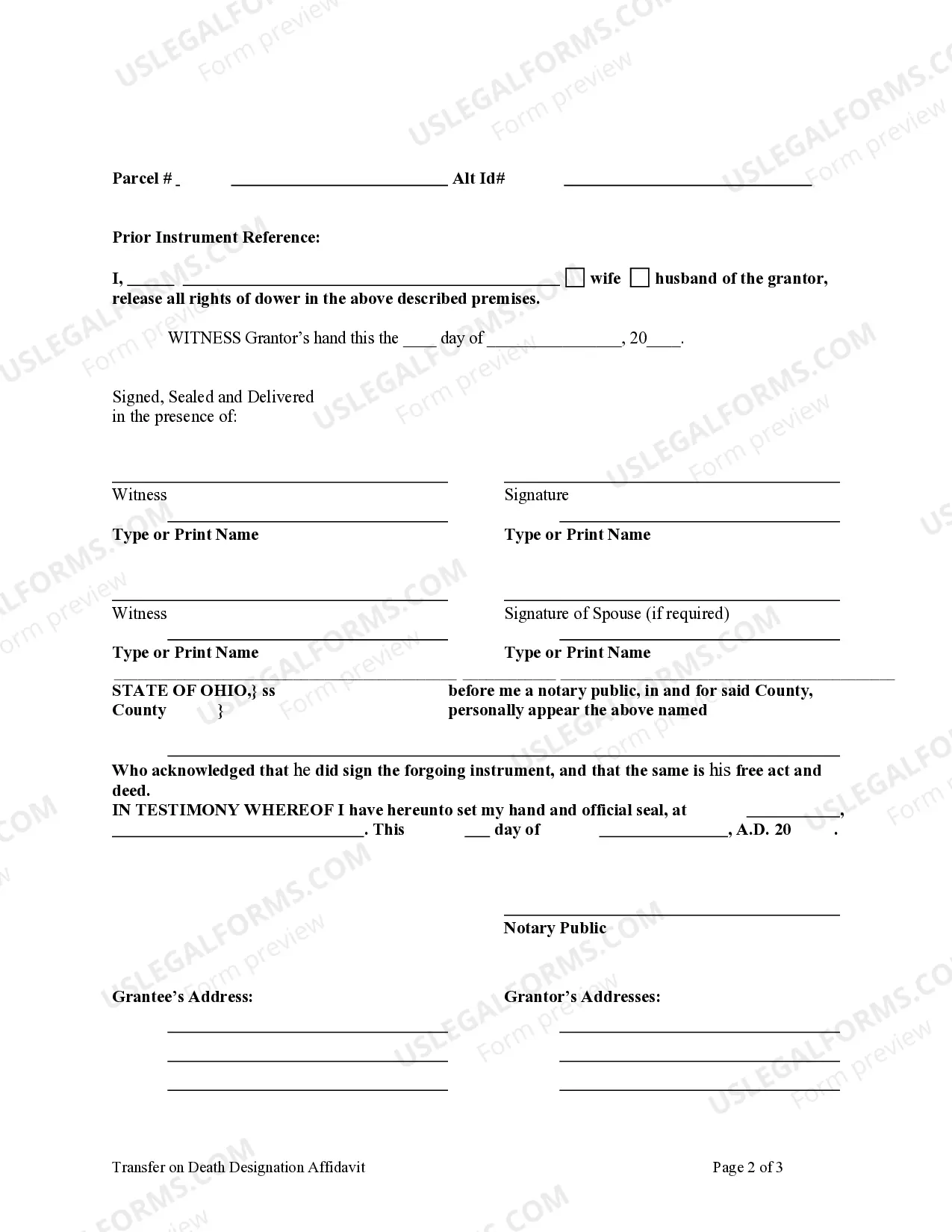

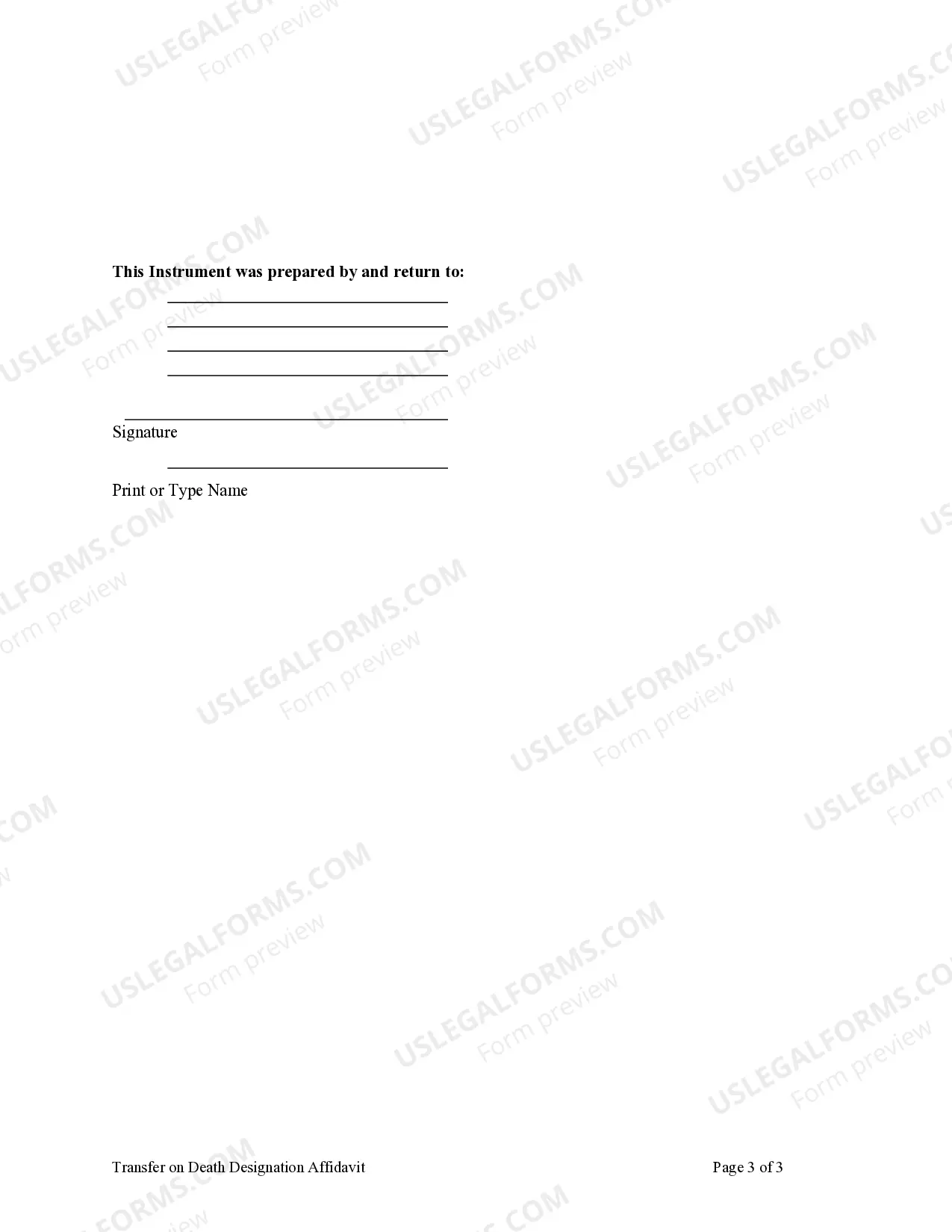

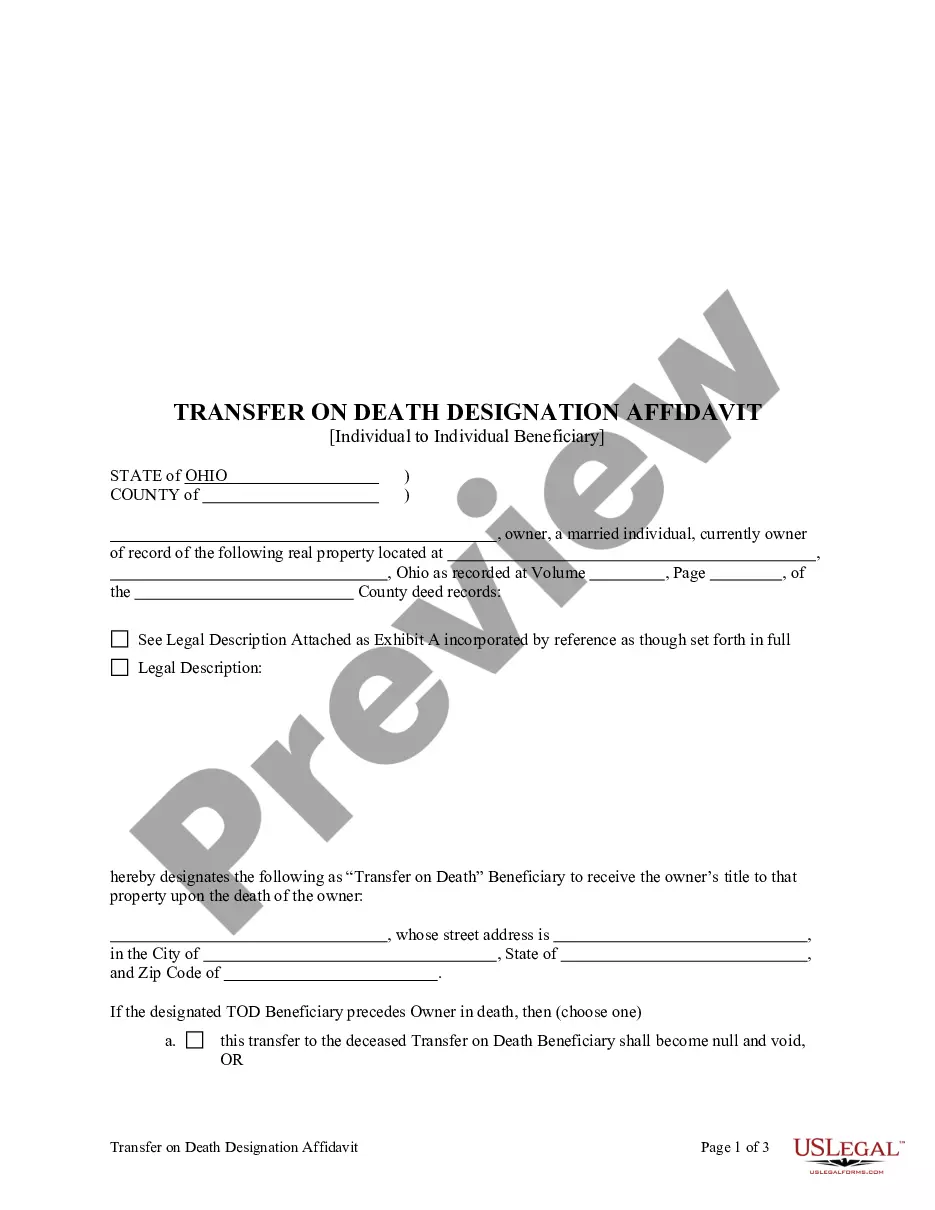

How to fill out Ohio Transfer On Death Designation Affidavit - TOD From Individual To A Trust?

Dealing with legal documentation and processes can be a lengthy addition to your overall day.

Transfer On Death Designation Within 2 Years Iht and similar forms typically require you to search for them and determine the best way to fill them out correctly.

Consequently, regardless of whether you are managing financial, legal, or personal issues, having an extensive and straightforward online directory of forms readily available will be very beneficial.

US Legal Forms is the top online platform for legal documents, providing over 85,000 state-specific templates and a range of resources to assist you in completing your paperwork effortlessly.

- Explore the selection of pertinent documents available to you with a single click.

- US Legal Forms offers state- and county-specific forms that can be downloaded anytime.

- Safeguard your document management processes by utilizing a reliable service that allows you to generate any document in minutes without extra or concealed fees.

- Simply Log In to your account, find Transfer On Death Designation Within 2 Years Iht, and obtain it directly from the My documents section.

- You can also access forms you have previously downloaded.

Form popularity

FAQ

While it's not legally required to hire a lawyer for a transfer on death designation, consulting one can be beneficial. A lawyer can ensure that your deed complies with state laws, which may vary significantly. Alternatively, platforms like US Legal Forms offer user-friendly resources, allowing you to create and file the deed yourself with confidence.

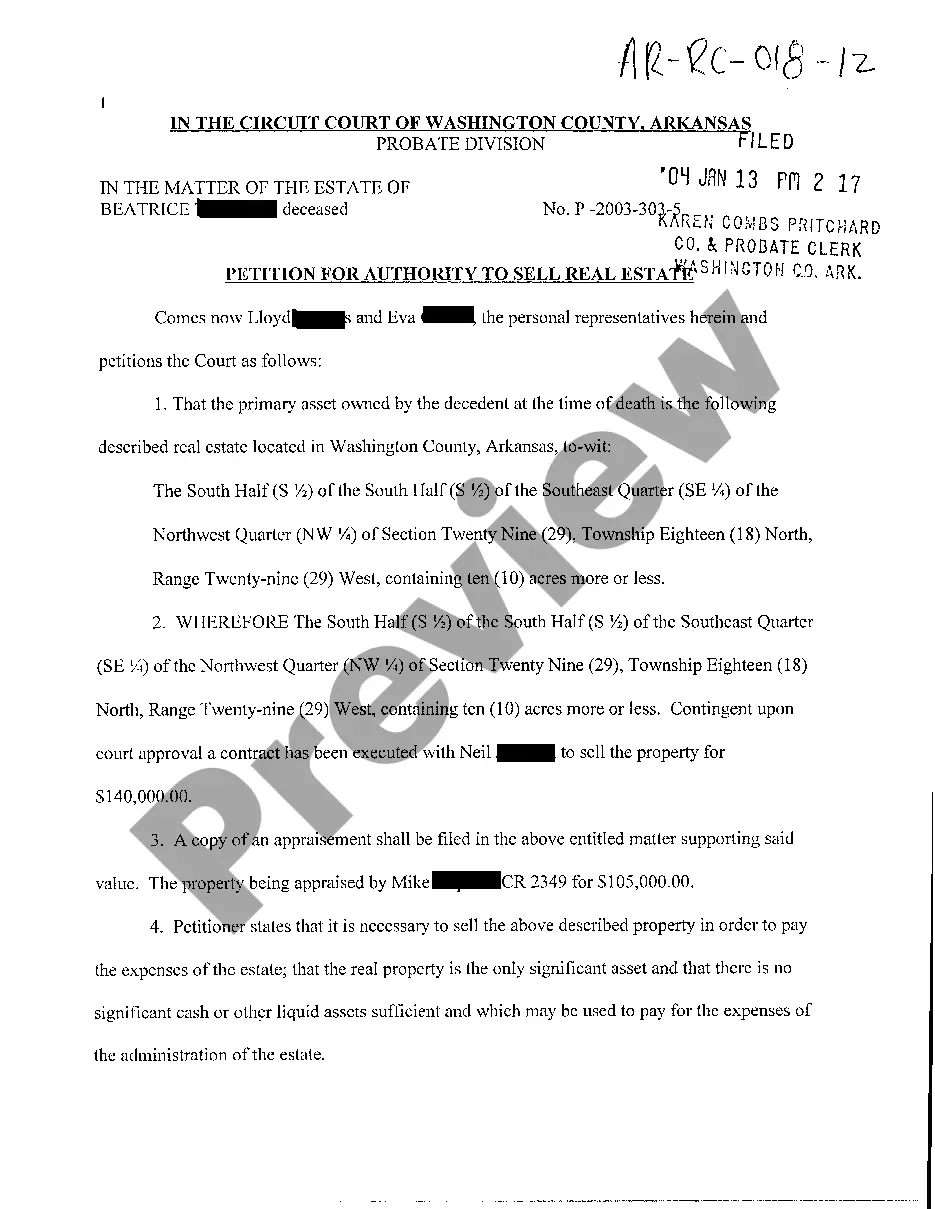

The process to transfer property after death typically starts with the execution of a transfer on death designation within 2 years iht. Upon the owner's death, the designated beneficiary can present the deed to the county recorder's office to initiate the transfer. This allows the property to pass directly to the beneficiary without going through probate, simplifying the overall process.

To file a transfer-on-death deed, you should visit your county recorder's office. It's important to file the deed with the correct office to ensure it is legally recognized. Many people find it convenient to use platforms like US Legal Forms, which can guide you through the filing process and provide the necessary forms.

You can create a transfer on death deed at your local county recorder's office or through an online legal service like US Legal Forms. This process typically involves filling out the appropriate form and ensuring that it meets your state's requirements. After completing the deed, it must be properly signed and notarized to ensure its validity.

You do not necessarily need a lawyer to file a transfer on death deed, as many individuals successfully handle this process on their own. However, consulting a legal professional can provide clarity and ensure that the deed complies with state laws. Platforms like US Legal Forms offer templates and guidance to help you navigate the filing process effectively.

Yes, a transfer on death designation within 2 years iht typically allows the assets to pass directly to the beneficiary upon the owner's death, thereby avoiding the probate process. This can save time and reduce costs associated with probate court. Ensure that you correctly designate your beneficiaries to fully benefit from this streamlined process.

You can obtain a transfer on a death certificate from the vital records office in the state where the death occurred. It is important to provide necessary details such as the deceased person's name, date of death, and your identification. Additionally, you may find online services like US Legal Forms helpful for obtaining the required forms and guidance on how to properly complete them.

The step up basis for a transfer on death account refers to the adjustment of the asset's value at the time of the owner's death. This means that beneficiaries receive the property at its fair market value, which can help reduce capital gains taxes if they decide to sell it. Understanding this concept is crucial, especially when considering a transfer on death designation within 2 years iht, as it offers significant tax advantages for your heirs.

To fill out a transfer on death deed form, start by gathering the necessary information, such as the property's legal description and the names of the beneficiaries. Next, clearly indicate that you intend to create a transfer on death designation within 2 years iht. Once you complete the form, ensure that you sign it in front of a notary public and record it with your local county office to make it effective.